Taxpayers

Police admit Canadian bribery scandal was nixed without talking to Trudeau, reviewing records

From LifeSiteNews

The Royal Canadian Mounted Police believed there was political pressure to dismiss a government bribery case against engineering firm SNC-Lavalin in 2019 but claimed there was insufficient evidence to proceed.

The Royal Canadian Mounted Police (RCMP) confirmed that it never talked with Prime Minister Justin Trudeau or was able to view secret cabinet records before dismissing charges in a bribery scandal involving the large engineering firm SNC-Lavalin.

The RCMP’s admission came after intense questioning before the House of Commons ethics committee late last month.

As per Blacklock’s Reporter, RCMP commissioner Michael Duheme testified, “No one is above the law,” adding that there was “insufficient evidence to proceed” with the investigation.

In a 2021 memo titled RCMP Assessment Report: Obstruction of Justice SNC-Lavalin Affair obtained from Access to Information requests last October by Democracy Watch, the RCMP noted that it did not doubt there was indeed political pressure to stop criminal prosecution of SNC-Lavalin.

“However, for it to be an offence under the Criminal Code, there must be more than a technical violation,” the 2021 memo read.

During the House of Commons ethics committee meeting in February, Duheme said he had considered the SNC-Lavalin case routine, noting, “We approach every investigation in the same manner.”

Staff Sergeant Frédéric Pincince, who serves as a director of investigations, admitted that the RCMP never questioned Trudeau in the SNC-Lavalin case but gave no reason.

“He was not interviewed,” testified Pincince, to which Conservative MP Larry Brock asked, “Was there at least an attempt to interview Justin Trudeau?”

“No,” Pincince replied.

SNC-Lavalin, which now goes by the name “AtkinsRéalis,” in 2019 pleaded guilty to fraud in a Québec Provincial Court and was hit with a $280 million fine. Company executives also admitted that they had paid $47.7 million in bribes to get contracts in Libya.

In October 2023, Canadian Liberal MPs on the ethics committee voted to stop the RCMP from testifying about the SNC-Lavalin bribery scandal.

In June 2023, LifeSiteNews reported that the RCMP denied it was looking into whether Trudeau and his cabinet committed obstruction of justice concerning the SNC-Lavalin bribery scandal.

SNC-Lavalin was faced with changes of corruption and fraud concerning about $48 million in payments made to Libyan government officials between 2001 and 2011. The company had hoped to be spared a trial and prosecution deferred prosecution agreement.

However, then-Attorney General Jody Wilson-Raybould did not go along with Trudeau’s plan, which would have allegedly appeared to help SNC-Lavalin. In 2019, she contended that both Trudeau and his top Liberal officials had inappropriately applied pressure on her for four months to directly intervene in the criminal prosecution of Montreal-based global engineering firm SNC-Lavalin relating to its scandal involving corruption and bribery charges connected to government contracts it once had in Libya.

Commissioner mum on whether there was ‘reluctance’ to charge a sitting PM

During the ethics committee meeting, Brock asked Duheme if there was an “overall general reluctance in charging a sitting Prime Minister?”

“I would say to that, we follow the evidence and if the evidence warrants charges, we charge,” Duheme replied.

Brock then asked if the RCMP obtained “all relevant documents to further the investigation?”

Duheme admitted that “we were limited with the information that we had access to.”

Brock pressed him, asking, “Is that a yes or no, sir?” to which Duheme replied, “I don’t know,” adding, “We didn’t know.”

“We don’t know, we still don’t know to this day all the information that is out there,” Duheme responded.

Brock then pressed Duheme, asking why the RCMP did not “exercise its absolute statutory right under the Criminal Code to obtain a production order or search warrant from a justice to obtain those cabinet documents?”

Duheme said the RCMP were not “able to obtain enough information or evidence.”

As for the initial investigation concerning SNC-Lavalin, Wilson-Raybould testified in early 2019 to Canada’s justice committee that she believed she was moved from her then-justice cabinet posting to veterans’ affairs due to the fact she did not grant a request from SNC-Lavalin for a deferred prosecution agreement rather than a criminal trial.

Of note is that a criminal conviction would have banned the company from landing any government contracts for 10 years.

Trudeau flat-out denied it was being investigated by the RCMP.

Less than four years ago, Trudeau was found to have broken the federal ethics laws, or Section 9 of the Conflict of Interest Act, for his role in pressuring Wilson-Raybould.

On February 12, 2019, Wilson-Raybould resigned from her veterans’ affairs post and Treasury Board president Jane Philpott quit in March 2019. They both cited a lack of confidence in the Liberal government’s handling of the scandal.

Then, in April 2019, Trudeau turfed Wilson-Raybould and Philpott from his caucus, meaning they were no longer part of the Liberal Party.

Business

Federal government’s accounting change reduces transparency and accountability

From the Fraser Institute

By Jake Fuss and Grady Munro

Carney’s deficit-spending plan over the next four years dwarfs the plan from Justin Trudeau, the biggest spender (per-person, inflation-adjusted) in Canadian history, and will add many more billions to Canada’s mountain of federal debt. Yet Prime Minister Carney has tried to sell his plan as more responsible than his predecessor’s.

All Canadians should care about government transparency. In Ottawa, the federal government must provide timely and comprehensible reporting on federal finances so Canadians know whether the government is staying true to its promises. And yet, the Carney government’s new spending framework—which increases complexity and ambiguity in the federal budget—will actually reduce transparency and make it harder for Canadians to hold the government accountable.

The government plans to separate federal spending into two budgets: the operating budget and the capital budget. Spending on government salaries, cash transfers to the provinces (for health care, for example) and to people (e.g. Old Age Security) will fall within the operating budget, while spending on “anything that builds an asset” will fall within the capital budget. Prime Minister Carney plans to balance the operating budget by 2028/29 while increasing spending within the capital budget (which will be funded by more borrowing).

According to the Liberal Party platform, this accounting change will “create a more transparent categorization of the expenditure that contributes to capital formation in Canada.” But in reality, it will muddy the waters and make it harder to evaluate the state of federal finances.

First off, the change will make it more difficult to recognize the actual size of the deficit. While the Carney government plans to balance the operating budget by 2028/29, this does not mean it plans to stop borrowing money. In fact, it will continue to borrow to finance increased capital spending, and as a result, after accounting for both operating and capital spending, will increase planned deficits over the next four years by a projected $93.4 billion compared to the Trudeau government’s last spending plan. You read that right—Carney’s deficit-spending plan over the next four years dwarfs the plan from Justin Trudeau, the biggest spender (per-person, inflation-adjusted) in Canadian history, and will add many more billions to Canada’s mountain of federal debt. Yet Prime Minister Carney has tried to sell his plan as more responsible than his predecessor’s.

In addition to obscuring the amount of borrowing, splitting the budget allows the government to get creative with its accounting. Certain types of spending clearly fall into one category or another. For example, salaries for bureaucrats clearly represent day-to-day operations while funding for long-term infrastructure projects are clearly capital investments. But Carney’s definition of “capital spending” remains vague. Instead of limiting this spending category to direct investments in long-term assets such as roads, ports or military equipment, the government will also include in the capital budget new “incentives” that “support the formation of private sector capital (e.g. patents, plants, and technology) or which meaningfully raise private sector productivity.” In other words, corporate welfare.

Indeed, based on the government’s definition of capital spending, government subsidies to corporations—as long as they somehow relate to creating an asset—could potentially land in the same spending category as new infrastructure spending. Not only would this be inaccurate, but this broad definition means the government could potentially balance the operating budget simply by shifting spending over to the capital budget, as opposed to reducing spending. This would add to the debt but allow the government to maneuver under the guise of “responsible” budgeting.

Finally, rather than split federal spending into two budgets, to increase transparency the Carney government could give Canadians a better idea of how their tax dollars are spent by providing additional breakdowns of line items about operating and capital spending within the existing budget framework.

Clearly, Carney’s new spending framework, as laid out in the Liberal election platform, will only further complicate government finances and make it harder for Canadians to hold their government accountable.

Business

Carney poised to dethrone Trudeau as biggest spender in Canadian history

From the Fraser Institute

By Jake Fuss

The Liberals won the federal election partly due to the perception that Prime Minister Mark Carney will move his government back to the political centre and be more responsible with taxpayer dollars. But in fact, according to Carney’s fiscal plan, he doesn’t think Justin Trudeau was spending and borrowing enough.

To recap, the Trudeau government recorded 10 consecutive budget deficits, racked up $1.1 trillion in debt, recorded the six highest spending years (per person, adjusted for inflation) in Canadian history from 2018 to 2023, and last fall projected large deficits (and $400 billion in additional debt) over the next four years including a $42.2 billion deficit this fiscal year.

By contrast, under Carney’s plan, this year’s deficit will increase to a projected $62.4 billion while the combined deficits over the subsequent three years will be $67.7 billion higher than under Trudeau’s plan.

Consequently, the federal debt, and debt interest costs, will rise sharply. Under Trudeau’s plan, federal debt interest would have reached a projected $66.3 billion in 2028/29 compared to $68.7 billion under the new Carney plan. That’s roughly equivalent to what the government will spend on employment insurance (EI), the Canada Child Benefit and $10-a-day daycare combined. More taxpayer dollars will be diverted away from programs and services and towards servicing the debt.

Clearly, Carney plans to be a bigger spender than Justin Trudeau—who was the biggest spender in Canadian history.

