Alberta

Red Deer South MLA Jason Stephan strongly urges Central Albertans to participate in the upcoming Leadership Review

Leadership Review of Jason Kenney in Red Deer

On Saturday, April 9, Alberta conservatives, of which there are many in Central Alberta, will have the opportunity to decide whether it is time to change the leader of the United Conservative Party. The vote will occur at the Cambridge Hotel in Red Deer.

What is the purpose of the leadership review?

Jason Kenney has been leader of the party for over 4 years, and to date, members have not yet had an opportunity to review his performance.

Several months ago, 22 local UCP constituency associations, passed resolutions requiring a review of the leader. Members have been waiting for a leadership review; it aligns with conservative principles of governance and accountability.

The United Conservative Party belongs to all Alberta conservatives, and it is the grassroots members who determine whether it is time to change our leader.

We have seen too much contention. It is not right to label men or women as “mainstream” or “extreme” depending on whether or not they want a change in leader. Our party has seen too much dividing, too much labelling, sometimes change is required to heal, to unite and move forward.

We will have a provincial election in the spring of 2023. Alberta is a conservative province, yet our party is not doing as well as it should in the polls.

We should always seek to put our best foot forward. This review will provide members of the party with the option to change the leader before the upcoming 2023 provincial election.

This is Your Time. You decide, not the leader, not the party.

Have you sometimes felt voiceless over the past two years? I understand that feeling. I have sometimes felt it myself. But this is your time. You can have a voice and it will be important. This is an opportunity for you to decide, not the leader, not the party.

Alberta conservatives will agree with many of policies of a conservative government. That is no surprise, conservative policies are very different from NDP policies. Conservative policies, regardless of the leader, increase economic prosperity and it is exciting to see this occurring.

But a leadership review is not about a comparison to the NDP. That will be the purpose of the election. Leadership reviews are about conservatives putting our best foot forward with the right leader for the right time.

All of us have strengths and weaknesses – some leaders are better suited for some times but not others. Sometimes a change in leader is simply a positive recognition of this truth.

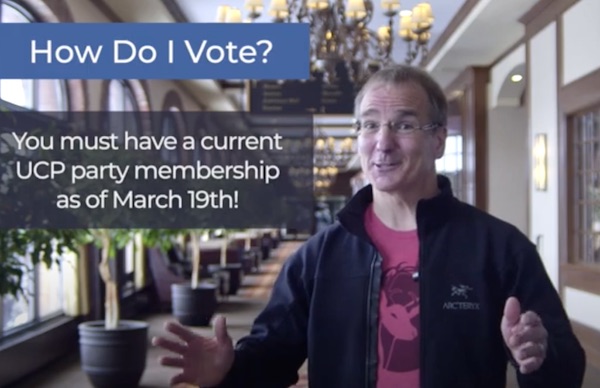

How do I vote?

This is what you must do to vote. There are three steps.

First, if you need to, buy or renew your party membership by March 19. The cost of a membership is $10 for one year. If you have any doubts whether your membership is current, you may want to pay $10 to make sure.

If you need to, but do not buy or renew your party membership by March 19 you do not get to vote!

Party memberships can be purchased online at – www.unitedconservative.ca/take-action/membership

Second, register on-line to vote. If you do this prior to March 19, the cost is $99 if you are over 25. If you less than 26, the cost is $49 – so let’s involve our families and many young conservatives, giving them a unique opportunity to have a voice!

After March 19, unless the party extends early bird prices, on-line registration costs increase to $149.

Online registration is at – www.unitedconservative.ca/sgm-2022

Last step, come to our Cambridge Hotel on April 9, between noon and 6 PM and vote!

What happens if Alberta conservatives want to change in their leader?

If Alberta conservatives say it is time to change the leader, there will be a leadership race for a new leader.

To assume that any one person is the only person who would be a good leader for our party is a false assumption, disregarding the many wonderful men and women in our province.

Politics should not be a career. It is a special opportunity to serve and having contributed one’s unique experiences and talents for the public good, stepping aside and allowing others to do the same.

Great leaders lead in love and inspire the best in those they serve.

There are many honest and principled men and women with their own unique strengths and experiences to offer for this time, who could be great leaders of our party.

A massive vote that is a true representation of Alberta grassroots conservatives is the right outcome.

Your voice matters! This is an important opportunity, let your friends and family know, invite them to come and join you, to have fun together, to take action together, to have your say, and to be heard! Let’s do it! See you there!

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

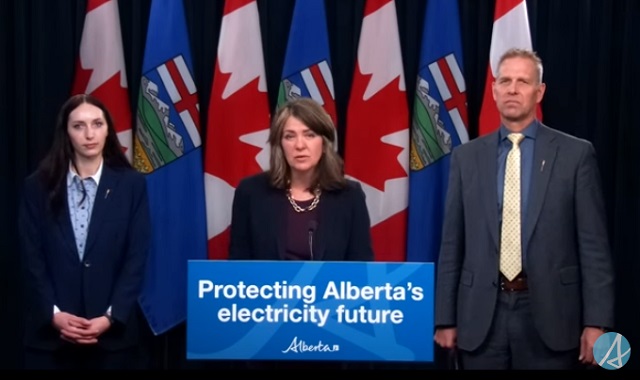

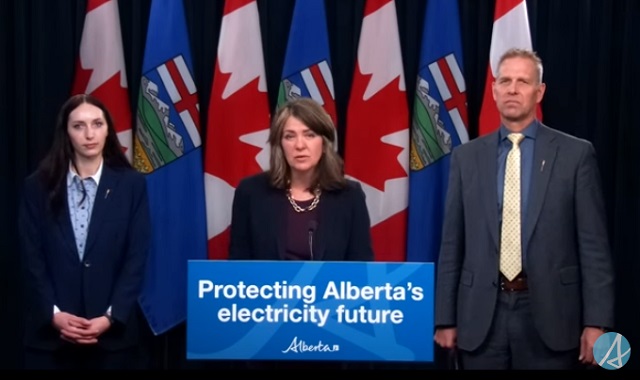

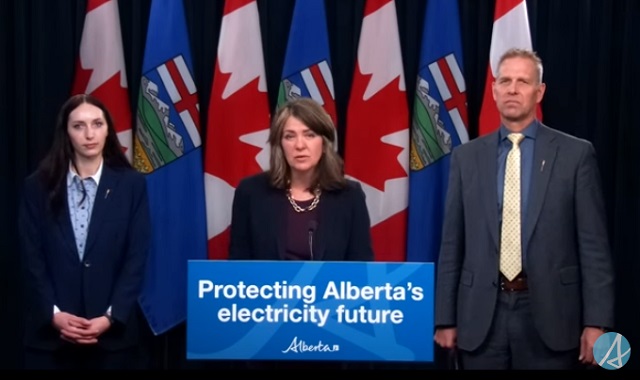

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoThe tale of two teachers

-

Business1 day ago

Business1 day agoMaxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

-

International19 hours ago

International19 hours agoUN attacks stay-at-home motherhood as ‘gender inequality’

-

COVID-191 day ago

COVID-191 day agoWHO Official Admits the Truth About Passports

-

Alberta20 hours ago

Alberta20 hours agoProvince to stop municipalities overcharging on utility bills

-

Energy19 hours ago

Energy19 hours agoAnti-LNG activists have decided that they now actually care for LNG investors after years of calling to divest

-

Alberta1 day ago

Alberta1 day agoAlberta moves to protect Edmonton park from Trudeau government’s ‘diversity’ plan

-

Freedom Convoy1 day ago

Freedom Convoy1 day agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge