Banks

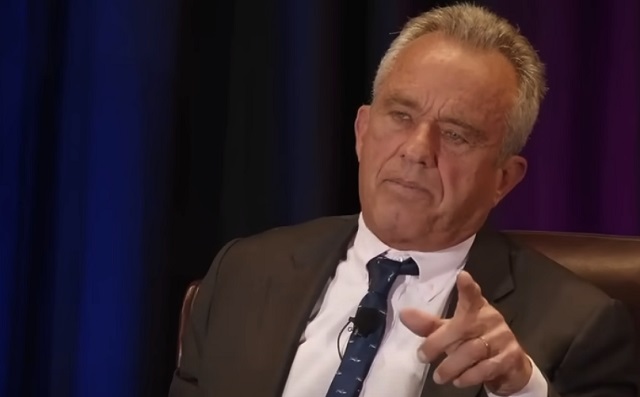

RFK Jr. warns Americans ‘will be slaves’ if central bank digital currency is established

From LifeSiteNews

The U.S. presidential candidate cited the Freedom Convoy trucker protests in Canada when the government ‘was able to destroy their lives’ by freezing bank accounts.

Democrat presidential candidate Robert F. Kennedy Jr. declared in no uncertain terms recently that establishing a Central Bank Digital Currency in the country will be “the end of freedom; we will be slaves if we allow that to happen.”

In a wide-ranging discussion at the University of Austin about freedom of speech and civil discourse, Kennedy said he didn’t “get” the connection between CBDCs and the loss of freedom of expression and other freedoms until he witnessed the Canadian trucker protest.

Robert F. Kennedy Jr on Why He Opposes Central Bank Digital Currencies

“That is part of the path to getting us where China is today. That’s where they started…It’s the end of freedom. We will be slaves if we allow that to happen.”@RobertKennedyJr pic.twitter.com/DSD6ZD0Bkk

— Chief Nerd (@TheChiefNerd) March 24, 2024

“The truckers in Canada were protesting the COVID mandates, the lockdowns, masking mandates, vaccination mandates, and others,” Kennedy began. “They started in Alberta. They picked up thousands of trucks as they drove across Canada to Ottawa.”

When they got to Ottawa — they were trying to petition Prime Minister Trudeau — and they were exercising a right that we all take for granted in this country: the right to assemble, the right to protest, the right to petition their government, and the government instead condemned them as right-wing fascists and racists, which if you look at the videos, they’re the opposite. Looks like Woodstock. They were delivering bottled water, they were cooking food for the poor, they were picking up garbage. There were musicians on every block.

It was really a beautiful thing.

However, the Trudeau government perceived the protesters to be an existential threat.

“The government used facial recognition systems and other intrusive technologies to identify the participants,” he recounted, and weaponized that information against them to freeze their bank accounts so they couldn’t purchase diesel for their trucks, buy food for their kids, or pay their mortgages or rents.

A pivotal moment for Kennedy occurred when one of the truckers told him that because of the government’s action, he was going to go to jail because he couldn’t pay his alimony.

He said that transactional freedom is as important as freedom of the press, or freedom of speech, “because if you have freedom of speech in the First Amendment and yet when you exercise that speech — if the government doesn’t like it — they can starve you to death. They can throw you out of your home.”

He explained that in China:

They keep a social credit score on you so that if (for instance) you’ve got your mask off below your nose, or if you’re not social distancing properly, or if you violate some other social norm, you get penalties taken off your social (credit) score and at some point they punish you.

Penalized persons are then limited to buying groceries from “stores that are within a certain radius of your house. You can’t buy gas. You can’t buy an airplane ticket. You can’t buy anything else, so you’re basically under home confinement.”

The truckers in Canada were never charged with a crime. They were certainly never convicted. It was just (that) they were doing something the government didn’t like.

So the government was able to destroy their lives, and that is a very dangerous power to give government. And that’s why I’m against Central Bank Digital Currencies because that is part of the path to getting us where China is today.

That’s where they started. That’s where all these other countries … with a Central Bank Digital Currency (started). And it’s the end of freedom. We will be slaves if we allow that to happen.

