Business

Trudeau’s Latest Scandal: Billions in Indigenous Procurement Fraud Exposed in Explosive OGGO Committee 145

As Trudeau Dodges Accountability on Foreign Interference, His Government’s Systemic Corruption in Indigenous Procurement is Revealed—Witness: “Billions Stolen by Fake Indigenous Businesses”

This week, Justin Trudeau was grilled during the Hogue Inquiry on foreign interference—a spectacle where, despite all his smoke and bluster, no one was named as traitors. Classic Trudeau: all talk, no action. But while the Prime Minister was busy dodging accountability on the global stage, a new scandal was brewing right under our noses. It’s not just foreign interference, WE Charity, SNC-Lavalin, his Green Slush Fund, or ArriveCAN. Oh no, it’s much worse.

For someone who loves to virtue-signal about reconciliation, Trudeau’s record on actually helping Indigenous communities is crumbling. Yesterday’s Meeting No. 145 of the Standing Committee on Government Operations and Estimates (OGGO) tore apart the Liberal façade of caring about Indigenous rights. The truth? Fraud, corruption, and negligence are running rampant within Trudeau’s government, and it’s Indigenous people who are paying the price.

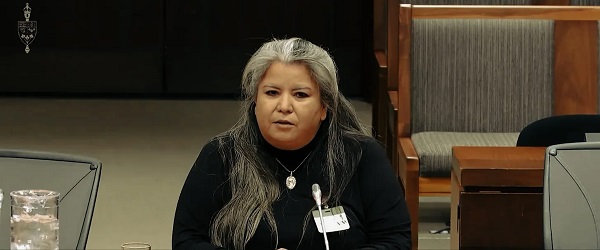

Witnesses from the Ghost Warrior Society and PLATO Testing exposed just how deep the rot goes. Crystal Semaganis, the leader of the Ghost Warrior Society, and Denis Carignan, president of PLATO Testing, laid out in chilling detail how fake Indigenous businesses are stealing billions of dollars meant for real Indigenous communities, all while Trudeau’s government sits back and lets it happen.

So, while Trudeau might want you to think he’s the champion of reconciliation, this committee revealed the real story: Trudeau’s corruption is systemic, and it’s Indigenous people who are being exploited. It’s time we dive into the committee and expose this latest chapter in the Trudeau scandal saga. Buckle up.

Trudeau’s Newest Scandal- Indigenous Procurement

The OGGO committee hearing on Indigenous procurement was supposed to be a moment of reckoning—a chance for the Trudeau government to finally come clean about the rampant fraud within its own ranks. Instead, what we witnessed was a masterclass in Liberal deflection, corruption, and the complete and total betrayal of the Indigenous communities Justin Trudeau pretends to care about.

This wasn’t just another day in Ottawa where Liberals paid lip service to reconciliation. Oh no, this committee meeting exposed the stunning hypocrisy at the heart of the Trudeau government. What the Liberals don’t want you to know is that billions of dollars—yes, billions—have been stolen by fake Indigenous businesses, all under the nose of the Trudeau government. And guess what? They’ve done nothing to stop it.

The star witness, Crystal Semaganis, leader of the Ghost Warrior Society, laid it out for everyone to see. These fraudulent actors—companies and individuals pretending to be Indigenous—have exploited a broken system where no one verifies Indigenous identity. According to Semaganis, billions of dollars in contracts meant to uplift Indigenous communities have been stolen by what she called “corporations posing as Indigenous Nations (CPIN).”

She even gave specific examples: one company alone has raked in $163 million since 1994 by pretending to be Indigenous. That’s right—$163 million. And how did this happen? Because the Trudeau government relies on an honor system for verifying Indigenous identity. You heard that right: an honor system. And because there’s no centralized system to authenticate claims, anyone can say they’re Indigenous, grab a few million in contracts, and laugh all the way to the bank.

Let’s be clear about what’s happening here: real Indigenous people are being robbed by these fraudsters, and the government is standing by, doing nothing. No oversight. No accountability. No legal consequences.

Larry Brock and Garnett Genuis: The Conservatives Fight Back

Thankfully, the Conservative MPs on this committee didn’t let Trudeau’s government get away with this fraud without a fight. Larry Brock (MP for Brantford—Brant) and Garnett Genuis (MP for Sherwood Park—Fort Saskatchewan) came out swinging, and they weren’t about to let the Liberals dodge accountability.

Brock, in particular, delivered a fiery takedown of the Liberal corruption machine. He pointed out that this kind of fraud doesn’t happen in a vacuum. No, this is part of a pattern of corruption that starts at the top—with Justin Trudeau himself. From WE Charity to SNC-Lavalin and now this Indigenous procurement scandal, it’s clear the Trudeau Liberals have made an art form out of covering up fraud and protecting their political cronies.

Brock wasn’t just making vague accusations—he linked it all together. He reminded the committee that, just like with ArriveCAN and WE Charity, the Liberals’ first instinct is always to protect their own. They obstruct, delay, and stall investigations until the truth is buried so deep that Canadians move on. But Brock wasn’t going to let this scandal go the same way. He grilled the witnesses, demanding answers on how these fake Indigenous entities could steal billions while the Trudeau government sat on its hands.

Garnett Genuis: “This government has a pattern of shutting down committees and avoiding accountability whenever it gets uncomfortable. They don’t want the truth, they want the scandal buried!”

Garnett Genuis, meanwhile, delivered the knockout punch. He didn’t mince words when he accused the Trudeau government of deliberately choosing not to act. Genuis pointed out that this fraud has been happening for years, and yet the government has refused to implement any kind of legal framework to stop it. Why? Because they benefit from the status quo. The fake Indigenous businesses walking away with billions in contracts? Many of them have deep connections within the Liberal Party. It’s not just negligence—it’s complicity.

The Liberal Stall: A Pattern of Dodging Accountability

But what did the Liberal MPs do in response to these explosive revelations? Did they express outrage? Did they vow to put an end to this fraud? Of course not. Instead, they did what Liberals always do when caught in a scandal: stall and deflect.

Sameer Zuberi, Jenica Atwin, and Majid Jowhari spent their time filibustering, offering vague platitudes about “improving the process” and “working together” to help Indigenous communities. Zuberi, the MP for Pierrefonds—Dollard, tried to steer the conversation toward how the government could improve future Indigenous business opportunities, conveniently sidestepping the massive fraud happening right now under his government’s watch.

Atwin, MP for Fredericton, delivered a particularly pathetic performance, rambling about reconciliation without once addressing the real issue of billions being stolen. And Majid Jowhari MP for Richmond Hill? Well, he focused on processes and frameworks, pretending the fraud revelations weren’t even the central issue.

These Liberals weren’t interested in getting to the bottom of this scandal. They were only interested in running out the clock, hoping the committee would end before anyone could connect the dots between this fraud and Trudeau’s corruption.

Final Thoughts

Let’s stop pretending that Justin Trudeau and his Liberals are going to do anything about this. They won’t. They’ve been caught red-handed, allowing billions to be stolen from Indigenous communities by fraudulent actors, and their only response has been to stall, deflect, and cover up. That’s their playbook. But we can’t let them get away with it.

It’s time for the opposition to step up—to do what this government refuses to do. The Conservatives, like Larry Brock and Garnett Genuis, need to pull the rug off this scandal and shine a light on the rot that’s taken hold of Indigenous procurement. We can’t let this cancer of corruption continue to fester under the surface while Trudeau and his cronies pat themselves on the back for their so-called reconciliation.

This isn’t just about fraud—it’s about honor and patriotism. We owe it to the Indigenous communities of this country to fight for them when their government won’t. We owe it to every hardworking taxpayer who sees their dollars funneled into fraudulent schemes, enriching those who know how to game the system. This is a battle for the soul of Canada, and it’s a battle that the opposition must take head-on.

If we believe in truth, if we believe in justice, then we can’t stop until every fake Indigenous business, every fraudulent actor, and every Liberal enabler is exposed. The cancer must be cut out. Canada deserves better. Our Indigenous people deserve better. And it’s time to hold this government to account, once and for all.

The opposition has a duty to tear down the curtain and show Canadians what’s really going on behind Trudeau’s façade of virtue-signaling. This isn’t just about politics—it’s about the future of our country, and the integrity of our government.

It’s time to act. Pull the rug off, expose the cancer, and take our country back.

Please subscribe to The Opposition with Dan Knight .

Alberta

Pierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

From Pierre Poilievre

Business

Why it’s time to repeal the oil tanker ban on B.C.’s north coast

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

By Will Gibson

Moratorium does little to improve marine safety while sending the wrong message to energy investors

In 2019, Martha Hall Findlay, then-CEO of the Canada West Foundation, penned a strongly worded op-ed in the Globe and Mail calling the federal ban of oil tankers on B.C.’s northern coast “un-Canadian.”

