Business

Watchdog Calls Out Carney’s Lack of Ethics Code

Democracy Watch Demands PM Re-Enact Full Ministerial Code and End Conflicts by Selling Investments as House Committee Probes Loophole-Ridden Ethics Law

The House of Commons Ethics Committee is finally cracking open the federal Conflict of Interest Act. It’s the first real review in years. And it’s overdue. Today, Democracy Watch is calling on Prime Minister Mark Carney to do something simple and obvious: re-issue the Prime Minister’s code for ministers and staff—publicly, in full—and work with every party to shut the gaping loopholes that have turned Canada’s ethics rules into a suggestion box.

The only publicly posted rulebook is still the 2015 “Open and Accountable Government” guide. It wasn’t signed by Mark Carney. It was signed by Justin Trudeau. Before that, Stephen Harper had his own “Accountable Government” code in 2007, which he strengthened in 2011. Paul Martin re-issued the code in 2004 as “Responsible Government,” and Jean Chrétien was the first to bring it in back in 2002. Every Prime Minister for more than two decades has put their name to a code—except Carney.

That’s a problem. Canadians deserve crystal-clear, enforceable standards: honesty, no apparent conflicts, decisions based on merit, real guardrails on political activity, fundraising, and dealings with lobbyists—and ministerial staff held to the same line. Put the rules in the PM’s own name or admit you plan to weaken them.

“Failing to re-enact the code—or watering it down—would gut already weak rules and further trash public trust,” said Duff Conacher, PhD (Law), Co-founder of Democracy Watch. “Canadians want standards with teeth, not press releases dressed up as ethics.”

Here’s what’s driving the urgency. The Conflict of Interest Act still lets the Prime Minister park massive holdings behind instruments branded as “blind trusts” or “ethics screens.” In practice, those devices often conceal participation; they don’t prevent it. That’s not oversight. That’s camouflage. Democracy Watch’s position is blunt: if you want to end the conflicts, sell the assets. Full divestment, including buyouts of stock options by Brookfield and any other connected companies, as past inquiries recommended.

“Prime Minister Carney’s so-called blind trust is not blind, and his ethics screen is an opaque mechanism that invites doubt about who benefits when the government acts,” Conacher said. “The fix is obvious: sell the investments. Anything less keeps Canadians in the dark.”

Parliament now has a choice. Use this committee review to close loopholes around blind trusts and ethics screens. Spell out what “improperly furthering private interests” really means. Put real independence, transparency, and penalties into law. And stop the double standard: cabinet and staff should face rules at least as tough as those on public servants and senators.

Democracy Watch is also urging broader reforms: clean up lobbying secrecy, slash the federal donation limit to cut off cash-for-access politics, protect whistleblowers who tell the truth, fix the federal access-to-information black box, and take the appointment of watchdogs out of the hands of the very politicians they’re supposed to police—no re-appointments, no cozy incentives.

And let’s be clear: this isn’t just Democracy Watch griping. It has credible grounding in the history of Canadian ethics law. The 1984 Starr–Sharp Task Force laid out a blueprint for a comprehensive ministerial code. Justice Parker’s 1987 commission went further, flatly recommending an end to the shell game of so-called blind trusts and, in cases of serious conflicts, requiring divestment. Parliament’s own research notes confirm it: the idea that you can “screen” away conflicts was discredited almost forty years ago. The fix was spelled out back then.

And yet here we are, in 2025, with a Prime Minister sitting on massive investments, hiding behind loopholes, and ducking responsibility to even sign his own code of conduct. Canadians see it. They know the difference between rules with teeth and ethics theatre.

Enough posturing. Enough smoke and mirrors. Re-enact the full PM Code today. Tighten the Act tomorrow. And end the Prime Minister’s conflicts by selling the assets outright. That’s how you rebuild trust, by earning it, by setting an example, and by standing on principle.

But let’s be honest: he won’t do it. He won’t because these Liberals are swamp creatures to their core. They talk transparency while cashing in behind the curtain. They preach accountability while hiding their own dealings. Canadians know it, and they’re sick of it.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Bruce Dowbiggin

Integration Or Indignation: Whose Strategy Worked Best Against Trump?

““He knows nothing; and he thinks he knows everything. That points clearly to a political career.” George Bernard Shaw

In the days immediately following Donald Trump’s rude intervention into the 2025 Canadian federal election— suggesting Canada might best choose American statehood— two schools of thought emerged.

