Energy

The 2015 Paris agreement outdated by AI advancement

From Resource Works

Evolving economy is running circles around green ambitions

In 2015 world leaders met in Paris to set the course for climate action and agreed to limit global warming to well below 2°C above pre-industrial levels. Those targets relied heavily on getting to 100% renewable energy, electrifying transport and reducing fossil fuels. But one big factor was left out of those plans: the rapid growth of artificial intelligence (AI) and the massive energy it’s consuming. Now as AI is becoming a pillar of the global economy, climate goals remain stagnant, and we need to ask the big questions about how we reconcile progress with responsibility.

AI’s rapid growth, especially since the introduction of generative AI tools like ChatGPT and MidJourney, has upended industries and created unprecedented demand for computer power. Training and running advanced AI models requires vast amounts of energy, mostly to power the data centers where the computations are done. These facilities use as much electricity as a medium sized city and are straining local grids and making it harder to decarbonize the power system.

The scale of this demand was not factored in when nations were setting their climate strategies in 2015. While many plans accounted for electrification of transport and heating, AI was still an emerging idea. Today the data center industry, driven by AI, cloud computing and internet usage, accounts for about 3% of global electricity consumption and that’s expected to rise sharply as AI adoption grows.

The energy challenges of AI are particularly acute in British Columbia, Canada where a clean electricity grid was once the foundation of the province’s climate strategy. BC Hydro, the publicly owned utility, generates most of its electricity from hydro. But recent data shows BC Hydro can’t meet domestic demand without importing electricity from neighboring regions including Alberta and the US where fossil fuels dominate the energy mix.

In the last fiscal year BC imported over 13,600 gigawatt-hours of electricity – more than double the annual output of the controversial Site C dam, a $16 billion hydro project currently under construction. Importing electricity undermines the province’s green credentials and raises questions about how it will meet future demand as data centers grow to support AI.

Climate goals initially focused on reducing emissions from transport and industrial processes are now being challenged by the energy demands of AI. For example, policies promoting electric vehicles (EVs) assumed electricity demand would grow incrementally but AI is upending those calculations. Data centers designed to power AI workloads require massive energy densities and continuous operation and are adding stress to grids already dealing with EVs and renewable energy integration.

Globally nations are facing similar dilemmas. In the US data centers are driving demand for new natural gas plants even as the federal government is committing to decarbonize the grid by 2035. Meanwhile countries like Ireland and the Netherlands have temporarily halted approvals for new data center connections to protect grid stability and meet emissions reduction targets. These tensions are highlighting the growing challenge of balancing climate goals with the demands of a digital economy which now has the added pressure of AI.

AI and its energy demands have added a new layer of complexity for climate policymakers. Some say the solution is to accelerate the transition to renewable energy and invest in advanced technologies like small modular reactors (SMRs) and energy storage. Others say it’s about improving data center efficiency through liquid cooling and more efficient chips.

But these solutions take time and capital and may not be enough to keep up with the rapid growth of AI driven energy demand. Policymakers will have to make tough choices: should resources be directed towards building more renewable capacity to support AI or should data center growth be limited? And how can we make sure AI’s benefits outweigh its costs?

The AI revolution has blown apart assumptions about energy demand and emissions reduction pathways and we need to face the reality of our existing climate strategies. As British Columbia is trying to balance the promise of AI with a sustainable future the time to act has never been more pressing. A net zero world will require not only innovation but also a willingness to confront the trade-offs that come with plugging in these transformative technologies to our planet.

Energy

The global math: Why exporting Canadian energy is a climate win

From Resource Works

New report finds that displacing coal and foreign gas with Canadian LNG could lower global emissions by 70 megatonnes a year

Canada’s energy policy debate has become trapped in a polarization that feels dangerously disconnected from global reality.

On one side, we have a domestic conversation focused intensely on our own emissions ledger—counting every tonne produced within our borders as a liability. On the other side is the global reality: a world hungry for energy, often turning to the dirtiest sources available to keep the lights on and economies growing.

I’ve long argued that we cannot solve a global problem like climate change by wearing blinders that restrict our view to the 49th parallel. Recently, on the Power Struggle podcast, I sat down with Mark Cameron to discuss the hard data that backs this up.

Cameron is a fellow at the Public Policy Forum and the co-author of a new report Refuel: What Canadian LNG and Oil Exports Could Mean for Global Emissions. The numbers tell a story that might surprise those who view energy exports solely as a climate negative.

Flipping the script on emissions

The central finding of the Refuel report challenges the orthodoxy that “more production equals more pollution.” When we look at the global picture, the opposite appears to be true.

“The headline news is that if Canada was to increase its LNG exports by [47 million tonnes a year] and if we are exporting primarily into Asian markets, there would be a net reduction in emissions of about 40 to 70 megatonnes per year,” Cameron told me.

Let that sink in. By increasing our economic output and shipping more product abroad, we could lower global emissions by an amount roughly equivalent to taking millions of cars off the road.

It comes down to displacement. The energy we export doesn’t vanish into a void; it replaces other, often dirtier, forms of power generation.

“In some of those markets, you’re displacing coal,” Cameron explained. “Coal obviously is about twice the emissions in generating electricity as LNG. So to the extent that you’re displacing coal, you’re getting a clear emissions reduction.”

The Canadian advantage

This isn’t just about the inherent chemistry of gas versus coal. It is also about the specific quality of the gas produced in Western Canada. Not all liquefied natural gas (LNG) is created equal.

Canada’s geography and technology provide a distinct edge over competitors regarding carbon intensity.

“Canadian LNG, because it has cooler temperatures, shorter shipping times to Asia, more electric drive in its production, is actually about 35 per cent lower in emissions than LNG that would be shipped from, say, the U.S. Gulf Coast,” Cameron said.

When we debate blocking a Canadian project, we act as if the alternative is zero consumption. But the alternative is often gas from the Gulf Coast—which requires more energy to cool in the hot southern climate and takes longer to ship—or worse, coal.

Asian markets know this. They are looking for reliability and lower carbon intensity.

“We want to have a certain percentage of LNG, and we want a certain percentage of that coming from Canada because it’s a stable market and it has a particularly low emissions intensity,” Cameron noted.

The reality of substitution

This brings us to the concept of “carbon leakage.” It is a harsh economic reality that if Canada steps out of the market, we don’t save the planet—we simply cede market share to those with lower environmental standards.

“If the LNG is not coming from Canada, it’s going to come from somewhere else,” Cameron said bluntly. “It’s going to come from the U.S. or Qatar or Australia, or it would be displaced by coal or another energy source. So when you look at all those things in balance, it does look like Canadian LNG is a net positive for the climate.”

Progress in the oilsands

While LNG often dominates the “transition fuel” conversation, the report also addresses the oilsands. The narrative there has often ignored massive strides in efficiency.

“That emissions intensity is coming down. It’s come down by about 30 per cent in the last 20 years,” Cameron said.

He pointed to operational fuel switching as a key driver of this progress.

“Canadian oilsands was using petroleum coke, essentially coal, to generate the steam for the oilsands production. That is almost entirely shifted to natural gas.”

The long game

Finally, we must address the timeline. Critics argue that building LNG infrastructure locks us into fossil fuels. But the transition is a decades-long process.

“There is going to be LNG demand,” Cameron said. “We don’t know exactly how much, but there’s going to be LNG demand for the next four or five, six decades.”

Furthermore, natural gas is a fundamental building block of modern civilization, used for fertilizer and chemical production, not just electricity.

“If we can produce the cleanest LNG in the world, we’re actually doing global climate a favour by building those projects,” Cameron added.

If we retreat from the world stage, we aren’t taking the moral high ground; we are merely outsourcing the emissions to countries with a heavier carbon footprint. A Canada that exports more is a Canada that contributes to a cleaner world.

Watch the video on Power Struggle

- Power Struggle audio and transcript

- Mark Cameron on LinkedIn

- Stewart Muir on X

- Stewart Muir on LinkedIn

Power Struggle on social media:

Energy

Trump’s Venezuela Move: A $17 Trillion Reset of Global Geopolitics and a Pivotal Shift in US Energy Strategy

From Energy Now

The Roosevelt Corollary to the Monroe Doctrine:

“Chronic wrongdoing, or an impotence which results in a general loosening of the ties of civilized society, may in America, as elsewhere, ultimately require intervention by some civilized nation, and in the Western Hemisphere the adherence of the United States to the Monroe Doctrine may force the United States, however reluctantly, in flagrant cases of such wrongdoing or impotence, to the exercise of an international police power.” – 24th U.S. President Theodore Roosevelt’s corollary to the Monroe Doctrine, delivered during his State of the Union Address, December 6, 1904.

The Trump Corollary to the Monroe Doctrine:

“After years of neglect, the United States will reassert and enforce the Monroe Doctrine to restore American preeminence in the Western Hemisphere, and to protect our homeland and our access to key geographies throughout the region. We will deny non-Hemispheric competitors the ability to position forces or other threatening capabilities, or to own or control strategically vital assets, in our Hemisphere.” – Passage contained in the Trump Administration’s 2025 National Security Strategy published November, 2025.

Prologue

In late November, the Trump White House issued a new national security strategy which it says is designed to “reassert and enforce the Monroe Doctrine to restore American preeminence in the Western Hemisphere.” The authors call it the “Trump Corollary” to President James Monroe’s 1823 policy that declared the Western Hemisphere a distinct U.S. sphere of influence.

Under Trump’s corollary, the president maintains he can authorize the Pentagon to engage in “non-international armed conflict” with terrorists. Given that the State Department had earlier designated Venezuela-based Cartel del Soles (Cartel of the Suns) and its affiliated cartel network as international terrorist organizations, and America’s longstanding policy that Nicolas Maduro stole his 2020 re-election and was not the legitimate leader of the country, this corollary frees the U.S. President to take action against him and his regime without seeking prior approval from congress.

It is key to note here that the second sentence of Trump’s new Corollary can logically be applied to both China and Russia and their key strategic investments across Central and South America, including Chinese-controlled port operations at either end of the Panama Canal, in Cuba, and its many other infrastructure investments throughout Central and South America. If President Trump intends to continue applying his new Corollary over his three remaining years in office, he will enjoy a target rich environment.

Trump Applies Both Corollaries to Nicolas Maduro

In the wee hours of January 3, 2025, Trump applied both the Roosevelt Corollary and the Trump Corollary to Nicolas Maduro. Maduro and his wife, Cilia Flores, were taken into custody by U.S. special forces and transported by the military to New York City, where they will face numerous charges related to indictments issued by a federal grand jury in 2020.

During his press conference Saturday morning in which Trump and his key officials detailed the operation to capture Maduro and seize control of the Venezuelan power structure, the President made clear that his administration will set the rules for the re-invigoration of Venezuela’s oil sector. The U.S. hasn’t exactly seized control of petroleum assets worth trillions, but it plans to set the rules of capture, production, refining, and export, and there is every reason to assume those rules will inure to America’s benefit.

Here’s a clip of some of what the President said:

Transcript:

As everyone knows, the oil business in Venezuela has been a bust, a total bust, for a long period of time. They were pumping almost nothing by comparison to what they could have been pumping and what could have taken place. We’re going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars. Fix the badly broken infrastructure, the oil infrastructure, and start making money for the country. And we are ready to stage a second and much larger attack if we need to do so. So we were prepared to do a second wave if we needed to do. We actually assumed that a second wave would be necessary, but now it’s probably not.

