Banks

Trump admin preparing executive order to stop debanking of conservatives

From LifeSiteNews

The Trump administration is preparing an executive order to penalize institutions that “debank” Americans over their political views, a practice the president says he was personally subjected to.

The Wall Street Journal reports it has seen a draft of the order, which has not been finalized, that tells federal regulators to review financial institutions for potential violations of federal laws by dropping customers or denying service for “impermissible factors” such as political views and review and rescind any policies that might have played a role in doing so. “Violators could be subject to monetary penalties, consent decrees or other disciplinary measures,” or potentially even referred for prosecution in extreme cases, the Journal reports.

President Donald Trump recounted his own experience with the issue earlier this week during an interview on CNBC, during which he said that Bank of America CEO Brian Moynihan “was kissing my a– when I was president, and when I called him after I was president, to deposit $1 billion plus and a lot of other things… ‘no, we can’t do it.’ That’s because the banks discriminated against me very badly. And I was very good to the banks. I had the greatest economy in the history of our country when I was president. They discriminated against many conservatives.”

“The banking regulators do everything you can to destroy Trump. And that’s what they did. And guess what? I’m president. How did that happen?” he boasted.

When asked about the president’s comments, Moynihan said his company “has been working with the Treasury administration today in this administration trying to figure out how to get these roles balanced so that we’re not subject to this swinging back and forth” and insisted “we bank everybody,” but did not specifically address Trump’s claims about their interaction.

Over the past several years, there have been numerous instances of banks, credit card companies, and crowdfunding platforms cutting off services to conservative individuals and groups, thanks in large part to the influence of left-wing groups like the Southern Poverty Law Center and Anti-Defamation League and corporate trends such as ESG (environmental, societal, governance) scoring.

The Biden administration’s interest in centralized digital currency further intensified fears of a future in which Americans’ basic economic freedoms are tied to conformity with the views of those in power. Thanks in part to such overreaches by the previous Democrat administration, the United States is now widely perceived as being in the midst of a widespread political and cultural backlash against so-called “woke” ideology.

Banks

Debanking Is Real, And It’s Coming For You

From the Frontier Centre for Public Policy

Marco Navarro-Genie warns that debanking is turning into Ottawa’s weapon of choice to silence dissent, and only the provinces can step in to protect Canadians.

Disagree with the establishment and you risk losing your bank account

What looked like a narrow, post-convoy overreach has morphed into something much broader—and far more disturbing. Debanking isn’t a policy misfire. It’s turning into a systemic method of silencing dissent—not just in Canada, but across the Western world.

Across Canada, the U.S. and the U.K., people are being cut off from basic financial services not because they’ve broken any laws, but because they hold views or support causes the establishment disfavors. When I contacted Eva Chipiuk after RBC quietly shut down her account, she confirmed what others had only whispered: this is happening to a lot of people.

This abusive form of financial blacklisting is deep, deliberate and dangerous. In the U.K., Nigel Farage, leader of Reform UK and no stranger to controversy, was debanked under the fig leaf of financial justification. Internal memos later revealed the real reason: he was deemed a reputational risk. Cue the backlash, and by 2025, the bank was forced into a settlement complete with an apology and compensation. But the message had already been sent.

That message didn’t stay confined to Britain. And let’s not pretend it’s just private institutions playing favourites. Even in Alberta—where one might hope for a little more institutional backbone—Tamara Lich was denied an appointment to open an account at ATB Financial. That’s Alberta’s own Crown bank. If you think provincial ownership protects citizens from political interference, think again.

Fortunately, not every institution has lost its nerve. Bow Valley Credit Union, a smaller but principled operation, has taken a clear stance: it won’t debank Albertans over their political views or affiliations. In an era of bureaucratic cowardice, Bow Valley is acting like a credit union should: protective of its members and refreshingly unapologetic about it.

South of the border, things are shifting. On Aug. 7, 2025, U.S. President Donald Trump signed an executive order titled “Guaranteeing Fair Banking for All Americans.” The order prohibits financial institutions from denying service based on political affiliation, religion or other lawful activity. It also instructs U.S. regulators to scrap the squishy concept of “reputational risk”—the bureaucratic smoke screen used to justify debanking—and mandates a review of past decisions. Cases involving ideological bias must now be referred to the Department of Justice.

This isn’t just paperwork. It’s a blunt declaration: access to banking is a civil right. From now on, in the U.S., politically motivated debanking comes with consequences.

Of course, it’s not perfect. Critics were quick to notice that the order conveniently omits platforms like PayPal and other payment processors—companies that have been quietly normalizing debanking for over a decade. These are the folks who love vague “acceptable use” policies and ideological red lines that shift with the political winds. Their absence from the order raises more than a few eyebrows.

And the same goes for another set of financial gatekeepers hiding in plain sight. Credit card networks like Visa, American Express and Mastercard have become powerful, unaccountable referees, denying service to individuals and organizations labelled “controversial” for reasons that often boil down to politics.

If these players aren’t explicitly reined in, banks might play by the new rules while the rest of the financial ecosystem keeps enforcing ideological conformity by other means.

If access to money is a civil right, then that right must be protected across the entire payments system—not just at your local branch.

While the U.S. is attempting to shield its citizens from ideological discrimination, there is a noticeable silence in Canada. Not a word of concern from the government benches—or the opposition. The political class is united, apparently, in its indifference.

If Ottawa won’t act, provinces must. That makes things especially urgent for Alberta and Saskatchewan. These are the provinces where dissent from Ottawa’s policies is most common—and where citizens are most likely to face politically motivated financial retaliation.

But they’re not powerless. Both provinces boast robust credit union systems. Alberta even owns ATB Financial, a Crown bank originally created to protect Albertans from central Canadian interference. But ownership without political will is just branding.

If Alberta and Saskatchewan are serious about defending civil liberties, they should act now. They can legislate protections that prohibit financial blacklisting based on political affiliation or lawful advocacy. They can require due process before any account is frozen. They can strip “reputational risk” from the rulebooks and make it clear to Ottawa: using banks to punish dissenters won’t fly here.

Because once governments—or corporations doing their bidding—can cut off your access to money for holding the wrong opinion, democracy isn’t just threatened.

It’s already broken.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Alberta

Your money isn’t as safe as you think

This article supplied by Troy Media.

The Emergencies Act proved how quickly bank accounts can be weaponized. Alberta must act now to protect its citizens.

When Eva Chipiuk (the Alberta lawyer who famously confronted former Prime Minister Justin Trudeau’s assertions at the Emergencies Act inquiry) found out her Royal Bank account was being shut down, it confirmed a chilling truth: those who challenge Ottawa are not safe from retribution.

Chipiuk committed no crime and was not charged with any offence. However, the Montreal-based Royal Bank refused to provide her services, citing an unspecified risk. The message is clear: if you challenge Ottawa, you may risk being treated as an economic non-person. This comes just months before Tamara Lich, an Alberta resident, is expected to be sentenced for standing up against COVID overreach.

The Alberta government cannot ignore these threats against its citizens. There is plenty Ottawa doesn’t like about Alberta and Albertans today. Given that, in a February 2022 Globe and Mail oped—written before he became prime minister—Mark Carney described civil protesters as “seditionists,” one doesn’t need much imagination to see how his government could treat Albertans who push for greater control over their future. The province must prepare now to shield its citizens from financial retaliation.

Albertans who think their money is safe if it’s parked at a credit union or ATB, instead of a chartered bank, are mistaken. It isn’t. Under the Criminal Code, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, and the Emergencies Act, Ottawa can force any “financial service provider”—including provincially regulated credit unions—to freeze accounts. For example, when Tamara Lich tried to open an account with ATB—Alberta’s Crown-owned financial institution—she was denied even an appointment.

Events such as these show that it doesn’t take a judge to determine you have run afoul of those laws—only a government that disagrees with you.

Alberta has the tools to defend its citizens, and it should use them. It should start by making ATB and its provincially regulated credit unions fortresses against politically motivated financial punishment. ATB, created in 1938 to shield farmers from the aggressive lending practices of Laurentian bankers, has a distinct status as an arm of the Alberta government.

That status can be leveraged today to keep Ottawa at bay by:

- Refocusing ATB on serving Albertans, not advancing trendy corporate agendas.

- Amending the ATB Financial Act to require judicial orders for any account freezes or closures, mandate public reporting of such actions, and enshrine political neutrality to ensure no Albertan is denied service for lawful political activity.

- Preparing to invoke the Sovereignty Act if Ottawa attempts another Emergencies Act-style move, instructing ATB and its credit unions to disregard unconstitutional federal orders unless validated by Alberta courts.

- Creating a Québec-style integrated financial regulator to oversee ATB and Alberta’s provincially regulated credit unions, insulating them from Ottawa’s reach.

- Exploring alternative payment systems to reduce reliance on Ottawa-controlled clearing mechanisms. Payments Canada—which Ottawa controls—could be used as a choke point against Alberta institutions. A provincial or private settlement system would blunt that weapon before it can be deployed.

Finally, Alberta should enact an Alberta Financial Rights Act guaranteeing that no one will be denied financial services and that no account can be frozen or closed without due process in open court.

Ottawa will not take this lying down. It can seek court injunctions, threaten ATB’s and our credit unions’ access to national payment systems, or pass legislation directly targeting provincial Crown corporations. Alberta must anticipate these moves now by drafting constitutional challenges, forging alliances with like-minded provinces, and building backup clearing systems.

When the federal government can freeze your account for giving $50 to the “wrong” cause, you are not a free citizen. You are a subject. The treatment of Tamara Lich and Eva Chipiuk’s debanking is a warning.

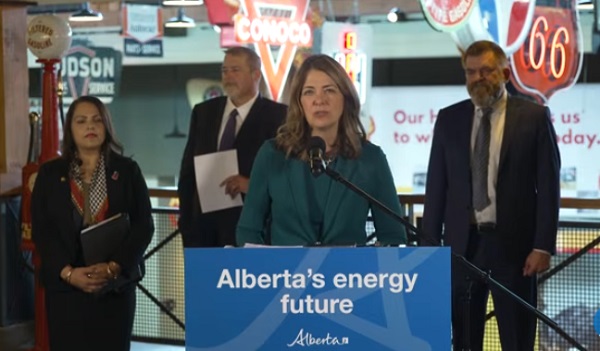

Alberta can either wait for the next wave of financial punishments to hit its citizens, or it can act decisively to make ATB and its provincially regulated credit unions fortresses that protect them. Premier Danielle Smith has a unique opportunity to put Alberta first again—and she should take it.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta2 days ago

Alberta2 days agoAlberta’s E3 Lithium delivers first battery-grade lithium carbonate

-

Automotive2 days ago

Automotive2 days agoCanada’s EV subsidies are wracking up billions in losses for taxpayers, and not just in the auto industry

-

Business2 days ago

Business2 days agoLA skyscrapers for homeless could cost federal taxpayers over $1 billion

-

Crime1 day ago

Crime1 day agoThe “Strong Borders Act,” Misses the Mark — Only Deep Legal Reforms Will Confront Canada’s Fentanyl Networks

-

Agriculture22 hours ago

Agriculture22 hours ago“We Made it”: Healthy Ostriches Still Alive in Canada

-

Business1 day ago

Business1 day agoUK Government Dismisses Public Outcry, Pushes Ahead with Controversial Digital ID Plan

-

Energy2 days ago

Energy2 days agoNuclear power outperforms renewables every time

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoAI chatbots a child safety risk, parental groups report