Six years later, her opinion hasn’t changed.

“It was bad legislation and the government should get rid of it,” said Hall Findlay, now director of the University of Calgary’s School of Public Policy.

The moratorium, known as Bill C-48, banned vessels carrying more than 12,500 tonnes of oil from accessing northern B.C. ports.

Targeting products from one sector in one area does little to achieve the goal of overall improved marine transport safety, she said.

“There are risks associated with any kind of transportation with any goods, and not all of them are with oil tankers. All that singling out one part of one coast did was prevent more oil and gas from being produced that could be shipped off that coast,” she said.

Hall Findlay is a former Liberal MP who served as Suncor Energy’s chief sustainability officer before taking on her role at the University of Calgary.

She sees an opportunity to remove the tanker moratorium in light of changing attitudes about resource development across Canada and a new federal government that has publicly committed to delivering nation-building energy projects.

“There’s a greater recognition in large portions of the public across the country, not just Alberta and Saskatchewan, that Canada is too dependent on the United States as the only customer for our energy products,” she said.

“There are better alternatives to C-48, such as setting aside what are called Particularly Sensitive Sea Areas, which have been established in areas such as the Great Barrier Reef and the Galapagos Islands.”

The Business Council of British Columbia, which represents more than 200 companies, post-secondary institutions and industry associations, echoes Hall Findlay’s call for the tanker ban to be repealed.

“Comparable shipments face no such restrictions on the East Coast,” said Denise Mullen, the council’s director of environment, sustainability and Indigenous relations.

“This unfair treatment reinforces Canada’s over-reliance on the U.S. market, where Canadian oil is sold at a discount, by restricting access to Asia-Pacific markets.

“This results in billions in lost government revenues and reduced private investment at a time when our economy can least afford it.”

The ban on tanker traffic specifically in northern B.C. doesn’t make sense given Canada already has strong marine safety regulations in place, Mullen said.

Notably, completion of the Trans Mountain Pipeline expansion in 2024 also doubled marine spill response capacity on Canada’s West Coast. A $170 million investment added new equipment, personnel and response bases in the Salish Sea.

“The [C-48] moratorium adds little real protection while sending a damaging message to global investors,” she said.

“This undermines the confidence needed for long-term investment in critical trade-enabling infrastructure.”

Indigenous Resource Network executive director John Desjarlais senses there’s an openness to revisiting the issue for Indigenous communities.

“Sentiment has changed and evolved in the past six years,” he said.

“There are still concerns and trust that needs to be built. But there’s also a recognition that in addition to environmental impacts, [there are] consequences of not doing it in terms of an economic impact as well as the cascading socio-economic impacts.”

The ban effectively killed the proposed $16-billion Eagle Spirit project, an Indigenous-led pipeline that would have shipped oil from northern Alberta to a tidewater export terminal at Prince Rupert, B.C.

“When you have Indigenous participants who want to advance these projects, the moratorium needs to be revisited,” Desjarlais said.

He notes that in the six years since the tanker ban went into effect, there are growing partnerships between B.C. First Nations and the energy industry, including the Haisla Nation’s Cedar LNG project and the Nisga’a Nation’s Ksi Lisims LNG project.

This has deepened the trust that projects can mitigate risks while providing economic reconciliation and benefits to communities, Dejarlais said.

“Industry has come leaps and bounds in terms of working with First Nations,” he said.

“They are treating the rights of the communities they work with appropriately in terms of project risk and returns.”

Hall Findlay is cautiously optimistic that the tanker ban will be replaced by more appropriate legislation.

“I’m hoping that we see the revival of a federal government that brings pragmatism to governing the country,” she said.

“Repealing C-48 would be a sign of that happening.”

-

Business1 day ago

Business1 day agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Crime2 days ago

Crime2 days agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Business15 hours ago

Business15 hours agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

Alberta10 hours ago

Alberta10 hours agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Health2 days ago

Health2 days agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Alberta15 hours ago

Alberta15 hours agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Opinion6 hours ago

Opinion6 hours agoBlind to the Left: Canada’s Counter-Extremism Failure Leaves Neo-Marxist and Islamist Threats Unchecked