Alberta

Why the oilsands’ weaknesses are turning into strengths

From the MacDonald Laurier Institute

By Heather Exner-Pirot

Global oil prices are recovering from a multi-year bust

Few industrial projects have been more maligned than Canada’s oilsands. It has been called tar sands, a carbon bomb, the “dirtiest oil on the planet.” It’s suffered through the shale revolution, the COVID-19 shutdown, and a torrent of ESG (Environmental, Social and Governance) divestment. Its grade of heavy oil has been discounted and shunned.

But despite the challenges, things are coming up roses. In almost every aspect of the sector that has looked weak in the past decade—costs, grade, carbon intensity—the oilsands are coming on strong, and poised to provide unprecedented revenue streams for Canadian public coffers.

Oilsands are known as “unconventional” oil, which is extraction from anything other than traditional, vertical wells. In northern Alberta, the expansive hydrocarbon resources are in bitumen form, a molasses-like consistency too heavy to flow on its own. It takes a lot of capital and energy to turn the oilsands’ oil into a product that can be transported, refined and used by consumers.

For this reason, the oilsands were seen in the early 2010s as an expensive form of oil, with high up-front costs and a high break-even price: up to USD$75/barrel for new oilsands mines. This made it difficult to compete with cheaper American shale, which came online at scale at the same time as the oilsands, to great chagrin in Calgary.

However, global oil prices are recovering from a multi-year bust, and new “in-situ” extraction technologies have greatly reduced oilsands recovery costs. Break-even prices now average less than USD$40/barrel, and BMO Capital Markets assessed in September that the average oilsands producers could cover their capital budgets and base dividends at USD$46/barrel. By contrast the average large U.S. producer requires USD$53.50/barrel. For new shale wells outside of Texas last year, it was $69/barrel.

Another advantage is that oilsands are low-decline, which means they have decades of inventory, or oil available to be extracted. Shale oil sites have declined as high as 50 percent in the first year. While the oilsands reap the benefits of past investments, shale producers need to continuously drill and invest in new production. (But they haven’t been of late: the U.S. oil rig count has fallen 21 percent since December 2022, largely because of new well costs.)

Another challenge for the oilsands has been its grade: “heavy” or dense, and “sour” or high in sulfur. Light, sweet crudes are easier to refine and have historically sold at a premium. The difference can be stark: at its worst in 2018, West Texas Intermediate (WTI) oil sold for USD$57 a barrel, compared to just USD$11 for heavy Western Canada Select (WCS).

But heavy oil has qualities that are desirable, even necessary for some refined products. Whereas light crude is primarily made into fuels, heavy oil is advantageous for plastics, petrochemicals, other fuels, and road surfacing: things we will still need in a post-combustion, net-zero world. Many American refineries are configured to process heavy oil. Because the U.S. produces virtually none itself, they depend on cheap Canadian sources.

Geopolitical factors are also bolstering heavy and sour oil. Recent production cuts by OPEC+, designed to lift global oil prices, have limited supply of medium and heavy sour grades, which matches the kind of oil the Biden Administration released in its big Strategic Petroleum Reserve sell-off last year. This has brought higher prices for heavy, sour oil, more good news for the oilsands.

As for the oilsands’ biggest Achilles heel, its carbon intensity, this is another weakness turning into a strength. The oilsands are geographically concentrated, with a small number of facilities producing large amounts of emissions. This makes them far easier to decarbonize than conventional oil, which needs huge fleets of rigs creating hundreds of emissions sources in order to produce comparable amounts of oil. Seizing the opportunity, the major oilsands producers are working together on one of the biggest carbon capture projects in the world, building a 400-km CO₂ pipeline that could link over 20 CCS facilities with a carbon storage hub in northeast Alberta. Small modular reactors are another option being explored to reduce emissions. It’s not easy or cheap, but it’s possible to reach net zero, which producers plan to do by 2050.

All of this is not just good news for the oilsands, but for Albertans and Canadians as well. In 2022, royalties going into public coffers from oil and gas extraction hit a record $33.8 billion; that’s more than all royalties from 2016-20 combined. The boost comes not just from higher prices but from Alberta’s strategy to charge significantly higher royalties—up to 40 percent—from oilsands facilities whose upfront development costs have been paid off and revenues are exceeding operating expenses.

A large number of facilities have already reached this threshold, and more are added each year. This flexible new paradigm of permanently higher royalties helps governments moderate the budget rollercoaster of volatile oil prices: nine times more at $55/barrel, and four and half times more at $120/barrel. Next year, when the TMX pipeline adds more than half a million barrels a day of capacity from the oilsands to new markets, the value of royalties will also increase, along with corporate taxes.

Of course, the oilsands still face headwinds from Ottawa, none bigger than a proposal to reduce oil and gas emissions by 42 percent (from 2019 levels) by 2030. Although the oil and gas sector has invested heavily in emissions reductions, and greenhouse gas intensity per barrel fell 20 percent between 2009 and 2020, there is no way to meet the new target without cutting production. S&P Global estimates that 1.3 million barrels of daily output will need to be slashed, which would be an existential threat to the sector. Fortunately, the political tide in Canada is turning in such a way that the oilsands could hang on long enough to see friendlier policies.

