Energy

Venezuela oil czar in surprise resignation amid graft probes

A boy jumps near the “Los Petroleros” sculpture that shows two men working on an oil drill of Petroleos de Venezuela, S.A, PDVSA, on the Sabana Grande boulevard, in Caracas, Venezuela, March 20, 2023. Venezuela’s oil czar, Tareck El Aissami announced his resignation on Twitter and pledged to help investigate any allegations involving PDVSA. (AP Photo/Ariana Cubillos)

By Regina Garcia Cano in Caracas

CARACAS, Venezuela (AP) — The man responsible for running Venezuela’s oil industry — the one that pays for virtually everything in the troubled country, from subsidized food to ridiculously cheap gas — has quit amid investigations into alleged corruption among officials in various parts of the government.

Tareck El Aissami’s announcement Monday was shocking on multiple counts. He was seen as a loyal ruling party member and considered a key figure in the government’s efforts to evade punishing international economic sanctions.

And he led the state oil company PDVSA in a Venezuelan business sector widely considered to be corrupt — in a country where embezzelment, bribery, money laundering and other wrongdoing are a lifestyle.

“Obviously, they are giving it the patina of an anti-corruption probe,” said Ryan Berg, director of the Americas program at the Center for Strategic and International Studies, a Washington-based think tank.

“Rule of law is not being advanced here,” Berg added. “This is really a chance for the regime to sideline someone that it felt for some reason was a danger to it in the moment and to continue perpetuating acts of corruption once particular individuals have been forced out of the political scene.”

Hours after El Aissami revealed his resignation on Twitter, President Nicolás Maduro called his government’s fight against corruption “bitter” and “painful.” He said he accepted the resignation “to facilitate all the investigations that should result in the establishment of the truth, the punishment of the culprits, and justice in all these cases.”

Venezuela’s National Anti-Corruption Police last week announced an investigation into unidentified public officials in the oil industry, the justice system and some local governments. Attorney General Tarek William Saab in a radio interview Monday said that at least a half dozen officials, including people affiliated with PDVSA, had been arrested, and he expected more to be detained.

Among those arrested is Joselit Ramirez, a cryptocurrency regulator who was indicted in the U.S. along with El Aissami on money laundering charges in 2020.

Corruption has long been rampant in Venezuela, which sits atop the world’s largest petroleum reserves. But officials are rarely held accountable — a major irritant to citizens, the majority of whom live on $1.90 a day, the international benchmark of extreme poverty.

“I assure you, even more so at this moment, when the country calls not only for justice but also for the strengthening of the institutions, we will apply the full weight of the law against these individuals,” Saab said.

Oil is Venezuela’s most important industry. A windfall of hundreds of billions in oil dollars thanks to record-high global prices allowed the late President Hugo Chávez to launch numerous initiatives, including state-run food markets, new public housing, free health clinics and education programs.

But a subsequent drop in prices and government mismanagement, first under Chávez’s government and then Maduro’s, ended the lavish spending. And so began a complex crisis that has pushed millions into poverty and driven more than 7 million Venezuela to migrate.

PDVSA’s mismanagement, and more recently economic sanctions imposed by the U.S., caused a steady production decline, going from the 3.5 million barrels a day when Chávez rose to power in 1999 to roughly 700,000 barrels a day last year.

David Smilde, a Tulane University professor who has conducted extensive research on Venezuela, said the moves by Maduro’s government are more than just an effort to clean its image.

“Arresting important figures and accepting the resignation of one of the most powerful ministers in a case that involves $3 billion does not improve your image,” he said. “It is probably because the missing money actually has an important impact on a government with serious budgetary problems.”

The Biden administration recently loosened some sanctions, even allowing oil giant Chevron for the first time in more than three years to resume production. Maduro’s government has been negotiating with its U.S.-backed political opponents primarily to get the sanctions lifted.

U.S. congressional researchers saw El Aissami as an impediment to Maduro’s goals.

“Should Al Aissami remain in that position, it could complicate efforts to lift oil sanctions,” a November report from the Congressional Research Center said.

