Fraser Institute

Ottawa’s health-care deal cements failed status quo in Canada

From the Fraser Institute

By Mackenzie Moir and Jake Fuss

Canada will reach a projected $244.1 billion in 2023, which translates to $6,205 per person—nearly double the level of per-person spending (inflation-adjusted) three decades ago. And yet, last year Canadians endured the longest median wait time (27.7 weeks) ever recorded for non-emergency surgery.

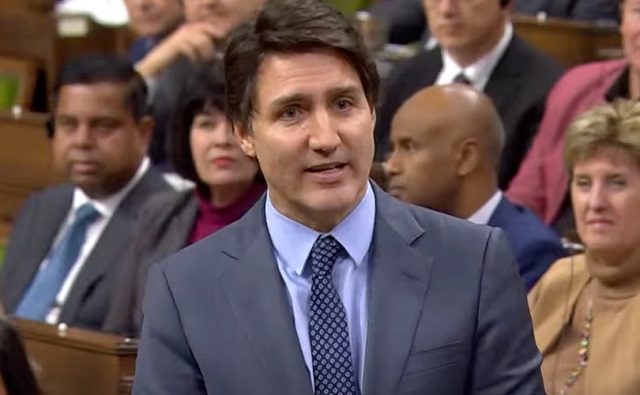

Last week, as part of Ottawa’s promised $46 billion in additional health-care spending, the Trudeau government agreed to increase Quebec’s share of federal health-care dollars by $900 million annually. Quebec was the last province to reach an agreement with Ottawa before the March 31 deadline. With the closure of this agreement, Canadian taxpayers are on the hook for more health-care spending than ever before. For the same old broken health-care system.

Of course, it ultimately doesn’t matter whether the $46 billion originates from Ottawa or the provinces. In the end, Canadian taxpayers foot the bill. And what do we get in return for our health-care dollars?

In 2021, the latest year of comparable data, Canada’s total health-care spending (as a percentage of the economy) was the highest among 29 other comparable countries with universal health care (after adjusting for differences in population age). This isn’t a new development. Canada has a long history of having one of most expensive systems among high-income universal health-care countries.

Despite this, according to the latest comparable data, Canada ranks among the poorest performing universal health-care countries in key areas such as the number of physicians, hospital beds and diagnostic technology (e.g. MRI machines). Further, according to the Commonwealth Fund, in 2020 Canada ranked dead last on timely access to specialist consultations and non-emergency surgery.

Meanwhile, public health-care spending in Canada will reach a projected $244.1 billion in 2023, which translates to $6,205 per person—nearly double the level of per-person spending (inflation-adjusted) three decades ago. And yet, last year Canadians endured the longest median wait time (27.7 weeks) ever recorded for non-emergency surgery.

In short, Canada’s health-care system is in shambles, but the answer does not lie in simply throwing more money in its general direction. Federal politicians should instead look to the example of welfare reform during the Chrétien era in the 1990s. Those reforms, which reduced federal transfers to provinces and eliminated most of the “strings” attached to federal funding, resulted in increased provincial autonomy, greater policy experimentation, fewer Canadians needing welfare and savings for the federal government (i.e. taxpayers).

This is the opposite of today’s approach to health care, where the existing vehicle for federal funding (the Canada Health Transfer) is connected to the Canada Health Act (CHA), which prevents provincial governments from innovating and experimenting in health care by threatening financial penalties for non-compliance with often vaguely defined federal preferences. The result is a stalemate that satisfies no one and ensures that Canada’s policies remain at odds with the policies of our better-performing universal health-care peers.

While new federal dollars for health care are undoubtedly appealing to premiers, they will not improve the state of health care for Canadians. Until our federal politicians have the courage to reform the CHA and follow the example of 1990s welfare reform to improve outcomes, our health-care system’s unacceptable status quo will continue.

Authors:

Business

Ottawa’s capital gains tax hike—final nail in ‘business investment’ coffin

From the Fraser Institute

By Tegan Hill and Jake Fuss

From 2014 to 2022, inflation-adjusted total business investment (in plants, machinery, equipment and new technologies but excluding residential construction) in Canada declined by C$34 billion. During the same period, after adjusting for inflation, business investment declined by a total of $3,748 per worker

According to the recent federal budget, the Trudeau government plans to increase the inclusion rate from 50 per cent to 66.7 per cent on capital gains over $250,000 for individuals and on all capital gains realized by corporations and trusts. Unfortunately, this tax hike will be the final nail in the coffin for business investment in Canada, which likely means even harder economic times ahead.

Canada already faces a business investment crisis. From 2014 to 2022, inflation-adjusted total business investment (in plants, machinery, equipment and new technologies but excluding residential construction) in Canada declined by C$34 billion. During the same period, after adjusting for inflation, business investment declined by a total of $3,748 per worker—from $20,264 per worker in 2014 to $16,515 per worker in 2022.

While business investment has declined in Canada since 2014, in other countries, including the United States, it’s continued to grow. This isn’t a post-COVID problem—this is a Canada problem.

And Canadians should be worried. Businesses investment is key for strong economic growth and higher living standards because when businesses invest in physical and intellectual capital they equip workers with the tools and technology (e.g. machinery, computer programs, artificial intelligence) to produce more and provide higher quality goods and services, which fuels innovation and higher productivity. And as firms become more efficient and increase profits, they’re able to pay higher wages, which is why business investment remains a key factor for higher incomes and living standards.

The Trudeau government’s policies—increased regulation, particularly in the energy and mining sectors (which makes Canada a relatively unattractive place to do business), higher and uncompetitive taxes, and massive federal deficits (which imply future tax increases)—have damaged business investment.

Unsurprisingly, weak business investment has correlated with a weak economy. In the fourth quarter of 2023, real economic growth per person ($58,111) officially fell below 2014 levels ($58,162). In other words, Canadian living standards have completely stagnated. In fact, over the last decade economic growth per person has been the weakest on record since the 1930s.

Instead of helping fix the problem, the Trudeau government’s capital gains tax hike will further damage Canada’s economy by reducing the return on investment and encouraging an exodus of capital from the country. Indeed, capital gains taxes are among the most economically-damaging forms of taxation because they reduce the incentive to invest.

Once again, the Trudeau government has enacted a policy that will deter business investment, which Canada desperately needs for strong economic growth. The key takeaway for Canadians? Barring a change in policy, you can expect harder times ahead.

Authors:

Fraser Institute

Federal government’s fiscal record—one for the history books

From the Fraser Institute

By Jake Fuss and Grady Munro

Per-person federal spending is expected to equal $11,901 this year. To put this into perspective, this is significantly more than Ottawa spent during the global financial crisis in 2008 or either world war.

The Trudeau government tabled its 2024 budget earlier this month and the contents of the fiscal plan laid bare the alarming state of federal finances. Both spending and debt per person are at or near record highs and prospects for the future don’t appear any brighter.

In the budget, the Trudeau government outlined plans for federal finances over the next five years. Annual program spending (total spending minus debt interest costs) will reach a projected $483. billion in 2024/25, $498.7 billion in 2025/26, and continue growing in the years following. By 2028/29 the government plans to spend $542.0 billion on programs—an 18.4 per cent increase from current levels.

This is not a new or surprising development for federal finances. Since taking office in 2015, the Trudeau government has shown a proclivity to spend at nearly every turn. Prime Minister Trudeau has already recorded the five highest levels of federal program spending per person (adjusted for inflation) in Canadian history from 2018 to 2022. Projections for spending in the 2024 budget assert the prime minister is now on track to have the eight highest years of per-person spending on record by the end of the 2025/26 fiscal year.

Per-person federal spending is expected to equal $11,901 this year. To put this into perspective, this is significantly more than Ottawa spent during the global financial crisis in 2008 or either world war. It’s also about 28.0 per cent higher than the full final year of Stephen Harper’s time as prime minister, meaning the size of the federal government has expanded by more than one quarter in a decade.

The government has chosen to borrow substantial sums of money to fund a lot of this marked growth in spending. Federal debt under the Trudeau government has risen before, during and after COVID regardless of whether the economy is performing relatively well or comparatively poor. Between 2015 and 2024, Ottawa is expected to run 10 consecutive deficits, with total gross debt set to reach $2.1 trillion within the next 12 months.

The scale of recent debt accumulation is eye-popping even after accounting for a growing population and the relatively high inflation of the past two years. By the end of the current fiscal year, each Canadian will be burdened with $12,769 more in total federal debt (adjusted for inflation) than they were in 2014/15.

You can attribute some of this increase in borrowing to the effects of COVID, but debt had already grown by $2,954 per person from 2014 to 2019—before the pandemic. Moreover, budget estimates show gross debt per person (adjusted for inflation) is expected to rise by more than $2,500 by 2028/29.

As with spending, the Trudeau government is on track to record the six highest years of federal debt per-person (adjusted for inflation) in Canadian history between 2020/21 and the end of its term next autumn. Why should Canadians care about this record debt?

Simply put, rising debt leads to higher interest payments that current and future generations of taxpayers must pay—leaving less money for important priorities such as health care and social services. Moreover, all this spending and debt hasn’t helped improve living standards for Canadians. Canada’s GDP per person—a broad measure of incomes—was lower at the end of 2023 than it was nearly a decade ago in 2014.

The Trudeau government’s track record with federal finances is one for the history books. Ottawa’s spending continues to be at near-record levels and Canadians have never been burdened with more debt. Those aren’t the type of records we should strive to achieve.

Authors:

-

CBDC Central Bank Digital Currency2 days ago

CBDC Central Bank Digital Currency2 days agoA Fed-Controlled Digital Dollar Could Mean The End Of Freedom

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoHow much do today’s immigrants help Canada?

-

COVID-199 hours ago

COVID-199 hours agoFormer Canadian lawmaker has no regrets about refusing COVID shot despite losing his job

-

Fraser Institute22 hours ago

Fraser Institute22 hours agoFederal government’s fiscal record—one for the history books

-

Alberta21 hours ago

Alberta21 hours agoPrincipal at Calgary Elementary School charged with possession of child pornography

-

Alberta17 hours ago

Alberta17 hours agoAlberta threatens to fight Trudeau government restrictions on Canada’s plastics industry

-

Alberta21 hours ago

Alberta21 hours agoRed Deer Company fined $360,000.00 after 2022 workplace fatality

-

Alberta9 hours ago

Alberta9 hours agoCanada’s postal service refuses to help with Trudeau’s gun ban buyback program: report