Alberta

Notes from Flight 163, the oilsands shuttle from Toronto to Edmonton

Shared with permission from author Stewart Muir

Stewart Muir is a Victoria-based writer who serves as executive director of the Resource Works Society.

On a recent Monday morning, I found myself on Air Canada Flight 163 from Toronto Pearson to Edmonton. As the plane loaded, I began to sense there was something not so regular about the passengers boarding the Airbus 320 for a regularly scheduled flight.

Unlike those I more typically see on my flights, nobody was in flip-flops or golf wear, or fussing with oversized or unnecessary luggage. This was a mix mostly without the easy-to-spot snowbirds, students, and first-time fliers.

The travellers this day were mostly middle-aged men, fit-looking and dressed Mark’s Work Wearhouse casual. There were some women too, and like the men they moved with familiar ease through the cabin lugging full but neatly packed backpacks or duffels. Many carried a preferred travel distraction in hand, ready for a few hours of Netflix or sudoku. I could hear the distinctive accents of the Maritimes and Quebec, and the more familiar central Canadian English, as they found their places the way transit riders enter a subway car.

It was rapidly apparent that I was witnessing a commuter routine, one not meaningfully different than the suit-filled shuttles carrying day-tripping lawyers, accountants, pharma reps, engineers and lobbyists from the same airport that morning to destinations like Ottawa, Montreal, Boston and New York.

In concentrated form, I was witnessing a typical, daily migration of the Canadian oil sands workforce, probably with some LNG and mining thrown in. They were heading to the workplace. Not for a day, but for stretches of a week or two.

Multiply this by dozens or scores, in airports across the country, usually less starkly evident than on this particular flight, and it was just a regular day in Canadian air travel as the massive energy employee base changed shift.

A few hours later, after we unloaded at the other end, I headed for the exit and my Uber. Not so most of my fellow passengers. They continued on their way to connecting flights – to destinations such as Fort McMurray, Grande Prairie, and air services flying direct to some of the big oil sands projects – in time for shift change at the work camps where they were expected.

Statistics could not convey more forcefully than this how the oil & gas economy has a singular and powerful effect on the economy. The large paycheques drawing these men and women to their jobs in the West flowed directly back to their family bank accounts in the GTA and beyond, paying mortgages, grocery bills, taxes and hockey fees.

Flight 163, multiplied many times over, represents what the energy sector, at its most direct and tangible, does for the Canadian economy.

This is what I’m thinking about while surveying a nation that is now deep into an unprecedented social and economic crisis.

Over the coming days and weeks, things that we do will affect how deep and damaging this crisis becomes.

We are seeing Green New Deal advocates pursue the thesis that the coming economic catastrophe is the perfect moment to “transition off fossil fuels”. There are plenty of signs of this thought process – “Hey guess what guys, in one stroke we could meet the Paris Agreement by dropping emissions to 30 per cent below 2005 levels – not by 2030, but by 2021!”

To put this in perspective, consider that the Conference Board of Canada recently estimated that in one of the milder transition scenarios, meeting such targets will cost Canadians $2.2 trillion and require 14 per less use of residential energy, 47 per cent less car travel, eight times the subway use, and 54 per cent less domestic air travel.

Who’s ready to make this change overnight? We couldn’t do it if we wanted to. Think for just a moment about the costs and tradeoffs required, and the difficulty of accomplishing it in the midst of a global health crisis. Clearly it makes no sense at all. Yet Canada might be the only oil-exporting country where accelerating the transition is likely to receive serious acknowledgment in senior decision-making circles.

Even without such measures, Canada is already moving in the right direction: we are a global leader in clean energy, with 80 per cent of the population living in provinces where more than 90 per cent of electricity is drawn from non-fossil fuel sources. This alone makes us the envy of the world. The prevalence of clean electricity means that wherever it is used in industry, the resulting resource commodity exports can outcompete most other similar products in climate terms, with the bonus that they can allow importing countries to reduce their own emissions.

Mere inattention could do as much damage at this time as a wrong decision. Standing back and watching the domestic oil and gas industry topple will have an effect on citizen wellbeing far in excess of what the collapse of any other industry would bring.

We would be looking at the long-term impairment of Canadian living standards – that is to say a reduction in the value of our jobs, in our quality of life, in our educational opportunities, and in our ability to help other countries while continuing as a net positive influence on the world.

The fossil fuel industry – “it is how we earn our living”

It’s hard to describe how important the energy industry is to Canada. Let me try.

Andy Calitz, the former CEO of LNG Canada who performed the herculean task of achieving a positive final investment decision (FID) for the project before moving on to his next challenge, provided a memorable image when he spoke at a small dinner of diplomats and academics I attended not long after the FID.

When the first shipload of liquefied natural gas departs from Kitimat in a few years’ time, he said, that cargo would be worth $100 million – a staggering sum. (I’ve run this figure past a couple of experienced heads in the energy field, and nobody has scoffed at it.)

In Vancouver, we go giddy each spring at the thought of cruise ship season, which last year saw 290 sailings out of the port. If, as is commonly said, one of those sailings means $1 million injected into the local economy, how does that compare with LNG?

Back of envelope math says that a single year of LNG Canada operations, with its promised traffic of one ship in and one ship out every day, will have the impact of one century of the Vancouver cruise industry. I’m not knocking the cruise industry, it’s important and we need it. But let that comparison sink in.

Here’s another one.

Back in 2017, I calculated that natural gas investments in British Columbia that year were on a scale that equated to building the behemoth Wynn hotel in Las Vegas (4,750 rooms over 215 acres) in the Vancouver area, along with a special SkyTrain extension to serve it. ( Natural gas is back: British Columbia drilling surge is behind $5+ billion in 2017 investment )

Never mind that no investor has ever come forward with such a bold plan for a new resort anywhere in Canada. And it’s actually pretty fortunate that we got the energy infrastructure rather than the casino, given the prospects for tourism in 2020.

Economist Patricia Mohr recently pointed out that Canada is “a trading nation and an ‘energy specialist’ — it is how we earn our living.” Crude oil, all by itself, generated net exports of $62 billion in 2019, up from $57.5 billion in 2018 — far above any other export category.

As Ms. Mohr stated, oil exports come in handy given that we habitually run large deficits in other areas including motor vehicles and parts, machinery, electronic equipment, and consumer goods.

During the COVID-19 crisis, it’s obvious we cannot go without lifesaving medical necessities. Unlike our abundant oil, producing them isn’t a great strength. Canada must import billions’ worth of these goods every year. If you isolate just three medical categories – vaccines, medical apparatus and breathing aids – the numbers show clearly that our own ability to manufacture these items is very limited, even as consumption grows year after year.

The current global crisis has already brought a plummeting Canadian dollar, which in turn makes the imported goods that we rely on more costly. Exports that we can sell for U.S. dollars will offset this, but only if we have products to sell and markets ready to buy them. We need to preserve the ability to produce more as more income is needed, while at the same time figuring in the unfortunate reality that many of the things we export are themselves falling in price, so that higher production volumes are required just to stay in place.

The resource economy actually turns out – despite its detractors – to be both flexible and durable as a source of national well-being. Markets for some of the commodities we produce can be expanded at will, something that cannot be said of iPhones, beach umbrellas or BMWs.

Right now in Russia, the government is starting to realize it might not have been such a good idea to enter into an oil price war with Saudi Arabia. More and more evidence suggests that for a winner to emerge will require not months but years of effort, and at the end of it the United States oil industry, resented deeply by both Russia and Saudi Arabia, could well come on top anyways.

The most chilling observation, as reported today by the Wall Street Journal, comes from Igor Sechin, head of Russia’s largest oil producer, state-controlled giant Rosneft: “If you give up your market share, you will never get it back.”

There’s a lesson in this for Canada. Those who see an “opportunity” to deliberately give up our oil market share, to encourage a fast pivot into an unknown energy future, are playing recklessly with how we as a country earn our living. If we ratchet down production by letting industry fail, and decide later that it was a mistake to do so, we will not easily be able to retrieve our market share. That’s a frightening thought. Worse still, killing off the industry will make Canadians more dependent on imported oil, which will have to be paid for using a weakened loonie.

Doing what’s necessary

In 2018, the federal government announced an export diversification strategy that would increase Canada’s overseas exports by 50 per cent by 2025. Even before the combined oil/pandemic crisis, it seemed an unlikely ambition.

“Investing in infrastructure to support trade” was one of the ways Ottawa deemed it could aid this ambitious goal, and credit is due for supporting projects such as the so-far-incomplete Trans Mountain and Coastal GasLink pipelines.

Other forces are holding us back. The Canada Infrastructure Bank, for example, is forbidden from investing its $35 billion of capital in fossil fuel projects, even if those investments could lead to lower energy use and emissions in the oil & gas upstream.

Meanwhile, our national infrastructure minister seems physically incapable of uttering the phrase “energy infrastructure” let alone the p-word (pipelines). Even our minister of natural resources has been placed in the uncomfortable position of carrying out a mandate letter requiring him to making finding alternative employment for oil and gas workers and communities a central task.

Now is the time to save, not strangle, an oil and gas industry that is frantically signalling the need for intervention .

Prime Minister Justin Trudeau’s Quebec lieutenant Pablo Rodriguez yesterday promised Bombardier : “Our government is taking the necessary steps to get you financial help as quickly as possible.” A stock analyst opined that the Canadian and Quebec governments were “likely to offer support if Bombardier gets close to the edge.” (See Globe and Mail story .)

If a single company controlled by a wealthy clan, making luxury jets for billionaires, is to be given this treatment, then there should be no hesitation all in backing the industry that convincingly represents the foundational strength of our entire nation.

Trudeau has always found it difficult to make strong gestures of support to the Canadian oil patch. This time, finding it within himself to say those words of support matters more than ever. There is a very serious risk that Canada’s long term prosperity in both an absolute and a relative sense will be impaired by what occurs in the coming hours, days and weeks. Ahead of us, economic success will only come through determination and political commitment to put people and jobs first.

Stewart Muir is a Victoria-based writer who serves as executive director of the Resource Works Society.

Grow your business with the Daily Oil Bulletin – the trusted source for Canada’s oilpatch.

Canada in talks with the U.S. to avoid troops at the border, says Trudeau

Alberta Energy Regulator names senior Saskatchewan government official as CEO

Alberta

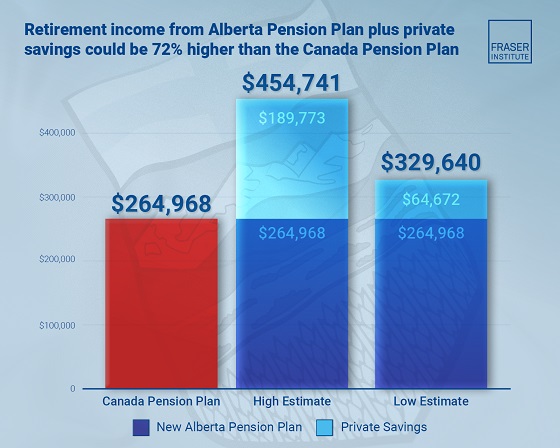

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Alberta1 day ago

Alberta1 day agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Daily Caller20 hours ago

Daily Caller20 hours ago‘Strange Confluence Of Variables’: Mike Benz Wants Transparency Task Force To Investigate What Happened in Butler, PA

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports