Inflation

Trudeau’s carbon tax rebrand lipstick on a pig

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

the Liberals are now calling it the ‘Canada Carbon Rebate.’

The Canadian Taxpayers Federation is criticizing the federal government for rebranding its carbon tax rebate instead of providing relief by scrapping the tax altogether.

“Prime Minister Justin Trudeau’s carbon tax rebrand is just lipstick on a pig,” said Franco Terrazzano, CTF Federal Director. “Canadians need tax relief, not a snappy new slogan that won’t do anything to make life more affordable.”

“The federal government is rebranding the carbon tax rebate,” reported CTV News today. “Previously known as the Climate Action Incentive Payment, the Liberals are now calling it the ‘Canada Carbon Rebate.’

“The change does not come with any adjustments to how the federal fuel charge system and corresponding refund actually works.”

The carbon tax will cost the average family up to $710 this year even after the rebates, according to the Parliamentary Budget Officer.

The federal government is increasing the carbon tax again on April 1. After the hike, the carbon tax will cost 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

“Trudeau’s real problem isn’t that Canadians don’t know what his government is doing, Trudeau’s real problem is that Canadians know his carbon tax is making life more expensive,” Terrazzano said. “Instead of a rebrand, Trudeau should scrap the carbon tax to provide real relief.”

Business

Taxpayers paying wages and benefits for 30% of all jobs created over the last 10 years

From the Fraser Institute

By Jason Childs

From 2015 to 2024, the government sector in Canada—including federal, provincial and municipal—added 950,000 jobs, which accounted for roughly 30 per cent of total employment growth in the country, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“In Canada, employment in the government sector has skyrocketed over the last 10 years,” said Jason Childs, a professor of economics at the University of Regina, senior fellow at the Fraser Institute and author of Examining the Growth of Public-Sector Employment Since 2015.

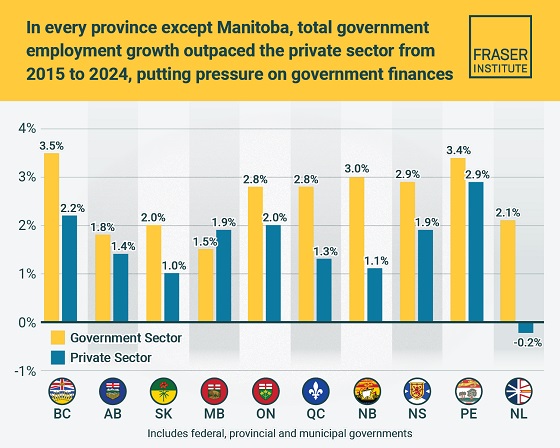

Over the same 10-year period (2015-2024), government-sector employment grew at an annual average rate of 2.7 per cent compared to only 1.7 per cent for the private sector. The study also examines employment growth by province. Government employment (federal, provincial, municipal) grew at a higher annual rate than the private sector in every province except Manitoba over the 10-year period.

The largest gaps between government-sector employment growth compared to the private sector were in Newfoundland and Labrador, New Brunswick, Quebec and British Columbia. The smallest gaps were in Alberta and Prince Edward Island.

“The larger government’s share of employment, the greater the ultimate burden on taxpayers to support government workers—government does not pay for itself,” Childs said.

A related study (Measuring the Cost to Canadians from the Growth in Public Administration, also authored by Childs) finds that, from 2015 to 2024, across all levels of government in Canada, the number of public administrators (many of who

work in government ministries, agencies and other offices that do not directly provide services to the public) grew by more than 328,000—or 3.5 per cent annually (on average).

“If governments want to reduce costs, they should look closely at the size of their public administration,” Childs said.

Examining the Growth of Public Sector Employment Since 2015

Business

The painful return of food inflation exposes Canada’s trade failures

This article supplied by Troy Media.

Canadians are feeling the pinch as Ottawa’s trade blunders and a weak dollar drive grocery bills higher

Almost a year ago, Canada’s Food Price Report projected that food inflation in 2025 would range between three and five per cent. We now stand squarely at four.

For consumers, it’s been a bruising year. After months of relative calm, grocery prices have surged again since spring, driven by tariffs, weather disruptions and a weakening Canadian dollar.

Between March and September, food inflation jumped sharply across several everyday staples. Coffee and tea prices rose by nearly 15 percentage points, sugar and confectionery climbed by more than three, while beef and condiments each increased by about one.

These aren’t luxury goods—they’re breakfast-table essentials. Canadians are paying more for their morning coffee, family barbecues and pantry staples than they were just six months ago.

When compared with other G7 countries, Canada’s performance stands out—and not in a good way. Japan currently faces the highest food inflation rate at 7.2 per cent, followed by the United Kingdom at 5.1 per cent. Canada sits third at 3.8 per cent, the only G7 country to post three consecutive monthly increases. Italy follows closely at 3.7 per cent, while the United States, Germany and France are all below Canada at 3.2, 2.9 and 1.7 per cent, respectively. For an advanced, food-producing nation, this is not a comfortable position.

Much of the renewed pressure can be traced back to trade policy. The counter tariffs introduced in March, combined with new U.S. measures, have quietly inflated costs across the entire food chain. Tariffs are by nature inflationary: they disrupt market efficiencies, raise input prices and trigger retaliatory actions that make goods more expensive on both sides of the border. What begins as a political statement quickly becomes an economic burden, felt most acutely in grocery aisles.

The loonie’s recent weakness has only made matters worse. Since January, the Canadian dollar has fallen significantly against the U.S. dollar, amplifying the cost of imported products such as coffee, cocoa and processed foods. For a country that imports roughly $70 billion in food annually, currency depreciation functions like a silent tax on every grocery bill.

As we move into the winter months, these forces show few signs of easing. Transportation costs remain high, retailers are passing along supplier increases and consumers are already adapting by trading down or buying less. While overall inflation is moderating elsewhere in the world, Canada’s food sector is moving in the opposite direction.

Prime Minister Mark Carney recently remarked that his government will be judged by the prices Canadians pay at the grocery store. On that score, Canadians are indeed paying attention. Tariffs, trade friction and a soft currency have all converged to make food more expensive. Voters are noticing.

In a world where food inflation is once again a global problem, Canada’s return to the top of the G7 pack is an unenviable distinction.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Censorship Industrial Complex21 hours ago

Censorship Industrial Complex21 hours agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Alberta24 hours ago

Alberta24 hours agoSchools should go back to basics to mitigate effects of AI

-

International1 day ago

International1 day agoAt Least 15 Killed In Shooting Targeting Jewish Community At Australia’s Bondi Beach, Police Say

-

Daily Caller22 hours ago

Daily Caller22 hours agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Great Reset1 day ago

Great Reset1 day agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

International21 hours ago

International21 hours agoRussia Now Open To Ukraine Joining EU, Officials Briefed On Peace Deal Say

-

Crime11 hours ago

Crime11 hours agoTrump designates fentanyl a ‘weapon of mass destruction’

-

Business23 hours ago

Business23 hours agoMajor tax changes in 2026: Report