Alberta

The Alberta energy transition you haven’t heard about

From the Canadian Energy Centre

Horizontal drilling technology and more investment in oil production have fundamentally changed the industry

There’s extensive discussion today about energy transition and transformation. Its primary focus is a transition from fossil fuels to lower-carbon energy sources.

But in Alberta, a fundamental but different energy transition has already taken place, and its ripple effects stretch into businesses and communities across the province.

The shift has affected the full spectrum of oil and gas activity: where production happens, how it’s done, who does it and what type of energy is produced.

Oil and gas development in Alberta today largely happens in different places and uses different technologies than 20 years ago. As a result, the companies that support activity and the communities where operations happen have had to change.

Regional Shift

For the first decade of this century, in terms of numbers of wells, most drilling activity happened in central and southeast Alberta, with companies primarily using vertical wells to target conventional shallow natural gas deposits.

In 2005, producers drilled more than 8,000 natural gas wells in these areas, according to Alberta Energy Regulator (AER) records.

But then, three things happened. The price of natural gas declined, the price of oil went up and new horizontal drilling technology unlocked vast energy resources that were previously uneconomic to produce.

By 2015, the amount of natural gas wells companies drilled in central and southeast Alberta was just 256. In 2023, the number dropped to only 50. Over approximately 20 years, activity dropped by 99 per cent.

Where did the investment capital go? The oil sands and heavy oil reserves of Alberta’s northeast and shale plays, including the Montney and Duvernay, in the province’s foothills and northwest.

Nearly 60 per cent of activity outside of the oil-rich northeast occurred in central and southeast Alberta in 2005. By 2023, overall oil and gas drilling in those regions had dropped by 30 per cent, while at the same time increasing by 159 per cent in the foothills and northwest.

“The migration of activity from central and southern Alberta to other regions of the province has been significant,” says David Yager, a longtime oil and gas service company executive who now works as a special advisor to Alberta Premier Danielle Smith.

“For decades there were vibrant oil service communities in places like Medicine Hat, Taber, Brooks, Drumheller and Red Deer,” he says.

“These [oil service communities] have contracted materially with the new service centres growing in places like Lloydminster, Bonnyville, Rocky Mountain House, Edson, Whitecourt, Fox Creek and Grande Prairie.”

Fewer Wells and Fewer Rigs

Extended-reach horizontal drilling compared to shallow, vertical drilling enables more oil and gas production from fewer wells.

Outside the oil sands, in 2005, producers in Alberta drilled 17,300 wells. In 2023, that dropped to just 3,700 wells, according to AER data.

Despite that massive nearly 80 per cent decrease in wells drilled, total production of oil, natural gas and natural gas liquids outside of the oil sands is essentially the same today as it was in 2005.

Last year, non-oil sands production was 3.1 million barrels of oil equivalent (boe) per day, compared to 3.4 million boe per day in 2005–but from about 13,600 fewer new wells.

Innovation from drilling and energy services companies has been a major factor in achieving these impressive results, says Mark Scholz, CEO of the Canadian Association of Energy Contractors. But there’s been a downside.

Yager notes that much of the drilling and service equipment employed on conventional oil and gas development is not suited for unconventional resource exploitation.

Scholz says the productivity improvements resulted in an oversupply of rigs, especially rigs with limited depth ratings and limited capability for “pad” drilling, where multiple wells are drilled the same area on the surface.

Rigs have been required to drill significantly deeper wellbores than in the traditional shallow gas market, he says.

“This has resulted in rig decommissioning or relocations and a tactical effort to upgrade engines, mud pumps, walking systems and pipe-handling technology to meet evolving customer demands,” he says.

“You need not go beyond the reductions in Canada’s drilling rig fleet to understand the impact of these operational innovations. Twenty years ago, there were 950 drilling rigs; today, we have 350, a 65 per cent reduction. [And] further contractions are likely in the near term.”

Scholz says, “collaboration and partnerships between producers and contractors were necessary to make this transition successful, but the rig fleet has evolved into a much deeper, technologically advanced fleet.”

A Higher Cost of Entry

Yager says that along with growth in the oil sands, replacing thousands of new vertical shallow gas wells with fewer, high-volume extended-reach horizontal wells has made it more challenging for smaller companies to participate.

“The barriers to entry in terms of capital required have changed tremendously. At one time a new shallow gas well could be drilled and put on stream for $150,000. Today’s wells in unconventional plays cost from $3 million to $8 million each,” he says.

“This has materially changed the exploration and production companies developing the resource, and the type of oilfield services equipment employed. An industry that was once dominated by multiple smaller players is increasingly consolidating into fewer, larger entities. This has unintended consequences that are not well understood by the public.”

More Oil (Sands), Less Gas

Higher oil prices and horizontal drilling helped change Alberta from a natural gas hotbed to a global oil powerhouse.

In the oil sands, horizontal wells enabled a key technology called steam assisted gravity drainage (SAGD), which went into commercial service in 2001 to allow for a massive expansion of what is referred to as in situ oil sands production.

In 2005, mining dominated oil sands production, at about 625,000 barrels per day compared to 440,000 barrels per day from in situ projects. In situ oil sands production exceeded mining for the first time in 2013, at 1.1 million barrels per day compared to 975,000 barrels per day from mining.

Today the oil sands production split is nearly half and half. Last year, in situ projects–primarily SAGD–produced approximately 1.8 million barrels per day, compared to about 1.7 million barrels per day from mining.

Natural gas used to exceed oil production in Alberta. In 2005, natural gas provided 54 per cent of the province’s total oil and gas supply. Nearly two decades later, oil accounts for 60 per cent compared to 29 per cent from natural gas. The remaining approximately 11 per cent of production is natural gas liquids like propane, butane and ethane.

Alberta’s non-renewable resource revenue reflects the shift in activity to more oil sands and less natural gas.

In 2005, Alberta received $8.4 billion in natural gas royalties and $950 million from the oil sands. In 2023, the oil sands led by a wide margin, providing $16.9 billion in royalties compared to $3.6 billion from natural gas.

Innovation and Emerging Resources

As Alberta’s oil and gas industry continues to evolve, another shift is happening as investments increase into emissions reduction technologies like carbon capture and storage (CCS) and emerging resources.

Since 2015, CCS projects in Alberta have safely stored more than 14 million tonnes of CO2 that would have otherwise been emitted to the atmosphere. And more CCS capacity is being developed.

Construction is underway on an $8.9-billion new net-zero plant producing polyethylene, the world’s most widely used plastic, that will capture and store CO2 emissions using the Alberta Carbon Trunk Line hub. Two additional CCS projects got the green light to proceed this summer.

Meanwhile, in 2023, producers spent $700 million on emerging resources including hydrogen, geothermal energy, helium and lithium. That’s more than double the $230 million invested in 2020, the first year the AER collected the data.

“Energy service contractors are on the frontlines of Canada’s energy evolution, helping develop new subsurface commodities such as lithium, heat from geothermal and helium,” Scholz says.

“The next level of innovation will be on the emission reduction front, and we see breakthroughs in electrification, batteries, bi-fuel engines and fuel-switching,” he says.

“The same level of collaboration between service providers and operators that we saw in our productivity improvement is required to achieve similar results with emission reduction technologies.”

Alberta

Alberta bill would protect freedom of expression for doctors, nurses, other professionals

From LifeSiteNews

‘Peterson’s law,’ named for Canadian psychologist Jordan Peterson, was introduced by Alberta Premier Danielle Smith.

Alberta’s Conservative government introduced a new law that will set “clear expectations” for professional regulatory bodies to respect freedom of speech on social media and online for doctors, nurses, engineers, and other professionals.

The new law, named “Peterson’s law” after Canadian psychologist Jordan Peterson, who was canceled by his regulatory body, was introduced Thursday by Alberta Premier Danielle Smith.

“Professionals should never fear losing their license or career because of a social media post, an interview, or a personal opinion expressed on their own time,” Smith said in a press release sent to media and LifeSiteNews.

“Alberta’s government is restoring fairness and neutrality so regulators focus on competence and ethics, not policing beliefs. Every Albertan has the right to speak freely without ideological enforcement or intimidation, and this legislation makes that protection real.”

The law, known as Bill 13, the Regulated Professions Neutrality Act, will “set clear expectations for professional regulatory bodies to ensure professionals’ right to free expression is protected.”

According to the government, the new law will “Limit professional regulatory bodies from disciplining professionals for expressive off-duty conduct, except in specific circumstances such as threats of physical violence or a criminal conviction.”

It will also restrict mandatory training “unrelated to competence or ethics, such as diversity, equity, and inclusion training.”

Bill 13, once it becomes law, which is all but guaranteed as Smith’s United Conservative Party (UCP) holds a majority, will also “create principles of neutrality that prohibit professional regulatory bodies from assigning value, blame or different treatment to individuals based on personally held views or political beliefs.”

As reported by LifeSiteNews, Peterson has been embattled with the College of Psychologists of Ontario (CPO) after it mandated he undergo social media “training” to keep his license following posts he made on X, formerly Twitter, criticizing Trudeau and LGBT activists.

He recently noted how the CPO offered him a deal to “be bought,” in which the legal fees owed to them after losing his court challenge could be waived but only if he agreed to quit his job as a psychologist.

Early this year, LifeSiteNews reported that the CPO had selected Peterson’s “re-education coach” for having publicly opposed the LGBT agenda.

The Alberta government directly referenced Peterson’s (who is from Alberta originally) plight with the CPO, noting “the disciplinary proceedings against Dr. Jordan Peterson by the College of Psychologists of Ontario, demonstrate how regulatory bodies can extend their reach into personal expression rather than professional competence.”

“Similar cases involving nurses, engineers and other professionals revealed a growing pattern: individuals facing investigations, penalties or compulsory ideological training for off-duty expressive conduct. These incidents became a catalyst, confirming the need for clear legislative boundaries that protect free expression while preserving professional standards.”

Alberta Minister of Justice and Attorney General Mickey Amery said regarding Bill 13 that the new law makes that protection of professionals “real and holds professional regulatory bodies to a clear standard.”

Last year, Peterson formally announced his departure from Canada in favor of moving to the United States, saying his birth nation has become a “totalitarian hell hole.”

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

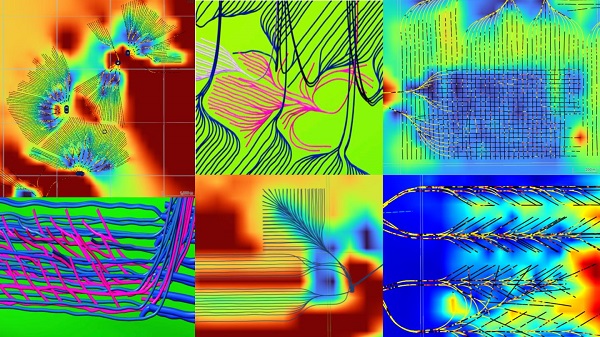

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

Energy2 days ago

Energy2 days agoExpanding Canadian energy production could help lower global emissions

-

Business2 days ago

Business2 days agoWill the Port of Churchill ever cease to be a dream?

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy protestor Evan Blackman convicted at retrial even after original trial judge deemed him a “peacemaker”

-

Daily Caller1 day ago

Daily Caller1 day agoTrump Gives Zelenskyy Until Thanksgiving To Agree On Peace Deal, With U.S. Weapons And Intel On The Line

-

Daily Caller1 day ago

Daily Caller1 day agoBari Weiss Reportedly Planning To Blow Up Legacy Media Giant

-

Business19 hours ago

Business19 hours agoI Was Hired To Root Out Bias At NIH. The Nation’s Health Research Agency Is Still Sick

-

Business2 days ago

Business2 days agoThe numbers Canada uses to set policy don’t add up

-

Business2 days ago

Business2 days agoNew airline compensation rules could threaten regional travel and push up ticket prices