Finally, the oilsands remain unloved by investors, although the tide has been turning with higher prices. Their enterprise multiple (EV/DACF), a standard valuation formula, is on average 5.8x as of September and was even lower in 2022. This is much lower than the S&P 500, which has averaged between 11 to 16x in the last few years. In Calgary this has been called the Ottawa penalty box: the only logical explanation for their low valuation seems to be the lack of confidence investors associate with the Canadian energy policy landscape. At any rate, oilsands companies are currently free cashflow machines and are rewarding the shareholders they do have with share buybacks.

After nearly a decade on their back foot, the oilsands have reason for optimism. Lots of people still love to hate them, but they’re starting to rack up some wins.

Heather Exner-Pirot is the director of energy, natural resources and environment at the Macdonald-Laurier Institute.

Alberta

Alberta bill would protect freedom of expression for doctors, nurses, other professionals

From LifeSiteNews

‘Peterson’s law,’ named for Canadian psychologist Jordan Peterson, was introduced by Alberta Premier Danielle Smith.

Alberta’s Conservative government introduced a new law that will set “clear expectations” for professional regulatory bodies to respect freedom of speech on social media and online for doctors, nurses, engineers, and other professionals.

The new law, named “Peterson’s law” after Canadian psychologist Jordan Peterson, who was canceled by his regulatory body, was introduced Thursday by Alberta Premier Danielle Smith.

“Professionals should never fear losing their license or career because of a social media post, an interview, or a personal opinion expressed on their own time,” Smith said in a press release sent to media and LifeSiteNews.

“Alberta’s government is restoring fairness and neutrality so regulators focus on competence and ethics, not policing beliefs. Every Albertan has the right to speak freely without ideological enforcement or intimidation, and this legislation makes that protection real.”

The law, known as Bill 13, the Regulated Professions Neutrality Act, will “set clear expectations for professional regulatory bodies to ensure professionals’ right to free expression is protected.”

According to the government, the new law will “Limit professional regulatory bodies from disciplining professionals for expressive off-duty conduct, except in specific circumstances such as threats of physical violence or a criminal conviction.”

It will also restrict mandatory training “unrelated to competence or ethics, such as diversity, equity, and inclusion training.”

Bill 13, once it becomes law, which is all but guaranteed as Smith’s United Conservative Party (UCP) holds a majority, will also “create principles of neutrality that prohibit professional regulatory bodies from assigning value, blame or different treatment to individuals based on personally held views or political beliefs.”

As reported by LifeSiteNews, Peterson has been embattled with the College of Psychologists of Ontario (CPO) after it mandated he undergo social media “training” to keep his license following posts he made on X, formerly Twitter, criticizing Trudeau and LGBT activists.

He recently noted how the CPO offered him a deal to “be bought,” in which the legal fees owed to them after losing his court challenge could be waived but only if he agreed to quit his job as a psychologist.

Early this year, LifeSiteNews reported that the CPO had selected Peterson’s “re-education coach” for having publicly opposed the LGBT agenda.

The Alberta government directly referenced Peterson’s (who is from Alberta originally) plight with the CPO, noting “the disciplinary proceedings against Dr. Jordan Peterson by the College of Psychologists of Ontario, demonstrate how regulatory bodies can extend their reach into personal expression rather than professional competence.”

“Similar cases involving nurses, engineers and other professionals revealed a growing pattern: individuals facing investigations, penalties or compulsory ideological training for off-duty expressive conduct. These incidents became a catalyst, confirming the need for clear legislative boundaries that protect free expression while preserving professional standards.”

Alberta Minister of Justice and Attorney General Mickey Amery said regarding Bill 13 that the new law makes that protection of professionals “real and holds professional regulatory bodies to a clear standard.”

Last year, Peterson formally announced his departure from Canada in favor of moving to the United States, saying his birth nation has become a “totalitarian hell hole.”

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

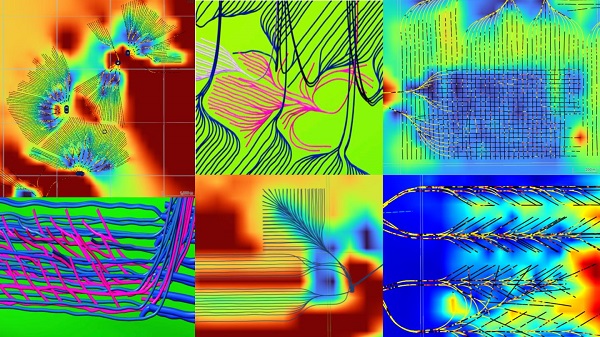

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

Energy1 day ago

Energy1 day agoExpanding Canadian energy production could help lower global emissions

-

Business1 day ago

Business1 day agoWill the Port of Churchill ever cease to be a dream?

-

Great Reset2 days ago

Great Reset2 days agoEXCLUSIVE: The Nova Scotia RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

Daily Caller2 days ago

Daily Caller2 days agoSpreading Sedition? Media Defends Democrats Calling On Soldiers And Officers To Defy Chain Of Command

-

COVID-1919 hours ago

COVID-1919 hours agoFreedom Convoy protestor Evan Blackman convicted at retrial even after original trial judge deemed him a “peacemaker”

-

Health2 days ago

Health2 days agoDisabled Canadians petition Parliament to reverse MAiD for non-terminal conditions

-

Business1 day ago

Business1 day agoThe numbers Canada uses to set policy don’t add up

-

Business1 day ago

Business1 day agoNew airline compensation rules could threaten regional travel and push up ticket prices