Alberta

Trudeau is punishing Albertans this Autumn

From the Canadian Taxpayers Federation

Author: Kris Sims

The colder weather is here. Albertans are making dinners and heating our homes against the chill this Autumn.

Nourishing and normal things, such as preparing a holiday meal and staying warm, are now financially punishable offenses.

Prime Minister Justin Trudeau’s two carbon taxes make driving to work, buying food and heating our homes cost much more.

As one of the Trudeau government consultants that drafted the legislation stated, the carbon tax is meant to “punish the poor behaviour of using fossil fuels.”

The first carbon tax adds 14 cents per litre of gasoline and 17 cents per litre of diesel. This costs about $10 extra to fill up a minivan and about $16 extra to fill up a pickup truck.

The carbon tax on diesel costs truckers about $160 extra to fill up the tanks on big-rig trucks.

The second carbon tax is a government fuel regulation that fines companies for the carbon in fuels. Those costs are passed down to drivers at the pump.

Trudeau fashioned his second carbon after British Columbia’s. B.C. drivers have been paying two carbon taxes for years, and it’s a key reason why they pay the highest fuel prices in North America, usually hovering at about $2 per litre. Trudeau wants to make Vancouver gas prices as commonly Canadian as maple syrup.

Trudeau imposed his second carbon tax this Canada Day. It’s not clear yet how much the second carbon tax costs for a litre of gasoline and diesel in Alberta. In Atlantic Canada, the second carbon tax tacks an extra four to eight cents per litre of fuel.

That big tax bill is only getting bigger because Trudeau is cranking up his carbon tax every year for the next seven years.

By 2030, Trudeau’s two carbon taxes will cost an extra 55 cents per litre of gasoline and 77 cents per litre of diesel, plus GST. Filling up a big rig truck with diesel will cost about $760 extra.

In seven years, average Albertans will pay more than $3,300 per year because of Trudeau’s two carbon taxes even after rebates.

Ordinary people pay Trudeau’s carbon taxes every day. So do truckers. So do farmers.

Remember the Thanksgiving turkey? Turkeys eat grain which is hit by the carbon tax when it goes through the grain dryer. Turkeys are raised in heated barns, which is carbon taxed, and the trucks hauling them from the slaughterhouse to the grocery store get carbon taxed, too. That’s how the carbon tax makes food cost more.

The Parliamentary Budget Officer reports the carbon tax will cost Canadians farmers close to $1 billion by 2030.

But it’s not just transportation and food that gets hit with the Trudeau’s carbon tax.

Home heating is punished too. The current carbon tax costs 12 cents extra per cubic metre of natural gas, 10 cents extra per litre of propane and 17 cents extra per litre of furnace oil.

An average Alberta home uses about 2,800 cubic metres of natural gas per year, so the carbon tax will cost them about $337 extra to heat their home. Costs are similar for propane and furnace oil.

Home heating is essential for a place like Alberta.

Punishing Canadians with a carbon tax is pointless and unfair.

It’s pointless because the carbon tax won’t fix climate change. As the PBO has noted, “Canada’s own emissions are not large enough to materially impact climate change.”

It’s unfair because ordinary people who are driving to work, buying food for their families and heating their homes are backed into a corner. Carbon tax cheerleaders tell them to “switch.”

Switch to what?

What abundant, reliable, affordable alternative energy source is available to Albertans? This isn’t like choosing between paper or plastic bags, this is about surviving the winter and affording food, or not.

Albertans should not be punished for staying warm and feeding our families.

Alberta

B.C. would benefit from new pipeline but bad policy stands in the way

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

Bill C-69 (a.k.a. the “no pipelines act”) has added massive uncertainty to the project approval process, requiring proponents to meet vague criteria that go far beyond any sensible environmental concerns—for example, assessing any project’s impact on the “intersection of sex and gender with other identity factors.”

In case you haven’t heard, the Alberta government plans to submit a proposal to the federal government to build an oil pipeline from Alberta to British Columbia’s north coast.

But B.C. Premier Eby dismissed the idea, calling it a project imported from U.S. politics and pursued “at the expense of British Columbia and Canada’s economy.” He’s simply wrong. A new pipeline wouldn’t come at the expense of B.C. or Canada’s economy—it would strengthen both. In fact, particularly during the age of Trump, provinces should seek greater cooperation and avoid erecting policy barriers that discourage private investment and restrict trade and market access.

