ESG

Tennessee Taking Lead In Protecting Civil Rights And Free Enterprise—And Stopping Political Debanking

Tennessee Gov. Bill Lee

From the Daily Caller News Foundation

By ERIC BLEDSOE

Last week, Tennessee Gov. Bill Lee (R.) signed into law a first-of-its-kind ban on politicized debanking. Sponsored by Rep. Jason Zachary (R.) and Senate Majority Leader Jack Johnson (R.), HB 2100 will prohibit the nation’s largest banks from discriminating against individuals, businesses, and non-profits for their political and religious views.

The new law is a landmark reform to stop large banks from imposing political litmus tests on Americans.

This legislation (HB 2100) is, of course, a reaction to the trend of the largest financial institutions creating partisan barriers to Americans’ access to financial services. Last year, Bank of America closed the deposit and credit card accounts of Memphis-based non-profit Indigenous Advance Ministries. The organization works with Ugandan widows and orphans to provide for their basic needs through Christian charity. Bank of America refused to give Indigenous Advance a reason why they closed the accounts—just that they no longer wanted to work with their “business type.”

Indigenous Advance’s experience is like what the National Committee for Religious Freedom (NCRF) faced when JPMorgan Chase closed their accounts. NCRF promotes religious liberty for Americans of all religious faiths. Chase said it would restore NCRF’s accounts if it disclosed a list of its donors, told the bank which political candidates it intended to support, and sent them the criteria NCRF uses to decide who they want to support politically. NCRF, out of respect for their donors’ right to privacy, declined.

John Eastman, past attorney for former President Donald Trump, was debanked twice at the end of last year by Bank of America and USAA. Again, the banks provided little to no explanation for the sudden closures. Eastman told the Daily Caller that the banks said it was their policy to not provide any further information. Banks stonewalling their customers on why they close their accounts is alarmingly becoming a pattern.

In December 2022, Wells Fargo abruptly closed the personal and business accounts of Brandon Wexler, a Florida-based gun dealer. The bank’s only explanation was a brief mention that it was due to their review of account risk. Wexler had a personal account with Wells Fargo for 25 years and a business account for 14 years. One instance of an account closing might not be worthy of attention, but more and more examples like these are becoming more common. And the only common thread, besides banks refusing to explain their actions, is that the targets of debanking hold political and religious views unpopular on Wall Street and Pennsylvania Avenue. This does not appear to be a policy at one bank, but an unspoken policy across the industry. Commenting on Wells Fargo’s action against him, Wexler said, “I’ve been with them for 25 years,” […] “I’m a professional fireman. I do everything the right way. It’s messed up.”

But large banks debanking individuals and non-profits is not the full extent of politically motivated financial service providers’ discrimination. In September, Tennessee Attorney General Jonathan Skrmetti sent a letter sent a letter to financial service providers who are signatories to the Net Zero Financial Service Providers Alliance (NZFSPA) warning them that their environmental, social, and governance (ESG) strategies may be in violation of antitrust and consumer protection laws. Both state and federal laws prohibit coordinated or collaborative efforts between corporations to restrict trade or commerce. All members of NZFSPA agree to “(a)lign all relevant services and products to achieve net zero greenhouse gas emissions by 2050 or sooner, scaling and mainstreaming Paris Agreement-alignment into the core of our business.” Though the 27 members of NZFSPA are supposed competitors in the financial services market, their joint commitment to restrict sectors of the economy like fossil fuel is clearly a coordinated effort.

Large financial institutions’ boycott of fossil fuel and discriminatory actions against individuals and non-profits for their religious or political views may seem disconnected at first. But those following the ESG movement won’t be surprised to see these politically motivated efforts across multiple sectors. Last month, Montana Attorney General Austin Knudsen sounded the alarm over these radical policies to Wells Fargo CEO Charles Scharf with the support of 15 other state attorneys general. A member of the Net Zero Banking Alliance (NZBA), Wells Fargo has committed, alongside 143 other banks, to implement ESG policies. In the letter, the attorneys general noted that Wells Fargo has a record of debanking Republican candidates and the firearms industry, imposing race- and gender-based quotas on credit customers, and publicly committing to implement radical climate standards on the energy industry.

Leftist activists realize they cannot accomplish such a radical agenda of eroding individual rights and a free economy through the ballot box. ESG is a political tool that enables the far left to bypass the democratic process to will their worldview onto Americans’ lives. In response, policymakers and other stakeholders must strengthen and enforce civil liberties protections, consumer rights, and antitrust laws, so that political activists cease willing their agenda on citizens.

Fortunately, states like Tennessee are taking the lead in protecting civil rights and free enterprise.

Eric Bledsoe is a Senior Policy Fellow at the Foundation for Government Accountability.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

Banks

Canada Pension Plan becomes latest institution to drop carbon ‘net zero’ target

From LifeSiteNews

Changes to the law require companies to more rigorously prove their environmental claims.

The investment group in charge of Canada’s governmental pension plan has ditched its “net zero” mandate, joining a growing list of major institutions doing the same.

According to the Canada Pension Plan (CPP) Investments’ latest annual report, the entity is no longer committed to carbon “net-zero” by 2050. The CPP’s ditching of the target comes after a number of major institutions, including the Royal Bank of Canada (RBC), Toronto-Dominion Bank (TD), Bank of Montreal (BMO), National Bank of Canada, and the Canadian Imperial Bank of Commerce (CIBC), all made similar moves in recent months.

While ditching the net-zero effort, chief executive of CPP Investments John Graham maintained that it is still “really important to incorporate climate and incorporate sustainability” in its long-term investment portfolio.

The dropping of the “climate” target comes as recent changes to Canada’s Competition Act now mandate that companies prove any environmental claims they make, with Graham insinuating these changes were a factor in the decision.

“Recent legal developments in Canada have introduced, kind of, new considerations around how net-zero commitments are interpreted, so that’s caused us to change a little bit how we talk about it, but nothing’s changed on what we’re actually doing.”

Over the past decade, left-wing activists have used “net zero” and “environmental, social & governance” (ESG) standards to encourage major Canadian and U.S. corporations to take particular stands on political and cultural issues, notably in promotion of homosexuality, transgenderism, race relations, the environment, and abortion.

Outside of Canada, many major corporations have announced they are walking back DEI and other related policies. Some of the most notable include Lowe’s, Jack Daniel’s, and Harley Davidson. Other companies such as Disney, Target, and Bud Light have faced negative sales due to consumers fighting back and refusing to patronize the businesses.

Since taking power in 2015, the Liberal government, first under Justin Trudeau and now under Mark Carney, has continued to push a radical environmental agenda in line with those promoted by the World Economic Forum’s “Great Reset” and the United Nations’ “Sustainable Development Goals.” Part of this push includes the promotion of so called net-zero energy by as early as 2035.

Business

The net zero industry is collapsing worldwide. Hopefully it will be abandoned for good

From LifeSiteNews

Perhaps the fundamental failure of Net Zero was political. Permission was never sought from taxpayers who would pay the costs and suffer the consequences of an always ill-fated enterprise.

The grand vision of “Net Zero” initiatives – by which emissions of carbon dioxide magically balance with expensive and futile capture and storage systems – have long been sold as the redemption arc for humanity’s profligate modern ways. Yet, like a poorly scripted dystopian thriller, the holes in this plot are glaring.

Net Zero was always a fragile concept. It rested on shaky and illogical assumptions: that wind turbines, solar panels and “green” hydrogen could reliably replace fossil fuels, that governments could redesign economies without unintended consequences, that voters would accept higher costs for daily necessities, and that developing countries would sacrifice growth for climate targets they had no hand in creating.

None of those fantasies held. Countries did not decarbonize nearly at the speed promised, even though climate bureaucracies clung to the illusion. Long-range targets, five-year reviews, and international pledges lacked common sense and defied physical and economic realities. The result? An unaccountable machine pushing impractical policies that most people never voted for and are now beginning to reject.

If Net Zero were a serious endeavor, its architects would confront the undeniable: China and India are more than delaying their decarbonization timelines – they’re burying them. Why has this been ignored?

China and India – responsible for more than 40% of global CO2 emissions in the last two decades – are accelerating fossil fuel use, not phasing it out. In Southeast Asia, coal, oil and natural gas continue to dominate. Vietnam, Indonesia and the Philippines are building new electric generating power plants using those fuels. These countries understand that economic growth comes first.

Africa, too, is pushing back. Leaders in Nigeria, Ghana, and Senegal have criticized Western attempts to block fossil fuel financing. African nations are investing in exploitation of oil and gas reserves.

If Asia represents the global rejection of Net Zero, Germany and the U.K. are poster children of the West’s self-inflicted wounds. Both nations, once hailed as Net Zero pioneers, are grappling with the harsh realities of their green ambitions. The transition to “renewables” has been plagued by economic pain, energy insecurity, and political backlash, exposing the folly of policies divorced from facts. When the war in Ukraine cut off energy supplies, Germany panicked. Suddenly, coal plants were back online. The Green Dream died a quiet death.

READ: Top Canadian bank ditches UN-backed ‘net zero’ climate goals it helped create

Trump funding cuts likely will accelerate the fall of Net Zero’s house of cards. The president’s decisions to slash financing for international and domestic green programs has severed the lifeline for global climate initiatives, including the United Nations Environment Program. Trump also vowed to redirect billions from the Inflation Reduction Act – Biden’s misnomered climate law – toward fossil fuel infrastructure.

The retreat of Net Zero interrupts the flow of trillions of dollars into an agenda with questionable motives and false promises. Climate finance had developed the fever of a gold rush. Banks, asset managers, and consulting firms hurried to brand themselves as “green.” ESG (Environmental, Social, Governance) investing promised to reward “climate-friendly” firms and punish alleged polluters.

The fallout was massive market distortions. Companies shifted resources to meet ESG checklists at the expense of fiduciary obligations. Now the tide is turning. The Net Zero Banking Alliance comprising top firms globally has been abandoned by America’s leading institutions. Similarly, a Net Zero investors alliance collapsed after BlackRock’s exit.

Perhaps the fundamental failure of Net Zero was political. Permission was never sought from taxpayers and consumers who would pay the costs and suffer the consequences of an always ill-fated enterprise. Climate goals were set behind closed doors. Policies were imposed from above. Higher utility bills, job losses and diminished economic opportunity became the burdens of ordinary families. All while elites flew private jets to international summits and lectured about the need to sacrifice.

A certain lesson in the slow passing of Net Zero is this: Energy policy must serve people, not ideology. That truth was always obvious and remains so.

Yet, some political leaders, legacy media and industry “yes-men” continue to blather on about a “green” utopia. How long the delusion persists remains to be seen.

Vijay Jayaraj is a Science and Research Associate at the CO2 Coalition, Fairfax, Virginia. He holds an M.S. in environmental sciences from the University of East Anglia and a postgraduate degree in energy management from Robert Gordon University, both in the U.K., and a bachelor’s in engineering from Anna University, India.

Reprinted with permission from American Thinker.

-

Alberta1 day ago

Alberta1 day agoAlberta health care blockbuster: Province eliminating AHS Health Zones in favour of local decision-making!

-

Crime2 days ago

Crime2 days agoUK finally admits clear evidence linking Pakistanis and child grooming gangs

-

conflict1 day ago

conflict1 day agoTrump: ‘We’ have control over Iranian airspace; know where Khomeini is hiding

-

Alberta16 hours ago

Alberta16 hours agoAlberta pro-life group says health officials admit many babies are left to die after failed abortions

-

Alberta15 hours ago

Alberta15 hours agoCentral Alberta MP resigns to give Conservative leader Pierre Poilievre a chance to regain a seat in Parliament

-

Business2 days ago

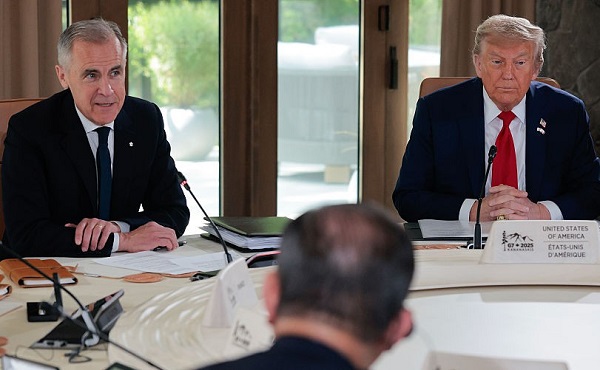

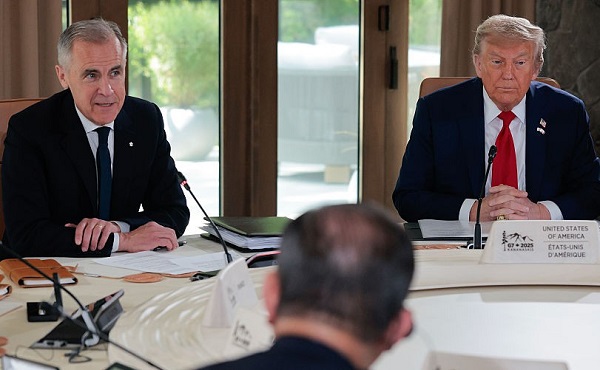

Business2 days agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Daily Caller16 hours ago

Daily Caller16 hours ago‘Not Held Hostage Anymore’: Economist Explains How America Benefits If Trump Gets Oil And Gas Expansion

-

Business2 days ago

Business2 days agoTrump family announces Trump Mobile: Made in America, for America