The first and most impactful school in the short term was the fainting-goat response of Canadian’s elites. Sensing an opening in which to erode Pierre Poilievre’s massive lead in the 2024 polls over Justin Trudeau, the Laurentian elite concocted Elbows Up, a self-pity response long on hurt feelings and short on addressing the issues Trump had cited in his trashing of the Canadian nation state.

In short order they fired Trudeau into oblivion, imported career banker Mark Carney as their new leader in a sham convention and convinced Canada’s Boomers that Trump had the tanks ready to go into Saskatchewan at a moment’s notice. The Elbows Up meme— citing Gordie Howe— clinched the group pout.

(In fact, Trump has said that America is the world’s greatest market, and if those who’ve used it for free in the past [Canada] want to keep special access they need to pay tariffs to the U.S. or drop protectionist charges on dairy and more against the U.S.)

The ruse worked out better than they could have ever imagined with Trump even saying he preferred to negotiate with Carney over Poilievre. In short order the Tories were shoved aside, the NDP kneecapped and the pet media anointed Carney the genius skewing Canada away from its largest trade partner to the Eurosphere. We remain in that bubble, although the fulsome promises of Carney’s first days are now coming due.

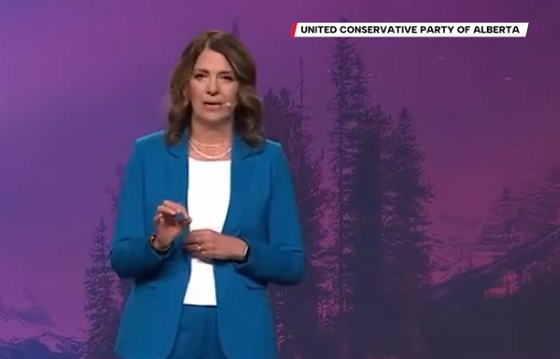

Which brings us to the second reaction. That was Alberta premier Danielle Smith bolting to Mar A Lago in the days following Trump’s comments. Her goal was to put pride aside and accept that a new world order was in play for Canada. She met with U.S. officials and, briefly, with Trump to remind them that Canada’s energy industry was integral to American prosperity and Canadian stability.

Needless to say, the fainting goats pitched a fit that not everyone was clutching pearls and rending garments in the wake of Trump’s dismissive assessment of his northern neighbours. Their solution to Trump was to join China in retaliatory tariffs— the only two nations to do so— and to boycott American products and travel. Like the ascetic monks they cut themselves off from real life. Trump has yet to get back to Carney the Magnificent

And Smith? She was a “traitor” or a “subversive” who should be keel hauled in the North Saskatchewan. For much of the intervening months she has been attacked at home in Alberta by the N-Deeps and in Ottawa by just about everyone on CBC, CTV, Global and the Globe & Mail. “How could she meet with the Cheeto?”

Nonetheless conservatives in the province moved toward a more independence within Canada. Smith articulated her demands for Alberta to prevent a referendum on whether to remain within Confederation. At the top of her list were pipelines and access to tidewater. Ergo, a no-go for BC’s squish premier David Eby who is the process of handing over his province to First Nations.

It became obvious that for all of Carney’s alleged diplomacy in Europe and Asia (is the man ever home?) he had a brewing disaster in the West with Alberta and Saskatchewan growing restless. In a striking move against the status quo, Nutrien announced it would ship its potash to tidewater via the U.S., thereby bypassing Vancouver’s strike-prone, outdated port and denying them billions.

Suddenly, Smith’s business approach began making eminent good sense if the goal is to keep Canada as one. So we saw last week’s “memorandum of understanding” between Alberta and Ottawa trading off carbon capture and carbon taxes for potential pipelines to tidewater on the B.C. coast. A little bit of something for everyone and a surrender on other things.

The most amazing feature of the Mark Carney/Danielle Smith MOU is that both politicians probably need the deal to fail. Carney can tell fossil-fuel enemy Quebec that he tried to reason with Smith, and Smith can say she tried to meet the federalists halfway. Failure suits their larger purposes. Which is for Carney to fold Canada into Euro climate insanity and Smith into a strong leverage against the pro-Canada petitioners in her province.

Soon enough, at the AFN Special Chiefs Assembly, FN Chief Cindy Woodhouse Nepinak told Carney that “Turtle Island” (the FN term for North America popularized by white hippy poet Gary Snyder) belongs to the FN people “from coast to coast to coast.” The pusillanimous Eby quickly piped up about tanker bans and the sanctity of B.C. waters etc.

