Canadian Energy Centre

Top 10 good news stories about Canadian energy in 2024

From the Canadian Energy Centre

Record oil production, more Indigenous ownership and inching closer to LNG

It’s likely 2024 will go down in history as a turning point for Canadian energy, despite challenging headwinds from federal government policy.

Here’s some of the good news.

10. New carbon capture and storage (CCS) projects to proceed

In June, Shell announced it will proceed with the Polaris and Atlas CCS projects, expanding emissions reduction at the company’s Scotford energy and chemicals park near Edmonton.

Polaris is designed to capture approximately 650,000 tonnes of CO2 per year, or the equivalent annual emissions of about 150,000 gasoline-powered cars. The CO2 will be transported by a 22-kilometre pipeline to the Atlas underground storage hub.

The projects build on Shell’s experience at the Quest CCS project, also located at the Scotford complex. Since 2015, Quest has stored more than eight million tonnes of CO2. Polaris and Atlas are targeted for startup in 2028.

Meanwhile, Entropy Inc. announced in July it will proceed with its Glacier Phase 2 CCS project. Located at the Glacier gas plant near Grande Prairie, the project is expected onstream in mid-2026 and will capture 160,000 tonnes of emissions per year.

Since 2015, CCS operations in Alberta have safely stored roughly 14 million tonnes of CO2, or the equivalent emissions of more than three million cars.

9. Canada’s U.S. oil exports reach new record

Expanded export capacity at the Trans Mountain Westridge Terminal. Photo courtesy Trans Mountain Corporation

Canada’s exports of oil and petroleum products to the United States averaged a record 4.6 million barrels per day in the first nine months of 2024, according to the U.S. Energy Information Administration.

Demand from Midwest states increased, along with the U.S. Gulf Coast, the world’s largest refining hub. Canadian sales to the U.S. West Coast also increased, enabled by the newly completed Trans Mountain Pipeline Expansion.

8. Alberta’s oil production never higher

In early December, ATB Economics analyst Rob Roach reported that Alberta’s oil production has never been higher, averaging 3.9 million barrels per day in the first 10 months of the year.

This is about 190,000 barrels per day higher than during the same period in 2023, enabled by the Trans Mountain expansion, Roach noted.

7. Indigenous energy ownership spreads

Communities of Wapiscanis Waseskwan Nipiy Limited Partnership in December 2023. Photo courtesy Alberta Indigenous Opportunities Corporation

In September, the Bigstone Cree Nation became the latest Indigenous community to acquire an ownership stake in an Alberta energy project.

Bigstone joined 12 other First Nations and Métis settlements in the Wapiscanis Waseskwan Nipiy Holding Limited Partnership, which holds 85 per cent ownership of Tamarack Valley Energy’s Clearwater midstream oil and gas assets.

The Alberta Indigenous Opportunities Corporation (AIOC) is backstopping the agreement with a total $195 million loan guarantee.

In its five years of operations, the AIOC has supported more than 60 Indigenous communities taking ownership of energy projects, with loan guarantees valued at more than $725 million.

6. Oil sands emissions intensity goes down

A November report from S&P Global Commodity said that oil sands production growth is beginning to rise faster than emissions growth.

While oil sands production in 2023 was nine per cent higher than in 2019, total emissions rose by just three per cent.

“This is a notable, significant change in oil sands emissions,” said Kevin Birn, head of S&P Global’s Centre for Emissions Excellence.

Average oil sands emissions per barrel, or so-called “emissions intensity” is now 28 per cent lower than it was in 2009.

5. Oil and gas producers beat methane target, again

Data released by the Alberta Energy Regulator in November 2024 confirmed that methane emissions from conventional oil and gas production in the province continue to go down, exceeding government targets.

In 2022, producers reached the province’s target to reduce methane emissions by 45 per cent compared to 2014 levels by 2025 three years early.

The new data shows that as of 2023, methane emissions have been reduced by 52 per cent.

4. Cedar LNG gets the green light to proceed

Haisla Nation Chief Councillor Crystal Smith and Pembina Pipeline Corporation CEO Scott Burrows announce the Cedar LNG positive final investment decision on June 25, 2024. Photo courtesy Cedar LNG

The world’s first Indigenous majority-owned liquefied natural gas (LNG) project is now under construction on the coast of Kitimat, B.C., following a positive final investment decision in June.

Cedar LNG is a floating natural gas export terminal owned by the Haisla Nation and Pembina Pipeline Corporation. It will have capacity to produce 3.3 million tonnes of LNG per year for export overseas, primarily to meet growing demand in Asia.

The $5.5-billion project will receive natural gas through the Coastal GasLink pipeline. Peak construction is expected in 2026, followed by startup in late 2028.

3. Coastal GasLink Pipeline goes into service

The countdown is on to Canada’s first large-scale LNG exports, with the official startup of the $14.5-billion Coastal GasLink Pipeline in November.

