Business

Switzerland has nearly 65% more doctors and much shorter wait times than Canada, despite spending roughly same amount on health care

From the Fraser Institute

Switzerland’s universal health-care system delivers significantly better results than Canada’s in terms of wait times, access to health professionals like doctors and nurses, and patient satisfaction finds a new study published by the Fraser Institute, an independent, non-partisan Canadian policy think-tank.

“Despite its massive price tag, Canada’s health-care system lags behind many other countries with universal health care,” said Yanick Labrie, senior fellow at the Fraser Institute and author of Building Responsive and Adaptive Health-Care Systems in Canada: Lessons from Switzerland.

The study highlights how Switzerland’s universal health-care system consistently outperforms Canada on most metrics tracked by the OECD.

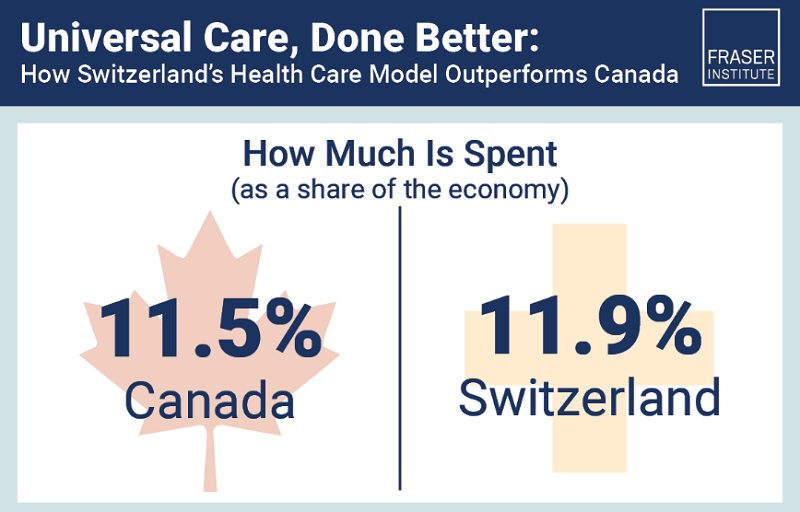

In 2022, the latest year of available data, despite Canada (11.5 per cent of GDP) and Switzerland (11.9 per cent) spending close to the same amount on health care, Switzerland had 4.6 doctors per thousand people compared to 2.8 in Canada. In other words, Switzerland had 64.3 per cent more doctors than Canada (on a per-thousand people basis).

Switzerland also had 4.4 hospital beds per thousand people compared to 2.5 for Canada—Switzerland (8th) outranked Canada (36th) on this metric out of 38 OECD countries with universal health care.

Likewise, 85.3 per cent of Swiss people surveyed by the CWF (Commonwealth Fund) reported being able to obtain a consultation with a specialist within 2 months. By comparison, only 48.3 per cent of Canadians experienced a similar wait time. Beyond medical resources and workforce, patient satisfaction diverges sharply between the two countries, as 94 per cent of Swiss patients report being satisfied with their health-care system compared to just 56 per cent in Canada.

“Switzerland shows that a universal health care system can reconcile efficiency and equity – all while being more accessible and responsive to patients’ needs and preferences,” Labrie said.

“Policymakers in Canada who hope to improve Canada’s broken health-care system should look to more successful universal health-care countries like Switzerland.”

Building Responsive and Adaptive Health Care Systems in Canada: Lessons from Switzerland

- Canada’s health-care system is increasingly unable to meet patient needs, with wait times reaching record lengths—over 30 weeks for planned care in 2024—despite significantly rising public spending and growing dissatisfaction among patients and providers nationwide.

- Swiss health care outperforms Canada in nearly all OECD performance indicators: more doctors and nurses per capita, better access to care, shorter wait times, lower unmet needs, and higher patient satisfaction (94% vs. Canada’s 56%).

- Switzerland ensures universal coverage through 44 competing private, not-for-profit insurers. Citizens are required to enroll but have the freedom to choose insurers and tailor coverage to their needs and preferences, promoting both access and autonomy.

- Swiss basic insurance coverage is broader than Canada’s, including outpatient care, mental health, prescribed medications, home care, and long-term care—with modest, capped cost-sharing, and exemptions for vulnerable groups, including children, low-income individuals, and the chronically ill.

- Patient cost participation (deductibles/co-payments) exists, but the system includes robust financial protection: 27.5% of the population receives direct subsidies, ensuring affordability and equity.

- Risk equalization mechanisms prevent risk selection and guarantee insurer fairness, promoting solidarity across demographic and health groups.

- Decentralized governance enhances responsiveness; cantons manage service planning, ensuring care adapts to local realities and population needs.

- Managed competition drives innovation and efficiency: over 75% of the Swiss now choose alternative models (e.g., HMOs, telemedicine, gatekeeping).

- The Swiss model proves that a universal, pluralistic, and competitive system can reconcile efficiency, equity, access, and patient satisfaction—offering powerful insights for Canada’s stalled health reform agenda.

Automotive

EV fantasy losing charge on taxpayer time

From the Fraser Institute

By Kenneth P. Green

The vision of an all-electric transportation sector, shared by policymakers from various governments in Canada, may be fading fast.

The latest failure to charge is a recent announcement by Honda, which will postpone a $15 billion electric vehicle (EV) project in Ontario for two years, citing market demand—or lack thereof. Adding insult to injury, Honda will move some of its EV production to the United States, partially in response to the Trump Tariff Wars. But any focus on tariffs is misdirection to conceal reality; failures in the electrification agenda have appeared for years, long before Trump’s tariffs.

In 2023, the Quebec government pledged $2.9 billion in financing to secure a deal with Swedish EV manufacturer NorthVolt. Ottawa committed $1.34 billion to build the plant and another $3 billion worth of incentives. So far, per the CBC, the Quebec government “ invested $270 million in the project and the provincial pension investor, the Caisse de dépôt et placement du Québec (CDPQ), has also invested $200 million.” In 2024, NorthVolt declared bankruptcy in Sweden, throwing the Canadian plans into limbo.

Last month, the same Quebec government announced it will not rescue the Lion Electric company from its fiscal woes, which became obvious in December 2024 when the company filed for creditor protection (again, long before the tariff war). According to the Financial Post, “Lion thrived during the electric vehicle boom, reaching a market capitalization of US$4.2 billion in 2021 and growing to 1,400 employees the next year. Then the market for electric vehicles went through a tough period, and it became far more difficult for manufacturers to raise capital.” The Quebec government had already lost $177 million on investments in Lion, while the federal government lost $30 million, by the time the company filed for creditor protection.

Last year, Ford Motor Co. delayed production of an electric SUV at its Oakville, Ont., plant and Umicore halted spending on a $2.8 billion battery materials plant in eastern Ontario. In April 2025, General Motors announced it will soon close the CAMI electric van assembly plant in Ontario, with plans to reopen in the fall at half capacity, to “align production schedules with current demand.” And GM temporarily laid off hundreds of workers at its Ingersoll, Ontario, plant that produces an electric delivery vehicle because it isn’t selling as well as hoped.

There are still more examples of EV fizzle—again, all pre-tariff war. Government “investments” to Stellantis and LG Energy Solution and Ford Motor Company have fallen flat and dissolved, been paused or remain in limbo. And projects for Canada’s EV supply chain remain years away from production. “Of the four multibillion-dollar battery cell manufacturing plants announced for Canada,” wrote automotive reporter Gabriel Friedman, “only one—a joint venture known as NextStar Energy Inc. between South Korea’s LG Energy Solution Ltd. and European automaker Stellantis NV—progressed into even the construction phase.”

What’s the moral of the story?

Once again, the fevered dreams of government planners who seek to pick winning technologies in a major economic sector have proven to be just that, fevered dreams. In 2025, some 125 years since consumers first had a choice of electric vehicles or internal combustion vehicles (ICE), the ICE vehicles are still winning in economically-free markets. Without massive government subsidies to EVs, in fact, there would be no contest at all. It’d be ICE by a landslide.

In the face of this reality, the new Carney government should terminate any programs that try to force EV technologies into the marketplace, and rescind plans to have all new light-duty vehicle sales be EVs by 2035. It’s just not going to happen, and planning for a fantasy is not sound government policy nor sound use of taxpayer money. Governments in Ontario, Quebec and any other province looking to spend big on EVs should also rethink their plans forthwith.

Alberta

Provincial pension plan may mean big savings for Albertans

From the Fraser Institute

By Tegan Hill

Amid a growing separatist movement in Alberta, a recent poll commissioned by the Smith government found that 55 per cent of Albertans would vote to replace the “Canada Pension Plan (CPP) with an Alberta Pension Plan that guaranteed all Alberta seniors the same or better benefits.” That’s a massive surge in support since last year when support for a provincial plan was approximately 22 per cent. And while there are costs and benefits to leaving the CPP, one thing is clear—Albertans could see savings under a provincial pension plan.

First, some context.

From 1981 to 2022 (the latest year of available data) Alberta workers contributed 14.4 per cent (on average) of total CPP payments while retirees in the province received only 10.0 per cent of the payments, due mainly to the province’s relatively high rates of employment, higher average incomes and younger population (i.e. fewer retirees).

Over that same period, Albertans’ net contribution to the CPP—the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. That’s more than six times more than British Columbia, the only other province that paid more into the CPP than retirees in the province received in benefits.

Some analysts argue that the surge in support for a provincial pension plan in Alberta is a result of strategic wording by the Smith government, specifying that seniors would be guaranteed the same or better benefits than under the current CPP.

It’s true, the wording of a poll question can impact the results. But according to the federal legislation that governs the CPP, any province that wishes to withdraw from the CPP in favour of a provincial plan must provide comparable benefits.

And in fact, several analyses show that due to Alberta’s demographic and economic factors, Alberta workers would receive the same retirement benefits under a provincial pension plan but pay lower contribution rates compared to what they currently pay, while contributions rates would have to increase for Canadians outside Alberta (excluding Quebec) to maintain the same benefits under the CPP.

More specifically, according to a report commissioned by the Smith government, Alberta’s contribution rate, which is effectively a tax taken off paycheques, would fall from the base CPP contribution rate (9.9 per cent) to an estimated 5.85 per cent under a provincial pension plan. That would save each Albertan up to $2,850 in 2027 (the first year of the hypothetical Alberta plan). Again, this lower contribution rate (i.e. tax) would deliver the same benefit levels in Alberta as the current CPP.

Even under more conservative assumptions, Albertans would still pay a lower contribution rate while receiving the same benefits. According to economist Trevor Tombe’s estimate, Alberta’s contribution rate would drop to 8.2 per cent and save Albertan workers approximately $836 annually.

Support for a separate provincial pension plan is on the rise. And Albertans should know that under an Alberta plan, due to demographic and economic factors, they could pay a lower contribution rate yet receive the same level of benefits.

-

espionage2 days ago

espionage2 days agoTrudeau Government Unlawfully Halted CSIS Foreign Operation, Endangering Officers and Damaging Canada’s Standing With Allies, Review Finds

-

Daily Caller1 day ago

Daily Caller1 day agoWatch As Tucker Carlson And Glenn Greenwald Get A Good Laugh Over CNN Pretending Biden’s Decline Is Breaking News

-

Economy1 day ago

Economy1 day agoIf the Liberal government has a plan for the future of conventional energy, now would be a good time to tell us what it is.

-

National2 days ago

National2 days agoMajority of Canadians want feds to focus on illegal gun smuggling not gun buyback program

-

Automotive1 day ago

Automotive1 day agoEV fantasy losing charge on taxpayer time

-

Energy2 days ago

Energy2 days agoThe environmental case for Canadian LNG

-

conflict10 hours ago

conflict10 hours agoBeijing ‘Imminent’ Threat to Taiwan: U.S. Defense Secretary Issues Stark Warning

-

Break The Needle10 hours ago

Break The Needle10 hours agoB.C. doubles down on involuntary care despite underinvestment