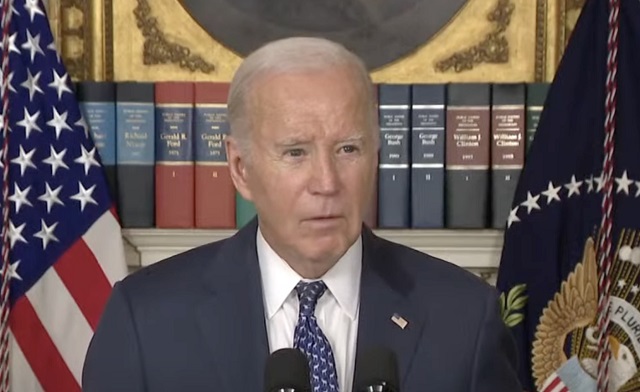

Vance Luther Boelter, wanted in the murders of former Minnesota House speaker and her husband, shown in image from video Saturday.

From The Center Square

Second lawmaker, his wife also shot; suspect remains at large

Two Minnesota state lawmakers who are members of the Democratic-Farm-Labor Party were shot early Saturday by a person posing as a law enforcement officer just north of Minneapolis.

House Speaker Emeritus Melissa Hortman and her husband were shot and killed in what Gov. Tim Walz called a politically-motivated assassination. The suspect, identified as Vance Boelter, 57, remains at large and a manhunt is ongoing. Authorities said he no longer is in the area of the shootings.

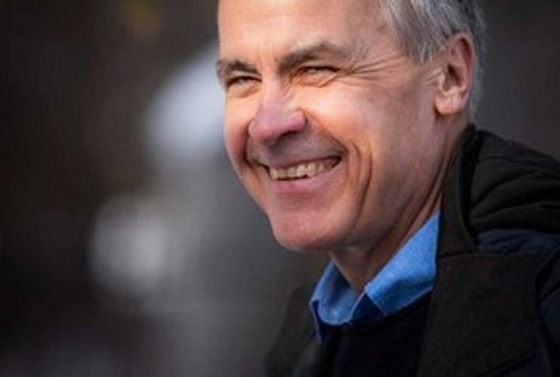

Gov. Walz on Shooting of Minnesota Legislators: ‘An Unspeakable Tragedy’. 6/14/25

Source: Minnesota Department of Public Safety

“My good friend and colleague, Speaker Melissa Hortman and her husband Mark, were shot and killed early this morning in what appears to be a politically-motivated assassination,” Walz said at a news conference. “Our state lost a great leader, and I lost a dearest of friends.”

State Sen. John Hoffman, DFL-Brooklyn Park, and his wife also were shot about 2 a.m., and Hortman and her husband were found about 90 minutes later.

Walz said the Hoffmans were each shot multiple times but he was hopeful for their recovery.

Law enforcement issued a shelter-in-place order for an area around Edinburgh Course that continued into the hours Saturday but has since been lifted. The suspect was seen wearing blue pants, a blue shirt, body armor, and reportedly driving a dark SUV with lights meant to make it appear like a police vehicle.

The suspect, Boelter, was appointed by Walz to serve on the Governor’s Workforce Development Board in 2019. Various media outlets reported that he is the director of Praetorian Guard Security Services, where he had access to police-like security equipment. Media outlets also reported that Boelter had a list of about 70 names in his vehicle which included the lawmakers who were shot, other lawmakers and abortion providers.

State officials are encouraging residents to not attend “No Kings” protests at the state capitol and across Minnesota. “No Kings” flyers were found in the suspect’s vehicle, law enforcement said.

The “suspect exploited the trust of our uniforms, what our uniforms are meant to represent,” Public Safety Commissioner Bob Jacobson said. “That betrayal is deeply disturbing to those of us who wear the badge with honor and responsibility.”

According to authorities, the gunman allegedly escaped through a back door of Hortman’s house following an exchange of gunfire with police.

President Donald Trump also released a statement on X, posted by White House Press Secretary Karoline Leavitt.

“Our Attorney General, Pam Bondi, and the FBI are investigating the situation, and they will be prosecuting anyone involved to the fullest extent of the law,” Trump said. “Such horrific violence will not be tolerated in the United States of America. God Bless the great people of Minnesota, a truly great place!”

The FBI said it is offering a reward of up to $50,000 for information leading to the arrest of Boelter.

Drew Evans, superintendent of the Minnesota Bureau of Criminal Apprehension, said Saturday that officers arrived at the Hortman residence as part of a routine check on lawmakers in the area and exchanged gunfire with the suspect, who managed to flee.

Brooklyn Park Police Chief Burley said officers knocked on the Hortmans door and were met by what appeared to be a police officer wearing police gear, a gun, a taser and a badge. Officers and the suspect exchanged gunfire in the home before the suspect fled out the rear of the house.

Burley also said the suspect was driving an SUV that looked like a police vehicle with lights. The car was impounded, and Burley said the suspect is on foot. He encouraged citizens to not answer the door for police officers and instructed Brooklyn Park police officers to not approach citizens alone, only in groups of two or more.

Burley said several people have been detained, and police are looking for others of interest.

Burley said a manifesto was found in the suspect’s vehicle that identified several other lawmakers. Both Hoffman and Hortman were on the list of people found in the car, Evans said.

Life-saving efforts were given to the Hortmans at the scene, Evans said.

“This was an act of targeted political violence. Peaceful discourse is the foundation of our democracy.We don’t settle our differences with violence at gun point. We must all stand against political violence,” Walz, also a DFL party member, said. “This tragic act in Minnesota should serve as a reminder that democracy and debate is a the way to settle our differences and move to a better place.”

The shootings happened seven miles away from each other, and law enforcement officials have called both shootings “targeted.”

Law enforcement was dispatched to the homes of several other state lawmakers – both Democrats and Republicans – in the Twin Cities area for protection overnight. Those lawmakers were told not to answer the door if an officer comes to it, but confirm with 911 before answering.

U.S. Sen. Amy Klobuhar, D-Minn., was shocked by the news.

“This is a stunning act of violence. I’m thankful for all the law enforcement who are responding in real time. My prayers are with the Hortman and Hoffman families. Both legislators are close friends and devoted to their families and public service,” Klobuchar said on social media.

Republican House Speaker Lisa Demuth, R-Cold Spring, called the shootings evil and asked for prayers.

“I am shocked and horrified by the evil attack that took place overnight. Please lift up in prayer the victims along with the law enforcement personal working to apprehend the perpetrator,” Demuth said on social media.

Walz activated the state emergency operations center early Saturday.

Hoffman was first elected to the Senate in 2012 and currently chairs the Human Services Committee.

Hortman was first elected in 2002 and was elected as speaker of the house in 2018. She is the current speaker emeritus.

She was also one of four DFL members to break with the party Monday and join Republicans to pass a state budget and end state health care services for noncitizens after a long and contentious special session.

The initial budget vote ended in a tie, before Hortman and three other DFL members broke ranks and joined Republicans to pass the legislation.