Energy

Stop The Cap On Oil And Gas

From Project Confederation

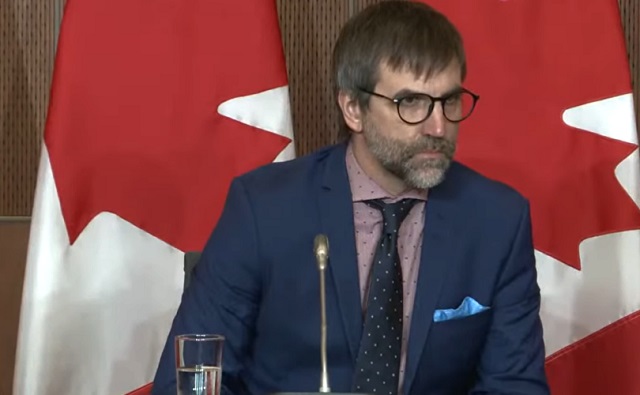

With the United Nations’s 28th Climate Change Conference in Dubai generating headlines, we all knew it was only a matter of time before Canada’s radical eco-activist Environment Minister did something stupid.

And here it is, from Steven Guilbeault himself:

“The Government of Canada’s plan to cap and reduce emissions from Canada’s largest emitting sector is ambitious, but practical. It considers the global demand for oil and gas — and the importance of the sector in Canada’s economy — and sets a limit that is strict, but achievable.”

That’s right, folks – the Oil and Gas emissions/production cap is finally upon us.

We launched a campaign last year, around this same time, warning that this was coming.

Now, we know just how bad it actually is.

If you already agree that we should Stop The Cap On Oil And Gas,

click here to sign the petition, but if you want more details, read on!

The framework that’s being proposed by the federal government would cap emissions at 35% – 38% below 2019 levels.

How exactly would this be done?

What will it cost?

No one knows.

The federal government just says that they’ll release the details via regulation sometime next year.

Alberta Premier Danielle Smith is livid, issuing a statement:

“[The announcement is an] intentional attack by the federal government on the economy of Alberta and the financial well-being of millions of Albertans and Canadians.”

“Justin Trudeau and his eco-extremist Minister of the Environment and Climate Change, Steven Guilbeault, are risking hundreds of billions of investments in Alberta’s and Canada’s economy.”

Saskatchewan Premier Scott Moe echoed Smith:

“[The cap] will have serious economic impacts on Canadians and limit our sustainable Canadian energy products from providing heat and electricity to the world.”

“Saskatchewan will protect our constitutional right to build our economy in accordance with the priorities of Saskatchewan families and businesses.”

The federal government has been in legal hot water lately over constitutional overreaches – with the Supreme Court deeming the Impact Assessment Act unconstitutional in October and the Federal Court ruling the plastics ban unconstitutional in November.

Ottawa has consistently ignored provincial jurisdiction on a wide range of issues, and their inability to stay in their constitutional lane has been a major source of tension with the provinces.

This emissions cap is just the latest example, as natural resource development is guaranteed to be the sole jurisdiction of the provinces in the Constitution of Canada.

As such, the emissions cap is clearly unconstitutional – but even if it wasn’t, it would be a terrible policy anyway.

First, it’s an admission by the government that the carbon tax – their signature climate change policy – is not working.

The entire purpose of the tax was to be a “market mechanism” to reduce emissions, and yet now they’re admitting that they need even more regulations to reduce emissions.

This cap is a direct and deliberate attack on western Canada’s oil and gas industry.

Remember – the cap will not apply to any industry other than oil and gas.

Ontario’s automotive industry, Quebec’s cement industry, and other high-emitting industries in other parts of Canada are not having their emissions capped.

The cap also excludes refineries – even though that is part of the oil and gas industry – because many of Canada’s refineries happen to be in regions of the country that mostly vote Liberal.

If the federal government were actually concerned about the environment, they would implement policies designed to reduce emissions across all industries and all regions of Canada.

Instead, the hypocritical and political nature of Ottawa’s climate agenda reveals their true intentions and undermines the credibility of their entire plan.

That’s why we’re renewing our campaign calling on the federal government to back off, respect the Constitution, and stop infringing on provincial jurisdiction.

If you agree, please sign our petition to Stop The Cap On Oil And Gas:

Josh Andrus

Executive Director

Project Confederation

Energy

Mistakes and misinformation by experts cloud discussions on energy

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

The new agreement (MOU) between the Carney and Alberta governments sets the foundation for a pipeline from Alberta to the British Columbia coast, at least conceptually. Unfortunately, many politicians and commentators, including the bureau chiefs for the Globe and Mail and Toronto Star, continue to get many energy facts wrong, which impairs the discussions of how best the country can and should move forward to capitalize on our natural resources.

For example, commentors often wrongly describe the tanker ban on the west coast (C-48) as a general ban on oil tankers. But in reality, the law only applies to tankers docking at Canadian ports. It does not and cannot prevent tankers from travelling the west coast so long as they’re not stationing at Canadian ports. This explains the continued oil tanker traffic in the northwest region for tankers docking in U.S. ports in Alaska. Simply put, there is not a general tanker ban on the west coast.

Commentators also continue to misrepresent the current capacity on the expanded Trans Mountain pipeline (TMX). According to the Canada Energy Regulator (CER), the average utilization of the TMX since it came online in June 2024 is 82 per cent (reaching as high as 89 per cent in March 2025). So, while there’s some room for additional oil transportation via TMX, it’s nowhere close to the “doubling” being discussed in central Canada. Critically, though, according to the CER, from “June 2024 to June 2025, committed capacity was effectively fully utilized each month, averaging 99% utilization.”

Similarly, there’s a misunderstanding by many in central Canada regarding the potential restart of the Keystone XL pipeline, which apparently President Trump is keen on. Keystone would not diversify Canada’s exports because while oil does make its way down to the southern U.S. where it can be exported, the actual sale of Canadian oil is to U.S. refineries, so our reliance on the U.S. as our near-sole export market would continue unless a west and/or east coast pipeline is developed.

There also continues to be an artificial and costly connection made between Ottawa removing the arbitrary emissions cap on greenhouse gases by the oil and gas sector and the approval of a new pipeline with the proposed Pathways carbon capture project, which is a collaboration between five of Canada’s largest oil producers. This connection was galvanized in the MOU.

The idea behind the project is to reduce (conceptually) the amount of greenhouse gas (GHG) emitted from oil extraction and transportation projects linked with Pathways. The Pathways project produces no economic value or product—it simply collects and stores GHG emissions—and reports suggest the total cost for the first phase of the project will reach $16.5 billion.

Should Canadians care about adding costs related to GHG mitigation? There are several factors to consider. First, Canada is already a low-GHG emitting producer of oil. According to the Carney government’s first budget (page 105, chart 1.5 which ranks the world’s 20 top oil producers based on their GHG emissions per unit of output), Canada already ranks 7th-lowest in terms of emissions. And more importantly, it’s lower than every country—Venezuela, Russia, Iraq and Mexico—that produces a similar type of oil as Canada. Any resources spent further reducing GHG emissions via carbon capture will result in small incremental gains contrasted with large costs (again, at least $16.5 billion). A number of analysts have already raised concerns about the investment and competitiveness implications of increasing the cost structures for Alberta producers.

Second, according to the federal government, in 2022 Canada produced 1.4 per cent of global GHG emissions, and the oil and gas sector produced roughly one-quarter of those emissions. In other words, if Canada eliminated all GHG emissions from the oil sector via carbon capture, the process would consume vast amounts of scarce resources (i.e. money) and result in a nearly undetectable change in global GHG emissions. One can only conclude that this is much more about international virtue-signalling than the actual economics and environmental implications of Canada’s potential energy projects.

At a time when Canada is struggling with crisis levels of private business investment, falling living standards and as the Bank of Canada described, a break-the-glass crisis in productivity growth, it’s clearly not wise to spend tens of billions of dollars on projects that might make politicians and bureaucrats feel better and enable them to use near Orwellian language like “zero-emissions oil” but that actually deliver almost no detectable environmental benefits.

To borrow our prime minister’s favourite phrase, kickstarting Canada’s oil and gas sector is the easiest way to catalyze economic growth given our vast energy reserves, know-how in the sector, and high productivity. To do so, we need a national dialogue rooted in facts.

Energy

Ottawa and Alberta’s “MOU” a step in the right direction—but energy sector still faces high costs and weakened competitiveness

From the Fraser Institute

By Tegan Hill and Elmira Aliakbari

The Memorandum of Understanding (MOU) between Alberta Premier Danielle Smith and Prime Minister Mark Carney, which includes a new oil pipeline to BC’s northwest coast, offers some hope for Canada’s energy future. While this agreement is a step in the right direction, it puts Alberta’s energy sector on the hook to secure access to new markets while facing higher costs and reduced competitiveness.

Earlier this year, Smith demanded then-newly elected Prime Minister Carney repeal nine “bad laws” stifling oil and gas investment, which has collapsed by nearly 61 per cent in the province since 2014, falling from $64.7 billion to $25.4 billion in 2024 (inflation-adjusted).

One key policy on the list was the proposed federal emissions cap, which would have applied exclusively to the oil and gas sector. According to the MOU, Canada will not move forward with the cap, which is a welcome change. Indeed, multiple analyses showed that the cap would have inevitably resulted in a production cut, costing the economy billions and resulting in tens of thousands of job losses. And, with oil and gas demand continuing to climb, the cap would have shifted production to other countries with lower environmental and human rights standards such as Iran, Russia and Venezuela.

Scrapping the Clean Electricity Regulations (CER) was also one of Smith’s demands. While the MOU states that “Canada and Alberta remain committed to achieving net zero greenhouse gas emissions by 2050”, the CER as it applies to the province will be suspended for the time being. Again, this is a critical and positive change for a province where 85 per cent of its electricity comes from fossil fuels—a larger share than nearly any other province. (For perspective, in Quebec, over 85 per cent of its electricity comes from hydro.) The Alberta Electric System Operator (AESO) estimates it would cost $44 to $54 billion to decarbonize Alberta’s grid by 2041—a 30 to 36 per cent spending increase—costs that ultimately fall on consumers.

A third key policy on Smith’s list of nine bad laws was repealing Bill C-48, which banned large oil tankers off BC’s northern coast from docking in Canadian ports. According to the MOU, there may be a limited exemption to the ban. Specifically, it states that to enable the export of bitumen there may be an “appropriate adjustment.” The law effectively prevents Canadian producers from accessing Asia and other international markets. Crucially, the legislation applies only to tankers docking in Canadian ports—U.S. and foreign tankers continue to operate freely in the same waters accessing U.S. ports. In other words, the law exclusively hinders Canada’s competitiveness—creating a carve out for one pipeline will not fix this problem.

All of these policy changes or exemptions are conditional on stronger industrial carbon pricing and support for the massive multibillion-dollar Pathways project–a 400-kilometer pipeline transporting carbon trapped at oil facilities to an underground storage facility near Cold lake Alberta and led by a group of Canada’s five largest oil companies. Earlier this year, Alberta froze its industrial carbon tax at $95 per tonne through 2026, but the MOU states that the system will ramp up to a minimum price of $130/tonne. This will increase the cost of producing, processing and transporting oil, at a time when a surge in global oil production and downward pressure on oil prices is expected. Ultimately, this will widen the competitiveness gap between Alberta and many other jurisdictions, such as the United States, that do not have comparable carbon pricing in place.

The agreement is also conditional on the $16.5 billion (minimum estimate) Pathways project to capture, sequester and store carbon underground. Adding carbon capture technology would increase production costs by roughly US $1.2-$3 per barrel for oil sands mining operations and US $3.6-$4.8 for oil sands facilities that use steam. These higher costs further erode the province’s competitiveness and won’t help in attracting private sector investment.

The memorandum of understanding makes some important strides for Canada’s energy future and is certainly an improvement on the status quo, but it still leaves Alberta’s energy sector facing higher costs and weakened competitiveness, and more broadly doesn’t remove the many impediments to large-scale development of our oil sector.

-

Agriculture2 days ago

Agriculture2 days agoHealth Canada indefinitely pauses plan to sell unlabeled cloned meat after massive public backlash

-

Alberta13 hours ago

Alberta13 hours agoWest Coast Pipeline MOU: A good first step, but project dead on arrival without Eby’s assent

-

Energy13 hours ago

Energy13 hours agoPoilievre says West Coast Pipeline MOU is no guarantee

-

Carbon Tax16 hours ago

Carbon Tax16 hours agoCanadian energy policies undermine a century of North American integration

-

Energy12 hours ago

Energy12 hours agoWill the New West Coast Pipeline MoU Lead to Results? Almost Certainly Not According to AI

-

Alberta12 hours ago

Alberta12 hours agoCarney forces Alberta to pay a steep price for the West Coast Pipeline MOU

-

Alberta16 hours ago

Alberta16 hours agoAlberta and Ottawa ink landmark energy agreement

-

Crime2 days ago

Crime2 days agoFBI Seizes $13-Million Mercedes Unicorn From Ryan Wedding’s Narco Network