Business

Trump victory means Canada must get serious about tax reform

From the Fraser Institute

By Jake Fuss and Alex Whalen

Following Donald Trump’s victory in Tuesday’s presidential election, lower taxes for both U.S. businesses and individuals will be at the top of his administration’s agenda. Meanwhile, Prime Minister Trudeau has raised taxes on businesses and individuals, including with his recent capital gains tax hike.

Clearly, Canada and the United States are now moving in opposite directions on tax policy. To prevent Canada from falling even further behind the U.S., policymakers in Ottawa and across Canada should swiftly increase our tax competitiveness.

Before the U.S. election, Canada was already considered a high-tax country that made it hard to do business. Canada’s top combined (federal and provincial) personal income tax rate (as represented by Ontario) ranked fifth-highest out of 38 high-income industrialized (OECD) countries in 2022 (the latest year of available data). And last year, Canadians in every province, across most of the income spectrum, faced higher personal income tax rates than Americans in nearly every U.S. state.

Our higher income tax rates make it harder to attract and retain high-skilled workers including doctors, engineers and entrepreneurs. High tax rates also reduce the incentives to save, invest and start a business—all key drivers of prosperity.

No doubt, we need reform now. To close the tax gap and increase our competitiveness, the federal government should reduce personal income tax rates. One option is to reduce the top rate from 33.0 per cent back down to 29.0 per cent (the rate before the Trudeau government increased it) and eliminate the three middle-income tax rates of 20.5 per cent, 26.0 per cent and 29.0 per cent.

These changes would establish a new personal income tax landscape with just two federal rates. Nearly all Canadians would face a personal income tax rate of 15.0 per cent, while top earners would pay a marginal tax rate of 29.0 per cent.

On business taxes, Canada’s rates are also higher than the global average and uncompetitive compared to the U.S., which makes it difficult to attract business investment and corporate headquarters that provide well-paid jobs and enhance living standards. According to Trump’s campaign promises, he plans to lower the federal business tax rate from 21 per cent to 20 per cent (and reduce the rate to 15 per cent for companies that make their products in the U.S.). Trump must work with congress to implement these changes, but barring any change in Canadian policy, business tax cuts in the U.S. will intensify Canada’s net outflow of business investment and corporate headquarters to the U.S.

The federal government should respond by lowering Canada’s business tax rate to match Trump’s plan. Moreover, Ottawa should (in coordination with the provinces) change tax policy to only tax business profits that are not reinvested in the company—that is, tax dividend payments, share buybacks and bonuses but don’t touch profits that are reinvested into the company (this type of business taxation has helped supercharge the economy in Estonia). These reforms would encourage greater business investment and ultimately raise living standards for Canadians. Finally, given Canada’s massive outflow of business investment, the government should (at a minimum) reverse the recent federal capital gains hike.

Of course, there’s much to quibble with in Trump’s policies. For example, his tariffs will hurt the U.S. economy (and likely Canada’s economy), and tax cuts without spending reductions and deficit-reduction will simply defer tax hikes into the future. But while policymakers in Ottawa can’t control U.S. policy, Trump’s tax plan will significantly exacerbate Canada’s competitiveness problem. We can’t afford to sit idle and do nothing. Ottawa should act swiftly in coordination with the provinces and pursue bold pro-growth tax reform for the benefit of Canadians.

Authors:

Business

Conservatives demand probe into Liberal vaccine injury program’s $50m mismanagement

From LifeSiteNews

The Liberals’ Vaccine Injury Support Program is accused of mismanaging a $50-million contract with Oxaro Inc. and failing to resolve claims for thousands of vaccine-injured Canadians.

Conservatives are calling for an official investigation into the Liberal-run vaccine injury program, which has cost Canadians millions but has little to show for it.

On July 14th, four Conservative Members of Parliament (MPs) signed a letter demanding answers after an explosive Global News report found the Liberals’ Vaccine Injury Support Program (VISP) misallocated taxpayer funds and disregarded many vaccine-injured Canadians.

“The federal government awarded a $50 million taxpayer-funded contract to Oxaro Inc. (formerly Raymond Chabot Grant Thornton Consulting Inc.). The purpose of this contract was to administer the VISP,” the letter wrote.

“However, there was no clear indication that Oxaro had credible experience in healthcare or in the administration of health-related claims raising valid questions about how and why this firm was selected,” it continued.

Canada’s VISP was launched in December 2020 after the Canadian government gave vaccine makers a shield from liability regarding COVID-19 jab-related injuries.

However, mismanagement within the program has led to many injured Canadians still waiting to receive compensation, while government contractors grow richer.

