Energy

The 2015 Paris agreement outdated by AI advancement

From Resource Works

Evolving economy is running circles around green ambitions

In 2015 world leaders met in Paris to set the course for climate action and agreed to limit global warming to well below 2°C above pre-industrial levels. Those targets relied heavily on getting to 100% renewable energy, electrifying transport and reducing fossil fuels. But one big factor was left out of those plans: the rapid growth of artificial intelligence (AI) and the massive energy it’s consuming. Now as AI is becoming a pillar of the global economy, climate goals remain stagnant, and we need to ask the big questions about how we reconcile progress with responsibility.

AI’s rapid growth, especially since the introduction of generative AI tools like ChatGPT and MidJourney, has upended industries and created unprecedented demand for computer power. Training and running advanced AI models requires vast amounts of energy, mostly to power the data centers where the computations are done. These facilities use as much electricity as a medium sized city and are straining local grids and making it harder to decarbonize the power system.

The scale of this demand was not factored in when nations were setting their climate strategies in 2015. While many plans accounted for electrification of transport and heating, AI was still an emerging idea. Today the data center industry, driven by AI, cloud computing and internet usage, accounts for about 3% of global electricity consumption and that’s expected to rise sharply as AI adoption grows.

The energy challenges of AI are particularly acute in British Columbia, Canada where a clean electricity grid was once the foundation of the province’s climate strategy. BC Hydro, the publicly owned utility, generates most of its electricity from hydro. But recent data shows BC Hydro can’t meet domestic demand without importing electricity from neighboring regions including Alberta and the US where fossil fuels dominate the energy mix.

In the last fiscal year BC imported over 13,600 gigawatt-hours of electricity – more than double the annual output of the controversial Site C dam, a $16 billion hydro project currently under construction. Importing electricity undermines the province’s green credentials and raises questions about how it will meet future demand as data centers grow to support AI.

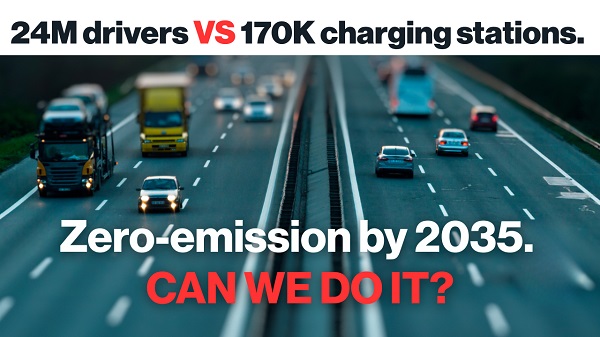

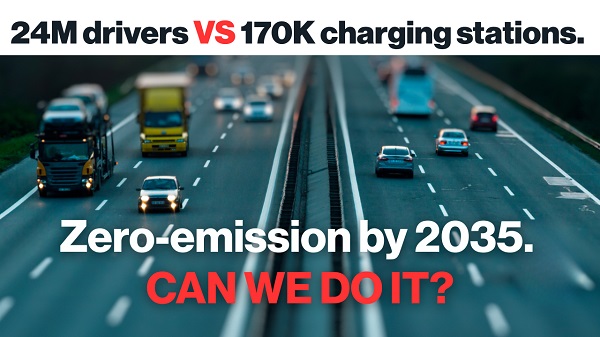

Climate goals initially focused on reducing emissions from transport and industrial processes are now being challenged by the energy demands of AI. For example, policies promoting electric vehicles (EVs) assumed electricity demand would grow incrementally but AI is upending those calculations. Data centers designed to power AI workloads require massive energy densities and continuous operation and are adding stress to grids already dealing with EVs and renewable energy integration.

Globally nations are facing similar dilemmas. In the US data centers are driving demand for new natural gas plants even as the federal government is committing to decarbonize the grid by 2035. Meanwhile countries like Ireland and the Netherlands have temporarily halted approvals for new data center connections to protect grid stability and meet emissions reduction targets. These tensions are highlighting the growing challenge of balancing climate goals with the demands of a digital economy which now has the added pressure of AI.

AI and its energy demands have added a new layer of complexity for climate policymakers. Some say the solution is to accelerate the transition to renewable energy and invest in advanced technologies like small modular reactors (SMRs) and energy storage. Others say it’s about improving data center efficiency through liquid cooling and more efficient chips.

But these solutions take time and capital and may not be enough to keep up with the rapid growth of AI driven energy demand. Policymakers will have to make tough choices: should resources be directed towards building more renewable capacity to support AI or should data center growth be limited? And how can we make sure AI’s benefits outweigh its costs?

The AI revolution has blown apart assumptions about energy demand and emissions reduction pathways and we need to face the reality of our existing climate strategies. As British Columbia is trying to balance the promise of AI with a sustainable future the time to act has never been more pressing. A net zero world will require not only innovation but also a willingness to confront the trade-offs that come with plugging in these transformative technologies to our planet.

Energy

China undermining American energy independence, report says

From The Center Square

By

The Chinese Communist Party is exploiting the left’s green energy movement to hurt American energy independence, according to a new report from State Armor.

Michael Lucci, founder and CEO of State Armor, says the report shows how Energy Foundation China funds green energy initiatives that make America more reliant on China, especially on technology with known vulnerabilities.

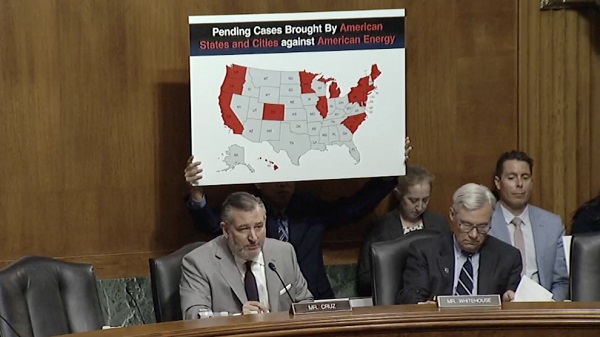

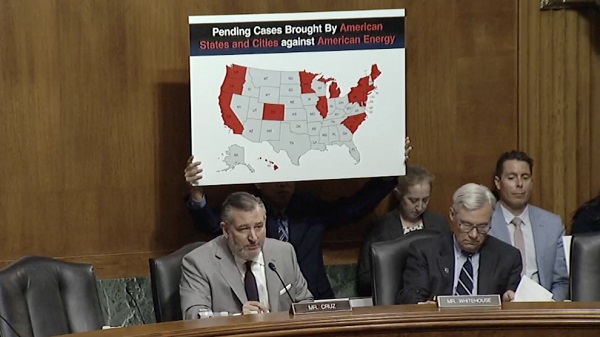

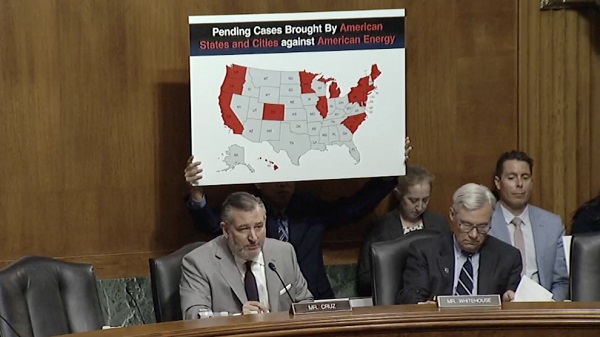

“Our report exposes how Energy Foundation China functions not as an independent nonprofit, but as a vehicle advancing the strategic interests of the Chinese Communist Party by funding U.S. green energy initiatives to shift American supply chains toward Beijing and undermine our energy security,” Lucci said in a statement before the Senate Judiciary Subcommittee’s hearing on Wednesday titled “Enter the Dragon – China and the Left’s Lawfare Against American Energy Dominance.”

Lucci said the group’s operations represent a textbook example of Chinese influence in America.

“This is a very good example of how the Chinese Communist Party operates influence operations within the United States. I would actually describe it as a perfect case study from their perspective,” he told The Center Square in a phone interview. “They’re using American money to leverage American policy changes that make the American energy grid dependent upon China.”

Lucci said one of the most concerning findings is that China-backed technology entering the U.S. power grid includes components with “undisclosed back doors” – posing a direct threat to the power grid.

“These are not actually green tech technologies. They’re red technologies,” he said. “We are finding – and this is open-source news reporting – they have undisclosed back doors in them. They’re described in a Reuters article as rogue communication devices… another way to describe that is kill switches.”

Lucci said China exploits American political divisions on energy policy to insert these technologies under the guise of environmental progress.

“Yes, and it’s very crafty,” he said. “We are not addressing the fact that these green technologies are red. Technologies controlled by the Communist Party of China should be out of the question.”

Although Lucci sees a future for carbon-free energy sources in the United States – particularly nuclear and solar energy – he doesn’t think the country should use technology from a foreign adversary to do it.

“It cannot be Chinese solar inverters that are reported in Reuters six weeks ago as having undisclosed back doors,” he said. “It cannot be Chinese batteries going into the grid … that allow them to sabotage our grid.”

Lucci said energy is a national security issue, and the United States is in a far better position to achieve energy independence than China.