Kennedy is far from alone in his alarm over the prospect of a CBDC being introduced in the U.S. or Canada.

Although digital currency offers some attractive features, it also would grant the federal government unlimited opportunity to weaponize the technology against citizens, allowing it to both spy on the spending habits of everyday Americans and block access to the money in their personal bank accounts.

U.S. Sen. Ted Cruz introduced the CBDC Anti-Surveillance State Act last month to prohibit the Federal Reserve from issuing a central bank digital currency that Republican sponsors of the bill believe could turn the nation into a “surveillance state” by handing over control of personal finances to federal government agencies.

“The Biden administration salivates at the thought of infringing on our freedom and intruding on the privacy of citizens to surveil their personal spending habits, which is why Congress must clarify that the Federal Reserve has no authority to implement a CBDC,” Cruz said.

“While Americans across the country are being punished for thinking, speaking, and voting the ‘wrong’ way, the last thing we need is the government surveilling personal finances,” Heritage Action for America explained in a statement concerning the new legislation. “Anti-CBDC legislation is necessary to safeguard Americans’ financial privacy in the face of potential surveillance, control, and political intimidation.”

“CBDCs present major privacy concerns for everyday Americans, including granting the government the ability to collect intimate personal details on U.S. citizens, and potentially track and freeze funds for any reason,” the Blockchain Association noted.

“Big government has no business spying on Americans to control their personal finances and track their transactions,” said Republican U.S. Sen. Rick Scott of Florida, a co-sponsor of the bill.

“It is a massive overreach,” he warned.

Banks

Bank of Canada Cuts Rates to 2.25%, Warns of Structural Economic Damage

Governor Tiff Macklem concedes the downturn runs deeper than a business cycle, citing trade wars, weak investment, and fading population growth as permanent drags on Canada’s economy.

In an extraordinary press conference on October 29th, 2025, Bank of Canada Governor Tiff Macklem stood before reporters in Ottawa and calmly described what most Canadians have already been feeling for months: the economy is unraveling. But don’t expect him to say it in plain language. The central bank’s message was buried beneath bureaucratic doublespeak, carefully manicured forecasts, and bilingual spin. Strip that all away, and here’s what’s really going on: the Canadian economy has been gutted by a combination of political mismanagement, trade dependence, and a collapsing growth model based on mass immigration. The central bank knows it. The data proves it. And yet no one dares to say the quiet part out loud.

Start with the headline: the Bank of Canada cut interest rates by 25 basis points, bringing the policy rate down to 2.25%, its second consecutive cut and part of a 100 basis point easing campaign this year. That alone should tell you something is wrong. You don’t slash rates in a healthy economy. You do it when there’s pain. And there is. Canada’s GDP contracted by 1.6% in the second quarter of 2025. Exports are collapsing, investment is weak, and the unemployment rate is stuck at 7.1%, the highest non-pandemic level since 2016.

Macklem admitted it: “This is more than a cyclical downturn. It’s a structural adjustment. The U.S. trade conflict has diminished Canada’s economic prospects. The structural damage caused by tariffs is reducing the productive capacity of the economy.” That’s not just spin—that’s an admission of failure. A major trading nation like Canada has built its economic engine around exports, and now, thanks to years of reckless dependence on U.S. markets and zero effort to diversify, it’s all coming apart.

And don’t miss the implications of that phrase “structural adjustment.” It means the damage is permanent. Not temporary. Not fixable with a couple of rate cuts. Permanent. In fact, the Bank’s own Monetary Policy Report says that by the end of 2026, GDP will be 1.5% lower than it was forecast back in January. Half of that hit comes from a loss in potential output. The other half is just plain weak demand. And the reason that demand is weak? Because the federal government is finally dialing back the immigration faucet it’s been using for years to artificially inflate GDP growth.

The Bank doesn’t call it “propping up” GDP. But the facts are unavoidable. In its MPR, the Bank explicitly ties the coming consumption slowdown to a sharp drop in population growth: “Population growth is a key factor behind this expected slowdown, driven by government policies designed to reduce the inflow of newcomers. Population growth is assumed to slow to average 0.5% over 2026 and 2027.” That’s down from 3.3% just a year ago. So what was driving GDP all this time? People. Not productivity. Not innovation. Not exports. People.

And now that the government has finally acknowledged the political backlash of dumping half a million new residents a year into an overstretched housing market, the so-called “growth” is vanishing. It wasn’t real. It was demographic window dressing. Macklem admitted as much during the press conference when he said: “If you’ve got fewer new consumers in the economy, you’re going to get less consumption growth.” That’s about as close as a central banker gets to saying: we were faking it.

And yet despite all of this, the Bank still clings to its bureaucratic playbook. When asked whether Canada is heading into a recession, Macklem hedged: “Our outlook has growth resuming… but we expect that growth to be very modest… We could get two negative quarters. That’s not our forecast, but we can’t rule it out.” Translation: It’s already here, but we’re not going to admit it until StatsCan confirms it six months late.

Worse still, when reporters pressed him on what could lift the economy out of the ditch, he passed the buck. “Monetary policy can’t undo the damage caused by tariffs. It can’t target the hard-hit sectors. It can’t find new markets for companies. It can’t reconfigure supply chains.” So what can it do? “Mitigate spillovers,” Macklem says. That’s central banker code for “stand back and pray.”

So where’s the recovery supposed to come from? The Bank pins its hopes on a moderate rebound in exports, a bit of resilience in household consumption, and “ongoing government spending.” There it is. More public sector lifelines. More debt. More Ottawa Band-Aids.

And looming behind all of this is the elephant in the room: U.S. trade policy. The Bank explicitly warns that the situation could worsen depending on the outcome of next year’s U.S. election. The MPR highlights that tariffs are already cutting into Canadian income, raising business costs, and eliminating entire trade-dependent sectors. Governor Macklem put it plainly: “Unless something else changes, our incomes will be lower than they otherwise would have been.”

Canadians should be furious. For years, we were told everything was fine. That our economy was “resilient.” That inflation was “transitory.” That population growth would solve all our problems. Now we’re being told the economy is structurally impaired, trade-dependent to a fault, and stuck with weak per-capita growth, high unemployment, and sticky core inflation between 2.5–3%. And the people responsible for this mess? They’ve either resigned (Trudeau), failed upward (Carney), or still refuse to admit they spent a decade selling us a fantasy.

This isn’t just bad economics. It’s political malpractice.

Canada isn’t failing because of interest rates or some mysterious global volatility. It’s failing because of deliberate choices—trade dependence, mass immigration without infrastructure, and a refusal to confront reality. The central bank sees the iceberg. They’re easing the throttle. But the ship has already taken on water. And no one at the helm seems willing to turn the wheel.

So here’s the truth: The Bank of Canada just rang the alarm bell. Quietly. Cautiously. But clearly. The illusion is over. The fake growth era is ending. And the reckoning has begun.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Banks

Debanking Is Real, And It’s Coming For You

From the Frontier Centre for Public Policy

Marco Navarro-Genie warns that debanking is turning into Ottawa’s weapon of choice to silence dissent, and only the provinces can step in to protect Canadians.

Disagree with the establishment and you risk losing your bank account

What looked like a narrow, post-convoy overreach has morphed into something much broader—and far more disturbing. Debanking isn’t a policy misfire. It’s turning into a systemic method of silencing dissent—not just in Canada, but across the Western world.

Across Canada, the U.S. and the U.K., people are being cut off from basic financial services not because they’ve broken any laws, but because they hold views or support causes the establishment disfavors. When I contacted Eva Chipiuk after RBC quietly shut down her account, she confirmed what others had only whispered: this is happening to a lot of people.

This abusive form of financial blacklisting is deep, deliberate and dangerous. In the U.K., Nigel Farage, leader of Reform UK and no stranger to controversy, was debanked under the fig leaf of financial justification. Internal memos later revealed the real reason: he was deemed a reputational risk. Cue the backlash, and by 2025, the bank was forced into a settlement complete with an apology and compensation. But the message had already been sent.

That message didn’t stay confined to Britain. And let’s not pretend it’s just private institutions playing favourites. Even in Alberta—where one might hope for a little more institutional backbone—Tamara Lich was denied an appointment to open an account at ATB Financial. That’s Alberta’s own Crown bank. If you think provincial ownership protects citizens from political interference, think again.

Fortunately, not every institution has lost its nerve. Bow Valley Credit Union, a smaller but principled operation, has taken a clear stance: it won’t debank Albertans over their political views or affiliations. In an era of bureaucratic cowardice, Bow Valley is acting like a credit union should: protective of its members and refreshingly unapologetic about it.

South of the border, things are shifting. On Aug. 7, 2025, U.S. President Donald Trump signed an executive order titled “Guaranteeing Fair Banking for All Americans.” The order prohibits financial institutions from denying service based on political affiliation, religion or other lawful activity. It also instructs U.S. regulators to scrap the squishy concept of “reputational risk”—the bureaucratic smoke screen used to justify debanking—and mandates a review of past decisions. Cases involving ideological bias must now be referred to the Department of Justice.

This isn’t just paperwork. It’s a blunt declaration: access to banking is a civil right. From now on, in the U.S., politically motivated debanking comes with consequences.

Of course, it’s not perfect. Critics were quick to notice that the order conveniently omits platforms like PayPal and other payment processors—companies that have been quietly normalizing debanking for over a decade. These are the folks who love vague “acceptable use” policies and ideological red lines that shift with the political winds. Their absence from the order raises more than a few eyebrows.

And the same goes for another set of financial gatekeepers hiding in plain sight. Credit card networks like Visa, American Express and Mastercard have become powerful, unaccountable referees, denying service to individuals and organizations labelled “controversial” for reasons that often boil down to politics.

If these players aren’t explicitly reined in, banks might play by the new rules while the rest of the financial ecosystem keeps enforcing ideological conformity by other means.

If access to money is a civil right, then that right must be protected across the entire payments system—not just at your local branch.

While the U.S. is attempting to shield its citizens from ideological discrimination, there is a noticeable silence in Canada. Not a word of concern from the government benches—or the opposition. The political class is united, apparently, in its indifference.

If Ottawa won’t act, provinces must. That makes things especially urgent for Alberta and Saskatchewan. These are the provinces where dissent from Ottawa’s policies is most common—and where citizens are most likely to face politically motivated financial retaliation.

But they’re not powerless. Both provinces boast robust credit union systems. Alberta even owns ATB Financial, a Crown bank originally created to protect Albertans from central Canadian interference. But ownership without political will is just branding.

If Alberta and Saskatchewan are serious about defending civil liberties, they should act now. They can legislate protections that prohibit financial blacklisting based on political affiliation or lawful advocacy. They can require due process before any account is frozen. They can strip “reputational risk” from the rulebooks and make it clear to Ottawa: using banks to punish dissenters won’t fly here.

Because once governments—or corporations doing their bidding—can cut off your access to money for holding the wrong opinion, democracy isn’t just threatened.

It’s already broken.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

-

Agriculture18 hours ago

Agriculture18 hours agoBovaer Backlash Update: Danish Farmers Get Green Light to Opt Out as UK Arla Trial Abruptly Ends!

-

Business2 days ago

Business2 days agoCBC cashes in on Carney as the news industry playing field tilts further in its favour, crippling the competition

-

Business23 hours ago

Business23 hours agoCarney’s Floor-Crossing Campaign. A Media-Staged Bid for Majority Rule That Erodes Democracy While Beijing Hovers

-

Daily Caller1 day ago

Daily Caller1 day agoMcKinsey outlook for 2025 sharply adjusts prior projections, predicting fossil fuels will dominate well after 2050

-

Agriculture2 days ago

Agriculture2 days agoFarmers Take The Hit While Biofuel Companies Cash In

-

Business1 day ago

Business1 day agoTrump: Americans to receive $2,000 each from tariff revenue

-

armed forces19 hours ago

armed forces19 hours agoIt’s time for Canada to remember, the heroes of Kapyong

-

International1 day ago

International1 day agoBBC boss quits amid scandal over edited Trump footage