[End]

President Trump’s statement that the United States has effectively gained control over Venezuela’s vast crude oil reserves and plans to control the process under which they will be developed and brought to market resets the global energy equation. The President’s further statement that his administration will work hand in glove with, specifically, America’s largest oil companies to restart and rebuild Venezuela’s oil sector no doubt sends shockwaves through corporate C-suites of the world’s biggest corporate drillers.

Which companies stand to benefit from this application of the Trump Corollary? Well, Chevron for one. The Houston-based giant has managed to retain its foothold in the country despite the expropriations of oil company assets executed by both Maduro and former president Hugo Chavez over the last 25 years.

Before Chavez invoked his seizing of assets policies, both ExxonMobil and ConocoPhillips were also big producers in the country. Presumably, Trump’s intention is to also bring those two giants into the rebuilding process.

Keep in mind here that other major companies not based in the United States were also major producers of Venezuelan crude. Those include British-based Shell and BP, as well as French major TotalEnergies and Norway’s Equinor.

It is unclear as of this writing whether those non-U.S. companies will be invited into the new program. But we can be sure that they will attempt to aggressively leverage their ways into the program using whatever means available to them, given the magnitude of the potential prize.

The geopolitical implications are enormous:

- Venezuela sits atop an estimated 303 billion barrels of proven reserves, the largest in the world.

- At current prices hovering around $57 per barrel, that’s a staggering $17.3 trillion in potential gross value.

- Even if extracted and sold at half that rate to account for production challenges, we’re talking about $8.7 trillion – more than the GDP of every nation on Earth except the U.S. and China.

Make no mistake: This move, executed in a swift 12-hour operation, marks a pivotal shift in U.S. energy strategy. For years, Venezuela’s oil wealth has been squandered under the socialist regimes led by Chavez and Maduro, whose mismanagement turned the once-prosperous OPEC founder into an economic basket case. Hyperinflation, corruption, and international sanctions crippled production, dropping output from almost 4 million barrels per day in the late 1990s to about 1 million bpd today. Now, with Maduro ousted, Trump plans to swing the door back open for American firms to revitalize this treasure trove.

This is a geopolitical coup: If properly managed, it could result in a tectonic realignment of global resource flows.

This injection of major new assets into the support structure for the petrodollar system – which had been struggling over the past 3 years to retain its dominance over international trade – combined with the second reminder of America’s unrivaled military might in the past 8 months, re-establishes the United States as the dominant global power. The reassertion of U.S. authority and willingness to enforce the Monroe Doctrine places hundreds of billions of dollars in investments and years of geopolitical maneuvering by both Russia and China at full risk.

Back to oil: Again, if it’s all properly managed – and history tells us it is a very big “if” – this is a move which greatly enhances U.S. leverage over global oil pricing mechanisms for years to come.

From a practical standpoint, unlocking Venezuela’s potential won’t be instantaneous. The Orinoco Belt, home to much of these heavy crude reserves, requires advanced extraction technologies like steam injection and diluents for transport – technologies and processes in which U.S. companies like Chevron and ExxonMobil excel. Past joint ventures under Maduro were hampered by expropriation risks and crumbling infrastructure, but a pro-U.S. interim government could fast-track investments.

The Venezuelan oil sector will be looking at billions in capital inflows, creating jobs in refining, pipelines, and shipping. Still, even with all that new investment flowing in, it can be safely assumed that we are looking at lead times of 5 to 7 years before the sector can be fully restored.

While we know Trump’s plan will be fraught with pitfalls and opposition from a wide variety of interests, the administration and companies likely to become involved do have a nearby success story to use as a model. That model sits right next door in the highly successful development of offshore oil blocks owned by neighboring country Guyana, operated by ExxonMobil.

As it happens, Chevron successfully acquired a 30% interest in the Guyana project last year as part of its buyout of Texas independent Hess Corp. Perhaps an even more interesting aspect of that development is that CNOOC – the Chinese National Offshore Oil Company – is a 25% owner in that Consortium.

Given ExxonMobil’s highly successful and cooperative working relations with the Guyanese government through multiple presidential administrations and Chevron’s uninterrupted operations in Venezuela, no companies are better positioned to help lead the rebuilding effort.

The move to revive Venezuelan oil production also greatly enhances Trump’s leverage in trade negotiations with Canada and its Prime Minister, Mark Carney.

Frustrated with Trump’s tariffs on his oil exports into the U.S., Carney has been working with Albertan Premiere Danielle Smith on a deal to build a massive new pipeline to reroute oil sands crude to the West Coast for shipment to Asian markets. Carney believed he had leverage over Trump in this equation, given that most U.S. Gulf Coast refineries are geared to process the heavy Canadian crude. Now, armed with control over Venezuela’s heavy crude riches, the leverage reverses in Trump’s favor.

Checkmate.

Globally, the ripple effects are profound.

- OPEC+ dynamics shift dramatically; with Venezuela’s output potentially ramping to 2-3 million barrels daily within the next 5-7 years, quota negotiations become a U.S.-influenced affair.

- Russia and Iran, already strained by sanctions, lose further bargaining power.

- Europe, grappling with energy security in what will hopefully soon become a post-Ukraine era, stands to gain a stable Western supplier, but only if its leaders at the EU decide to work more productively and cooperatively with the U.S. government than they have done in recent months.

- China, Venezuela’s top creditor with $60 billion in loans tied to oil shipments, will be forced to recalibrate and decide how best to respond to what it has already denounced as unjustified U.S. aggression.

Critics will decry this as neo-imperialism, echoing Russia’s actions in Ukraine. To which Trump will most likely respond with his best imitation of Ayn Rand’s mythical Atlas shrugging.

It’s important to be clear here: Maduro’s regime functioned as a narco-terror state, propped by human trafficking and drug networks that spilled into U.S. borders, killing tens of thousands of U.S. citizens annually.

This intervention fully aligns with the Monroe Doctrine’s modern revival – protecting the Western Hemisphere from malign influences. Russia and China can complain about U.S. infringement on their investments in the region, but they ignored the potential for an American president invoking the Monroe Doctrine at their own peril. Trump’s new Corollary was no secret – the whole world had every opportunity to read it and reflect on its meaning when it was published in November. If Xi and Putin failed to do that, that’s their failing.

Of course, risks abound. Chinese control of supply chains, legal challenges under international law, and environmental pushback from green activists could and no doubt will complicate extraction. Venezuela’s heavy oil is carbon-intensive, clashing with global net-zero goals. Yet, in the Trump-led rising era of energy realism, physics wins over narratives, and pragmatism overrules ideology, as even green-boosting billionaire Bill Gates recently conceded.

Trump’s critics and America’s rivals must also deal with the likelihood that this move taking down the Maduro regime is almost certainly not the end game, but the first move in a longer campaign that will likely extend to other South and Central American nations actively involved in the drug trade and human trafficking. Those include Colombia, Cuba, and Mexico. Other leftwing bosses in the hemisphere, like Brazil’s Lula da Silva – himself elected under highly suspicious circumstances in 2022 – are no doubt feeling mighty nervous about their own status in light of Trump’s willingness to reapply U.S. regional hegemony.

Bottom line: Trump is scrambling the geopolitical chessboard. Throughout the 20th century and across the first quarter of the 21st, control of oil reserves has always served as the single most important factor in the exercise of geopolitical leverage. With this move into Venezuela, no country controls more massive reserves of oil than the United States does today.

That is All

-

Environment13 hours ago

Environment13 hours agoLeft-wing terrorists sabotage German power plant, causing massive power outage

-

International6 hours ago

International6 hours agoPoilievre, Carney show support for Maduro capture as NDP’s interim leader denounces it

-

Opinion2 days ago

Opinion2 days agoHell freezes over, CTV’s fabrication of fake news and our 2026 forecast is still searching for sunshine

-

Daily Caller12 hours ago

Daily Caller12 hours agoMinnesota Governor resigns from re-election campaign as massive government frauds revealed

-

COVID-192 days ago

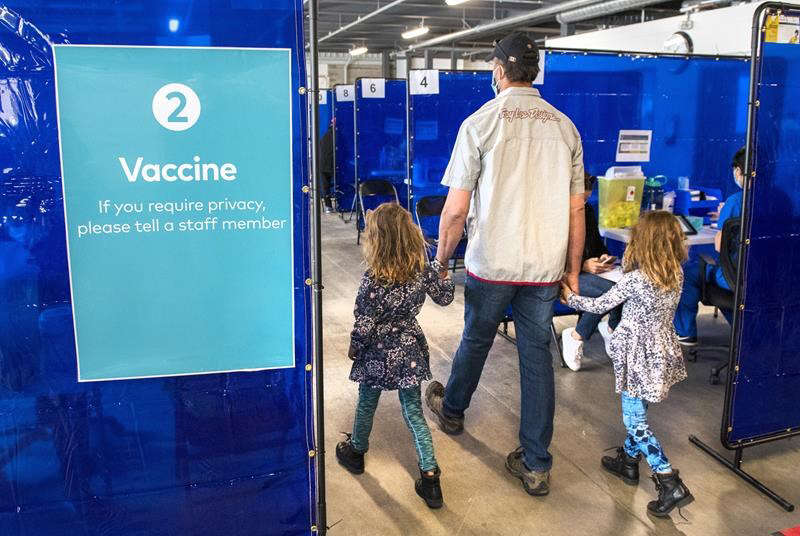

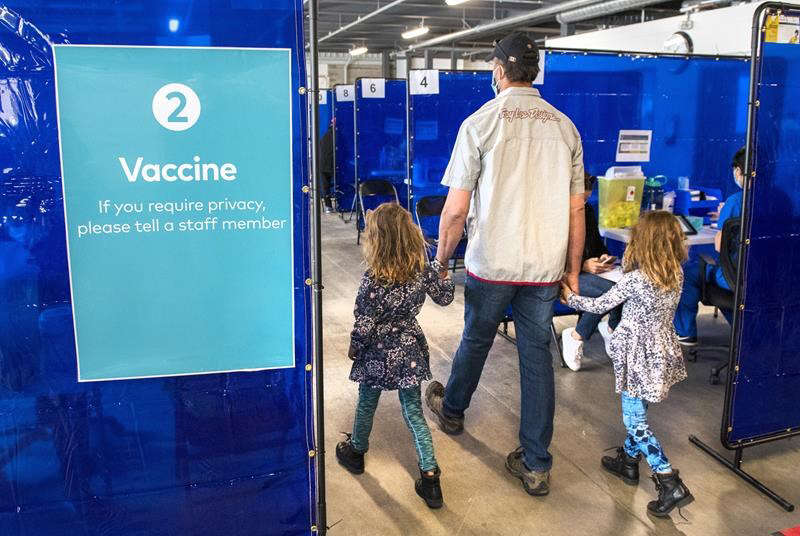

COVID-192 days agoA new study proves, yet again, that the mRNA Covid jabs should NEVER have been approved for young people.

-

Energy13 hours ago

Energy13 hours agoTrump’s Venezuela Move: A $17 Trillion Reset of Global Geopolitics and a Pivotal Shift in US Energy Strategy

-

International12 hours ago

International12 hours agoMaduro, wife plead not guilty in first court appearance

-

Frontier Centre for Public Policy16 hours ago

Frontier Centre for Public Policy16 hours agoIs Canada still worth the sacrifice for immigrants?