The 670-kilometre pipeline transports natural gas from near Dawson Creek, B.C. to the LNG Canada project at Kitimat, where it will be supercooled and transformed into LNG.

LNG Canada will have capacity to export 14 million tonnes of LNG per year to overseas markets, primarily in Asia, where it is expected to help reduce emissions by displacing coal-fired power.

The terminal’s owners – Shell, Petronas, PetroChina, Mitsubishi and Korea Gas Corporation – are ramping up natural gas production to record rates, according to RBN Energy.

RBN analyst Martin King expects the first shipments to leave LNG Canada by early next year, setting up for commercial operations in mid-2025.

2. Construction starts on $8.9 billion net zero petrochemical plant

In April, construction commenced near Edmonton on the world’s first plant designed to produce polyethylene — a widely used, recyclable plastic — with net zero scope 1 and 2 emissions.

Dow Chemicals’ $8.9 billion Path2Zero project is an expansion of the company’s manufacturing site in Fort Saskatchewan. Using natural gas as a feedstock, it will incorporate CCS to reduce emissions.

According to business development agency Edmonton Global, the project is spurring a boom in the region, with nearly 200 industrial projects worth about $96 billion now underway or nearing construction.

Dow’s plant is scheduled for startup in 2027.

1. Trans Mountain Pipeline Expansion completed

The “Golden Weld” marked mechanical completion of construction for the Trans Mountain Expansion Project on April 11, 2024. Photo courtesy Trans Mountain Corporation

The long-awaited $34-billion Trans Mountain Pipeline Expansion officially went into service in May, in a game-changer for Canadian energy with ripple effects around the world.

The 590,000 barrel-per-day expansion for the first time gives customers outside the United States access to large volumes of Canadian oil, with the benefits flowing to Canada’s economy.

According to the Canada Energy Regulator, exports to non-U.S. locations more than doubled following the expansion startup, averaging 420,000 barrels per day compared to about 130,000 barrels per day in 2023.

The value of Canadian oil exports to Asia has soared from effectively zero to a monthly average of $515 million between June and October, according to ATB Economics.

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

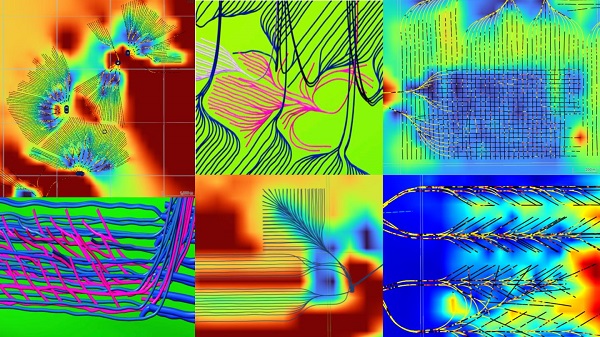

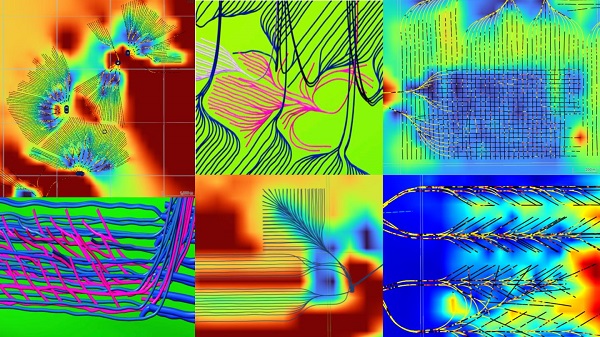

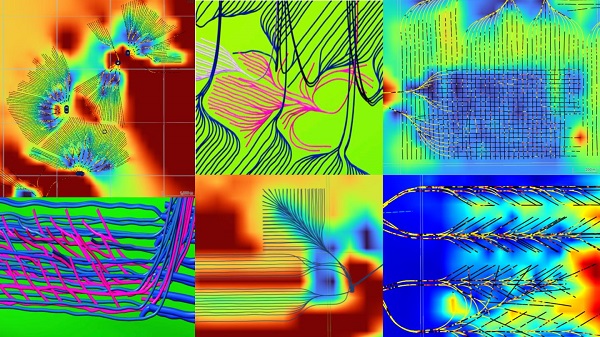

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

Alberta

How economic corridors could shape a stronger Canadian future

Ship containers are stacked at the Panama Canal Balboa port in Panama City, Saturday, Sept. 20, 2025. The Panama Canals is one of the most significant trade infrastructure projects ever built. CP Images photo

From the Canadian Energy Centre

Q&A with Gary Mar, CEO of the Canada West Foundation

Building a stronger Canadian economy depends as much on how we move goods as on what we produce.

