Business

Sale of beer with alcohol banned at World Cup stadiums

DOHA, Qatar (AP) — The sale of all beer with alcohol at the eight World Cup stadiums was banned Friday, only two days before the soccer tournament is set to start.

Non-alcoholic beer will still be sold at the 64 matches in the country.

“Following discussions between host country authorities and FIFA, a decision has been made to focus the sale of alcoholic beverages on the FIFA Fan Festival, other fan destinations and licensed venues, removing sales points of beer from … stadium perimeters,” FIFA said in a statement.

Champagne, wine, whiskey and other alcohol is still expected to be served in the luxury hospitality areas of the stadiums. Outside of those places, beer is normally the only alcohol sold to regular ticket holders.

Ab InBev, the parent company of World Cup beer sponsor Budweiser, did not immediately respond to a request for comment.

AB InBev pays tens of millions of dollars at each World Cup for exclusive rights to sell beer and has already shipped the majority of its stock from Britain to Qatar in expectation of selling its product to millions of fans. The company’s partnership with FIFA started at the 1986 tournament and they are in negotiations for renewing their deal for the next World Cup in North America.

While a sudden decision like this may seem extreme in the West, Qatar is an autocracy governed by a hereditary emir, who has absolute say over all governmental decisions.

Qatar, an energy-rich Gulf Arab country, follows an ultraconservative form of Islam known as Wahhabism like neighboring Saudi Arabia. However, alcohol sales have been permitted in hotel bars for years.

Qatar’s government and its Supreme Committee for Delivery and Legacy did not immediately respond to request for comment.

Already, the tournament has seen Qatar change the date of the opening match only weeks before the World Cup began.

When Qatar launched its bid to host the World Cup, the country agreed to FIFA’s requirements of selling alcohol in stadiums, and again when signing contracts after winning the vote in 2010.

At the 2014 World Cup in Brazil, the host country was forced to change a law to allow alcohol sales in stadiums.

Ronan Evain, the executive director of the fan group Football Supporters Europe, called the decision to ban beer sales at the stadiums in Qatar “extremely worrying.”

“For many fans, whether they don’t drink alcohol or are used to dry stadium policies at home, this is a detail. It won’t change their tournament,” Evain wrote on Twitter. “But with 48 (hours) to go, we’ve clearly entered a dangerous territory — where ‘assurances’ don’t matter anymore.”

AB InBev’s deal with FIFA was renewed in 2011 — after Qatar was picked as host — in a two-tournament package through 2022. However, the Belgium-based brewer has faced uncertainty in recent months on the exact details of where it can serve and sell beer in Qatar.

An agreement was announced in September for beer with alcohol to be sold within the stadium perimeters before and after games. Only alcohol-free Bud Zero would be sold in the stadium concourses for fans to drink in their seats in branded cups.

Last weekend, AB InBev was left surprised by a new policy insisted on by Qatari organizers to move beer stalls to less visible locations within the perimeter.

Budweiser was also to be sold in the evenings only at the official FIFA fan zone in downtown Al Bidda Park, where up to 40,000 fans can gather to watch games on giant screens. The price was confirmed as $14 for a beer.

The company will be based at an upscale hotel in the West Bay area of Doha with its own branded nightclub for the tournament.

At the W Hotel in Doha, workers continued putting together a Budweiser-themed bar planned at the site. Its familiar AB logo was plastered on columns and walls at the hotel, with one reading: “The World Is Yours To Take.”

___

AP World Cup coverage: https://apnews.com/hub/world-cup and https://twitter.com/AP_Sports

Graham Dunbar, The Associated Press

Business

Canada has given $109 million to Communist China for ‘sustainable development’ since 2015

From LifeSiteNews

A briefing note showed Canadian aid has gone to ‘key foreign policy priorities in China, including human rights, gender equality, sustainable development, and climate change.’

A federal briefing note disclosed that well over $100 million has been provided to the Communist Chinese government in so-called “foreign aid” to promote “sustainable development” that includes woke ideology such as gender equality.

As reported by Blacklock’s Reporter, a recent briefing note titled Assistance to China from May for the Minister of International Development showed $109 million has gone to “key foreign policy priorities in China, including human rights, gender equality, sustainable development, and climate change” since 2015 and $645 million since 2003.

The briefing note asked directly if funding was “going to the Government of China.”

In reply, the briefing note stated, “Canada has not provided direct bilateral assistance to Chinese state authorities since 2013, though it continues to provide small amounts of funding to international partners and non-state partners on the ground.”

Former Prime Minister Justin Trudeau came to power in 2015 and increased relations with the Communist Chinese regime. This trend under the Liberal Party government has continued with Prime Minister Mark Carney.

During a 2025 federal election campaign debate, Conservative Party leader Pierre Poilievre called out Carney for his ties to Communist China.

Conservative MP Andrew Scheer has consistently called out any money at all going to China, saying, “I don’t believe Canadian taxpayers should be sending any money to China.”

“We’re talking about a Communist dictatorial government that abuses human rights, quashes freedoms, violates rights of its citizens, and has a very aggressive foreign policy throughout the region,” he noted.

Scheer added that he has been calling on the Carney Liberals to “stand up for themselves, stand up for Canadians, stop being bullied and pushed around on the world stage, especially by China.”

Most of the money in foreign aid was spent through globalist-backed agencies such as the World Bank and the United Nations Development Program. Some 39 percent of the money was said to have gone straight to Chinese recipients, but no projects were itemized.

Other countries have received millions of dollars in foreign aid, with $2.1 billion going to Ukraine, $195 million to Ethiopia, $172 million to Haiti, and $151 million to the West Bank and Gaza last year.

Foreign aid to all nations totaled $12.3 billion.

LifeSiteNews recently reported that the Canadian Liberal government gave millions in aid to Chinese universities.

China has been accused of direct election meddling in Canada, as reported by LifeSiteNews.

LifeSiteNews also reported that a new exposé by investigative journalist Sam Cooper has claimed there is compelling evidence that Carney and Trudeau are/were strongly influenced by an “elite network” of foreign actors, including those with ties to China and the World Economic Forum.

Business

Canada’s combative trade tactics are backfiring

This article supplied by Troy Media.

Defiant messaging may play well at home, but abroad it fuels mistrust, higher tariffs and a steady erosion of Canada’s agri-food exports

The real threat to Canadian exporters isn’t U.S. President Donald Trump’s tariffs, it’s Ottawa and Queen’s Park’s reckless diplomacy.

The latest tariff hike, whether triggered by Ontario’s anti-tariff ad campaign or not, is only a symptom. The deeper problem is Canada’s escalating loss of credibility at the trade table. Washington’s move to raise duties from 35 per cent to 45 per cent on nonCUSMA imports (goods not covered under the Canada-United States-Mexico Agreement, the successor to NAFTA) reflects a diplomatic climate that is quickly souring, with very real consequences for Canadian exporters.

Some analysts argue that a 10-point tariff increase is inconsequential. It is not. The issue isn’t just what is being tariffed; it is the tone of the relationship. Canada is increasingly seen as erratic and reactive, negotiating from emotion rather than strategy. That kind of reputation is dangerous when dealing with the U.S., which remains Canada’s most important trade partner by a wide margin.

Ontario Premier Doug Ford’s stand up to America messaging, complete with a nostalgic Ronald Reagan cameo, may have been rooted in genuine conviction. Many Canadians share his instinct to defend the country’s interests with bold language. But in diplomacy, tone often outweighs intent. What plays well domestically can sound defiant abroad, and the consequences are already being felt in boardrooms and warehouses across the country.

Ford’s public criticisms of companies such as Crown Royal, accused of abandoning Ontario, and Stellantis, which recently announced it will shift production of its Jeep Compass from Brampton to Illinois as part of a US$13 billion U.S. investment, may appeal to voters who like to see politicians get tough. But those theatrics reinforce the impression that Canada is hostile to

international investors. At a time when global capital can move freely, that perception is damaging. Collaboration, not confrontation, is what’s needed most to secure investment in Canada’s economy.

Such rhetoric fuels uncertainty on both sides of the border. The results are clear: higher tariffs, weaker investor confidence and American partners quietly pivoting away from Canadian suppliers.

