Canadian Energy Centre

RBC says Canada’s Indigenous owned energy projects are ‘economic reconciliation in action’

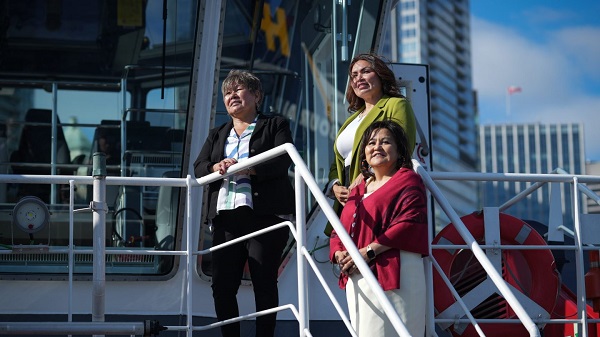

Eva Clayton, back left, President of the Nisga’a Lisims Government (joint venture owner of the proposed Ksi Lisims LNG project), Crystal Smith, back right, Haisla Nation Chief Councillor (joint venture owner of the Cedar LNG project, now under construction), and Karen Ogen, front right, CEO of the First Nations Natural Gas Alliance pose for a photograph on the HaiSea Wamis zero-emission tugboat outside the LNG2023 conference, in Vancouver, B.C., Monday, July 10, 2023. CP Images photo

From the Canadian Energy Centre

As construction gets underway on Cedar LNG, the world’s first Indigenous majority-owned LNG export terminal, a report from RBC highlights the project as a model of successful energy development in Canada.

“We broke a pattern that had existed for over a century,” said Karen Ogen, CEO of the First Nations Natural Gas Alliance.

“First Nations have been at the heart of the LNG opportunity, not on the sidelines or just on the job sites but in the boardrooms helping to make it happen.”

RBC said the Cedar LNG project in Kitimat, B.C. – a partnership between the Haisla Nation (50.1 per cent) and Pembina Pipeline Corporation (49.9 per cent) – is a model for Indigenous economic reconciliation in action.

“Canada’s future growth and prosperity depends heavily on getting Indigenous economic reconciliation right,” said report co-author Varun Srivatsan, RBC’s director of policy and strategic engagement.

“If not, the country’s ability to diversify our resource exports, enjoy independence and resiliency in strategic sectors, and improve productivity, which has lagged that of other countries for years, are all at risk.”

RBC outlined the enormous potential of Indigenous-led energy projects to drive economic growth.

Almost three-quarters of the 504 major resource and energy projects planned or underway in Canada run through or are within 20 kilometres of Indigenous territories.

The value of Indigenous equity opportunity from these projects is estimated at $98 billion over the next 10 years, with oil and gas projects dominating the list at $57.6 billion.

“It’s clear that First Nations are critical to LNG in Canada. It’s First Nations territory from where the gas is extracted in Treaty 8 territory, it’s First Nations territory across which gas is transported via pipeline, it’s First Nations territory where LNG terminals are located, and it’s First Nations waters through which carriers take LNG to market. This is why we say Canadian LNG is Indigenous LNG. And we are going to make history,” Ogen said.

Cedar LNG reached a final investment decision last June, following a permitting process that saw the Haisla Nation directly involved in planning the facilities and operations.

This includes a floating LNG terminal with emissions among the world’s lowest, at 0.08 per cent CO2 equivalent per tonne of LNG compared to the global average of 0.35 per cent. Operations are slated to start in late 2028.

“Our community felt it was important that our values of being Haisla, being Indigenous, were felt through every decision that was being made. That is what makes this project unique,” said Crystal Smith, the Haisla Nation’s elected chief councillor.

Central to the Haisla’s involvement in Cedar LNG are the jobs and ongoing revenues that benefit the nation and neighbouring communities.

This has included support for education and cultural programs and building a state-of-the-art health facility and a new housing development.

“Cedar LNG shows what is achievable when you have a shared vision,” Smith said.

“It is going to mean that my kids and grandkids have a different future from what I or anybody in my generation have experienced in our community. It is going to revive our culture, revive our language, and make us stronger going forward.”

Alberta

Enbridge CEO says ‘there’s a good reason’ for Alberta to champion new oil pipeline

Enbridge CEO Greg Ebel. The company’s extensive pipeline network transports about 30 per cent of the oil produced in North America and nearly 20 per cent of the natural gas consumed in the United States. Photo courtesy Enbridge

From the Canadian Energy Centre

B.C. tanker ban an example of federal rules that have to change

The CEO of North America’s largest pipeline operator says Alberta’s move to champion a new oil pipeline to B.C.’s north coast makes sense.

“There’s a good reason the Alberta government has become proponent of a pipeline to the north coast of B.C.,” Enbridge CEO Greg Ebel told the Empire Club of Canada in Toronto the day after Alberta’s announcement.

“The previous [federal] government’s tanker ban effectively makes that export pipeline illegal. No company would build a pipeline to nowhere.”

It’s a big lost opportunity. With short shipping times to Asia, where oil demand is growing, ports on B.C.’s north coast offer a strong business case for Canadian exports. But only if tankers are allowed.

A new pipeline could generate economic benefits across Canada and, under Alberta’s plan, drive economic reconciliation with Indigenous communities.

Ebel said the tanker ban is an example of how policies have to change to allow Canada to maximize its economic potential.

Repealing the legislation is at the top of the list of needed changes Ebel and 94 other energy CEOs sent in a letter to Prime Minister Mark Carney in mid-September.

The federal government’s commitment to the tanker ban under former Prime Minister Justin Trudeau was a key factor in the cancellation of Enbridge’s Northern Gateway pipeline.

That project was originally targeted to go into service around 2016, with capacity to ship 525,000 barrels per day of Canadian oil to Asia.

“We have tried to build nation-building pipelines, and we have the scars to prove it. Five hundred million scars, to be quite honest,” Ebel said, referencing investment the company and its shareholders made advancing the project.

“Those are pensioners and retail investors and employees that took on that risk, and it was difficult,” he said.

For an industry proponent to step up to lead a new Canadian oil export pipeline, it would likely require “overwhelming government support and regulatory overhaul,” BMO Capital Markets said earlier this year.

Energy companies want to build in Canada, Ebel said.

“The energy sector is ready to invest, ready to partner, partner with Indigenous nations and deliver for the country,” he said.

“None of us is calling for weaker environmental oversight. Instead, we are urging government to adopt smarter, clearer, faster processes so that we can attract investment, take risks and build for tomorrow.”

This is the time for Canadians “to remind ourselves we should be the best at this,” Ebel said.

“We should lead the way and show the world how it’s done: wisely, responsibly, efficiently and effectively.”

With input from a technical advisory group that includes pipeline leaders and Indigenous relations experts, Alberta will undertake pre-feasibility work to identify the pipeline’s potential route and size, estimate costs, and begin early Indigenous engagement and partnership efforts.

The province aims to submit an application to the Federal Major Projects Office by spring 2026.

Alberta

‘Visionary’ Yellowhead Pipeline poised to launch Alberta into the future

From the Canadian Energy Centre

Heartland leaders welcome proposed new natural gas connector

As a lifelong farmer, entrepreneur and community leader, Alanna Hnatiw knows first-hand the crucial role energy plays in a strong and diverse economy.

The mayor of Sturgeon County, a sprawling rural municipality northeast of Edmonton, Hnatiw has spent much of the last decade working to protect its agricultural roots while building new industries that support the jobs and services families and businesses rely on every day.

Hnatiw says there is widespread appreciation among the county’s 20,000 residents for the opportunities afforded by the province’s oil and gas resources. That’s why she joined other leaders in Alberta’s Industrial Heartland region to applaud a major new natural gas pipeline planned for the area.

“Natural gas is an integral to all the industrial operations in Sturgeon County and the surrounding area. It goes beyond just burning it to turn turbines, it is the feedstock for all kinds of value-added processing. From fertilizer and plastics to petrochemicals and hydrogen, natural gas is the lynchpin for us into the future,” she said.

Filling growing demand

Hnatiw is one of more than a dozen community and industry leaders who sent letters of support to the Alberta Utilities Commission (AUC) last year endorsing ATCO Energy Systems’ proposed Yellowhead Pipeline project.

The project achieved a significant milestone in August when the AUC approved ATCO’s application determining the pipeline is needed.

The largest infrastructure investment in the company’s history, the 230-kilometre pipeline from Peers to Fort Saskatchewan will transport more than 1.1 billion cubic feet of natural gas per day when operational in late 2027.

For context, Alberta produced about 11 billion cubic feet per day of natural gas in 2024, according to the Alberta Energy Regulator.

The Yellowhead Pipeline will boost deliveries to the greater Edmonton area as demand continues to grow for power generation, manufacturing, petrochemical processing and residential use.

Industrial customers have reserved 90 per cent of the pipeline’s capacity to meet their future needs.

This includes Dow Chemical, which plans to build an $8.9-billion net-zero ethylene processing facility in Fort Saskatchewan, Heidelberg Materials’ Edmonton facility that aims to be the world’s first full-scale cement plant equipped with carbon capture and storage (CCS), and McCain Foods, which requires more natural gas for a planned expansion of its French fry factory in Coaldale.

Prosperity driver

Edmonton Global CEO Malcolm Bruce described the Yellowhead Pipeline as a “visionary” infrastructure project in his letter of support to the AUC.

“The [project] will create jobs, enable billions in new investment and drive Alberta’s hydrogen roadmap and natural gas vision and strategy.”

ATCO’s projections show the pipeline will generate substantial economic benefits. The company estimates that during construction, it will support 12,000 jobs and contribute $1.6 billion per year to Alberta’s economy.

Once in operation, the pipeline is expected to support 23,700 jobs per year and add $3.9 billion annually to Alberta’s GDP.

For Sturgeon County, the project also provides much-needed certainty that natural gas will be available for the $30 billion in new industrial investments the region is hoping to attract in the coming years.

Future plans

The municipality is already home to major operations including the NWR Sturgeon Refinery and Nutrien fertilizer plant, both of which capture carbon dioxide emissions that are transported through the Alberta Carbon Trunk Line for deep underground storage near Clive, Alberta.

Hnatiw said future development may include hydrogen production with CCS, petrochemical processing, gas-fired power plants and large-scale data centres.

“With our operations running near capacity right now, this new pipeline helps alleviate the uncertainty around gas supplies for industrial developers,” Hnatiw said.

The county’s industrial goals are inextricably tied to ensuring its farming sector continues to flourish, she said.

“Eighty per cent of our land base is agricultural, but it only accounts for one per cent of our budget as far as taxes go, so we need our industrial residents to support our rural way of life,” she said.

“We don’t want people to have to leave our community to make a living. We want a future that is full of opportunity, and one that is also sustainable for the families that produce our food, our fuel, and all the other value-added products we can provide.”

ATCO’s next step is to file for AUC approval to build the pipeline later this year. The company expects construction to begin in 2026.

-

Daily Caller2 days ago

Daily Caller2 days agoUtah Republican Senator Planning To Attend Big Globalist Climate Shindig Despite Trump’s Energy Policies

-

International23 hours ago

International23 hours agoNumber of young people identifying as ‘transgender’ declines sharply: report

-

Energy1 day ago

Energy1 day agoIndigenous Communities Support Pipelines, Why No One Talks About That

-

Business1 day ago

Business1 day agoFinance Committee Recommendation To Revoke Charitable Status For Religion Short Sighted And Destructive

-

Business19 hours ago

Business19 hours ago“Nation Building,” Liberal Style: We’re Fixing a Sewer, You’re Welcome, Canada

-

Bruce Dowbiggin19 hours ago

Bruce Dowbiggin19 hours agoLong-Distance Field Goals Have Flipped The Field. Will The NFL Panic?

-

Business2 days ago

Business2 days agoFinance Titans May Have Found Trojan Horse For ‘Climate Mandates’

-

Alberta21 hours ago

Alberta21 hours agoThe Technical Pitfalls and Political Perils of “Decarbonized” Oil