Digital Currency

Thousands of political and business leaders gathering in Davos to promote their vision for our future

WEF social media video from 2016 that stated eight predictions about the world in 2030, including: “You’ll own nothing. And you’ll be happy. What you want you’ll rent, and it’ll be delivered by drone.” – Reuters

From the: World Economic Forum Annual Meeting

-

The Annual Meeting 2023 will take place in Davos, Klosters from 16-20 January.

-

The theme of the meeting is ‘Cooperation in a Fragmented World’.

-

The meeting will bring together 2,700 leaders from 130 countries including 52 heads of state/government.

Cooperation in a Fragmented World

Under the theme ‘Cooperation in a Fragmented World’, the Annual Meeting 2023 will bring together more than 2,700 leaders from government, business and civil society, at a pivotal time for the world.

Multiple crises are deepening divisions and fragmenting the geopolitical landscape. Leaders must address people’s immediate, critical needs while also laying the groundwork for a more sustainable, resilient world by the end of the decade.

“We see the manifold political, economic and social forces creating increased fragmentation on a global and national level. To address the root causes of this erosion of trust, we need to reinforce cooperation between the government and business sectors, creating the conditions for a strong and durable recovery. At the same time there must be the recognition that economic development needs to be made more resilient, more sustainable and nobody should be left behind,” said Klaus Schwab, Founder and Executive Chairman, World Economic Forum.

The programme of the 53rd Annual Meeting focuses on solutions and public-private cooperation to tackle the world’s most pressing challenges. It encourages world leaders to work together on the interconnected issues of energy, climate and nature; investment, trade and infrastructure; frontier technologies and industry resilience; jobs, skills, social mobility and health; and geopolitical cooperation in a multipolar world. Special emphasis is on gender and geographical diversity across all sessions.

Top political leaders taking part include:

Olaf Scholz, Federal Chancellor of Germany; Ursula von der Leyen, President of the European Commission; Roberta Metsola, President of the European Parliament; Yoon Suk-yeol, President of the Republic of Korea; Cyril M. Ramaphosa, President of South Africa; Pedro Sánchez, Prime Minister of Spain; Alain Berset, President of the Swiss Confederation 2023 and Federal Councillor of Home Affairs; Ilham Aliyev, President of the Republic of Azerbaijan; Alexander De Croo, Prime Minister of Belgium; Gustavo Francisco Petro Urrego, President of Colombia; Félix Tshisekedi, President of the Democratic Republic of the Congo; Sanna Marin, Prime Minister of Finland; Kyriakos Mitsotakis, Prime Minister of Greece; Leo Varadkar, Taoiseach of Ireland; Maia Sandu, President of the Republic of Moldova; Aziz Akhannouch, Head of Government of Morocco; Mark Rutte, Prime Minister of the Netherlands; Ferdinand Marcos, President of the Philippines; Andrzej Duda, President of Poland; Aleksandar Vučić, President of Serbia; Samia SuluhuHassan, President of United Republic of Tanzania; Najla Bouden, Prime Minister of Tunisia.

As well as:

John F. Kerry, Special Presidential Envoy for Climate of the United States of America; Avril Haines, US Director of National Intelligence; Martin J. Walsh, Secretary of Labor of the United States; Katherine Tai, United States Trade Representative; Chrystia Freeland, Deputy Prime Minister and Minister of Finance of Canada; Christine Lagarde, President, European Central Bank.

Heads of international organizations taking part include:

Antonio Guterres, UN Secretary-General; Kristalina Georgieva, Managing Director, International Monetary Fund; Ngozi Okonjo-Iweala, Director General, World Trade Organization; Jens Stoltenberg, Secretary General, North Atlantic Treaty Organization; Tedros Adhanom Ghebreyesus, Director General, World Health Organization; Fatih Birol, Executive Director, International Energy Agency; Catherine Russell, Executive Director, UNICEF; Mirjana Spoljaric Egger, President, International Committee of the Red Cross.

This year will bring about the highest ever business participation at Davos, with over 1,500 leaders registered across 700 organizations, including over 600 of the world’s top CEOs form the World Economic Forum’s Members and Partners, with top-level representation from sectors such as financial services, energy, materials and infrastructure, information and communication technologies. They come as governments increasingly look to business to take big ideas and put them into action quickly and inclusively. There will also be a strong representation of Global Innovators who are transforming industries, with more than 90 mission-driven leaders from the Forum’s Technology Pioneers and recently launched Unicorn communities.