“Despite the $50 million contract, over 1,700 of the 3,100 claims remain unresolved,” the Conservatives continued. “Families dealing with life-altering injuries have been left waiting years for answers and support they were promised.”

Furthermore, the claims do not represent the total number of Canadians injured by the allegedly “safe and effective” COVID shots, as inside memos have revealed that the Public Health Agency of Canada (PHAC) officials neglected to report all adverse effects from COVID shots and even went as far as telling staff not to report all events.

The PHAC’s downplaying of vaccine injuries is of little surprise to Canadians, as a 2023 secret memo revealed that the federal government purposefully hid adverse effect so as not to alarm Canadians.

Of the $50.6 million that Oxaro Inc., has received, $33.7 million has been spent on administrative costs, compared to only $16.9 million going to vaccine-injured Canadians.

The letter further revealed that former VISP employees have revealed that the program lacked professionalism, describing what Conservatives described as “a fraternity house rather than a professional organization responsible for administering health-related claims.”

“Reports of constant workplace drinking, ping pong, and Netflix are a slap in the face to taxpayers and the thousands of Canadians waiting for support for life altering injuries,” the letter continued.

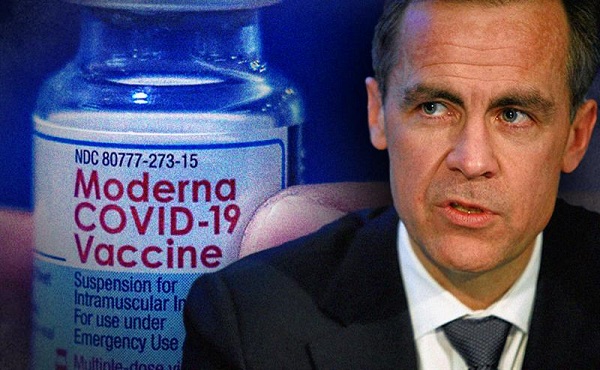

Regardless of this, the Liberal government, under Prime Minister Mark Carney, is considering renewing its contract with Oxaro Inc.

Indeed, this would hardly be the first time that Liberals throw taxpayer dollars at a COVID program that is later exposed as ineffective and mismanaged.

Canada’s infamous ArriveCan app, which was mandated for all travelers in and out of Canada in 2020, has cost Canadians $54 million, despite the Public Health Agency of Canada admitting that they have no evidence that the program saved lives.

Details regarding the app and the government contracts surrounding it have been hidden from Canadians, as Liberals were exposed in 2023 for hiding a RCMP investigation into the app from auditors.

An investigation of the ArriveCan app began in 2022 after the House of Commons voted 173-149 for a full audit of the controversial app.

Business

Canada must address its birth tourism problem

By Sergio R. Karas for Inside Policy

One of the most effective solutions would be to amend the Citizenship Act, making automatic citizenship conditional upon at least one parent being a Canadian citizen or permanent resident.

Amid rising concerns about the prevalence of birth tourism, many Western democracies are taking steps to curb the practice. Canada should take note and reconsider its own policies in this area.

Birth tourism occurs when pregnant women travel to a country that grants automatic citizenship to all individuals born on its soil. There is increasing concern that birthright citizenship is being abused by actors linked to authoritarian regimes, who use the child’s citizenship as an anchor or escape route if the conditions in their country deteriorate.

Canada grants automatic citizenship by birth, subject to very few exceptions, such as when a child is born to foreign diplomats, consular officials, or international representatives. The principle known as jus soli in Latin for “right of the soil” is enshrined in Section 3(1)(a) of the Citizenship Act.

Unlike many other developed countries, Canada’s legislation does not consider the immigration or residency status of the parents for the child to be a citizen. Individuals who are in Canada illegally or have had refugee claims rejected may be taking advantage of birthright citizenship to delay their deportation. For example, consider the Supreme Court of Canada’s ruling in Baker v. Canada. The court held that the deportation decision for a Jamaican woman – who did not have legal status in Canada but had Canadian-born children – must consider the best interests of the Canadian-born children.

There is mounting evidence of organized birth tourism among individuals from the People’s Republic of China, particularly in British Columbia. According to a January 29 news report in Business in Vancouver, an estimated 22–23 per cent of births at Richmond Hospital in 2019–20 were to non-resident mothers, and the majority were Chinese nationals. The expectant mothers often utilize “baby houses” and maternity packages, which provide private residences and a comprehensive bundle of services to facilitate the mother’s experience, so that their Canadian-born child can benefit from free education and social and health services, and even sponsor their parents for immigration to Canada in the future. The financial and logistical infrastructure supporting this practice has grown, with reports of dozens of birth houses in British Columbia catering to a Chinese clientele.

Unconditional birthright citizenship has attracted expectant mothers from countries including Nigeria and India. Many arrive on tourist visas to give birth in Canada. The number of babies born in Canada to non-resident mothers – a metric often used to measure birth tourism – dropped sharply during the COVID-19 pandemic but has quickly rebounded since. A December 2023 report in Policy Options found that non-resident births constituted about 1.6 per cent of all 2019 births in Canada. That number fell to 0.7 per cent in 2020–2021 due to travel restrictions, but by 2022 it rebounded to one per cent of total births. That year, there were 3,575 births to non-residents – 53 per cent more than during the pandemic. Experts believe that about half of these were from women who travelled to Canada specifically for the purpose of giving birth. According to the report, about 50 per cent of non-resident births are estimated to be the result of birth tourism. The upward trend continued into 2023–24, with 5,219 non-resident births across Canada.

Some hospitals have seen more of these cases than others. For example, B.C.’s Richmond Hospital had 24 per cent of its births from non-residents in 2019–20, but that dropped to just 4 per cent by 2022. In contrast, Toronto’s Humber River Hospital and Montreal’s St. Mary’s Hospital had the highest rates in 2022–23, with 10.5 per cent and 9.4 per cent of births from non-residents, respectively.

Several developed countries have moved away from unconditional birthright citizenship in recent years, implementing more restrictive measures to prevent exploitation of their immigration systems. In the United Kingdom, the British Nationality Act abolished jus soli in its unconditional form. Now, a child born in the UK is granted citizenship only if at least one parent is a British citizen or has settled status. This change was introduced to prevent misuse of the immigration and nationality framework. Similarly, Germany follows a conditional form of jus soli. According to its Nationality Act, a child born in Germany acquires citizenship only if at least one parent has legally resided in the country for a minimum of eight years and holds a permanent residence permit. Australia also eliminated automatic birthright citizenship. Under the Australian Citizenship Act, a child born on Australian soil is granted citizenship only if at least one parent is an Australian citizen or permanent resident. Alternatively, if the child lives in Australia continuously for ten years, they may become eligible for citizenship through residency. These policies illustrate a global trend toward limiting automatic citizenship by birth to discourage birth tourism.

In the United States, Section 1 of the Citizenship Clause of the Fourteenth Amendment to the Constitution prescribes that “All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.” The Trump administration has launched a policy and legal challenge to the longstanding interpretation that every person born in the US is automatically a citizen. It argues that the current interpretation incentivizes illegal immigration and results in widespread abuse of the system.

On January 20, 2025, President Donald Trump issued Executive Order 14156: Protecting the Meaning and Value of American Citizenship, aimed at ending birthright citizenship for children of undocumented migrants and those with lawful but temporary status in the United States. The executive order stated that the Fourteenth Amendment’s Citizenship Clause “rightly repudiated” the Supreme Court’s “shameful decision” in the Dred Scott v. Sandford case, which dealt with the denial of citizenship to black former slaves. The administration argues that the Fourteenth Amendment “has never been interpreted to extend citizenship universally to anyone born within the United States.” The executive order claims that the Fourteenth Amendment has “always excluded from birthright citizenship persons who were born in the United States but not subject to the jurisdiction thereof.” The order outlines two categories of individuals that it claims are not subject to United States jurisdiction and thus not automatically entitled to citizenship: a child of an undocumented mother and father who are not citizens or lawful permanent residents; and a child of a mother who is a temporary visitor and of a father who is not a citizen or lawful permanent resident. The executive order attempts to make ancestry a criterion for automatic citizenship. It requires children born on US soil to have at least one parent who has US citizenship or lawful permanent residency.

On June 27, 2025, the US Supreme Court in Trump v. CASA, Inc. held that lower federal courts exceed their constitutional authority when issuing broad, nationwide injunctions to prevent the Trump administration from enforcing the executive order. Such relief should be limited to the specific plaintiffs involved in the case. The Court did not address whether the order is constitutional, and that will be decided in the future. However, this decision removes a major legal obstacle, allowing the administration to enforce the policy in areas not covered by narrower injunctions. Since the order could affect over 150,000 newborns each year, future decisions on the merits of the order are still an especially important legal and social issue.

In addition to the executive order, the Ban Birth Tourism Act – introduced in the United States Congress in May 2025 – aims to prevent women from entering the country on visitor visas solely to give birth, citing an annual 33,000 births to tourist mothers. Simultaneously, the State Department instructed US consulates abroad to deny visas to applicants suspected of “birth tourism,” reinforcing a sharp policy pivot.

In light of these developments, Canada should be wary. It may see an increase in birth tourism as expectant mothers look for alternative destinations where their children can acquire citizenship by birth.

Canadian immigration law does not prevent women from entering the country on a visitor visa to give birth. The Immigration and Refugee Protection Act (IRPA) and the associated regulations do not include any provisions that allow immigration officials or Canada Border Services officers to deny visas or entry based on pregnancy. Section 22 of the IRPA, which deals with temporary residents, could be amended. However, making changes to regulations or policy would be difficult and could lead to inconsistent decisions and a flurry of litigation. For example, adding questions about pregnancy to visa application forms or allowing officers to request pregnancy tests in certain high-risk cases could result in legal challenges on the grounds of privacy and discrimination.

In a 2019 Angus Reid Institute survey, 64 per cent of Canadians said they would support changing the law to stop granting citizenship to babies born in Canada to parents who are only on tourist visas. One of the most effective solutions would be to amend Section 3(1)(a) of the Citizenship Act, making it mandatory that at least one parent be a Canadian citizen or permanent resident for a child born in Canada to automatically receive citizenship. Such a model would align with citizenship legislation in countries like the UK, Germany, and Australia, where jus soli is conditional on parental status. Making this change would close the current loophole that allows birth tourism, without placing additional pressure on visa officers or requiring new restrictions on tourist visas. It would retain Canada’s inclusive citizenship framework while aligning with practices in other democratic nations.

Canada currently lacks a proper and consistent system for collecting data on non-resident births. This gap poses challenges in understanding the scale and impact of birth tourism. Since health care is under provincial jurisdiction, the responsibility for tracking and managing such data falls primarily on the provinces. However, there is no national framework or requirement for provinces or hospitals to report the number of births by non-residents, leading to fragmented and incomplete information across the country. One notable example is BC’s Richmond Hospital, which has become a well-known birth tourism destination. In the 2017–18 fiscal year alone, 22 per cent of all births at Richmond Hospital were to non-resident mothers. These births generated approximately $6.2 million in maternity fees, out of which $1.1 million remained unpaid. This example highlights not only the prevalence of the practice but also the financial burden it places on the provincial health care programs. To better address the issue, provinces should implement more robust data collection practices. Information should include the mother’s residency or visa status, the total cost of care provided, payment outcomes (including outstanding balances), and any necessary medical follow-ups.

Reliable and transparent data is essential for policymakers to accurately assess the scope of birth tourism and develop effective responses. Provinces should strengthen data collection practices and consider introducing policies that require security deposits or proof of adequate medical insurance coverage for expectant mothers who are not covered by provincial healthcare plans.

Canada does not currently record the immigration or residency status of parents on birth certificates, making it difficult to determine how many children are born to non-resident or temporary resident parents. Including this information at the time of birth registration would significantly improve data accuracy and support more informed policy decisions. By improving data collection, increasing transparency, and adopting preventive financial safeguards, provinces can more effectively manage the challenges posed by birth tourism, and the federal government can implement legislative reforms to deal with the problem.

Sergio R. Karas, principal of Karas Immigration Law Professional Corporation, is a certified specialist in Canadian citizenship and immigration law by the Law Society of Ontario. He is co-chair of the ABA International Law Section Immigration and Naturalization Committee, past chair of the Ontario Bar Association Citizenship and Immigration Section, past chair of the International Bar Association Immigration and Nationality Committee, and a fellow of the American Bar Foundation. He can be reached at [email protected]. The author is grateful for the contribution to this article by Jhanvi Katariya, student-at-law.

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Alberta1 day ago

Alberta1 day agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Daily Caller22 hours ago

Daily Caller22 hours ago‘Strange Confluence Of Variables’: Mike Benz Wants Transparency Task Force To Investigate What Happened in Butler, PA

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

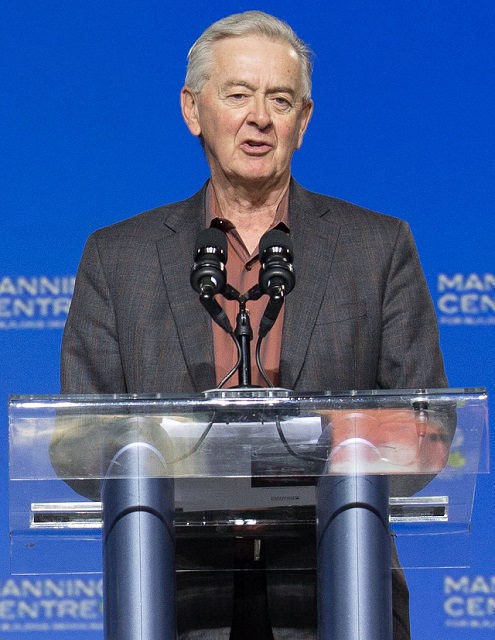

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts