Energy

Strong domestic supply chain an advantage as Canada moves ahead with new nuclear

From the MacDonald Laurier Institute

By Sasha Istvan

Canada has two major advantages. We produce uranium and we have an established supply chain.

The pledge from 22 countries, including Canada, to collectively triple nuclear capacity by 2050 drew cheers and raised eyebrows at the United Nations Climate Change Conference last fall in Dubai. Climate commitments are no stranger to bold claims. So, the question remains, can it be done?

In Canada, we are well on our way with successful and ongoing refurbishments of Ontario’s existing nuclear fleet and planning for the development of small modular reactors, or SMRs, in Ontario, New Brunswick, Saskatchewan and most recently Alberta.

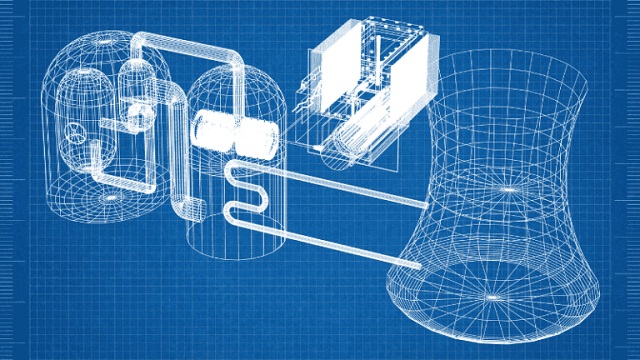

The infrastructure required to generate nuclear energy is significant. You not only need engineers and technicians working at a plant, but the supply chain to support it.

Over five decades worth of nuclear generation has allowed Canada to build a world class supply chain. Thus far it has focused on servicing CANDU reactors, but now we have the potential to expand into SMRs.

I first became interested in the CANDU reactor after working as a manufacturing engineer for one of the major fuel and tooling suppliers of Ontario Power Generation and Bruce Power. I witnessed firsthand the sophistication and quality of the nuclear supply chain in Ontario, being particularly impressed by the technical expertise and skilled workers in the industry.

The CANDU reactor is the unsung hero of the Canadian energy industry: one of the world’s safest nuclear reactors, exported around the world, and producing around 60 per cent of Ontario’s electricity, as well as 40 per cent of New Brunswick’s.

Having visited machine shops across Ontario, it’s evident that Canadians should take pride that the expertise and technology required for the safe generation of nuclear energy is available here in Canada.

As Canada looks to grow its nuclear output to achieve net-zero goals, its well-established engineering and manufacturing capabilities can make it a leader in the global expansion of nuclear energy as other nations work to make their COP28 declaration a reality.

Canada has two major advantages. The first is that it is a globally significant producer of uranium. We already export uranium from our incredible reserves in northern Saskatchewan and fabricate unenriched uranium fuel for CANDU. Canadian uranium will be an important ingredient in the success and sustainability of a nuclear renaissance, especially for our allies.

The second is that we have an established and active supply chain. While new nuclear builds have slowed dramatically in the western world — a result of the fallout from Chernobyl and Fukushima, as well as competition from cheap natural gas — Bruce Power and OPG are in the midst of major refurbishments to extend their operations until 2064 and 2055, respectively.

Bruce Power has successfully completed the first unit refurbishment on schedule and within budget, with ongoing work on the second unit. OPG has accomplished refurbishments for two out of its four units at Darlington, with the latest unit completed ahead of schedule and under budget. These multibillion-dollar refurbishments have actually grown our nuclear supply chain and demonstrate that it’s firing on all cylinders.

SMRs are the next phase of nuclear technology. Their size and design make them well suited for high production and modular construction. Investing in the supply chain for SMRs now positions Canada for significant economic gains.

OPG plans to build four GE-Hitachi BWRX-300 reactors, with the first slated for service as early as 2028. This first-of-a-kind investment will help identify and overcome design challenges and develop its own supply chain. That will benefit not only their project but those that follow suit.

SaskPower is planning to proceed with the same SMR design, as well as the first pilot globally of the Westinghouse eVinci microreactor; New Brunswick is moving ahead with the ARC-100, both for its existing nuclear site at Point Lepreau as well as in the Port of Belledune; and OPG and Capital Power recently announced a partnership to explore a nuclear reactor in Alberta, including the potential for the BWRX-300.

While the bulk of the nuclear supply chain is currently located in Ontario, other provinces have already been investing in the development of local capacity.

All this activity sets Canada up to leverage first-mover advantage and become a significant global provider of BWRX-300 components. Canada will not only see the economic benefits during initial construction but also through sustained demand for replacement parts in the future.

Nuclear energy has already made a significant contribution to the Canadian economy. In 2019, a study commissioned by the Canadian Nuclear Association and the Organization of Canadian Nuclear Industries showed that the nuclear industry accounted for $17 billion of Canada’s annual GDP annually and has created over 76,000 jobs.

Notably, 89 per cent of these positions were classified as high-skilled, and over 40 per cent of the workforce was under 40. This study, conducted before the announcement of SMR plans, was followed by a more recent report from the Conference Board of Canada on the economic impact of OPG’s SMR initiatives. The study found that the construction of just four SMRs at OPG could boost the Canadian GDP by $15.3 billion (2019 dollars) over 65 years and sustain approximately 2,000 jobs annually during that period.

Public perception of nuclear is improving. In 2023, the percentage of Canadians wanting to see further development of nuclear power generation in Canada grew to 57 per cent compared with 51 per cent in 2021.

As well, the Business Council of Canada has voiced its support for nuclear expansion, emphasizing Canada’s strategic advantages: political and public backing across the spectrum, coupled with a rich history of nuclear expertise.

Nuclear energy is dispatchable, sustainable and a proven technology. As nations move to achieve their climate goals, it has one other major benefit: a supply chain that is wholly western and in Canada’s case almost totally domestic.

While the critical minerals and manufactured goods required for batteries, wind and solar energy rely heavily on China and other politically unstable or authoritarian countries, nuclear provides energy independence. Canada is well positioned to help our allies improve their energy security with our strong, competitive nuclear supply chain.

Sasha Istvan is an engineer based in Calgary, with experience in both the nuclear supply chain and the oil and gas sector.

Energy

B.C. Residents File Competition Bureau Complaint Against David Suzuki Foundation for Use of False Imagery in Anti-Energy Campaigns

From Energy Now and The Canadian Newswire

A group of eight residents of Northeast British Columbia have filed a formal application for inquiry with Canada’s Competition Bureau, calling for an investigation into the David Suzuki Foundation’s (the Foundation) use of false and misleading imagery in its anti-energy campaigns.

The complaint alleges that the Foundation has repeatedly used a two-decade-old aerial photograph of Wyoming gas wells to falsely depict modern natural gas development in B.C.’s Montney Formation. This area produces roughly half of Canada’s natural gas.

Key Facts:

- The misleading image has been used on the Foundation’s website, social media pages, reports and donation appeals.

- The Foundation has acknowledged the image’s true source (Wyoming) in some contexts but has continued to use it to represent B.C. development.

- The residents claim this materially misleads donors and the public, violating Section 74.01(1) of the Competition Act.

- The complaint is filed under Sections 9 and 10 of the Act, asking the Bureau to investigate and impose remedies including ceasing the conduct, publishing corrective notices, and returning proceeds.

Quote from Deena Del Giusto, Spokesperson:

“This is about fairness and truth. The people of Northeast B.C. are proud of the work they do to produce energy for Canada and the world. They deserve honest debate, not scare tactics and misleading imagery used to raise millions in donations. We’re asking the Competition Bureau to hold the David Suzuki Foundation to the same standard businesses face: tell the truth.”

Background:

Natural gas development in the Montney Formation supports thousands of jobs and fuels economic activity across the region. Accurate public information is vital to informed debate, especially as many Canadians live far from production sites.

SOURCE Deena Del Giusto

Economy

Trump opens door to Iranian oil exports

This article supplied by Troy Media.

U.S. President Donald Trump’s chaotic foreign policy is unravelling years of pressure on Iran and fuelling a surge of Iranian oil into global markets. His recent pivot to allow China to buy Iranian crude, despite previously trying to crush those exports, marks a sharp shift from strategic pressure to transactional diplomacy.

This unpredictability isn’t just confusing allies—it’s transforming global oil flows. One day, Trump vetoes an Israeli plan to assassinate Iran’s supreme leader, Ayatollah Khamenei. Days later, he calls for Iran’s unconditional surrender. After announcing a ceasefire between Iran, Israel and the United States, Trump praises both sides then lashes out at them the next day.

The biggest shock came when Trump posted on Truth Social that “China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the U.S., also.” The statement reversed the “maximum pressure” campaign he reinstated in February, which aimed to drive Iran’s oil exports to zero. The campaign reimposes sanctions on Tehran, threatening penalties on any country or company buying Iranian crude,

with the goal of crippling Iran’s economy and nuclear ambitions.

This wasn’t foreign policy—it was deal-making. Trump is brokering calm in the Middle East not for strategy, but to boost American oil sales to China. And in the process, he’s giving Iran room to move.

The effects of this shift in U.S. policy are already visible in trade data. Chinese imports of Iranian crude hit record levels in June. Ship-tracking firm Vortexa reported more than 1.8 million barrels per day imported between June 1 and 20. Kpler data, covering June 1 to 27, showed a 1.46 million bpd average, nearly 500,000 more than in May.

Much of the supply came from discounted May loadings destined for China’s independent refineries—the so-called “teapots”—stocking up ahead of peak summer demand. After hostilities broke out between Iran and Israel on June 12, Iran ramped up exports even further, increasing daily crude shipments by 44 per cent within a week.

Iran is under heavy U.S. sanctions, and its oil is typically sold at a discount, especially to China, the world’s largest oil importer. These discounted barrels undercut other exporters, including U.S. allies and global producers like Canada, reducing global prices and shifting power dynamics in the energy market.

All of this happened with full knowledge of the U.S. administration. Analysts now expect Iranian crude to continue flowing freely, as long as Trump sees strategic or economic value in it—though that position could reverse without warning.

Complicating matters is progress toward a U.S.-China trade deal. Commerce Secretary Howard Lutnick told reporters that an agreement reached in May has now been finalized. China later confirmed the understanding. Trump’s oil concession may be part of that broader détente, but it comes at the cost of any consistent pressure on Iran.

Meanwhile, despite Trump’s claims of obliterating Iran’s nuclear program, early reports suggest U.S. strikes merely delayed Tehran’s capabilities by a few months. The public posture of strength contrasts with a quieter reality: Iranian oil is once again flooding global markets.

With OPEC+ also boosting output monthly, there is no shortage of crude on the horizon. In fact, oversupply may once again define the market—and Trump’s erratic diplomacy is helping drive it.

For Canadian producers, especially in Alberta, the return of cheap Iranian oil can mean downward pressure on global prices and stiffer competition in key markets. And with global energy supply increasingly shaped by impulsive political decisions, Canada’s energy sector remains vulnerable to forces far beyond its borders.

This is the new reality: unpredictability at the top is shaping the oil market more than any cartel or conflict. And for now, Iran is winning.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Energy1 day ago

Energy1 day agoB.C. Residents File Competition Bureau Complaint Against David Suzuki Foundation for Use of False Imagery in Anti-Energy Campaigns

-

Alberta2 days ago

Alberta2 days agoAlberta uncorks new rules for liquor and cannabis

-

COVID-191 day ago

COVID-191 day agoCourt compels RCMP and TD Bank to hand over records related to freezing of peaceful protestor’s bank accounts

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal23 hours ago

C2C Journal23 hours agoCanada Desperately Needs a Baby Bump

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

Agriculture11 hours ago

Agriculture11 hours agoLacombe meat processor scores $1.2 million dollar provincial tax credit to help expansion