Leaders from civil society taking part in the meeting include:

Seth F. Berkley, Chief Executive Officer, Gavi, the Vaccine Alliance; Stephen Cotton, General-Secretary, International Transport Workers’ Federation; Christy Hoffman, General-Secretary, UNI Global Union; Hindou Oumarou Ibrahim, President, Association for Indigenous Women and Peoples of Chad; Azza Karam, Secretary-General, Religions for Peace; Oleksandra Matviichuk, Nobel Peace Prize Winner 2022 and President, Centre for Civil Liberties; David Miliband, President, International Rescue Committee; Luisa Neubauer, Climate Activist, Fridays for Future Movement; Kirsten Schuijt, Director-General, WWF International; and Gurudev Sri Sri Ravi Shankar, Founder, Art of Living Foundation.

Among the new initiatives at the Annual Meeting is the Global Collaboration Village, a purpose-driven metaverse that fosters more sustainable public-private collaboration and spurs action to deliver impact at scale. The first-ever metaverse multilateral meeting hosted by the Forum will bring together experts and leaders from finance, food and retail to drive action on ocean health and seafood waste.

This year more than 160 of the Forum’s civic-minded young leaders will join as members of our Global Shapers, Young Global Leaders and Social Entrepreneurs communities. We will also welcome nine Indigenous leaders bringing the knowledge and expertise of their communities to advance regional and global efforts in ecosystem restoration, inclusive trade and sustainable development.

More than 125 experts and heads of the world’s leading universities, research institutions, and think tanks will join the Meeting, bringing the latest facts, insights, science, and data into the programme and the Forum’s work.

The Arts and Culture programme features a number of sessions and immersive art installations on the preservation of coral reefs, displaced peoples and the global refugee crisis, gender equality and female empowerment, and global sea-level rise. It will include the 27th Annual Crystal Awards and our Cultural Leaders.

This year is the 20th anniversary of the Open Forum, which welcomes diverse people from around the world to listen and share experiences with experts and leaders on pressing issues. The theme is, Our Environment: Lessons, Challenges and Opportunities. For more information, click here.

The 53rd Annual Meeting will also be climate-neutral for the sixth consecutive year. New initiatives to boost resource efficiency and reduce emissions will build on the Forum’s 2018 ISO 20121 certification for sustainable event management. Learn more about our strategy and efforts here.

Example of a typical session sees varied personas such as the President of Columbia and former US VP Al Gore speaking with three environmentalists, three business leaders, the President of the National Congress of American Indians, and internationally renowned cellist Yo-Yo Ma talking about “Leading the Charge through Earth’s New Normal”. Here is that agenda item:

—

Leading the Charge through Earth’s New Normal

The world is undergoing interacting crises in food, energy, health and nature that are threatening our way of life and accelerating us towards a global catastrophe.

What visionary leadership is needed for systems thinking, transformative solutions and global collaboration to build a more inclusive, prosperous and sustainable future?

Public Speakers

Joyeeta Gupta

Professor of Environment and Development in the Global South, University of Amsterdam

Johan Rockström

Director, Potsdam Institute for Climate Impact Research (PIK)

Roshni Nadar Malhotra

Chairperson, HCL Technologies Ltd

Al Gore

Vice-President of the United States (1993-2001); Chairman and Co-Founder, Generation Investment Management LLP

Gustavo Francisco Petro Urrego

President of Colombia, Colombia Government

Marc Benioff

Chair and Co-Chief Executive Officer, Salesforce

Andrew Forrest

Chairman and Founder, Fortescue Metals Group Limited

Fawn Sharp

President, National Congress of American Indians

Yo-Yo Ma

Cellist

Gim Huay Neo

Managing Director, Centre for Nature and Climate, World Economic Forum Geneva

Banks

Top Canadian bank studies possible use of digital dollar for ‘basic’ online payments

From LifeSiteNews

A new report released by the Bank of Canada proposed a ‘promising architecture well-suited for basic payments’ through the use of a digital dollar, though most Canadians are wary of such an idea.

Canada’s central bank has been studying ways to introduce a central bank digital currency (CBDC) for use for online retailers, according to a new report, despite the fact that recent research suggests Canadians are wary of any type of digital dollar.

In a new 47-page report titled, “A Retail CBDC Design For Basic Payments Feasibility Study,” which was released on June 13, 2025, the Bank of Canada (BOC) identified a “promising architecture well-suited for basic payments” through the use of a digital dollar.

The report reads that CBDCs “can be fast and cheap for basic payments, with high privacy, although some areas such as integration with retail payments systems, performance of auditing and resilience of the core system state require further investigation.”

While the report authors stopped short of fully recommending a CBDC, they noted it is a decision that could happen “outside the scope of this analysis.”

