Business

Taxpocalypse 2025: Trudeau Rings in the New Year with Higher Taxes and Empty Wallets

Taxpayer Federation’s report reveals how Trudeau’s government is using new taxes to crush the middle class, fund wasteful projects, and expand a bloated bureaucracy while Canadians struggle

When the clock strikes midnight, it won’t just be the start of 2025—it’ll mark the beginning of Taxpocalypse 2025, a year where Justin Trudeau’s government will hit the middle class harder than ever before.

The Canadian Taxpayers Federation has released a report that lays bare the financial storm Canadians are about to endure. It’s not just inflation draining your wallet; it’s an avalanche of new taxes designed to fund Trudeau’s bloated government and its endless corruption. Let’s go through the numbers, because you deserve to know what’s really happening.

First, payroll taxes are going up. If you earn $81,200 or more, you’ll be paying $403 more in Canada Pension Plan and Employment Insurance contributions this year. Your employer will also fork out nearly $6,000 per employee. Small businesses—already struggling with inflation and high costs—are being crushed under this weight. This isn’t job creation; it’s job destruction.

Then there’s the carbon tax. Starting tomorrow, it jumps from $80 per tonne to $95, adding 20.9¢ per litre to the cost of gasoline. Filling up a 70-litre tank will now cost you almost $15 in carbon taxes alone. If you heat your home with natural gas, get ready to pay an additional $415 this year. Trudeau claims this is about fighting climate change, but in reality, it’s just another excuse to fill government coffers.

And if you thought inflation was bad, bracket creep makes it worse. As your income grows slightly due to inflation, you’re pushed into higher tax brackets without actually having more buying power. So, you’ll pay more in income tax on money that doesn’t go as far as it did last year. Meanwhile, the wealthy use loopholes to avoid taxes, and the poor get targeted rebates. Once again, it’s the middle class holding the bag.

Don’t believe me about how bad things have gotten under Trudeau? Let’s talk inflation—specifically food inflation. Here are the year-over-year increases:

- 2021: 4.0% (September)

- 2022: 11.0% (October)

- 2023: 8.3% (June)

- 2024: 2.7% (October)

Now, let’s compound that year over year. Since 2021, food prices have soared 28.37%. Think about that—almost a third of your grocery budget wiped out. A dollar that used to buy a loaf of bread now barely buys three-quarters of one. And this year, Trudeau’s new taxes will take even more out of your wallet.

But while you’re paying more for less, Trudeau has been busy inflating something else: the federal public service. Since he took office in 2015, he has added 108,793 new public servants to the federal payroll—a 42% increase in the size of the federal public service. And for what? Are hospitals better staffed? Are services more efficient? Absolutely not. Wait times for healthcare are worse than ever. Infrastructure projects are endlessly delayed.

I’m an independent Canadian journalist exposing corruption, delivering unfiltered truths and untold stories. Join me on Substack for fearless reporting that goes beyond headlines

If you ask me, Trudeau bloated the public sector to artificially keep unemployment numbers down. Let’s be clear: it’s the private sector that provides for the public sector, not the other way around. Every new bureaucrat added to the payroll is funded by taxes from hardworking Canadians—people like you—who are already struggling to make ends meet.

So, under Trudeau, you’re paying more for groceries, more in taxes, and getting less in return. This isn’t governance; it’s theft. But here’s the real insult: all of this money is going to fund Trudeau’s swamp of waste and corruption. Take the ArriveCAN app, a disaster that cost $54 million—for what? A glorified QR code. Contracts were handed out to insiders, many of whom didn’t even do any work.

Then there’s the Green Slush Fund, which has wasted nearly $400 million on pet projects rife with conflicts of interest. Liberal insiders funneled taxpayer money into their own businesses, and Trudeau’s government just shrugged.

The alcohol escalator tax is going up too, adding 2% more to the already sky-high taxes on beer, wine, and spirits. And don’t forget the digital services tax, a 3% levy on platforms like Amazon and Netflix. Experts say most of this cost will be passed directly to consumers.

Final Thoughts

This is Justin Trudeau’s Canada: a nation where the poor are shielded, the rich find their loopholes, and the middle class—the backbone of this country—is bled dry. Payroll taxes, carbon taxes, alcohol taxes, income taxes—it’s all part of an elaborate scheme to fund the bloated vanity projects and corruption of a government that no longer even pretends to care about the people footing the bill.

And while Canadians are working longer hours to afford less, struggling to put food on their tables, start families, or even dream of owning a home, Trudeau jet-sets around the world like royalty. Whether it’s sipping top-shelf wine at a global summit or skiing the pristine slopes of Red Mountain, this guy lives like a king while the rest of you pick up the tab.

It’s no wonder Canadians are booing him in public—it’s not only justified, it’s well deserved. He’s earned every jeer, every shout of frustration, because his leadership has failed this country at every turn. Under Trudeau, affordability has become a joke, and hard work no longer guarantees success.

But here’s the best part, Justin: there’s an election this year. Canadians finally get the chance to tell you exactly what they think of your disastrous leadership. They’ll send your Liberal ship straight into the iceberg, where it belongs.

So, go ahead, call the election. Take the globalist agenda you’ve been so proud to champion, pack it up with your carbon-tax hypocrisy, and prepare for your next gig as a keynote speaker for the World Economic Forum. You’ve proven you’re great at reading from a script that someone else writes—just not at running a country.

Enjoy your top sirloin tonight, Justin. Canadians? They’ll be eating Kraft Dinner while watching your government fall apart. Happy New Year. And Canada, don’t forget: Taxpocalypse 2025 starts tomorrow. Let’s make it the year we take our country back.

Invite your friends and earn rewards

Business

RFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

From LifeSiteNews

By Matt Lamb

They got rid of all the older children essentially and just had younger children who were too young to be diagnosed and they stratified that, stratified the data

The Centers for Disease Control and Prevention (CDC) found newborn babies who received the Hepatitis B vaccine had 1,135-percent higher autism rates than those who did not or received it later in life, Robert F. Kennedy Jr. told Tucker Carlson recently. However, the CDC practiced “trickery” in its studies on autism so as not to implicate vaccines, Kennedy said.

RFK Jr., who is the current Secretary of Health and Human Services, said the CDC buried the results by manipulating the data. Kennedy has pledged to find the causes of autism, with a particular focus on the role vaccines may play in the rise in rates in the past decades.

The Hepatitis B shot is required by nearly every state in the U.S. for children to attend school, day care, or both. The CDC recommends the jab for all babies at birth, regardless of whether their mother has Hep B, which is easily diagnosable and commonly spread through sexual activity, piercings, and tattoos.

“They kept the study secret and then they manipulated it through five different iterations to try to bury the link and we know how they did it – they got rid of all the older children essentially and just had younger children who were too young to be diagnosed and they stratified that, stratified the data,” Kennedy told Carlson for an episode of the commentator’s podcast. “And they did a lot of other tricks and all of those studies were the subject of those kind of that kind of trickery.”

But now, Kennedy said, the CDC will be conducting real and honest scientific research that follows the highest standards of evidence.

“We’re going to do real science,” Kennedy said. “We’re going to make the databases public for the first time.”

He said the CDC will be compiling records from variety of sources to allow researchers to do better studies on vaccines.

“We’re going to make this data available for independent scientists so everybody can look at it,” the HHS secretary said.

— Matt Lamb (@MattLamb22) July 1, 2025

Health and Human Services also said it has put out grant requests for scientists who want to study the issue further.

Kennedy reiterated that by September there will be some initial insights and further information will come within the next six months.

Carlson asked if the answers would “differ from status quo kind of thinking.”

“I think they will,” Kennedy said. He continued on to say that people “need to stop trusting the experts.”

“We were told at the beginning of COVID ‘don’t look at any data yourself, don’t do any investigation yourself, just trust the experts,”‘ he said.

In a democracy, Kennedy said, we have the “obligation” to “do our own research.”

“That’s the way it should be done,” Kennedy said.

He also reiterated that HHS will return to “gold standard science” and publish the results so everyone can review them.

Business

Elon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party

From LifeSiteNews

By Robert Jones

The Tesla CEO warned that Trump’s $5 trillion plan erases DOGE’s cost-cutting gains, while threatening to unseat lawmakers who vote for it.

Elon Musk has reignited his feud with President Donald Trump by denouncing his “Big Beautiful Bill” in a string of social media posts, warning that it would add $5 trillion to the national debt.

“I’m sorry, but I just can’t stand it anymore. This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination. Shame on those who voted for it: you know you did wrong. You know it,” Musk exclaimed in an X post last month.

I’m sorry, but I just can’t stand it anymore.

This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination.

Shame on those who voted for it: you know you did wrong. You know it.

— Elon Musk (@elonmusk) June 3, 2025

Musk renewed his criticism Monday after weeks of public silence, shaming lawmakers who support it while vowing to unseat Republicans who vote for it.

“They’ll lose their primary next year if it is the last thing I do on this Earth,” he posted on X, while adding that they “should hang their heads in shame.”

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

The Tesla and SpaceX CEO also threatened to publish images branding those lawmakers as “liars.”

Trump responded on Truth Social by accusing Musk of hypocrisy. “He may get more subsidy than any human being in history,” the president wrote. “Without subsidies, Elon would probably have to close up shop and head back home to South Africa… BIG MONEY TO BE SAVED!!!”

( @realDonaldTrump – Truth Social Post )

( Donald J. Trump – Jul 01, 2025, 12:44 AM ET )Elon Musk knew, long before he so strongly Endorsed me for President, that I was strongly against the EV Mandate. It is ridiculous, and was always a major part of my campaign. Electric cars… pic.twitter.com/VPadoTBoEt

— Donald J. Trump 🇺🇸 TRUTH POSTS (@TruthTrumpPosts) July 1, 2025

Musk responded by saying that even subsidies to his own companies should be cut.

Before and after the 2024 presidential election, Musk spoke out about government subsidies, including ones for electric vehicles, stating that Tesla would benefit if they were eliminated.

This latest exchange marks a new escalation in the long-running and often unpredictable relationship between the two figures. Musk contributed more than $250 million to Trump’s reelection campaign and was later appointed to lead the Department of Government Efficiency (DOGE), which oversaw the termination of more than 120,000 federal employees.

Musk has argued that Trump’s new bill wipes out DOGE’s savings and reveals a deeper structural problem. “We live in a one-party country – the PORKY PIG PARTY!!” he wrote, arguing that the legislation should be knows as the “DEBT SLAVERY bill” before calling for a new political party “that actually cares about the people.”

It is obvious with the insane spending of this bill, which increases the debt ceiling by a record FIVE TRILLION DOLLARS that we live in a one-party country – the PORKY PIG PARTY!!

Time for a new political party that actually cares about the people.

— Elon Musk (@elonmusk) June 30, 2025

In June, Musk deleted several inflammatory posts about the president, including one claiming that Trump was implicated in the Jeffrey Epstein files. He later acknowledged some of his comments “went too far.” Trump, in response, said the apology was “very nice.”

With the bill still under Senate review, the dispute underscores growing pressure on Trump from fiscal hardliners and tech-aligned conservatives – some of whom helped deliver his return to power. Cracks in the coalition may spell longer term problems for the Make America Great Again movement.

-

Business6 hours ago

Business6 hours agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Alberta1 day ago

Alberta1 day agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime18 hours ago

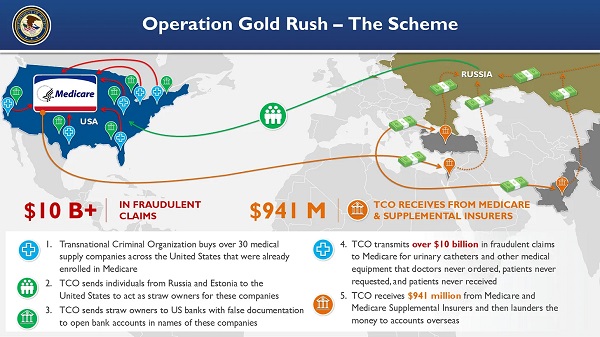

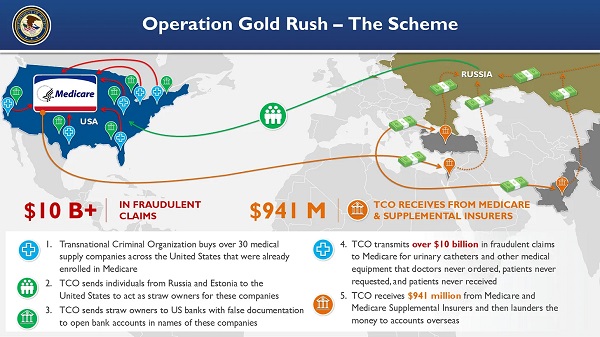

Crime18 hours agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Crime1 day ago

Crime1 day agoSuspected ambush leaves two firefighters dead in Idaho

-

Alberta1 day ago

Alberta1 day agoWhy the West’s separatists could be just as big a threat as Quebec’s

-

Business1 day ago

Business1 day agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Health18 hours ago

Health18 hours agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Business1 day ago

Business1 day agoMassive government child-care plan wreaking havoc across Ontario