On the campaign trail, Carney was creative in attempting to sell this as a responsible fiscal plan. For example, he split operating and capital spending into two separate budgets. According to his plan’s projections, the Carney government will balance the operating budget—which includes bureaucrat salaries, cash transfers (e.g. health-care funding) and benefits (e.g. Old Age Security)—by 2028/29, while borrowing huge sums to substantially increase capital spending, defined by Carney as anything that builds an asset. This is sleight-of-hand budgeting. Tell the audience to look somewhere—in this case, the operating budget—so it ignores what’s happening in the capital budget.

It’s also far from certain Carney will actually balance the operating budget. He’s banking on finding a mysterious $28.0 billion in savings from “increased government productivity.” His plan to use artificial intelligence and amalgamate service delivery will not magically deliver these savings. He’s already said no to cutting the bureaucracy or reducing any cash transfers to the provinces or individuals. With such a large chunk of spending exempt from review, it’s very difficult to see how meaningful cost savings will materialize.

And there’s no plan to pay for Carney’s spending explosion. Due to rising deficits and debt, the bill will come due later and younger generations of Canadians will bear this burden through higher taxes and/or fewer services.

Finally, there’s an obvious parallel between Carney and Trudeau on the inventive language used to justify more spending. According to Carney, his plan is not increasing spending but rather “investing” in the economy. Thus his campaign slogan “Spend less, invest more.” This wording is eerily similar to the 2015 and 2019 Trudeau election platforms, which claimed all new spending measures were merely “investments” that would increase economic growth. Regardless of the phrasing, Carney’s spending increases will produce the same results as under Trudeau—federal finances will continue to deteriorate without any improvement in economic growth. Canadian living standards (measured by per-person GDP) are lower today than they were seven years ago despite a massive increase in federal “investment” during the Trudeau years. Yet Carney, not content to double down on this failed approach, plans to accelerate it.

The numbers don’t lie; Carney’s fiscal plan includes more spending and borrowing than Trudeau’s plan. This will be a fiscal and economic disaster with Canadians paying the price.

-

Crime21 hours ago

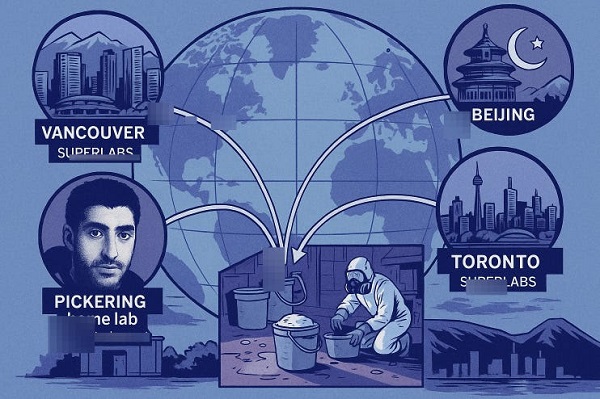

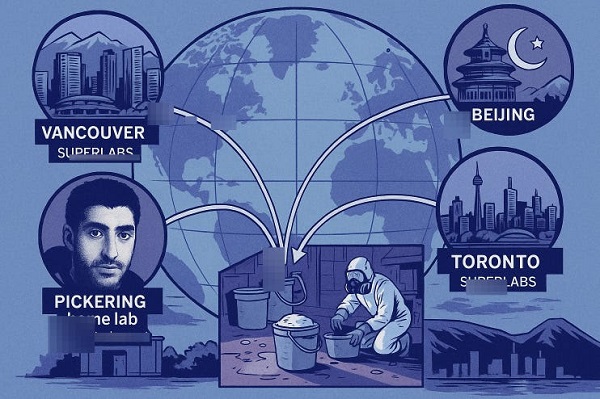

Crime21 hours agoCanada Blocked DEA Request to Investigate Massive Toronto Carfentanil Seizure for Terror Links

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThe Liberals torched their own agenda just to cling to power

-

Business1 day ago

Business1 day agoCanada urgently needs a watchdog for government waste

-

Business2 days ago

Business2 days agoTrump says he expects ‘great relationship’ with Carney, who ‘hated’ him less than Poilievre

-

COVID-1912 hours ago

COVID-1912 hours agoTulsi Gabbard says US funded ‘gain-of-function’ research at Wuhan lab at heart of COVID ‘leak’

-

Business13 hours ago

Business13 hours agoTop Canadian bank ditches UN-backed ‘net zero’ climate goals it helped create

-

Business1 day ago

Business1 day agoOverregulation is choking Canadian businesses, says the MEI

-

International4 hours ago

International4 hours agoPentagon Salivates Over ‘Expensive’ Weapons While China Races Into Future With Iron Grip Over Cheap Drone Tech