Energy

‘Take On The Resistance’: Who Could Trump Tap To Help Cement His ‘Drill, Baby, Drill’ Agenda?

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By NICK POPE

Former President Donald Trump has promised to revitalize and unleash the American energy sector if he returns to the White House in 2025, and has a plethora of former officials and new faces he could tap for key executive branch roles.

The Biden administration has utilized executive agencies like the Environmental Protection Agency (EPA), Department of the Interior (DOI) and the Department of Energy (DOE) to implement many of the key policies driving its sprawling climate agenda. These agencies will be crucial to any effort by a prospective Trump administration to undo President Joe Biden’s energy legacy and execute Trump’s “drill, baby, drill” agenda.

Several insiders with extensive experience in Republican energy politics speculated to the Daily Caller News Foundation as to who Trump could pick to lead that charge if he wins in November.

“I am really impressed by the number of former Trump officials, as well as people who have not served before who are also interested in doing so in the future who have reached out to inquire about my prior experience or the process,” David Bernhardt, who served as the secretary of the interior during the latter half of Trump’s first term, told the DCNF. “If President Trump wins, he’s going to have droves of capable people to choose from to fill his political appointments this time around — a lot of seasoned veterans, and also a lot of people with new, fresh ideas. I think that’s very exciting and bodes well for the president’s second term and for our country.”

When asked how he would bring down the cost of goods such as gas, Trump says, "Drill baby, drill!" pic.twitter.com/cVjqzjeaAJ

— Daily Caller (@DailyCaller) May 11, 2023

However, the Trump campaign told the DCNF that internal discussions about who may fill these roles have not started.

“There have been no such discussions about who will serve in a second Trump Administration,” Karoline Leavitt, the Trump campaign’s national press secretary, told the DCNF. “When the time comes, President Trump will choose the best possible people to implement his America First agenda.”

Whoever Trump selects to lead the EPA will have to confront an agency that has been juiced with thousands of new employees and promulgated numerous major regulations. The Biden administration has used the EPA to advance some of its most aggressive environmental policies, which include a major green power plants regulation, electric vehicle (EV) mandates, stringent fine particulate matter emissions rules and more.

At least some of these rules figure to be on the chopping block if Trump returns to office, as the former president has already pledged to walk back EV regulations.

Andrew Wheeler, who helmed the agency between 2019 and 2021, could be tapped to take the reins again if Trump wins in November, one energy expert, who wishes to not be publicly identified, speculated to the DCNF.

Others who may be under consideration include Mandy Gunasekara, who served variously as EPA chief of staff, principal deputy assistant administrator and senior policy advisor during Trump’s first term.

“I have a beautiful community in Oxford, Mississippi, and it would be very hard to leave. Plus, the idea of going back into a hostile situation away from my children and the ‘Bible girls’ is hard pill to pill to swallow. Ultimately, that’s a bridge I’ll cross if I get there,” Gunasekara told the DCNF. “Andrew Wheeler is a very experienced leader at EPA and would no doubt faithfully execute the President’s agenda again.”

Myron Ebell, a recently-retired energy policy expert formerly at the Competitive Enterprise Institute and a member of the Trump EPA transition team, believes that Gunasekara and Wheeler “would both be great choices,” he told the DCNF.

“I think it’s inappropriate to discuss a position I may be offered,” Wheeler told the DCNF when contacted for this story.

Another name to watch is Anne Vogel, who currently runs the Ohio EPA, according to the energy expert. Prior to taking that role, Vogel worked for the American Electric Power Company, handling federal regulatory matters in Washington, and she also has experience working at a private law firm.

“Director Anne Vogel currently has no intention of leaving her position at Ohio EPA,” a spokesperson for the agency told the DCNF.

Notably, Vogel testified to Congress in March 2023 about the train derailment and subsequent chemical burn-off that marred the skies of East Palestine, Ohio, in February 2023.

“I think that we’re going to need people that are committed to reforming these agencies and advancing the Trump agenda, which is basically unleashing the energy sector, and that includes the coal industry, oil and gas and everything else,” Steve Milloy, a senior legal fellow for the Energy and Environmental Legal Institute and a former member of the Trump EPA transition team, told the DCNF. “They’ve got to be willing to take on the resistance. And in Trump one, people weren’t necessarily willing or prepared to take on the resistance, and there’s going to be a lot of resistance.”

EPA Chief Insists His Agency Has Not Sent ‘One Dime’ To Hardline Left-Wing Org — But There’s A $50 Million Problemhttps://t.co/BXjlAkuWup

— Daily Caller (@DailyCaller) July 11, 2024

‘Full Speed Ahead’

As the agency in charge of managing America’s federally-controlled lands and waters, DOI has a major role to play in the American energy sector given that it leases millions of onshore and offshore acres to oil and gas developers. Under Biden and Interior Secretary Deb Haaland, DOI has taken numerous actions to restrict development on millions of acres of American land and issued a bare-bones leasing schedule for offshore oil and gas extraction in the Gulf of Mexico, for example.

In light of Trump’s calls to “drill, baby, drill,” the DOI’s approach to natural resource management is likely to change dramatically from its current attitude as part of the Biden administration.

Tom Pyle, president of the American Energy Alliance, told the DCNF to keep an eye on Republican Govs. Mike Dunleavy of Alaska and Doug Burgum of North Dakota as possible leaders of DOI under a prospective second Trump presidency. However, Burgum may be in play for other positions, such as secretary of the interior or perhaps a high-level White House role, Pyle told the DCNF.

A representative for Burgum referred the DCNF to the Trump campaign.

Both McKenna and Ebell indicated that Bernhardt could be a good fit to return to the top job at DOI should he and Trump have mutual interest. For his part, Bernhardt declined to comment about whether he wants to get back into the fray or specific roles he would ostensibly have interest in filling during a second Trump term.

Pyle said he does not expect Trump to feel an obligation to stick to the establishment when selecting his political appointees.

“It’s clear with President Trump’s vice presidential pick [J.D. Vance] that he no longer feels compelled to extend an olive branch to the GOP establishment,” Pyle told the DCNF. “It’s Trump’s party now, and he chose someone who he thinks will best help implement his agenda.”

Mike McKenna, a GOP strategist with extensive energy sector experience, agreed that Dunleavy and Burgum could each be the type of person to run the DOI for Trump if called upon to do so.

“I hope they will go full speed ahead on restoring or increasing energy production in the federal estate” regardless of who Trump might pick for the top job if he wins, Ebell told the DCNF. “But I also hope that they will focus and put some effort into improving federal land management.”

Ebell floated former Alaska Republican Lt. Gov. Mead Treadwell as a possibility should he have interest. He also said that Republican Sens. John Barrasso of Wyoming and Mike Lee of Utah would both do well in the position, in his view, but that they may both be too valuable as seasoned legislators to make the jump to the executive branch.

“Senator Barrasso is focused on working for the people of Wyoming and passing President Trump’s agenda in the U.S. Senate,” a Barrasso spokesperson told the DCNF.

SEN. HAWLEY: "Jobs for blue-collar workers in this nation are valuable resources…Why should those things…be sacrificed in favor of your agenda for radical climate change?"

HAALAND: "I know that there's like 1.9 jobs for every American in the country…There's a lot of jobs."… pic.twitter.com/n21gostPdE

— Daily Caller (@DailyCaller) May 2, 2023

‘Dark Horse’

Choosing a successor for Jennifer Granholm to lead the DOE will be another key decision for Trump should he prevail this November.

Among other initiatives, the Biden DOE has pushed regulations promoting energy efficient appliances, a broad building decarbonization agenda and sought to loan huge sums of taxpayer cash to green energy companies since 2021.

McKenna, who is plugged into both the energy industry and GOP politics, flagged several possible candidates to look out for.

Paul Dabbar, who served as the under secretary for science at DOE during Trump’s first term, could be an option, with McKenna pointing to his managerial skills as a strength that could appeal to Trump. Dabbar declined to comment when contacted for this story.

McKenna also identified Burgum as a possible option for DOE, but like Pyle, McKenna believes that Burgum could be called on to take any number of roles, stretching from DOE to the White House or even the Department of Commerce, should he have interest in serving in a possible second Trump administration.

One “dark horse” possibility to watch is Bill Cooper, who currently works for Golden Pass LNG as vice president and general counsel, McKenna said. In addition to his private sector mettle, Cooper has experience at DOE, having served in the agency for about two years in various senior roles during Trump’s first term, making him a possible candidate should he have interest in the gig.

Ebell is not discounting the possibility that Trump may dip into the private sector to find his potential energy secretary.

“I think looking in the private sector makes sense,” Ebell told the DCNF. “It makes a lot of sense if it’s somebody who isn’t part of the subsidy chain, who isn’t part of the corporate welfare world, special interests who get money under the so-called Inflation Reduction Act, or other DOE programs.”

Cooper, Treadwell, Lee’s office and Dunleavy’s office did not respond to requests for comment.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Alberta

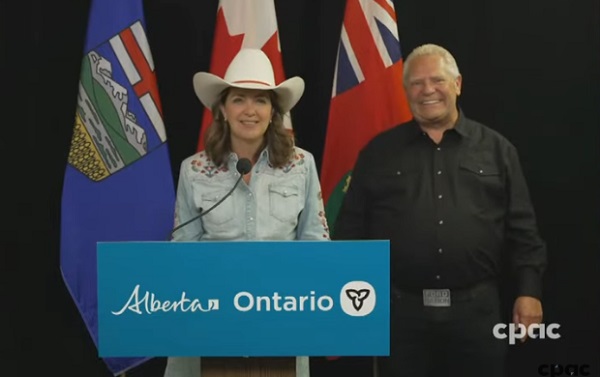

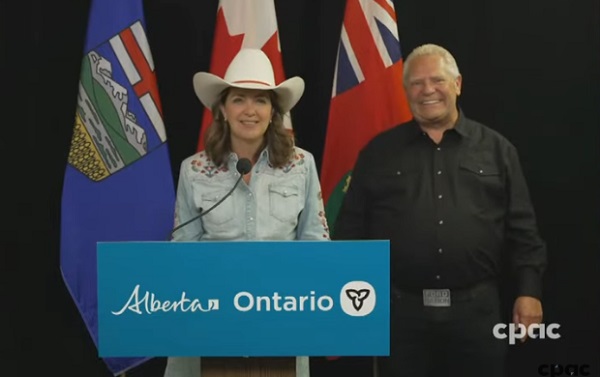

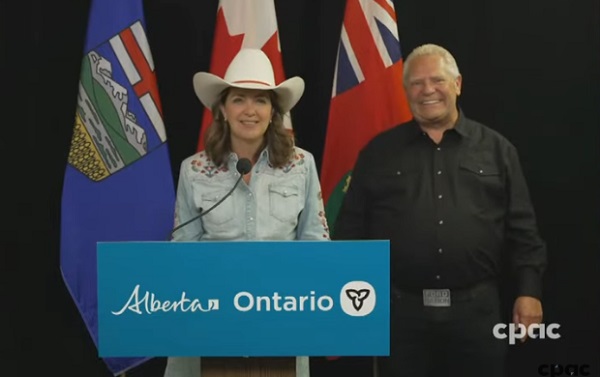

Alberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

Alberta-Ontario MOUs fuel more pipelines and trade

Alberta Premier Danielle Smith and Ontario Premier Doug Ford have signed two memorandums of understanding (MOUs) during Premier Ford’s visit to the Calgary Stampede, outlining their commitment to strengthen interprovincial trade, drive major infrastructure development, and grow Canada’s global competitiveness by building new pipelines, rail lines and other energy and trade infrastructure.

The two provinces agree on the need for the federal government to address the underlying conditions that have harmed the energy industry in Canada. This includes significantly amending or repealing the Impact Assessment Act, as well as repealing the Oil Tanker Moratorium Act, Clean Electricity Regulations, the Oil and Gas Sector Greenhouse Gas Emissions Cap, and all other federal initiatives that discriminately impact the energy sector, as well as sectors such as mining and manufacturing. Taking action will ensure Alberta and Ontario can attract the investment and project partners needed to get shovels in the ground, grow industries and create jobs.

The first MOU focuses on developing strategic trade corridors and energy infrastructure to connect Alberta and Ontario’s oil, gas and critical minerals to global markets. This includes support for new oil and gas pipeline projects, enhanced rail and port infrastructure at sites in James Bay and southern Ontario, as well as end-to-end supply chain development for refining and processing of Alberta’s energy exports. The two provinces will also collaborate on nuclear energy development to help meet growing electricity demands while ensuring reliable and affordable power.

The second MOU outlines Alberta’s commitment to explore prioritizing made-in-Canada vehicle purchases for its government fleet. It also includes a joint commitment to reduce barriers and improve the interprovincial trade of liquor products.

“Alberta and Ontario are joining forces to get shovels in the ground and resources to market. These MOUs are about building pipelines and boosting trade that connects Canadian energy and products to the world, while advocating for the right conditions to get it done. Government must get out of the way, partner with industry and support the projects this country needs to grow. I look forward to working with Premier Doug Ford to unleash the full potential of our economy and build the future that people across Alberta and across the country have been waiting far too long for.”

“In the face of President Trump’s tariffs and ongoing economic uncertainty, Canadians need to work together to build the infrastructure that will diversify our trading partners and end our dependence on the United States. By building pipelines, rail lines and the energy and trade infrastructure that connects our country, we will build a more competitive, more resilient and more self-reliant economy and country. Together, we are building the infrastructure we need to protect Canada, our workers, businesses and communities. Let’s build Canada.”

These agreements build on Alberta and Ontario’s shared commitment to free enterprise, economic growth and nation-building. The provinces will continue engaging with Indigenous partners, industry and other governments to move key projects forward.

“Never before has it been more important for Canada to unite on developing energy infrastructure. Alberta’s oil, natural gas, and know-how will allow Canada to be an energy superpower and that will make all Canadians more prosperous. To do so, we need to continue these important energy infrastructure discussions and have more agreements like this one with Ontario.”

“These MOUs with Ontario build on the work Alberta has already done with Saskatchewan, Manitoba, Northwest Territories and the Port of Prince Rupert. We’re proving that by working together, we can get pipelines built, open new rail and port routes, and break down the barriers that hold back opportunities in Canada.”

“Canada’s economy has an opportunity to become stronger thanks to leadership and steps taken by provincial governments like Alberta and Ontario. Removing interprovincial trade barriers, increasing labour mobility and attracting investment are absolutely crucial to Canada’s future economic prosperity.”

Together, Alberta and Ontario are demonstrating the shared benefits and opportunities that result from collaborative partnerships, and what it takes to keep Canada competitive in a changing world.

Quick facts

- Steering committees with Alberta and Ontario government officials will be struck to facilitate work and cooperation under the agreements.

- Alberta and Ontario will work collaboratively to launch a preliminary joint feasibility study in 2025 to help move private sector led investments in rail, pipeline(s) and port(s) projects forward.

- These latest agreements follow an earlier MOU Premiers Danielle Smith and Doug Ford signed on June 1, 2025, to open up trade between the provinces and advance shared priorities within the Canadian federation.

Related information

-

Alberta10 hours ago

Alberta10 hours agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Immigration

-

Business2 days ago

Business2 days agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

International2 days ago

International2 days agoElon Musk forms America Party after split with Trump

-

Alberta10 hours ago

Alberta10 hours agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

COVID-1914 hours ago

COVID-1914 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Alberta Sports Hall of Fame and Museum1 day ago

Alberta Sports Hall of Fame and Museum1 day agoAlberta Sports Hall of Fame 2025 Inductee Profiles – Para Nordic Skiing – Brian and Robin McKeever

-

Crime11 hours ago

Crime11 hours agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein