Banks

What 100 million “unbanked” Nigerians can teach Canadians about Central Bank Digital Currency

From the Frontier Centre for Public Policy

By Gieb Lisikh

Despite credit cards, e-transfers and online banking having already made money go pretty much digital, the Bank of Canada is busily working on a much bigger transformation. Canada is one of about 100 countries that – in uncanny synchronicity – several years ago joined the race toward retail central bank digital currency (CBDC).

Touted as the digital equivalent of cash, CBDC risks eroding the established banking system and, among many other problems, is likely to be vulnerable to hackers’ attacks which, should a foreign government use this as a tactic in “hybrid” warfare, might prove capable of destabilizing a target country’s economy.

Considering such acute risks, it would be reasonable to expect that the explosion of worldwide interest in CBDC is justified by its special qualities that address obvious pressing needs of the citizenry. The purported consumer and other needs for CBDC, however, seem to be entirely fabricated, while the qualities that actually differentiate CBDC from the money we use now are hushed and obscured by virtue-signalling.

CBDC’s main advertised feature is equivalency to cash. It is everywhere marketed as a means to advance “financial inclusion” – a convenient way for the “unbanked” to access financial services – both a stand-in and replacement for cash, which it is claimed is about to disappear from use.

The Bank of Canada admits, however, that CBDC cannot actually replace cash or make an “unbanked” person “banked”. That’s because CBDC does nothing to address the two key reasons people still use cash: the need for privacy and independence from technology. CBDC does the opposite. First, CBDC has a built-in lack of privacy as it’s designed to always leave a digital trail. Second, it requires the use of an internet-connected device – meaning it is not only technology-dependent but interruptible.

While some research suggests only 2 percent of Canadians still rely heavily on cash, a Bank of Canada survey found that 46 percent of us would find the elimination of cash anywhere from inconvenient to disastrous. What might happen if governments forcibly removed cash from circulation? We don’t need to guess, for we have a large-scale case-study available.

In Nigeria, about half of adults had no bank account when in October 2021 the government introduced eNaira, the world’s first serious CBDC implementation. Making 100 million “unbanked” Nigerians happy was no doubt intended not only as a national but as a global endorsement for CBDC. Yet it did the opposite, eventually rocking the country to its core.

A piddly 0.8 percent of already “banked” Nigerians downloaded eNaira wallets in the first year after the launch, of whom most did not engage in any transactions. Not dissuaded by such overwhelming indifference, the government doubled-down with an all-out attack on cash, demonetizing banknotes and forcing Nigerians to exchange their cash holdings for eNaira. The nation’s 100 million poorest people were left with paper money they could not use to buy food or other necessities. This triggered violent riots as desperate hungry people took to the streets, demanding reinstatement of cash. The situation persisted for more than three months until cash was re-enabled. Today Nigeria’s government is trying to boost eNaira use through artificial cash shortages.

The International Monetary Fund’s (IMF) consultants heavily pushed the “financial inclusion” narrative in Nigeria, fully endorsing it as “a key policy objective that central banks, especially those in emerging and low-income countries, are considering for retail [CBDC].” Yet bizarrely, the same IMF document notes: “The impact of CBDC for improving financial inclusion is currently speculative, where further evidence and experience are needed to fully understand benefits and limitations.”

How can the main reason for a large financial overhaul that will be life-altering for hundreds of millions of people and carries many risks be…speculative? As if dodging this question, the Bank of Canada turns the conversation on its head: instead of looking for a justifiable use case that warrants “wide adoption, acceptance and use of CBDC”, it goes into talk of “overcoming the barriers”. The Bank seems to have made its commitment to building CBDC capacity before finding a genuine need. And that leaves us with the only sensible conclusion: that the advertised justifications are just an awkward façade, hiding the real and not-so-welcome reasons.

The two major features making CBDC different from traditional money are that CBDC is centrally traceable and programmable. This makes CBDC almost infinitely dangerous. It will be only one step from monitoring your every financial move to telling you how and when to spend your money. CBDC will enable “special purposes” like spending caps or blocks, transfer limits, consumption controls, penalty taxes, forced loans, nudge economics, geo fencing and more. These things are already happening in China and, according to Russian officials, may soon begin there as well.

Those utterly undemocratic purposes should outrage any Westerner, but they fit China’s social credit system like a glove. They could be further enhanced by other privacy-intrusive measures like digital ID, surveillance and elimination of cash or alternative monetary systems such as cryptocurrency.

Canadians have expressed no desire, understanding or even, for the most part, awareness of the publicly-funded CBDC development and the reasons behind it. As in Nigeria, the nation’s central bank does not listen but simply insists on and proceeds with this affair, claiming it’s to benefit Canadians but failing or not even trying to articulate how.

The original, full-length version of this article was recently published in C2C Journal.

Gleb Lisikh is a researcher and IT management professional, and a father of three children. He lives in Vaughan, Ontario and grew up in various parts of the Soviet Union.

Banks

RFK Jr. warns Americans ‘will be slaves’ if central bank digital currency is established

From LifeSiteNews

The U.S. presidential candidate cited the Freedom Convoy trucker protests in Canada when the government ‘was able to destroy their lives’ by freezing bank accounts.

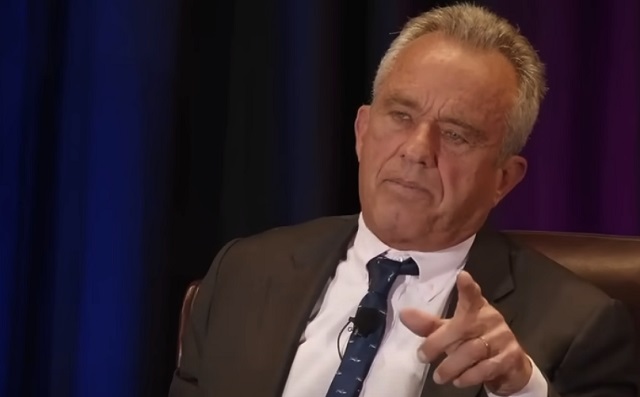

Democrat presidential candidate Robert F. Kennedy Jr. declared in no uncertain terms recently that establishing a Central Bank Digital Currency in the country will be “the end of freedom; we will be slaves if we allow that to happen.”

In a wide-ranging discussion at the University of Austin about freedom of speech and civil discourse, Kennedy said he didn’t “get” the connection between CBDCs and the loss of freedom of expression and other freedoms until he witnessed the Canadian trucker protest.

Robert F. Kennedy Jr on Why He Opposes Central Bank Digital Currencies

“That is part of the path to getting us where China is today. That’s where they started…It’s the end of freedom. We will be slaves if we allow that to happen.”@RobertKennedyJr pic.twitter.com/DSD6ZD0Bkk

— Chief Nerd (@TheChiefNerd) March 24, 2024

“The truckers in Canada were protesting the COVID mandates, the lockdowns, masking mandates, vaccination mandates, and others,” Kennedy began. “They started in Alberta. They picked up thousands of trucks as they drove across Canada to Ottawa.”

When they got to Ottawa — they were trying to petition Prime Minister Trudeau — and they were exercising a right that we all take for granted in this country: the right to assemble, the right to protest, the right to petition their government, and the government instead condemned them as right-wing fascists and racists, which if you look at the videos, they’re the opposite. Looks like Woodstock. They were delivering bottled water, they were cooking food for the poor, they were picking up garbage. There were musicians on every block.

It was really a beautiful thing.

However, the Trudeau government perceived the protesters to be an existential threat.

“The government used facial recognition systems and other intrusive technologies to identify the participants,” he recounted, and weaponized that information against them to freeze their bank accounts so they couldn’t purchase diesel for their trucks, buy food for their kids, or pay their mortgages or rents.

A pivotal moment for Kennedy occurred when one of the truckers told him that because of the government’s action, he was going to go to jail because he couldn’t pay his alimony.

He said that transactional freedom is as important as freedom of the press, or freedom of speech, “because if you have freedom of speech in the First Amendment and yet when you exercise that speech — if the government doesn’t like it — they can starve you to death. They can throw you out of your home.”

He explained that in China:

They keep a social credit score on you so that if (for instance) you’ve got your mask off below your nose, or if you’re not social distancing properly, or if you violate some other social norm, you get penalties taken off your social (credit) score and at some point they punish you.

Penalized persons are then limited to buying groceries from “stores that are within a certain radius of your house. You can’t buy gas. You can’t buy an airplane ticket. You can’t buy anything else, so you’re basically under home confinement.”

The truckers in Canada were never charged with a crime. They were certainly never convicted. It was just (that) they were doing something the government didn’t like.

So the government was able to destroy their lives, and that is a very dangerous power to give government. And that’s why I’m against Central Bank Digital Currencies because that is part of the path to getting us where China is today.

That’s where they started. That’s where all these other countries … with a Central Bank Digital Currency (started). And it’s the end of freedom. We will be slaves if we allow that to happen.

Kennedy is far from alone in his alarm over the prospect of a CBDC being introduced in the U.S. or Canada.

Although digital currency offers some attractive features, it also would grant the federal government unlimited opportunity to weaponize the technology against citizens, allowing it to both spy on the spending habits of everyday Americans and block access to the money in their personal bank accounts.

U.S. Sen. Ted Cruz introduced the CBDC Anti-Surveillance State Act last month to prohibit the Federal Reserve from issuing a central bank digital currency that Republican sponsors of the bill believe could turn the nation into a “surveillance state” by handing over control of personal finances to federal government agencies.

“The Biden administration salivates at the thought of infringing on our freedom and intruding on the privacy of citizens to surveil their personal spending habits, which is why Congress must clarify that the Federal Reserve has no authority to implement a CBDC,” Cruz said.

“While Americans across the country are being punished for thinking, speaking, and voting the ‘wrong’ way, the last thing we need is the government surveilling personal finances,” Heritage Action for America explained in a statement concerning the new legislation. “Anti-CBDC legislation is necessary to safeguard Americans’ financial privacy in the face of potential surveillance, control, and political intimidation.”

“CBDCs present major privacy concerns for everyday Americans, including granting the government the ability to collect intimate personal details on U.S. citizens, and potentially track and freeze funds for any reason,” the Blockchain Association noted.

“Big government has no business spying on Americans to control their personal finances and track their transactions,” said Republican U.S. Sen. Rick Scott of Florida, a co-sponsor of the bill.

“It is a massive overreach,” he warned.

Banks

Canada is preparing to launch ‘open banking.’ Here’s what that means

From LifeSiteNews

By David James

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The Canadian government is setting the stage to bring in what is termed “open banking.”

It is described as a “secure way” for customers to share their financial data with financial technology companies (fintechs or fintech apps). The holders of the account do not have to provide their online banking usernames and passwords. Instead, the data is shared by the customer’s bank with the fintech company, or app, through an online channel.

Open banking is often contrasted with what is called screen scraping, which is when the third party is provided with the online banking username and password, enabling them to log in directly to the bank account as if they were the customer.

Open banking has been adopted by 68 countries, including the United Kingdom and Australia. The U.S. Congress passed the necessary legislation to set it up in 2010, but it was not until last October that the Consumer Financial Protection Bureau (CFPB) issued a proposed rule necessary for implementation.

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The greatest peril is fraudulent account linking: unauthorized connections between customer accounts and third-party applications. This can be done by linking the victim’s financial account to an app controlled by the fraudster, allowing unauthorized access to the person’s funds. Or, the fraudster’s financial account can be linked to a victim’s third-party app, allowing scammers to transfer funds into their account. Substantial sums of money can be stolen before the victim becomes aware of the breach.

Such risks are commonplace in the digital banking environment. For instance, in Australia, according to the Australian Bureau of Statistics, credit card fraud affected 8.7 per cent of the population in 2022-23. The average amount stolen, however, was only $A200 and only 18 per cent had more than $A1000 taken. With open banking, if there is a breach, any sums stolen are likely to be much larger.

Neither is there any reason to think open banking is completely secure just because customers do not reveal their username and password. The Australian Banking Association warned that, after cyberattacks on the government medical insurer Medibank and telco Optus, “the engagement of a third party standing in the shoes of the customer … introduces a range of new risks for which banks may need to develop specific scam, fraud and cyber mitigation tools.”

According to research by financial advisory company Konsentus, the adoption of open banking has been strongest in Asia. In the U.S., customers have a strong attraction to credit cards and the rewards on offer. That is expected to represent a big barrier to take up. In Britain participation has “plateaued,” according to The Open Banking Impact Report (OBI report).

What are the advantages of open banking? According to the OBI report open banking has become a “critical component of cloud accounting” in Britain, which is helping smaller businesses track their financial positions more accurately. It is claimed that giving more entities access to customers’ financial data also increases competition.

Open banking is supposedly more efficient. The fintech company Gocardless contends that: “bank-to-bank payments are fully integrated and use a digital pull-based mechanism, where the merchant requests payment. In contrast, manual bank payments or card payments require the customer to send the payment to the business. Bank-to-bank payments tend to have lower failure rates compared to credit/debit card methods. Thus, businesses spend less time chasing missed payments.”

Another more doubtful claim is that open banking will make things easier for lenders. Abhigyan Shrivastava, leader in banking and technology transformation for Bendigo and Adelaide Bank writes that open banking is: “set to have a significant impact on lending transformation in Australia… with increased competition, personalized lending products, and more efficient lending processes.”

There is little reason, however, to think that better exposure to borrowers’ data will make any difference to lending practices. It will still be a matter of borrowers being able to provide enough collateral to qualify for a loan and to demonstrate they have sufficient income to pay the interest. In other words, banking as usual.

What is most likely is that the benefits of the initiative will primarily go to the banks and financial technology companies. That these entities argue, unconvincingly, that open banking is more “customer-centric” rouses the suspicion that ordinary customers will ultimately gain little.

-

COVID-1921 hours ago

COVID-1921 hours agoPfizer reportedly withheld presence of cancer-linked DNA in COVID jabs from FDA, Health Canada

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoJordan Peterson, Canadian lawyer warn of ‘totalitarian’ impact of Trudeau’s ‘Online Harms’ bill

-

Alberta2 days ago

Alberta2 days agoAlberta rejects unconstitutional cap on plastic production

-

Alberta2 days ago

Alberta2 days agoAlberta official reveals ‘almost all’ wildfires in province this year have been started by humans

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCome For The Graduate Studies, Stay For The Revolution

-

Business2 days ago

Business2 days agoTaxpayers criticize Trudeau and Ford for Honda deal

-

Alberta2 days ago

Alberta2 days agoPolitical parties will be part of municipal elections in Edmonton and Calgary pilot projects

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoAustralian politicians attack Elon Musk for refusing to remove video of Orthodox bishop’s stabbing