The United States remains the main destination for Canada’s leading exports, oil and natural gas. In 2024, nearly 96 per cent of oil exports and virtually all natural gas exports went to our southern neighbour. In light of President Trump’s tariffs on Canadian energy and other goods, it’s long past time to diversify our trade and find new export markets.

Given that most of Canada’s oil and gas is landlocked in the Prairies, pipelines to coastal terminals are the only realistic way to reach overseas markets. After the completion of the Trans Mountain Pipeline Expansion (TMX) project in May 2024, which transports crude oil from Alberta to B.C. and opened access to Asian markets, exports to non-U.S. destinations increased by almost 60 per cent. This new global reach strengthens Canada’s leverage in trade negotiations with Washington, as it enables Canada to sell its energy to markets beyond the U.S.

Yet trade is just one piece of the broader economic impact. In its first year of operation, the TMX expansion generated $13.6 billion in additional revenue for the economy, including $2.0 billion in extra tax revenues for the federal government. By 2043, TMX operations will contribute a projected $9.2 billion to Canada’s economic output, $3.7 billion in wages, and support the equivalent of more than 36,000 fulltime jobs. And B.C. stands to gain the most, with $4.3 billion added to its economic output, nearly $1 billion in wages, and close to 9,000 new jobs. With all due respect to Premier Eby, this is good news for B.C. workers and the provincial economy.

In contrast, cancelling pipelines has come at a real cost to B.C. and Canada’s economy. When the Trudeau government scrapped the already-approved Northern Gateway project, Canada lost an opportunity to increase the volume of oil transported from Alberta to B.C. and diversify its trading partners. Meanwhile, according to the Canadian Energy Centre, B.C. lost out on nearly 8,000 jobs a year (or 224,344 jobs in 29 years) and more than $11 billion in provincial revenues from 2019 to 2048 (inflation-adjusted).

Now, with the TMX set to reach full capacity by 2027/28, and Premier Eby opposing Alberta’s pipeline proposal, Canada may miss its chance to export more to global markets amid rising oil demand. And Canadians recognize this opportunity—a recent poll shows that a majority of Canadians (including 56 per cent of British Columbians) support a new oil pipeline from Alberta to B.C.

But, as others have asked, if the economic case is so strong, why has no private company stepped up to build or finance a new pipeline?

Two words—bad policy.

At the federal level, Bill C-48 effectively bans large oil tankers from loading or unloading at ports along B.C.’s northern coast, undermining the case for any new private-sector pipeline. Meanwhile, Bill C-69 (a.k.a. the “no pipelines act”) has added massive uncertainty to the project approval process, requiring proponents to meet vague criteria that go far beyond any sensible environmental concerns—for example, assessing any project’s impact on the “intersection of sex and gender with other identity factors.” And the federal cap on greenhouse gas (GHG) emissions exclusively for the oil and gas sector will inevitably force a reduction in oil and gas production, again making energy projects including pipelines less attractive to investors.

Clearly, policymakers in Canada should help diversify trade, boost economic growth and promote widespread prosperity in B.C., Alberta and beyond. To achieve this goal, they should put politics aside, focus of the benefits to their constituents, and craft regulations that more thoughtfully balance environmental concerns with the need for investment and economic growth.