Gary Mar, CEO of the Canada West Foundation, says economic corridors — the networks that connect producers, ports and markets — are central to the nation-building projects Canada hopes to realize.

He spoke with CEC about how these corridors work and what needs to change to make more of them a reality.

CEC: What is an economic corridor, and how does it function?

Gary Mar: An economic corridor is a major artery connecting economic actors within a larger system.

Consider the road, rail and pipeline infrastructure connecting B.C. to the rest of Western Canada. This infrastructure is an important economic corridor facilitating the movement of goods, services and people within the country, but it’s also part of the economic corridor connecting western producers and Asian markets.

Economic corridors primarily consist of physical infrastructure and often combine different modes of transportation and facilities to assist the movement of many kinds of goods.

They also include social infrastructure such as policies that facilitate the easy movement of goods like trade agreements and standardized truck weights.

The fundamental purpose of an economic corridor is to make it easier to transport goods. Ultimately, if you can’t move it, you can’t sell it. And if you can’t sell it, you can’t grow your economy.

CEC: Which resources make the strongest case for transport through economic corridors, and why?

Gary Mar: Economic corridors usually move many different types of goods.

Bulk commodities are particularly dependent on economic corridors because of the large volumes that need to be transported.

Some of Canada’s most valuable commodities include oil and gas, agricultural commodities such as wheat and canola, and minerals such as potash.

CEC: How are the benefits of an economic corridor measured?

Gary Mar: The benefits of economic corridors are often measured via trade flows.

For example, the upcoming Roberts Bank Terminal 2 in the Port of Vancouver will increase container trade capacity on Canada’s west coast by more than 30 per cent, enabling the trade of $100 billion in goods annually, primarily to Asian markets.

Corridors can also help make Canadian goods more competitive, increasing profits and market share across numerous industries. Corridors can also decrease the costs of imported goods for Canadian consumers.

For example, after the completion of the Trans Mountain Expansion in May 2024 the price differential between Western Canada Select and West Texas Intermediate narrowed by about US$8 per barrel in part due to increased competition for Canadian oil.

This boosted total industry profits by about 10 per cent, and increased corporate tax revenues to provincial and federal governments by about $3 billion in the pipeline’s first year of operation.

CEC: Where are the most successful examples of these around the world?

Gary Mar: That depends how you define success. The economic corridors transporting the highest value of goods are those used by global superpowers, such as the NAFTA highway that facilitates trade across Canada, the United States and Mexico.

The Suez and Panama canals are two of the most significant trade infrastructure projects ever built, facilitating 12 per cent and five per cent of global trade, respectively. Their success is based on their unique geography.

Canada’s Asia-Pacific Gateway, a coordinated system of ports, rail lines, roads, and border crossings, primarily in B.C., was a highly successful initiative that contributed to a 48 per cent increase in merchandise trade with Asia from $44 million in 2006 to $65 million in 2015.

China’s Belt and Road initiative to develop trade infrastructure in other countries is already transforming global trade. But the project is as much about extending Chinese influence as it is about delivering economic returns.

Piles of coal awaiting export and gantry cranes used to load and unload containers onto and from cargo ships are seen at Deltaport, in Tsawwassen, B.C., on Monday, September 9, 2024. CP Images photo

CEC: What would need to change in Canada in terms of legislation or regulation to make more economic corridors a reality?

Gary Mar: A major regulatory component of economic corridors is eliminating trade barriers.

The federal Free Trade and Labour Mobility in Canada Act is a good start, but more needs to be done at the provincial level to facilitate more internal trade.

Other barriers require coordinated regulatory action, such as harmonizing weight restrictions and road bans to streamline trucking.

By taking a systems-level perspective – convening a national forum where Canadian governments consistently engage on supply chains and trade corridors – we can identify bottlenecks and friction points in our existing transportation networks, and which investments would deliver the greatest return on investment.

-

Crime2 days ago

Crime2 days ago‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer

-

National23 hours ago

National23 hours agoPsyop-Style Campaign That Delivered Mark Carney’s Win May Extend Into Floor-Crossing Gambits and Shape China–Canada–US–Mexico Relations

-

COVID-1920 hours ago

COVID-1920 hours agoCovid Cover-Ups: Excess Deaths, Vaccine Harms, and Coordinated Censorship

-

Health1 day ago

Health1 day agoCDC’s Autism Reversal: Inside the Collapse of a 25‑Year Public Health Narrative

-

Bruce Dowbiggin21 hours ago

Bruce Dowbiggin21 hours agoBurying Poilievre Is Job One In Carney’s Ottawa

-

Alberta1 day ago

Alberta1 day ago‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

-

Alberta1 day ago

Alberta1 day agoAlberta to protect three pro-family laws by invoking notwithstanding clause

-

Great Reset11 hours ago

Great Reset11 hours agoEXCLUSIVE: The Nova Scotia RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia