Uncategorized

The average Canadian family paid more in 2023 on taxes than it did on housing, food and clothing combined

From the Fraser Institute

By Jake Fuss and Callum MacLeod

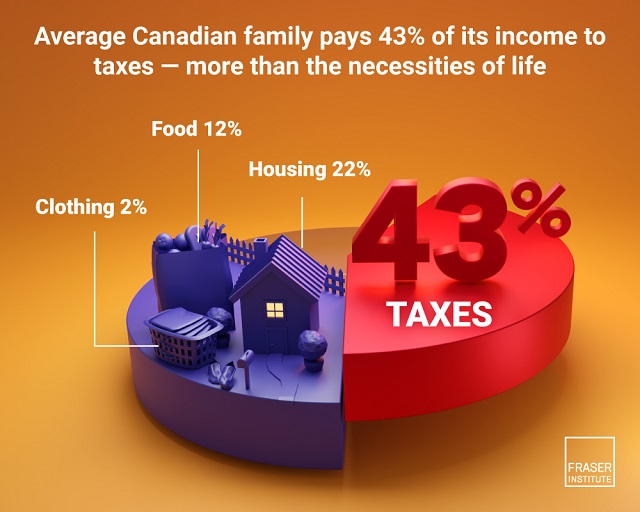

The average Canadian family spent 43.0 per cent of its income on taxes in 2023—more than housing, food and clothing costs combined, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy

think-tank.

“Taxes remain the largest household expense for families in Canada,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Taxes versus the Necessities of Life: The Canadian Consumer Tax Index 2024 Edition.

In 2023, the average Canadian family earned an income of $109,235 and paid in total taxes equaling $46,988. In other words, the average Canadian family spent 43.0 per cent of its income on taxes compared to 35.6 per cent on basic necessities.

This is a dramatic shift since 1961 when the average Canadian family spent much less of its income on taxes (33.5 per cent) than the basic necessities (56.5 per cent). Taxes have grown much more rapidly than any other single expenditure for the average Canadian family.

The total tax bill for Canadians includes visible and hidden taxes (paid to the federal, provincial and local governments) including income, payroll, sales, property, carbon, health, fuel and alcohol taxes. Moreover, since 1961, the average Canadian family’s total tax bill has increased nominally by 2,705 per cent, dwarfing increases in annual housing costs (2,006 per cent), clothing (478 per cent) and food (901 per cent).

“Considering the sheer amount of income that goes towards taxes in this country, Canadians may question whether or not we’re getting good value for our money,” Fuss said.

- The Canadian Consumer Tax Index tracks the total tax bill of the average Canadian family from 1961 to 2023. Including all types of taxes, that bill has increased by 2,705% since 1961.

- Taxes have grown much more rapidly than any other single expenditure for the average Canadian family: expenditures on shelter increased by 2,006%, food by 901%, and clothing by 478% from 1961 to 2023.

- The 2,705% increase in the tax bill has also greatly outpaced the increase in the Consumer Price Index (901%), which measures the average price that consumers pay for food, shelter, clothing, transportation, health and personal care, education, and other items.

- The average Canadian family now spends more of its income on taxes (43.0%) than it does on basic necessities such as food, shelter, and clothing combined (35.6%). By comparison, 33.5% of the average family’s income went to pay taxes in 1961 while 56.5% went to basic necessities.

- In 2023, the average Canadian family earned an income of $109,235 and paid total taxes equaling $46,988 (43.0%). In 1961, the average family had an income of $5,000 and paid a total tax bill of $1,675 (33.5%).

Authors:

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

New report warns WHO health rules erode Canada’s democracy and Charter rights

The Justice Centre for Constitutional Freedoms has released a new report titled Canada’s Surrender of Sovereignty: New WHO health regulations undermine Canadian democracy and Charter freedoms. Authored by Nigel Hannaford, a veteran journalist and researcher, the report warns that Canada’s acceptance of the World Health Organization’s (WHO) revised International Health Regulations (IHR) represents a serious erosion of national independence and democratic accountability.

The IHR amendments, which took effect on September 19, 2025, authorize the WHO Director-General to declare global “health emergencies” that could require Canada to follow directives from bureaucrats in Geneva, bypassing the House of Commons and the will of Canadian voters.

The WHO regards these regulations as “binding,” despite having no ability or legal authority to impose such regulations. Even so, Canada is opting to accept the regulations as binding.

By accepting the WHO’s revised IHR, the report explains, Canada has relinquished its own control over future health crises and instead has agreed to let the WHO determine when a “pandemic emergency” exists and what Canada must do to respond to it, after which Canada must report back to the WHO.

In fact, under these International Health Regulations, the WHO could demand countries like Canada impose stringent freedom-violating health policies, such as lockdowns, vaccine mandates, or travel restrictions without debate, evidence review, or public accountability, the report explains.

Once the WHO declares a “Pandemic Emergency,” member states are obligated to implement such emergency measures “without delay” for a minimum of three months.

Importantly, following these WHO directives would undermine government accountability as politicians may hide behind international “commitments” to justify their actions as “simply following international rules,” the report warns.

Canada should instead withdraw from the revised IHR, following the example of countries like Germany, Austria, Italy, Czech Republic, and the United States. The report recommends continued international cooperation without surrendering control over domestic health policies.

Constitutional lawyer Allison Pejovic said, “[b]y treating WHO edicts as binding, the federal government has effectively placed Canadian sovereignty on loan to an unelected international body.”

“Such directives, if enforced, would likely violate Canadians’ Charter rights and freedoms,” she added.

Mr. Hannaford agreed, saying, “Canada’s health policies must be made in Canada. No free and democratic nation should outsource its emergency powers to unelected bureaucrats in Geneva.”

The Justice Centre urges Canadians to contact their Members of Parliament and demand they support withdrawing from the revised IHR to restore Canadian sovereignty and reject blind compliance with WHO directives.

-

Alberta2 days ago

Alberta2 days agoDanielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

-

International2 days ago

International2 days agoTOTAL AND COMPLETE BLOCKADE: Trump cuts off Venezuela’s oil lifeline

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

Daily Caller13 hours ago

Daily Caller13 hours ago‘Almost Sounds Made Up’: Jeffrey Epstein Was Bill Clinton Plus-One At Moroccan King’s Wedding, Per Report

-

COVID-192 days ago

COVID-192 days agoSenator Demands Docs After ‘Blockbuster’ FDA Memo Links Child Deaths To COVID Vaccine

-

Business1 day ago

Business1 day agoCanada Hits the Brakes on Population

-

COVID-192 days ago

COVID-192 days agoChina Retaliates Against Missouri With $50 Billion Lawsuit In Escalating Covid Battle

-

International2 days ago

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right