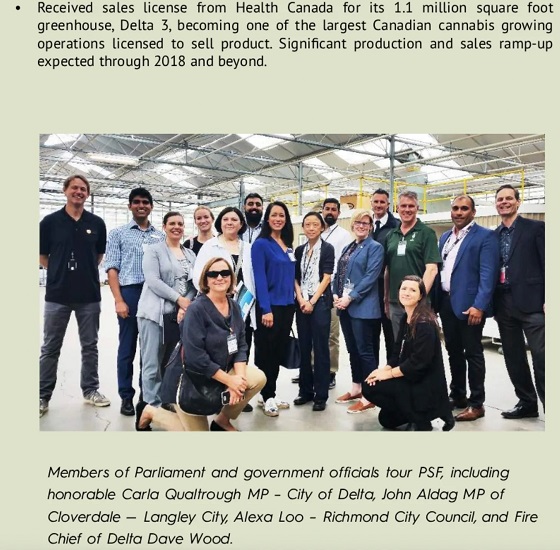

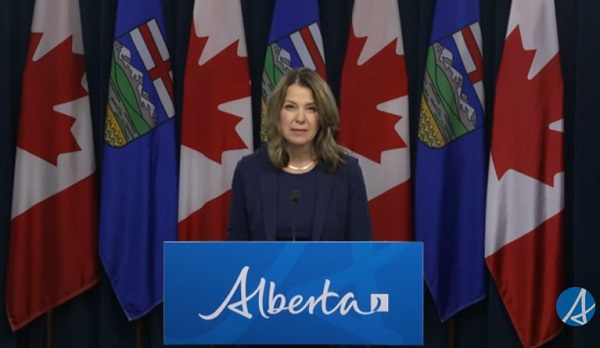

Alberta

Alberta introduces bill allowing province to reject international agreements

From LifeSiteNews

Under the proposed law, international treaties or accords signed by the federal government would not apply in Alberta unless approved through its own legislation.

Alberta’s Conservative government introduced a new law to protect “constitutional rights” that would allow it to essentially ignore International Agreements, including those by the World Health Organization (WHO), signed by the federal Liberal government.

The new law, Bill 1, titled International Agreements Act and introduced Thursday, according to the government, “draws a clear line: international agreements that touch on provincial areas of jurisdiction must be debated and passed into law in Alberta.”

Should the law pass, which is all but certain as Alberta Premier Danielle Smith’s Conservatives hold a majority government, it would mean that any international treaties or accords signed by the federal government would not apply in Alberta unless approved through its own legislation.

“As we return to the legislature, our government is focused on delivering on the mandate Albertans gave us in 2023 to stand up for this province, protect our freedoms and chart our path forward,” Smith said.

“We will defend our constitutional rights, protect our province’s interests and make sure decisions that affect Albertans are made by Albertans. The federal government stands at a crossroads. Work with us, and we’ll get things done. Overstep, and Alberta will stand its ground.”

According to the Alberta government, while the feds have the “power to enter into international agreements on behalf of Canada,” it “does not” have the “legal authority to impose its terms on provinces.”

“The International Agreements Act reinforces that principle, ensuring Alberta is not bound by obligations negotiated in Ottawa that do not align with provincial priorities,” the province said.

The new Alberta law is not without precedent. In 2000, the province of Quebec passed a similar law, allowing it to ignore international agreements unless approved by local legislators.

The Smith government did not say which current federal agreements it would ignore, but in theory, it could apply to any agreement Canada has signed with the United Nations or the WHO.

-

Health2 days ago

Health2 days agoFor Anyone Planning on Getting or Mandating Others to Get an Influenza Vaccine (Flu Shot)

-

Business2 days ago

Business2 days agoLiberals backtrack on bill banning large cash gifts, allowing police to search Canadians’ mail

-

Sports2 days ago

Sports2 days ago‘We Follow The Money’: Kash Patel Says Alleged NBA Ties To Mafia Just ‘The Start’ Of FBI Investigation

-

Alberta2 days ago

Alberta2 days agoPremier Smith moves to protect Alberta in International Agreements

-

Business1 day ago

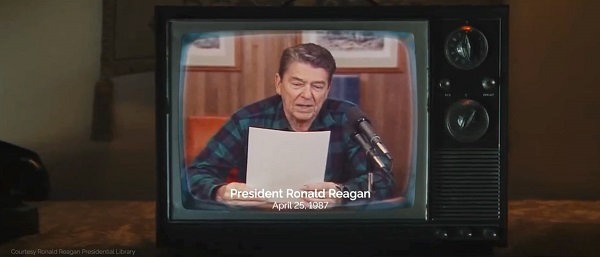

Business1 day ago‘TERMINATED’: Trump Ends Trade Talks With Canada Over Premier Ford’s Ronald Reagan Ad Against Tariffs

-

Business2 days ago

Business2 days agoA Middle Finger to Carney’s Elbows Up

-

Business10 hours ago

Business10 hours agoCarney government risks fiscal crisis of its own making

-

Alberta10 hours ago

Alberta10 hours agoB.C. would benefit from new pipeline but bad policy stands in the way