Many Canadian food exporters are already losing U.S. accounts, not because of trade rules but because of eroding trust. Executives in the agri-food sector are beginning to wonder whether Canada can still be counted on as a reliable partner, and some have already shifted contracts southward.

Ford’s political campaigns may win applause locally, but Washington’s retaliatory measures do not distinguish between provinces. They hit all exporters, including Canada’s food manufacturers that rely heavily on the U.S. market, which purchases more than half of Canada’s agri-food exports. That means farmers, processors and transportation companies across the country are caught in the crossfire.

Those who believe the new 45 per cent rate will have little effect are mistaken. Some Canadian importers now face steeper duties than competitors in Vietnam, Laos or even Myanmar. And while tariffs matter, perception matters more. Right now, the optics for Canada’s agri-food sector are poor, and once confidence is lost, it is difficult to regain.

While many Canadians dismiss Trump as unpredictable, the deeper question is what happened to Canada’s once-cohesive Team Canada approach to trade. The agri-food industry depends on stability and predictability. Alienating our largest customer, representing 34 per cent of the global consumer market and millions of Canadian jobs tied to trade, is not just short-sighted, it’s economically reckless.

There is no trade war. What we are witnessing is an American recalibration of domestic fiscal policy with global consequences. Canada must adapt with prudence, not posturing.

The lesson is simple: reckless rhetoric is costing Canada far more than tariffs. It’s time to change course, especially at Queen’s Park.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Alberta1 day ago

Alberta1 day agoPremier Smith sending teachers back to school and setting up classroom complexity task force

-

Business2 days ago

Business2 days agoThe painful return of food inflation exposes Canada’s trade failures

-

Alberta2 days ago

Alberta2 days agoCoutts border officers seize 77 KG of cocaine in commercial truck entering Canada – Street value of $7 Million

-

International21 hours ago

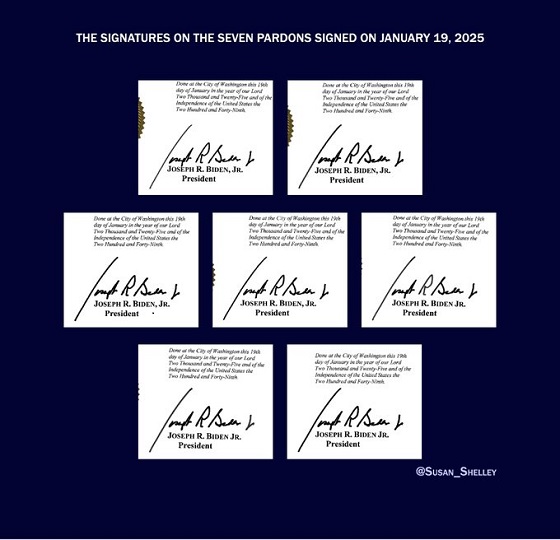

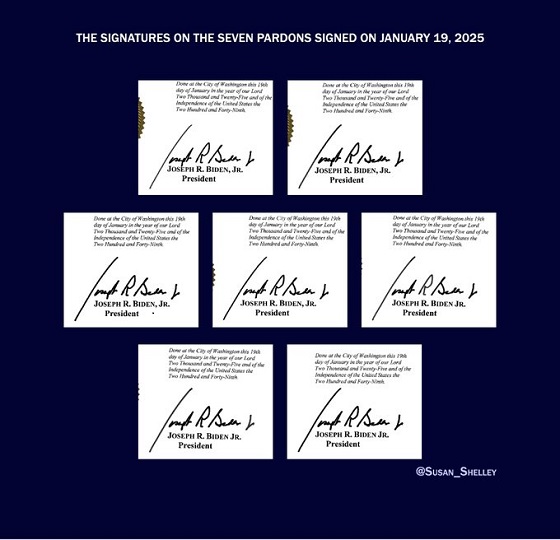

International21 hours agoBiden’s Autopen Orders declared “null and void”

-

Business23 hours ago

Business23 hours agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

National2 days ago

National2 days agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Business2 days ago

Business2 days agoOttawa Bought Jobs That Disappeared: Paying for Trudeau’s EV Gamble

-

Canada Free Press21 hours ago

Canada Free Press21 hours agoThe real genocide is not taking place in Gaza, but in Nigeria