The U.S. government designated El Aissami, a powerful Maduro ally, as a narcotics kingpin in 2017 in connection with activities in his previous positions as interior minister and a state governor. The Treasury Department alleged that “he oversaw or partially owned narcotics shipments of over 1,000 kilograms from Venezuela on multiple occasions, including those with the final destinations of Mexico and the United States.”

Under the government of Chávez, El Aissami headed the Ministry of Internal Affairs. He was appointed minister of oil in April 2020.

“El Aissami was a key player in the Maduro government’s sanctions evasion strategy. We’re talking about someone who knows where all the bodies are buried, so it will be key to watch where he ends up,” said Geoff Ramsey, a senior fellow at the Atlantic Council focused on Colombia and Venezuela. “If El Aissami ends up being implicated himself, it could have serious implications for the entire power structure.”

In September, Maduro’s government renewed wrongdoing accusations against another former oil minister, Rafael Ramírez, alleging he was involved in a multibillion-dollar embezzlement operation during the early 2010s that took advantage of a dual currency exchange system. Ramírez, who oversaw the OPEC nation’s oil industry for a decade, denied the accusations.

In 2016, Venezuela’s then opposition-led National Assembly said $11 billion went missing at PDVSA in the 2004-2014 period when Ramirez was in charge of the company. In 2015, the U.S. Treasury Department accused a bank in Andorra of laundering some $2 billion stolen from PDVSA.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Daily Caller

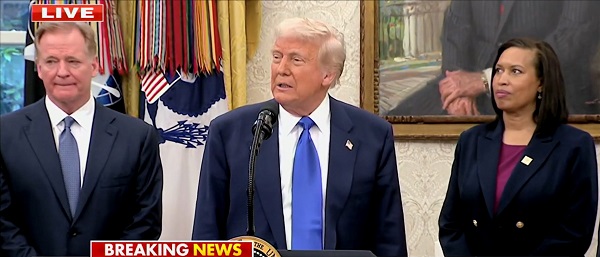

Trump Issues Order To End Green Energy Gravy Train, Cites National Security

From the Daily Caller News Foundation

By Audrey Streb

President Donald Trump issued an executive order calling for the end of green energy subsidies by strengthening provisions in the One Big Beautiful Bill Act on Monday night, citing national security concerns and unnecessary costs to taxpayers.

The order argues that a heavy reliance on green energy subsidies compromise the reliability of the power grid and undermines energy independence. Trump called for the U.S. to “rapidly eliminate” federal green energy subsidies and to “build upon and strengthen” the repeal of wind and solar tax credits remaining in the reconciliation law in the order, directing the Treasury Department to enforce the phase-out of tax credits.

“For too long, the Federal Government has forced American taxpayers to subsidize expensive and unreliable energy sources like wind and solar,” the order states. “Reliance on so-called ‘green’ subsidies threatens national security by making the United States dependent on supply chains controlled by foreign adversaries.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Former President Joe Biden established massive green energy subsidies under his signature 2022 Inflation Reduction Act (IRA), which did not receive a single Republican vote.

The reconciliation package did not immediately terminate Biden-era federal subsidies for green energy technology, phasing them out over time instead, though some policy experts argued that drawn-out timelines could lead to an indefinite continuation of subsidies. Trump’s executive order alludes to potential loopholes in the bill, calling for a review by Secretary of the Treasury Scott Bessent to ensure that green energy projects that have a “beginning of construction” tax credit deadline are not “circumvented.”

Additionally, the executive order directs the U.S. to end taxpayer support for green energy supply chains that are controlled by foreign adversaries, alluding to China’s supply chain dominance for solar and wind. Trump also specifically highlighted costs to taxpayers, market distortions and environmental impacts of subsidized green energy development in explaining the policy.

Ahead of the reconciliation bill becoming law, Trump told Republicans that “we’ve got all the cards, and we are going to use them.” Several House Republicans noted that the president said he would use executive authority to enhance the bill and strictly enforce phase-outs, which helped persuade some conservatives to back the bill.

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

Censorship Industrial Complex15 hours ago

Censorship Industrial Complex15 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Alberta4 hours ago

Alberta4 hours ago‘Far too serious for such uninformed, careless journalism’: Complaint filed against Globe and Mail article challenging Alberta’s gender surgery law

-

Daily Caller2 days ago

Daily Caller2 days agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns