Energy

Transmountain Pipeline Expansion Project a success?

From the Frontier Centre for Public Policy

The Transmountain Mountain Pipeline expansion project (TMEP) was completed on May 01, 2024. Its startup the following month ended an eleven-year saga of tectonic federal energy policy initiatives, climate change requirements, federal regulatory restructuring, and indigenous reconciliation. That it was finished at all is a triumph, but there was muted celebration.

The original proponent for TMEP was Kinder Morgan (KM), who filed its application with the federal energy regulator in 2013. The expansion would be constructed in the existing right of way of the existing pipeline and increase capacity from 300,000 barrels of oil and refined products to 890,000 barrels of oil per day. This included expansion of the existing dock and loading facilities. Protests began virtually the next day. The cost estimate at that time was $7.4 billion for the 1,150 km pipeline and related facilities. The federal regulator and the federal government approved the project in 2016.

Between 2016 and 2018, the intensity of the protests against TMEP and a new government formed in British Columbia that vowed it would use any means possible to make sure TMX would not be built created significant hurdles. KM warned that the protest’s impact and B.C.’s regulatory and legal challenges were creating significant uncertainty, and the project would be delayed at least a year, stopping all non-essential spending. Ultimately KM decided it would not continue with the project because of the increased execution risk and cost to complete the project that the legal and regulatory challenges, and increasing protests, posed.

The project’s shelving by KM led to the federal government acquiring all the Kinder Morgan assets, including TM for $4.7 billion in 2018. Construction then began in 2019. The execution risks remained the same with the legal and regulatory challenges. They were compounded by a legal challenge to the substance of the federal government’s consultation with indigenous people, which was their constitutional duty. The courts agreed that the federal government had not met its constitutional duty to consult and ordered that it be redone. This led to further delays and in 2020 the cost estimate increased to $12.6 billion, then increased again to $21.4 billion in 2022. Ultimately, the federal regulator imposed 157 conditions on TMEP that it had to meet before it could operate.

COVID, extensive flooding and regulatory delays led to a further cost increase up to $30.9 billion in 2023. The final updated cost increased to $34 billion in 2024 due to labour costs, inflation, and materials delays.

The foregoing “Coles notes” version of events sets out the challenges endured by TMX as of Thursday, May 23, 2024. It also highlights that delays in a major project like TMEP have a massive impact on costs. But what gets lost in all this is that in 2013 KM, a public company, made a commercial decision to proceed with the project. There was and still is a huge market pull for the pipeline and the incremental oil volumes. There is huge economic and strategic value for Canada that will benefit all sectors of the economy and indigenous communities, who will most likely end with significant pipeline ownership.

Market access for Canada’s oil production in the Pacific markets will change the oil trading dynamics and value for Canadian production. Canada has the third largest oil reserves in the world. Canada is among the best in its class for environmental, safety, social and governance of its energy production. Canada is also among the best in pipeline construction and safety. So, who best to execute a monumental project like TMX?

We need to reflect and admire the skill, diligence, and perseverance of everyone involved with bringing to fruition TMX as a world class, state of the art major piece of energy infrastructure.

Yes, TMX is a success but the process through which it had to persevere was a failure and we should reflect and learn from it. In the end, despite the final cost, Canada will reap the economic benefits from TMX for decades because the world needs oil and Canada has lots of it.

Chris Bloomer is a board member of FCPP and the former president and CEO of the Canadian Energy Pipeline Association. He has held senior executive positions in the energy industry in Canada and internationally.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Daily Caller

Trump Issues Order To End Green Energy Gravy Train, Cites National Security

From the Daily Caller News Foundation

By Audrey Streb

President Donald Trump issued an executive order calling for the end of green energy subsidies by strengthening provisions in the One Big Beautiful Bill Act on Monday night, citing national security concerns and unnecessary costs to taxpayers.

The order argues that a heavy reliance on green energy subsidies compromise the reliability of the power grid and undermines energy independence. Trump called for the U.S. to “rapidly eliminate” federal green energy subsidies and to “build upon and strengthen” the repeal of wind and solar tax credits remaining in the reconciliation law in the order, directing the Treasury Department to enforce the phase-out of tax credits.

“For too long, the Federal Government has forced American taxpayers to subsidize expensive and unreliable energy sources like wind and solar,” the order states. “Reliance on so-called ‘green’ subsidies threatens national security by making the United States dependent on supply chains controlled by foreign adversaries.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Former President Joe Biden established massive green energy subsidies under his signature 2022 Inflation Reduction Act (IRA), which did not receive a single Republican vote.

The reconciliation package did not immediately terminate Biden-era federal subsidies for green energy technology, phasing them out over time instead, though some policy experts argued that drawn-out timelines could lead to an indefinite continuation of subsidies. Trump’s executive order alludes to potential loopholes in the bill, calling for a review by Secretary of the Treasury Scott Bessent to ensure that green energy projects that have a “beginning of construction” tax credit deadline are not “circumvented.”

Additionally, the executive order directs the U.S. to end taxpayer support for green energy supply chains that are controlled by foreign adversaries, alluding to China’s supply chain dominance for solar and wind. Trump also specifically highlighted costs to taxpayers, market distortions and environmental impacts of subsidized green energy development in explaining the policy.

Ahead of the reconciliation bill becoming law, Trump told Republicans that “we’ve got all the cards, and we are going to use them.” Several House Republicans noted that the president said he would use executive authority to enhance the bill and strictly enforce phase-outs, which helped persuade some conservatives to back the bill.

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

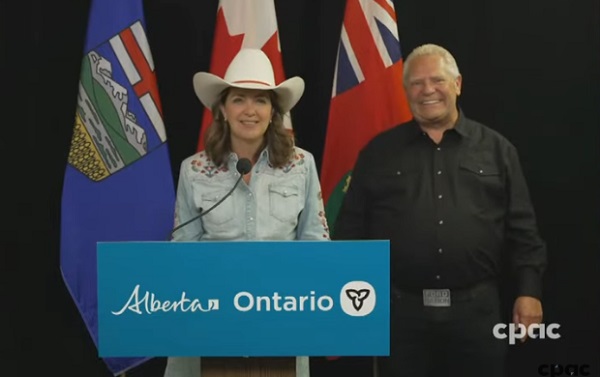

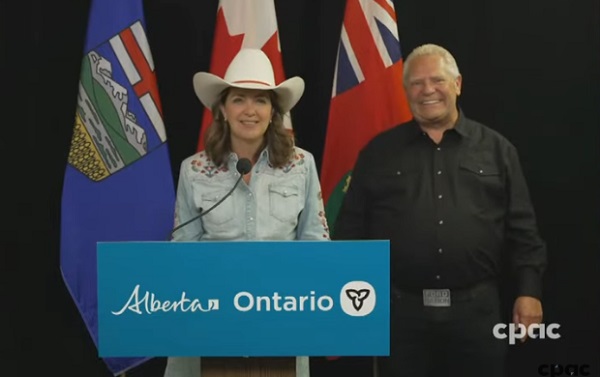

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Fraser Institute24 hours ago

Fraser Institute24 hours agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

Censorship Industrial Complex13 hours ago

Censorship Industrial Complex13 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Daily Caller1 day ago

Daily Caller1 day ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV