Uncategorized

Watch Live: Premier Kenney declares state of emergency in Alberta

From the Province of Alberta

Strong restrictions to slow the spread of COVID-19

Alberta’s government is declaring a state of public health emergency and putting aggressive measures in place to protect the health system and reduce the rising spread of COVID-19 cases.

New public health measures

Not following mandatory restrictions could result in fines of $1,000 per ticketed offence and up to $100,000 through the courts.

Provincewide measures

Public and private gatherings

Effective immediately, mandatory restrictions on social gatherings are in effect provincewide. These measures will be in place until further notice and include:

- No indoor social gatherings are permitted in any setting, including workplaces.

- Outdoor social gatherings are limited to a maximum of 10 people.

- Funeral services and wedding ceremonies must follow all public health guidance and are limited to a maximum of 10 in-person attendees. Receptions are not permitted.

Schools

In all schools, Grades 7-12 will move to at-home learning on Nov. 30, ending in-person classes early.

- Students in early childhood services and Grades K-6 will remain learning in-person until Dec. 18.

- All students will return to at-home learning after the winter break and resume in-person learning on Jan. 11, 2021.

- These measures are mandatory.

Diploma exams are optional for the rest of the school year. Students and their families can choose whether to write the exam or receive an exemption for the April, June, and August 2021 exam sessions.

Measures for regions under enhanced status

Effective immediately, mandatory restrictions on places of worship, businesses and services are in effect in areas under enhanced status. These measures will be in place until further notice.

Places of worship

- Places of worship are limited to a maximum of one-third normal attendance per service.

- Physical distancing between households and masking are required.

- Faith-based leaders are encouraged to move services online.

- In-person faith group meetings can continue, but must maintain physical distancing and public health measures must be followed.

Businesses and services

Starting Nov. 27, business and service restrictions fall under three categories: closed for in-person business, open with restrictions, and open by appointment only. Impacts by category are available here: alberta.ca/enhanced-public-health-measures.aspx.

These measures will remain in place for three weeks, but will be extended if needed.

Albertans are encouraged to limit in-person visits to retail locations, shop local and use curbside pickup, delivery and online services, where possible.

Specific measures for Calgary, Edmonton and surrounding communities

Mandatory mask requirements

Effective immediately, a new mandatory mask requirement for indoor workplaces is in place for Edmonton, Calgary and surrounding areas. This includes any location where employees are present, and applies to visitors, including delivery personnel, and employees or contractors.

This measure will be in place until further notice.

All existing guidance and legal orders remain in place in all areas. Alberta Health, AHS and local municipalities continue to closely monitor the spread across the province.

Quick facts

- A full breakdown of the new measures can be found here.

- There are 13,349 active cases and 35,695 recovered cases in Alberta.

- There are 348 people in hospital due to COVID-19, including 66 in intensive care.

- The total number of COVID-19 deaths is 492.

- Legally, all Albertans must physically distance and isolate when sick or with symptoms.

- Good hygiene is your best protection: wash your hands regularly for at least 20 seconds, avoid touching your face, cough or sneeze into an elbow or sleeve, and dispose of tissues appropriately.

Uncategorized

Mortgaging Canada’s energy future — the hidden costs of the Carney-Smith pipeline deal

Much of the commentary on the Carney-Smith pipeline Memorandum of Understanding (MOU) has focused on the question of whether or not the proposed pipeline will ever get built.

That’s an important topic, and one that deserves to be examined — whether, as John Robson, of the indispensable Climate Discussion Nexus, predicted, “opposition from the government of British Columbia and aboriginal groups, and the skittishness of the oil industry about investing in a major project in Canada, will kill [the pipeline] dead.”

But I’m going to ask a different question: Would it even be worth building this pipeline on the terms Ottawa is forcing on Alberta? If you squint, the MOU might look like a victory on paper. Ottawa suspends the oil and gas emissions cap, proposes an exemption from the West Coast tanker ban, and lays the groundwork for the construction of one (though only one) million barrels per day pipeline to tidewater.

But in return, Alberta must agree to jack its industrial carbon tax up from $95 to $130 per tonne at a minimum, while committing to tens of billions in carbon capture, utilization, and storage (CCUS) spending, including the $16.5 billion Pathways Alliance megaproject.

Here’s the part none of the project’s boosters seem to want to mention: those concessions will make the production of Canadian hydrocarbon energy significantly more expensive.

As economist Jack Mintz has explained, the industrial carbon tax hike alone adds more than $5 USD per barrel of Canadian crude to marginal production costs — the costs that matter when companies decide whether to invest in new production. Layer on the CCUS requirements and you get another $1.20–$3 per barrel for mining projects and $3.60–$4.80 for steam-assisted operations.

While roughly 62% of the capital cost of carbon capture is to be covered by taxpayers — another problem with the agreement, I might add — the remainder is covered by the industry, and thus, eventually, consumers.

Total damage: somewhere between $6.40 and $10 US per barrel. Perhaps more.

“Ultimately,” the Fraser Institute explains, “this will widen the competitiveness gap between Alberta and many other jurisdictions, such as the United States,” that don’t hamstring their energy producers in this way. Producers in Texas and Oklahoma, not to mention Saudi Arabia, Venezuela, or Russia, aren’t paying a dime in equivalent carbon taxes or mandatory CCUS bills. They’re not so masochistic.

American refiners won’t pay a “low-carbon premium” for Canadian crude. They’ll just buy cheaper oil or ramp up their own production.

In short, a shiny new pipe is worthless if the extra cost makes barrels of our oil so expensive that no one will want them.

And that doesn’t even touch on the problem for the domestic market, where the higher production cost will be passed onto Canadian consumers in the form of higher gas and diesel prices, home heating costs, and an elevated cost of everyday goods, like groceries.

Either way, Canadians lose.

So, concludes Mintz, “The big problem for a new oil pipeline isn’t getting BC or First Nation acceptance. Rather, it’s smothering the industry’s competitiveness by layering on carbon pricing and decarbonization costs that most competing countries don’t charge.” Meanwhile, lurking underneath this whole discussion is the MOU’s ultimate Achilles’ heel: net-zero.

The MOU proudly declares that “Canada and Alberta remain committed to achieving Net-Zero greenhouse gas emissions by 2050.” As Vaclav Smil documented in a recent study of Net-Zero, global fossil-fuel use has risen 55% since the 1997 Kyoto agreement, despite trillions spent on subsidies and regulations. Fossil fuels still supply 82% of the world’s energy.

With these numbers in mind, the idea that Canada can unilaterally decarbonize its largest export industry in 25 years is delusional.

This deal doesn’t secure Canada’s energy future. It mortgages it. We are trading market access for self-inflicted costs that will shrink production, scare off capital, and cut into the profitability of any potential pipeline. Affordable energy, good jobs, and national prosperity shouldn’t require surrendering to net-zero fantasy.If Ottawa were serious about making Canada an energy superpower, it would scrap the anti-resource laws outright, kill the carbon taxes, and let our world-class oil and gas compete on merit. Instead, we’ve been handed a backroom MOU which, for the cost of one pipeline — if that! — guarantees higher costs today and smothers the industry that is the backbone of the Canadian economy.

This MOU isn’t salvation. It’s a prescription for Canadian decline.

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

-

International1 day ago

International1 day agoGeorgia county admits illegally certifying 315k ballots in 2020 presidential election

-

International1 day ago

International1 day agoCommunist China arrests hundreds of Christians just days before Christmas

-

Business1 day ago

Business1 day agoSome Of The Wackiest Things Featured In Rand Paul’s New Report Alleging $1,639,135,969,608 In Gov’t Waste

-

Energy15 hours ago

Energy15 hours agoThe Top News Stories That Shaped Canadian Energy in 2025 and Will Continue to Shape Canadian Energy in 2026

-

Alberta1 day ago

Alberta1 day agoCalgary’s new city council votes to ban foreign flags at government buildings

-

Business2 days ago

Business2 days agoWarning Canada: China’s Economic Miracle Was Built on Mass Displacement

-

International15 hours ago

International15 hours ago$2.6 million raised for man who wrestled shotgun from Bondi Beach terrorist

-

Alberta2 days ago

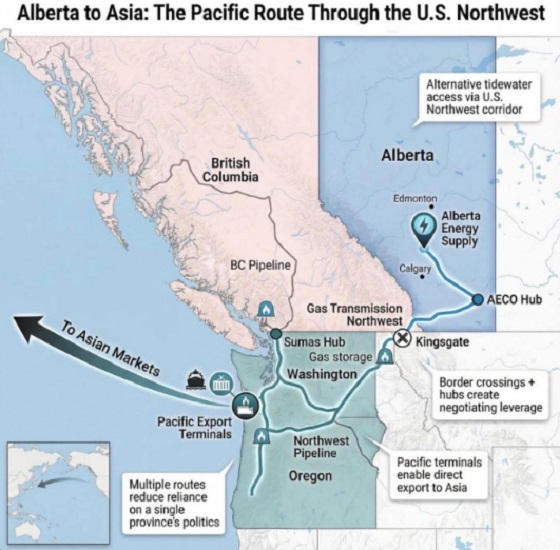

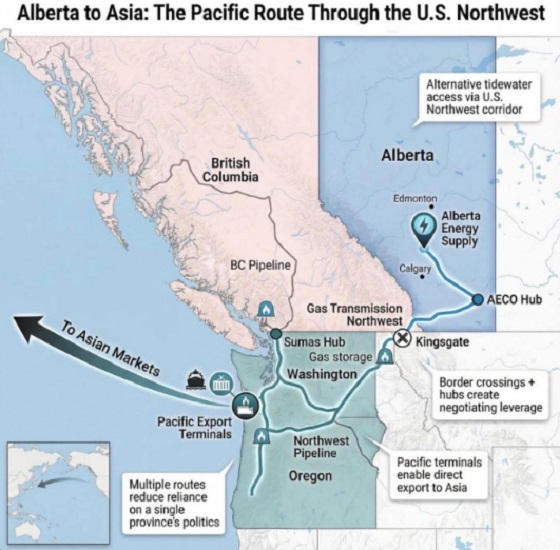

Alberta2 days agoWhat are the odds of a pipeline through the American Pacific Northwest