“Our framing highlights other promising architectures for an online retail CBDC, whose analysis we leave as an area for further exploration,” reads the report.

When it comes to a digital Canadian dollar, the Bank of Canada last year found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Indeed, a 2023 study found that most Canadians, about 85 percent, do not want a digital dollar, as previously reported by LifeSiteNews.

The study found that a “significant number” of Canadians are suspicious of government overreach and would resist any measures by the government or central bank to create digital forms of official money.

The BOC has said that it would continue to look at other countries’ use and development of CBDCs and will work with other “central banks” to improve so-called cross border payments.

Last year, as reported by LifeSiteNews, the BOC has already said that plans to create a digital “dollar,” also known as a central bank digital currency (CBDC), have been shelved.

Digital currencies have been touted as the future by some government officials, but, as LifeSiteNews has reported before, many experts warn that such technology would restrict freedom and could be used as a “control tool” against citizens, similar to China’s pervasive social credit system.

The BOC last August admitted that the creation of a CBDC is not even necessary, as many people rely on cash to pay for things. The bank concluded that the introduction of a digital currency would only be feasible if consumers demanded its release.

Conservative Party leader Pierre Poilievre has promised, should he ever form the government, he would oppose the creation of a digital dollar.

Contrast this to Canada’s current Liberal Prime Minister Mark Carney. He has a history of supporting central bank digital currencies and in 2022 supported “choking off the money” donated to the Freedom Convoy protests against COVID mandates.

Business

Justice Centre launches new petition: Keep cash legal and accessible. Stop Bill C-2

Public Safety Minister Gary Anandasangaree speaks to Bill C-2 (Screenshot from CBC video)

The Justice Centre for Constitutional Freedoms has launched a petition calling upon the Prime Minister of Canada to strike the criminalization of cash payments of $10,000 or more from Bill C-2 and to introduce legislation protecting the right of Canadians to use cash of any amount for legal transactions.

Public Safety Minister Gary Anandasangaree introduced Bill C-2, or the Strong Borders Act, in the House of Commons on June 3, 2025. According to a Government of Canada statement, Bill C-2 will equip law enforcement with tools to secure borders and to combat crime, the drug trade, and money laundering.

Buried deep within the Bill, however, are provisions that would make it a criminal offence for businesses, professionals, and charities to accept cash payments of $10,000 or more in a single transaction or in a series of related transactions.

Bill C-2 at page 59

Justice Centre President John Carpay warns that the criminalization of cash transactions threatens the privacy, freedom of expression, and autonomy of all Canadians. When cash transactions are criminalized, governments, banks, and law enforcement can track and interfere with legitimate purchases and donations.

“We must not criminalize everyday Canadians for using physical currency. Once $10,000 is criminalized, it will be all too easy for future governments to lower the threshold to $5,000, then $1,000, and eventually nothing.”

Bill C-2 is just one point in a concerning anti-cash trend in Canada.

Quebec’s controversial Bill 54, passed into law in March 2024, allows police to assume that any person carrying $2,000 or more in cash is connected to criminal activity. Officers can seize the cash, and citizens must prove their innocence to get the cash back.

“Restricting the use of cash is a dangerous step towards tyranny,” continued Mr. Carpay. “Cash protects citizens from surveillance by government and banks, credit card companies, and other corporations. In a free society, violating the right of law-abiding citizens to use cash is not the answer to money laundering or the drug trade.”

Signers of the petition call upon the Prime Minister of Canada to strike the criminalization of cash payments from Bill C-2.

Signers of the petition also call upon the Prime Minister of Canada to introduce legislation that protects Canadians’ right to use cash of any amount for legal transactions.

-

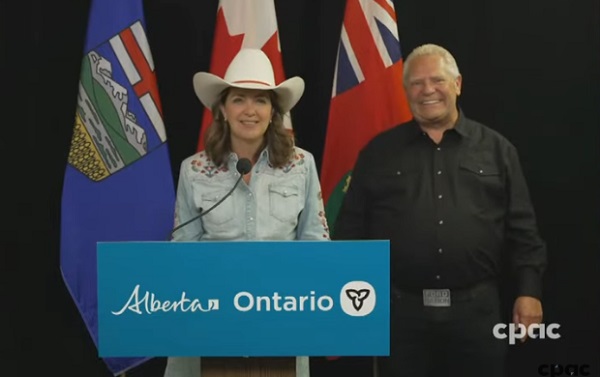

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

Censorship Industrial Complex13 hours ago

Censorship Industrial Complex13 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV