Alberta

Ottawa will provide “actuarial analysis” of Alberta’s CPP assets

Federal-provincial-territorial meeting on pensions: Minister HornerPresident of Treasury Board and Minister of Finance Nate Horner issued the following statement following the Nov. 3 federal-provincial- territorial (FPT) meeting of finance ministers: “This morning, I was able to participate in a federal-provincial-territorial (FPT) discussion with the country’s finance ministers to discuss pensions. “To be clear, Alberta is committed to making sure that any potential creation of an Alberta Pension Plan will not leave our fellow Canadians without a stable pension and its associated benefits. “For the past several weeks, Alberta has been having an open discussion about the possibility of establishing an Alberta Pension Plan that will benefit our seniors and workers. This will only happen if Albertans vote to do so in a referendum. “To help frame the conversation, we commissioned a report by an independent, expert actuary, Lifeworks (formerly known as Morneau-Shepell). The report provides details as to the asset transfer value that Alberta could expect to receive according to the withdrawal formula that was voluntarily agreed to by all Canadian provinces decades ago when the Canada Pension Plan (CPP) was established, and which was once again updated, with agreement by the provinces, in 1997. “We are encouraged to hear the federal government commit to providing a comprehensive actuarial analysis of the asset transfer value Alberta would be entitled to receive should it withdraw from the CPP. We’ve been asking for this for several weeks. It is critical for the ongoing discussion of an Alberta Pension Plan that we have a firm asset transfer number (and the potential benefit increases to Albertans stemming from that transfer amount) upon which Albertans can make an informed decision. “There are other critical conversations happening across the country, including the federal government’s changes to the carbon tax. We have all heard multiple premiers raise concerns about the federal government’s recent actions on carbon tax carve outs for some provinces, and several finance ministers again raised the urgency of this issue during our call, including me. “Canadians remain in the midst of an affordability crisis and the carbon tax continues to hurt us all. While a number of us had hoped to also address this issue during the call, I am very eager to have a fulsome conversation at our next FPT, scheduled for Dec. 14-15. At that time, I hope we can discuss cutting the carbon tax so Albertans and Canadians will no longer be penalized according to where they live, and which members of Parliament they elect.” |

Alberta

Alberta judge sides with LGBT activists, allows ‘gender transitions’ for kids to continue

From LifeSiteNews

‘I think the court was in error,’ Alberta Premier Danielle Smith has said. ‘There will be irreparable harm to children who get sterilized.’

LGBT activists have won an injunction that prevents the Alberta government from restricting “gender transitions” for children.

On June 27, Alberta King’s Court Justice Allison Kuntz granted a temporary injunction against legislation that prohibited minors under the age of 16 from undergoing irreversible sex-change surgeries or taking puberty blockers.

“The evidence shows that singling out health care for gender diverse youth and making it subject to government control will cause irreparable harm to gender diverse youth by reinforcing the discrimination and prejudice that they are already subjected to,” Kuntz claimed in her judgment.

Kuntz further said that the legislation poses serious Charter issues which need to be worked through in court before the legislation could be enforced. Court dates for the arguments have yet to be set.

READ: Support for traditional family values surges in Alberta

Alberta’s new legislation, which was passed in December, amends the Health Act to “prohibit regulated health professionals from performing sex reassignment surgeries on minors.”

The legislation would also ban the “use of puberty blockers and hormone therapies for the treatment of gender dysphoria or gender incongruence” to kids 15 years of age and under “except for those who have already commenced treatment and would allow for minors aged 16 and 17 to choose to commence puberty blockers and hormone therapies for gender reassignment and affirmation purposes with parental, physician and psychologist approval.”

Just days after the legislation was passed, an LGBT activist group called Egale Canada, along with many other LGBT organizations, filed an injunction to block the bill.

In her ruling, Kuntz argued that Alberta’s legislation “will signal that there is something wrong with or suspect about having a gender identity that is different than the sex you were assigned at birth.”

She further claimed that preventing minors from making life-altering decisions could inflict emotional damage.

However, the province of Alberta argued that these damages are speculative and the process of gender-transitioning children is not supported by scientific evidence.

“I think the court was in error,” Alberta Premier Danielle Smith said on her Saturday radio show. “That’s part of the reason why we’re taking it to court. The court had said there will be irreparable harm if the law goes ahead. I feel the reverse. I feel there will be irreparable harm to children who get sterilized at the age of 10 years old – and so we want those kids to have their day in court.”

READ: Canadian doctors claim ‘Charter right’ to mutilate gender-confused children in Alberta

Overwhelming evidence shows that persons who undergo so-called “gender transitioning” procedures are more likely to commit suicide than those who are not given such irreversible surgeries. In addition to catering to a false reality that one’s sex can be changed, trans surgeries and drugs have been linked to permanent physical and psychological damage, including cardiovascular diseases, loss of bone density, cancer, strokes and blood clots, and infertility.

Meanwhile, a recent study on the side effects of “sex change” surgeries discovered that 81 percent of those who have undergone them in the past five years reported experiencing pain simply from normal movements in the weeks and months that followed, among many other negative side effects.

Alberta

Why the West’s separatists could be just as big a threat as Quebec’s

By Mark Milke

It is a mistake to dismiss the movement as too small

In light of the poor showing by separatist candidates in recent Alberta byelections, pundits and politicians will be tempted to again dismiss threats of western separatism as over-hyped, and too tiny to be taken seriously, just as they did before and after the April 28 federal election.

Much of the initial skepticism came after former Leader of the Opposition Preston Manning authored a column arguing that some in central Canada never see western populism coming. He cited separatist sympathies as the newest example.

In response, (non-central Canadian!) Jamie Sarkonak argued that, based upon Alberta’s landlocked reality and poll numbers (37 per cent Alberta support for the “idea” of separation with 25 per cent when asked if a referendum were held “today”), western separation was a “fantasy” that “shouldn’t be taken seriously.” The Globe and Mail’s Andrew Coyne, noting similar polling, opined that “Mr. Manning does not offer much evidence for his thesis that ‘support for Western secession is growing.’”

Prime Minister Mark Carney labelled Manning’s column “dramatic.” Toronto Star columnist David Olive was condescending. Alberta is “giving me a headache,” he wrote. He argued the federal government’s financing of “a $34.2-billion expansion of the Trans Mountain pipeline (TMX)” as a reason Albertans should be grateful. If not, wrote Olive, perhaps it was time for Albertans to “wave goodbye” to Canada.

As a non-separatist, born-and-bred British Columbian, who has also spent a considerable part of his life in Alberta, I can offer this advice: Downplaying western frustrations — and the poll numbers — is a mistake.

One reason is because support for western separation in at least two provinces, Alberta and Saskatchewan, is nearing where separatist sentiment was in Quebec in the 1970s.

In our new study comparing recent poll numbers from four firms (Angus Reid Institute, Innovative Research Group, Leger, and Mainstreet Research), the range of support in recent months for separation from Canada in some fashion is as follows, from low to high: Manitoba (6 per cent to 12 per cent); B.C. (nine per cent to 20 per cent); Saskatchewan (20 per cent to 33 per cent) and Alberta (18 per cent to 36.5 per cent). Quebec support for separation was in a narrow band between 27 per cent and 30 per cent.

What such polling shows is that, at least at the high end, support for separating from Canada is now higher in Saskatchewan and Alberta than in Quebec.

Another, even more revealing comparison is how western separatist sentiment now is nearing actual Quebec votes for separatism or separatist parties back five decades ago. The separatist Parti Québécois won the 1976 Quebec election with just over 41 per cent of the vote. In the 1980 Quebec referendum on separation, “only” 40 per cent voted for sovereignty association with Canada (a form of separation, loosely defined). Those percentages were eclipsed by 1995, when separation/sovereignty association side came much closer to winning with 49.4 per cent of the vote.

Given that current western support for separation clocks in at as much as 33 per cent in Saskatchewan and 36.5 per cent in Alberta, it begs this question: What if the high-end polling numbers for western separatism are a floor and not a ceiling for potential separatist sentiment?

One reason why western support for separation may yet spike is because of the Quebec separatist dynamic itself and its impact on attitudes in other parts of Canada. It is instructive to recall in 1992 that British Columbians opposed a package of constitutional amendments, the Charlottetown Accord, in a referendum, in greater proportion (68.3 per cent) than did Albertans (60.2 per cent) or Quebecers (56.7 per cent).

Much of B.C.’s opposition (much like in other provinces) was driven by proposals for special status for Quebec. It’s exactly why I voted against that accord.

Today, with Prime Minister Carney promising a virtual veto to any province over pipelines — and with Quebec politicians already saying “non” — separatist support on the Prairies may become further inflamed. And I can almost guarantee that any whiff of new favours for Quebec will likely drive anti-Ottawa and perhaps pro-separatist sentiment in British Columbia.

There is one other difference between historic Quebec separatist sentiment and what exists now in a province like Alberta: Alberta is wealthy and a “have” province while Quebec is relatively poor and a have-not. Some Albertans will be tempted to vote for separation because they feel the province could leave and be even more prosperous; Quebec separatist voters have to ask who would pay their bills.

This dynamic again became obvious, pre-election, when I talked with one Alberta CEO who said that five years ago, separatist talk was all fringe. In contrast, he recounted how at a recent dinner with 20 CEOs, 18 were now willing to vote for separation. They were more than frustrated with how the federal government had been chasing away energy investment and killing projects since 2015, and had long memories that dated back to the National Energy Program.

(For the record, they view the federal purchase of TMX as a defensive move in response to its original owner, Kinder Morgan, who was about to kill the project because of federal and B.C. opposition. They also remember all the other pipelines opposed/killed by the Justin Trudeau government.)

Should Canadians outside the West dismiss western separatist sentiment? You could do that. But it’s akin to the famous Clint Eastwood question: Do you feel lucky?

Mark Milke is president and founder of the Aristotle Foundation for Public Policy and co-author, along with Ven Venkatachalam, of Separatist Sentiment: Polling comparisons in the West and Quebec.

-

Business5 hours ago

Business5 hours agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Alberta1 day ago

Alberta1 day agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime17 hours ago

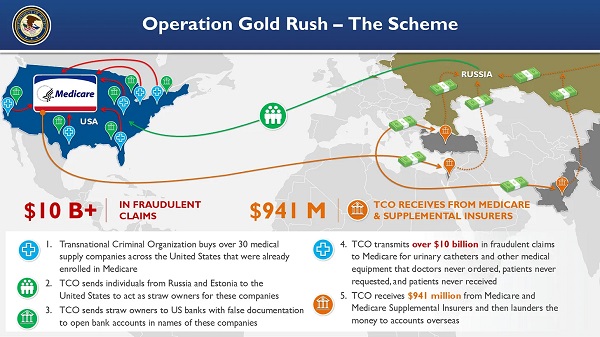

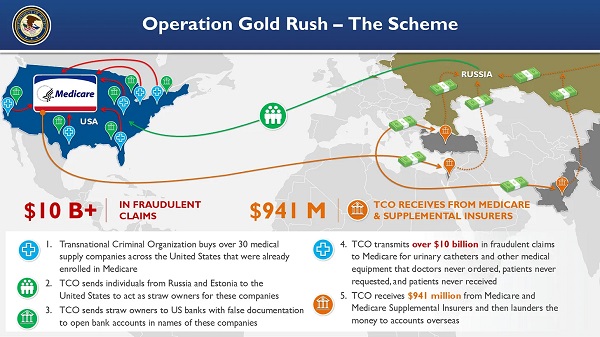

Crime17 hours agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Crime1 day ago

Crime1 day agoSuspected ambush leaves two firefighters dead in Idaho

-

Alberta1 day ago

Alberta1 day agoWhy the West’s separatists could be just as big a threat as Quebec’s

-

Business1 day ago

Business1 day agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Health17 hours ago

Health17 hours agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Business1 day ago

Business1 day agoMassive government child-care plan wreaking havoc across Ontario