Business

Why a domestic economy upgrade trumps diversification

From the Macdonald Laurier Institute

By Stephan Nagy for Inside Policy

The path to Canadian prosperity lies not in economic decoupling from the US but in strategic modernization within the North American context.

President Donald Trump’s ongoing tariff threats against Canadian exports has sent shockwaves through Ottawa’s political establishment. As businesses from Windsor to Vancouver brace for potential economic fallout, a fundamental question has emerged: Should Canada diversify away from its overwhelming economic dependence on the United States, or should it instead use this moment to modernize and upgrade its economic hard and software within the North American context? The evidence overwhelmingly supports the latter approach in which Canada reduces interprovincial trade barriers and regulations, builds infrastructure to move energy and other resources within Canada, and invests in Canadian human capital and relationships with the US to maximize synergies, stakeholder buy-in and mutual benefit.

The knee-jerk reaction to blame Trump’s economic nationalism misses a crucial point: America’s retreat from championing global free trade began well before his unorthodox political ascendance in 2016. The Obama administration’s signature Trans-Pacific Partnership (TPP) faced mounting bipartisan skepticism before Trump withdrew from it in 2017. Hillary Clinton, during her presidential campaign, explicitly stated she would oppose the deal, reversing her earlier support. “I will stop any trade deal that kills jobs or holds down wages, including the Trans-Pacific Partnership,” Clinton declared during a campaign speech in Michigan in August 2016.

When President Joe Biden took office, rather than resurrect the TPP, his administration proposed the Indo-Pacific Economic Framework (IPEF). Unlike traditional trade agreements, the IPEF conspicuously omitted market access provisions while emphasizing supply chain resilience and environmental standards. During the IPEF ministerial meeting in Los Angeles in September 2022, U.S. Trade Representative Katherine Tai specifically noted that the framework “moves beyond the traditional model” of free trade agreements.

These policy evolutions reflect a deeper transformation in American economic thinking: a bipartisan consensus has emerged around industrial policy aimed at rebuilding domestic manufacturing, securing critical supply chains, and maintaining technological leadership against authoritarian competitors such as China.

Prime Minister Justin Trudeau and his Cabinet fundamentally misunderstood these shifts, leading to a series of diplomatic missteps that have damaged Canada-US relations. Most damaging has been a pattern of public rhetoric dismissive of both Trump personally and his MAGA supporters more broadly.

In June 2018, following the G7 summit in Charlevoix, Quebec, Trudeau declared in a press conference that Canada “will not be pushed around” by the United States, characterizing Trump’s tariffs as “insulting.” This prompted Trump to withdraw his endorsement of the summit’s joint statement and label Trudeau as “very dishonest and weak” on Twitter.

Former Deputy Prime Minister Chrystia Freeland repeatedly aligned the MAGA movement with authoritarianism. In an August 2022 speech at the Brookings Institution, she characterized Trump supporters as part of a global “anti-democratic movement.” In October 2023, she went further, drawing parallels between MAGA and authoritarian regimes like Russia and China. These statements resonate poorly with nearly half of American voters who supported Trump in recent elections and are borderline disinformation with such exaggerated mischaracterizations of American voters.

Former Foreign Affairs Minister François-Philippe Champagne was caught on camera in December 2022 referring to Trump’s policies as “deranged” while speaking with European counterparts. The video, which social media users circulated widely, further inflamed tensions between the administrations.

Such diplomatic indiscretions might be dismissed as political theatre if they didn’t coincide with concrete policy failures. The Trudeau government neglected critical infrastructure projects that would have strengthened North American economic integration while reducing Canada’s vulnerability to U.S. policy shifts.

To illustrate, Japan and Germany approached Canada to secure liquefied natural gas (LNG) exports as part of their efforts to reduce reliance on Russian energy supplies. Japan expressed high expectations for Canadian LNG during Prime Minister Fumio Kishida’s visit, while Germany explored LNG opportunities during Chancellor Olaf Scholz’s visit, emphasizing the urgency of diversifying energy sources due to geopolitical tensions. However, Trudeau rejected these requests, citing a weak business case for LNG exports from Canada’s East Coast due to logistical challenges and lack of infrastructure. Instead, Trudeau shifted focus to clean energy initiatives and critical minerals, reflecting Canada’s evolving industrial policy priorities.

The economic relationship between Canada and the US represents perhaps the most thoroughly integrated bilateral commercial partnership in the world. The statistics alone tell a compelling story: daily two-way trade exceeds $3 billion, supporting approximately 2.7 million Canadian jobs – roughly one-in-six workers in the country.

This integration manifests in countless ways across industries.

For example, in automotive manufacturing, a single vehicle assembled in Ontario typically crosses the Canada-US border seven times during production. A Honda Civic assembled in Alliston, Ontario, contains components from both countries, with engines from Ohio and transmissions from Georgia integrated with Canadian-made bodies and electronics.

The energy infrastructure between the two nations functions essentially as a single system. The North American power grid delivers Canadian hydroelectricity to major US markets, while Canadian refineries process crude oil from both countries. TransCanada’s natural gas pipeline network serves both markets seamlessly, with approximately 3.2 trillion cubic feet flowing between the countries annually.

In aerospace, Bombardier’s commercial aircraft division collaborates with American suppliers like Pratt & Whitney and Collins Aerospace, creating integrated supply chains that span the border. Montreal’s aerospace cluster works in close coordination with counterparts in Seattle and Wichita.

Beyond traditional industries, American-Canadian technological collaboration has accelerated in recent years. For example, the Vector Institute in Toronto has established formal research partnerships with MIT’s Computer Science and Artificial Intelligence Laboratory, collaborating on foundational AI research. Their joint papers on neural network optimization have been cited more than 3,000 times since 2020.

Quantum computing initiatives at the University of Waterloo’s Institute for Quantum Computing maintain ongoing research exchanges with Google’s quantum computing team in Santa Barbara, California. Their shared work on quantum error correction protocols has advanced the field significantly.

In clean technology, Hydro-Québec’s energy storage division and Massachusetts-based Form Energy announced in 2023 a $240 million joint venture developing grid-scale iron-air batteries to enable renewable energy deployment across North America.

The SCALE.AI supercluster, headquartered in Montreal, includes American tech giants like Microsoft, Amazon, and IBM collaborating with Canadian start-ups on supply chain optimization technologies.

Against this backdrop of deep integration, calls for Canada to diversify away from the US toward markets like China reflect wishful thinking rather than economic reality. Dezan Shira & Associates in its China Briefing advocated expanding commercial ties with Beijing despite China’s documented history of economic coercion toward Canada.

This recommendation ignores the painful lessons of recent history. The arbitrary detention of Michael Kovrig and Michael Spavor for over 1,000 days in Chinese prisons, the imposition of punitive restrictions on Canadian agricultural exports following the arrest of Huawei executive Meng Wanzhou, and documented interference in Canadian domestic politics all demonstrate the risks of economic dependence on China.

The CD Howe Institute’s March 2025 analysis cites the overwhelming preponderance of trade flows: 76 per cent of Canadian exports go to the United States, compared to just 3.7 per cent to China, 2.4 per cent to the UK, and 2.32 per cent to Japan. As the report notes, “Given geographic proximity, linguistic compatibility, and complementary regulatory frameworks, any significant trade diversification away from the United States would require decades of sustained effort and acceptance of considerably higher transaction costs.”

Rather than pursuing illusory diversification, Canada should focus on strategic economic modernization that positions it as an indispensable partner in America’s industrial revitalization.

First, Canada must dismantle internal trade barriers that fragment its domestic market. The Canadian Federation of Independent Business estimates these interprovincial trade barriers cost the economy $130 billion annually – nearly 7 per cent of GDP. Harmonizing regulations and procurement practices would create a more efficient national market better positioned to integrate with the US economy.

Second, Canada should leverage its critical mineral resources – including lithium, cobalt, and rare earth elements – as strategic assets for North American supply chain security. The Minerals Security Partnership launched in 2022 provides a framework for such co-operation, but Canada has yet to fully capitalize on its geological advantages.

Third, Ottawa should accelerate east-west energy infrastructure development to enhance continental energy security. The proposed Energy East pipeline, which would have transported Western Canadian crude to Eastern refineries, fell victim to regulatory hurdles in 2017. Reviving such projects would reduce Eastern Canada’s dependence on imported oil while creating more resilient North American energy networks.

Finally, Canada should position itself as a key contributor to emerging technology initiatives. Trump’s proposed $500 billion AI infrastructure investment represents an opportunity for Canadian AI researchers and companies to integrate more deeply into US innovation ecosystems.

The path to Canadian prosperity lies not in economic decoupling from the US but in strategic modernization within the North American context. The integrated nature of the two economies – built over generations through geographic proximity, shared values, and complementary capabilities – represents a competitive advantage too valuable to abandon.

As American industrial policy evolves to address 21st-century challenges, Canada faces a choice: it can either adapt its economic framework to remain an essential partner in this transformation or risk marginalization through misguided diversification efforts. The evidence overwhelmingly supports the former approach.

For Canada, the answer is smarter, not less, North American integration.

Dr. Stephen Nagy is as a professor at the International Christian University, Tokyo and a senior fellow at the Macdonald-Laurier Institute. Concurrently, he is a visiting fellow with the Japan Institute for International Affairs (JIIA). He serves as the director of policy studies for the Yokosuka Council of Asia Pacific Studies (YCAPS), spearheading their Indo-Pacific Policy Dialogue series. He is currently working on middle-power approaches to great-power competition in the Indo-Pacific.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Business

Carney’s new agenda faces old Canadian problems

From the Fraser Institute

In his June speech announcing a major buildup of Canada’s military, Prime Minister Mark Carney repeated his belief that this country faces a “hinge moment” of the sort the allied countries confronted after the Second World War.

A better comparison might be with the beginning of the war itself.

Then, the Allies found themselves at war with an autocratic state bent on their defeat and possible destruction. Now, Carney faces an antagonistic American president bent on annexing Canada through economic warfare.

Then, Canada rose to the challenge, creating the world’s third-largest navy and landing an army at Normandy on D-Day. Now, Carney has announced the most aggressive reorienting of Canada’s economic, foreign and defence policies in generations.

Polls show strong support among Canadians for this new agenda. But the old Canada is still there. It will fight back. It may yet win.

The situation certainly would have been more encouraging had Carney not inherited Justin Trudeau’s legacy of severe economic and environmental restrictions—picking economic winners and losers rather than letting the market decide—and chronic deficits. The new prime minister would do well to dismantle as much of that legacy as he can.

Some advocate a return to the more laissez-faire approach of Stephen Harper’s government. But Harper didn’t confront a belligerent president hoping to annex Canada through the “economic force” of tariff walls.

The prime minister succeeded in getting Bill C-5, which is intended to weaken at least some of the restrictions on resource development and infrastructure, passed into law. He and the premiers pledge to finally dismantle generations of internal trade and labour mobility barriers. If we must trade less with the Americans, we can at least learn to trade with ourselves.

And the prime minister deserves high praise for reversing decades of military decline through increased spending and efforts to improve procurement. If Carney accomplishes nothing more than restoring Canada’s defences, especially in the Arctic, he will be well remembered.

That said, major challenges confront the Carney agenda.

There’s much talk about a new national energy corridor. But what does that mean? One KPMG executive defined it as a “dedicated, streamlined pathway for the energy, electricity, decarbonization, transportation and digital infrastructure.”

Yes, but what does that mean?

Whatever it means, some First Nations will oppose it tooth-and-nail. Not all of them, mind you. The First Nations Major Project Coalition is dedicated to assisting First Nations in working with government and the private sector for the benefit of all. But many First Nations people consider resource development further exploitation of their ancestral lands by a colonizing power. At the first major proposal to which they do not buy in, they will take the government to court.

What investor will be willing to commit to a project that could be blocked for years as First Nations and Ottawa fight it out all the way to the Supreme Court?

The prime minister, formerly a fervent advocate of combatting climate change, now talks about developing “conventional energy,” which means oil and gas pipelines. But environmental activists will fiercely oppose those pipelines.

There is so much that could go wrong. Sweep away those internal trade barriers? Some premiers will resist. Accelerate housing development? Some mayors will resist. Expand exports to Europe and Asia? Some businesses and entrepreneurs will say it’s not worth the risk.

As for the massive increase in defence spending, where will the money come from? What will be next year’s deficit? What will be the deficit’s impact on inflation, interest rates and sovereign creditworthiness? The obstacles are high enough to make anyone wonder how much, if any, of the government’s platform will be realized. But other factors are at work as well, factors that were also present in 1939.

To execute his mandate, Carney is surrounding himself with what, back in the Second World War, were called “dollar a year men”—executives who came to Ottawa from the private sector to mobilize the economy for wartime.

In Carney’s case he has brought in Marc-André Blanchard as chief of staff and Michael Sabia as clerk of the privy council. Both are highly experienced in government and the private sector. Both are taking very large pay cuts because, presumably, they understand the gravity of the times and believe in the prime minister’s plans.

Most important, Carney’s agenda has broad support from a public that fears for the country’s future and will have little patience toward any group seeking to block the prime minister’s agenda.

Millions of Canadians want this government’s reform efforts to succeed. Those who would put it at risk of failing will have to contend with public anger. That gives Carney a shot at making real change.

-

Alberta9 hours ago

Alberta9 hours agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Immigration

-

Business2 days ago

Business2 days agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

International2 days ago

International2 days agoElon Musk forms America Party after split with Trump

-

Disaster2 days ago

Disaster2 days agoTexas flood kills 43 including children at Christian camp

-

Alberta9 hours ago

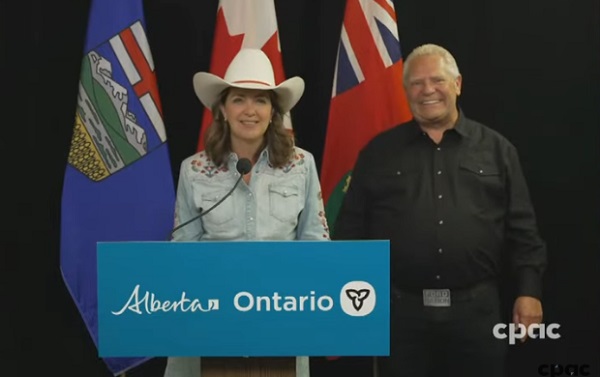

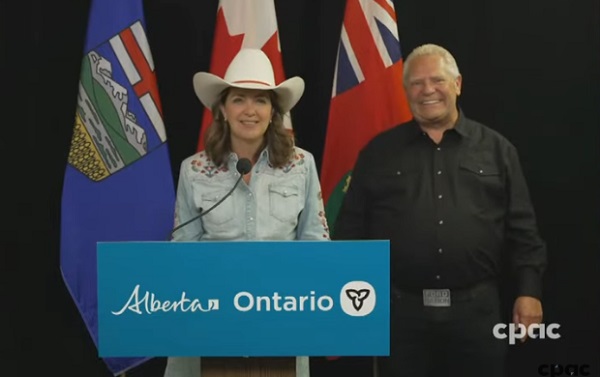

Alberta9 hours agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

COVID-1912 hours ago

COVID-1912 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Alberta Sports Hall of Fame and Museum23 hours ago

Alberta Sports Hall of Fame and Museum23 hours agoAlberta Sports Hall of Fame 2025 Inductee Profiles – Para Nordic Skiing – Brian and Robin McKeever