Others pointed out the massive flaw in a plan to attract private interests to build a vital bitumen pipeline if the tankers it fills are not allowed to sail through the Dixon Entrance to get to Asia.

But then Eby got Nutrien’s message that his power-sharing with the indigenous might cause other provinces to bypass B.C. (imagine California telling Texas it can’t ship through its ports over moral objections to a product). He’s now saying he’s open to pipelines but not to lift the tanker ban along the coast. Whatever.

Meanwhile the kookaburras of isolation back east continue with virtue signalling on American booze— N.S. to sell off its remains stocks — while dreaming that Trump’s departure will lead to the good-old days of reliance on America’s generosity.

But Smith looks to be wining the race. B.C.’s population shrank 0.04 percent in the second quarter of 2025, the only jurisdiction in Canada to do so. Meanwhile, Alberta is heading toward five million people, with interprovincial migrants making up 21 percent of its growth.

But what did you expect from the Carney/ Eby Tantrum Tandem? They keep selling fear in place of GDP. As GBS observed, “You have learnt something. That always feels at first as if you have lost something.”

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, his new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.

Business

Carney’s Toronto cabinet meetings cost $530,000

By Jen Hodgson

Prime Minister Mark Carney’s two-day cabinet meeting in Toronto cost taxpayers more than $532,000, records reviewed by the Canadian Taxpayers Federation show. Carney’s cabinet meetings cost thousands of dollars more than recent cabinet retreats hosted by former prime minister Justin Trudeau.

“If you’re spending thousands of dollars more than Trudeau on meetings, you’re spending too much money,” said Franco Terrazzano, CTF Federal Director. “It’s going to be hard for politicians to explain to taxpayers why all of the meeting rooms in Ottawa weren’t good enough.”

Carney’s two-day cabinet meeting was held at the Pan Pacific Toronto in September, according to government records submitted in response to an Order Paper Question. Pan Pacific’s website describes itself as a “luxury hotel.”

The Privy Council Office spent $250,400 on the venue and “hospitality,” $78,700 for audiovisual services, $40,000 for security and $8,073 on shipping. The PCO spent another $38,300 on accommodation, meals and transportation.

The total bill to taxpayers may balloon higher. The PCO noted costs only include expenditures processed as of Sept. 23. “Certain associated travel claims and invoices may still be awaiting submission or receipt,” wrote the PCO.

The Royal Canadian Mounted Police spent $29,000 on the cabinet meeting. That only includes expenditures processed as of Sept. 17.

The Translation Bureau charged taxpayers $30,600 for travel expenses, travel time and interpretation services.

Other departments also spent $57,400 for the cabinet meeting. Most of that was for transportation, but some ministers charged taxpayers for meals and accommodation for themselves and their staff.

Carney’s Toronto cabinet meeting cost more than recent cabinet meetings hosted by Trudeau.

Trudeau’s cabinet retreat to Charlottetown, P.E.I., in August 2023, cost taxpayers $485,196. Even after adjusting for inflation, Trudeau’s cabinet retreat cost about $26,000 less than Carney’s.

The Trudeau government also held a cabinet meeting in Vancouver in 2022. It cost taxpayers $471,070. Even after adjusting for inflation, Trudeau’s cabinet retreat cost about $25,000 less than Carney’s.

“Carney told Canadians he was going to cut waste and he should start by not dropping half a million bucks on meetings,” Terrazzano said. “We need a culture change in Ottawa and that needs to start with the prime minister and ministers respecting taxpayers’ hard-earned money.”

-

Alberta2 days ago

Alberta2 days agoThis new Canada–Alberta pipeline agreement will cost you more than you think

-

Energy2 days ago

Energy2 days agoUnceded is uncertain

-

Automotive2 days ago

Automotive2 days agoPower Struggle: Governments start quietly backing away from EV mandates

-

Business18 hours ago

Business18 hours agoCanada’s climate agenda hit business hard but barely cut emissions

-

Energy22 hours ago

Energy22 hours agoCanada following Europe’s stumble by ignoring energy reality

-

MAiD1 day ago

MAiD1 day agoFrom Exception to Routine. Why Canada’s State-Assisted Suicide Regime Demands a Human-Rights Review

-

Alberta2 days ago

Alberta2 days agoAlberta will defend law-abiding gun owners who defend themselves

-

Business1 day ago

Business1 day agoCarney government should privatize airports—then open airline industry to competition