“We are luckily endowed with energy independence if we choose to have it. China is not endowed with that luxury,” he said. “They’re poor in natural resources. We’re very well endowed – one of the best – with natural resources for energy production.”

He said that’s why China continues to build coal plants – and some of that coal comes from Australia – while pushing the United States to use solar energy.

“It’s very foolish of us to just make ourselves dependent on their technologies that we don’t need, and which are coming with embedded back doors that give them actual control over our energy grid,” he said.

Lucci says lawmakers at both the state and federal levels need to respond to this threat quickly.

“The executive branch should look at whether Energy Foundation China is operating as an unregistered foreign agent,” he said. “State attorneys general should be looking at these back doors that are going into our power grid – undisclosed back doors. That’s consumer fraud. That’s a deceptive trade practice.”

Energy

Carney’s Bill C-5 will likely make things worse—not better

From the Fraser Institute

By Niels Veldhuis and Jason Clemens

The Carney government’s signature legislation in its first post-election session of Parliament—Bill C-5, known as the Building Canada Act—recently passed the Senate for final approval, and is now law. It gives the government unprecedented powers and will likely make Canada even less attractive to investment than it is now, making a bad situation even worse.

Over the past 10 years, Canada has increasingly become known as a country that is un-investable, where it’s nearly impossible to get large and important projects, from pipelines to mines, approved. Even simple single-site redevelopment projects can take a decade to receive rezoning approval. It’s one of the primary reasons why Canada has experienced a mass exodus of investment capital, some $387 billion from 2015 to 2023. And from 2014 to 2023, the latest year of comparable data, investment per worker (excluding residential construction and adjusted for inflation) dropped by 19.3 per cent, from $20,310 to $16,386 (in 2017 dollars).

In theory, Bill C-5 will help speed up the approval process for projects deemed to be in the “national interest.” But the cabinet (and in practical terms, the prime minister) will determine the “national interest,” not the private sector. The bill also allows the cabinet to override existing laws, regulations and guidelines to facilitate investment and the building of projects such as pipelines, mines and power transmission lines. At a time when Canada is known for not being able to get large projects done, many are applauding this new approach, and indeed the bill passed with the support of the Opposition Conservatives.

But basically, it will allow the cabinet to go around nearly every existing hurdle impeding or preventing large project developments, and the list of hurdles is extensive: Bill C-69 (which governs the approval process for large infrastructure projects including pipelines), Bill C-48 (which effectively bans oil tankers off the west coast), the federal cap on greenhouse gas emissions for only the oil and gas sector (which effectively means a cap or even reductions in production), a quasi carbon tax on fuel (called the Clean Fuels Standard), and so on.

Bill C-5 will not change any of these problematic laws and regulations. It simply will allow the cabinet to choose when and where they’re applied. This is cronyism at its worst and opens up the Carney government to significant risks of favouritism and even corruption.

Consider firms interested in pursuing large projects. If the bill becomes the law of the land, there won’t be a new, better and more transparent process to follow that improves the general economic environment for all entrepreneurs and businesses. Instead, there will be a cabinet (i.e. politicians) with new extraordinary powers that firms can lobby to convince that their project is in the “national interest.”

Indeed, according to some reports, some senators are referring to Bill C-5 as the “trust me” law, meaning that because there aren’t enough details and guardrails within the legislation, senators who vote in favour are effectively “trusting” Prime Minister Carney and his cabinet to do the right thing, effectively and consistently over time.

Consider the ambiguity in the legislation and how it empowers discretionary decisions by the cabinet. According to the legislation, cabinet “may consider any factor” it “considers relevant, including the extent to which the project can… strengthen Canada’s autonomy, resilience and security” or “provide economic benefits to Canada” or “advance the interests of Indigenous peoples” or “contribute to clean growth and to meeting Canada’s objectives with respect to climate change.”

With this type of “criteria,” nearly anything cabinet or the prime minister can dream up could be deemed in the “national interest” and therefore provide the prime minister with unprecedented and near unilateral powers.

In the preamble to the legislation, the government said it wants an accelerated approval process, which “enhances regulatory certainty and investor confidence.” In all likelihood, Bill C-5 will do the opposite. It will put more power in the hands of a very few in government, lead to cronyism, risks outright corruption, and make Canada even less attractive to investment.

-

Automotive1 day ago

Automotive1 day agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Alberta6 hours ago

Alberta6 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Business1 day ago

Business1 day agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Business8 hours ago

Business8 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoFDA Exposed: Hundreds of Drugs Approved without Proof They Work

-

Crime8 hours ago

Crime8 hours agoSuspected ambush leaves two firefighters dead in Idaho

-

Energy1 day ago

Energy1 day agoChina undermining American energy independence, report says