Business

Patriotic Millionaires concept of tax ‘fairness’ ignores tax facts in Canada

From the Fraser Institute

By Jake Fuss and Tegan Hill

A group of wealthy Canadians called the “Patriotic Millionaires” recently asked governments in Canada to increase the amount of taxes they pay to “ensure greater fairness” in the system. In particular, the group is calling for a wealth tax and higher taxes on capital gains.

Unfortunately, the Patriotic Millionaires (whose motto is “Tax the rich!”) seem to misunderstand the current distribution of taxes paid by different income groups in Canada and the economic consequences of raising taxes.

The fixation on tax “fairness” (which the Patriotic Millionaires never actually define) is not new in Canada. It was a constant focus of the Trudeau government, which decided to increase “fairness” by increasing the top federal personal income tax rate from 29 per cent to 33 per cent in 2016 and proposing to raise taxes on capital gains in 2024.

These policies, like the Patriotic Millionaires, ignored basic facts about taxes. According to a recent study, the top 20 per cent of income-earning families in Canada paid 54.2 per cent of all federal, provincial and local taxes while earning less than half of the country’s total income (46.4 per cent). These families are the only income group in Canada that pay a larger share of taxes than their share of income.

In contrast, the remaining 80 per cent of Canadian families pay less in taxes than their share of total income. For example, the bottom 20 per cent of income-earning families pay 2.0 per cent of total taxes while earning 5.0 per cent of total income.

Why? Because Canada, like most advanced economies, has a progressive income tax system where government taxes individuals at increasingly higher rates as their income rises. For example, the marginal federal tax rate is 15 per cent on individual incomes up to $57,375 but more than double that rate (33 per cent) on income that exceeds $253,414.

According to the Patriotic Millionaires, Canada needs a “wealth tax,” which taxes a person’s net wealth. But time and time again, wealth taxes have failed to deliver the promised results of proponents. Eight European countries that experimented with wealth taxes have since abandoned them because they were expensive to administer, raised little revenue and imposed enormous costs on their economies. In particular, wealth taxes discourage investment, which is needed to broadly raise living standards and improve prosperity, by prompting people to move their assets away from productive investments (e.g. new businesses) to investments that may be exempt from the tax.

So, if Ottawa implemented a wealth tax, we’d likely see a reallocation of investment away from startups and towards housing (assuming housing remains exempt from the tax). Consequently, companies and investors would have less resources to invest in the technology, machinery and equipment that improve productivity, create jobs and drive higher living standards, particularly for average workers.

The Patriotic Millionaires also want to raise taxes on capital gains, which would have similar negative effects by making it more expensive for individuals and businesses to invest in Canada, leading to stagnant wages and living standards for Canadians.

The Patriotic Millionaires are misguided in their claims about “fairness” in the tax system. High-income earners already pay the majority of all taxes in Canada, and proportionality is one of the only objective measures of fairness with respect to the tax burden. Their policy proposals, if enacted by government, would only harm the economy rather than help it. That wouldn’t be fair to Canadian workers.

Business

Parliamentary Budget Officer begs Carney to cut back on spending

PBO slices through Carney’s creative accounting

The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to cut spending following today’s bombshell Parliamentary Budget Officer report that criticizes the government’s definition of capital spending and promise to balance the operating budget.

“The reality is that Carney is continuing on a course of unaffordable borrowing and the PBO report shows government messaging about ‘balancing the operating budget’ is not credible,” said Franco Terrazzano, CTF Federal Director. “Carney is using creative accounting to hide the spiralling debt.”

Carney’s Budget 2025 splits the budget into operating and capital spending and promises to balance the operating budget by 2028-29.

However, today’s PBO budget report states that Carney’s definition of capital spending is “overly expansive.” Without using that “overly expansive” definition of capital spending, the government would run an $18 billion operating deficit in 2028-29, according to the PBO.

“Based on our definition, capital investments would total $217.3 billion over 2024-25 to 2029-30, which is approximately 30 per cent ($94 billion) lower compared to Budget 2025,” according to the PBO. “Moreover, based on our definition, the operating balance in Budget 2025 would remain in a deficit position over 2024-25 to 2029-30.”

The PBO states that the Carney government is using “a definition of capital investment that expands beyond the current treatment in the Public Accounts and international practice.” The report specifically points out that “by including corporate income tax expenditures, investment tax credits and operating (production) subsidies, the framework blends policy measures with capital formation.”

The federal government plans to borrow about $80 billion this year, according to Budget 2025. Carney has no plan stop borrowing money and balance the budget. Debt interest charges will cost taxpayers $55.6 billion this year, which is more than the federal government will send to the provinces in health transfers ($54.7 billion) or collect through the GST ($54.4 billion).

“Carney isn’t balancing anything when he borrows tens of billions of dollars every year,” Terrazzano said. “Instead of applying creative accounting to the budget numbers, Carney needs to cut spending and debt.”

Business

Carney government needs stronger ‘fiscal anchors’ and greater accountability

From the Fraser Institute

By Tegan Hill and Grady Munro

Following the recent release of the Carney government’s first budget, Fitch Ratings (one of the big three global credit rating agencies) issued a warning that the “persistent fiscal expansion” outlined in the budget—characterized by high levels of spending, borrowing and debt accumulation—will erode the health of Canada’s finances and could lead to a downgrade in Canada’s credit rating.

Here’s why this matters. Canada’s credit rating impacts the federal government’s cost of borrowing money. If the government’s rating gets downgraded—meaning Canadian federal debt is viewed as an increasingly risky investment due to fiscal mismanagement—it will likely become more expensive for the government to borrow money, which ultimately costs taxpayers.

The cost of borrowing (i.e. the interest paid on government debt) is a significant part of the overall budget. This year, the federal government will spend a projected $55.6 billion on debt interest, which is more than one in every 10 dollars of federal revenue, and more than the government will spend on health-care transfers to the provinces. By 2029/30, interest costs will rise to a projected $76.1 billion or more than one in every eight dollars of revenue. That’s taxpayer money unavailable for programs and services.

Again, if Canada’s credit rating gets downgraded, these costs will grow even larger.

To maintain a good credit rating, the government must prevent the deterioration of its finances. To do this, governments establish and follow “fiscal anchors,” which are fiscal guardrails meant to guide decisions regarding spending, taxes and borrowing.

Effective fiscal anchors ensure governments manage their finances so the debt burden remains sustainable for future generations. Anchors should be easily understood and broadly applied so that government cannot get creative with its accounting to only technically abide by the rule, but still give the government the flexibility to respond to changing circumstances. For example, a commonly-used rule by many countries (including Canada in the past) is a ceiling/target for debt as a share of the economy.

The Carney government’s budget establishes two new fiscal anchors: balancing the federal operating budget (which includes spending on day-to-day operations such as government employee compensation) by 2028/29, and maintaining a declining deficit-to-GDP ratio over the years to come, which means gradually reducing the size of the deficit relative to the economy. Unfortunately, these anchors will fail to keep federal finances from deteriorating.

For instance, the government’s plan to balance the “operating budget” is an example of creative accounting that won’t stop the government from borrowing money each year. Simply put, the government plans to split spending into two categories: “operating spending” and “capital investment” —which includes any spending or tax expenditures (e.g. credits and deductions) that relates to the production of an asset (e.g. machinery and equipment)—and will only balance operating spending against revenues. As a result, when the government balances its operating budget in 2028/29, it will still incur a projected deficit of $57.9 billion when spending on capital is included.

Similarly, the government’s plan to reduce the size of the annual deficit relative to the economy each year does little to prevent debt accumulation. This year’s deficit is expected to equal 2.5 per cent of the overall economy—which, since 2000, is the largest deficit (as a share of the economy) outside of those run during the 2008/09 financial crisis and the pandemic. By measuring its progress off of this inflated baseline, the government will technically abide by its anchor even as it runs relatively large deficits each and every year.

Moreover, according to the budget, total federal debt will grow faster than the economy, rising from a projected 73.9 per cent of GDP in 2025/26 to 79.0 per cent by 2029/30, reaching a staggering $2.9 trillion that year. Simply put, even the government’s own fiscal plan shows that its fiscal anchors are unable to prevent an unsustainable rise in government debt. And that’s assuming the government can even stick to these anchors—which, according to a new report by the Parliamentary Budget Officer, is highly unlikely.

Unfortunately, a federal government that can’t stick to its own fiscal anchors is nothing new. The Trudeau government made a habit of abandoning its fiscal anchors whenever the going got tough. Indeed, Fitch Ratings highlighted this poor track record as yet another reason to expect federal finances to continue deteriorating, and why a credit downgrade may be on the horizon. Again, should that happen, Canadian taxpayers will pay the price.

Much is riding on the Carney government’s ability to restore Canada’s credibility as a responsible fiscal manager. To do this, it must implement stronger fiscal rules than those presented in the budget, and remain accountable to those rules even when it’s challenging.

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Alberta2 days ago

Alberta2 days agoHow economic corridors could shape a stronger Canadian future

-

Daily Caller2 days ago

Daily Caller2 days agoLaura Ingraham’s Viral Clash With Trump Prompts Her To Tell Real Reasons China Sends Students To US

-

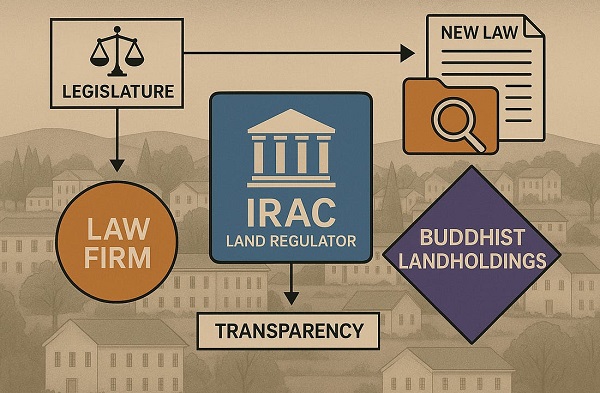

Business1 day ago

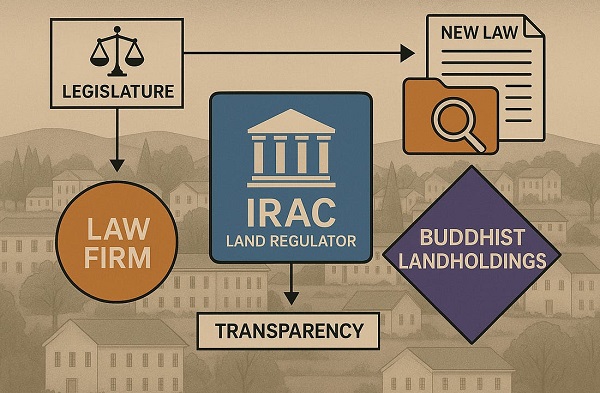

Business1 day agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

Business1 day ago

Business1 day agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

COVID-191 day ago

COVID-191 day agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

International22 hours ago

International22 hours agoIs America drifting toward civil war? Joe Rogan thinks so

-

Censorship Industrial Complex21 hours ago

Censorship Industrial Complex21 hours agoEU’s “Democracy Shield” Centralizes Control Over Online Speech