Business

McTeague: Will Carney cave to radical climate activists?

By Dan McTeague

Massive government spending and the ongoing trade war with the U.S. continue to threaten Canadians’ livelihoods. The most obvious solution for Canada is to develop our energy resources and building pipelines.

While the Carney government is talking a big game, radical climate activists continue to attempt to stop any development of Canadian oil and gas.

Will Prime Minister Mark Carney do what’s best for the country or will he cave to these special interest groups?

Dan McTeague discusses in his latest video.

Agriculture

Ottawa’s EV Gamble Just Cost Canola Farmers Billions

From the Frontier Centre for Public Policy

By Conrad Eder

Ottawa’s EV subsidies have backfired. Western Canada’s canola farmers are the latest victims of misguided government industrial policy

Economic policy is more like gardening than engineering. You can shovel all the money you want into trying to grow coconuts in a Canadian winter, but you’ll achieve far better results—and feed many more people—by planting potatoes in the spring and letting nature run its course.

For Canada, that means embracing policies that create fertile ground for all businesses to compete, innovate, and serve consumers. Ottawa, unfortunately, prefers to play God with the weather. What began as economic tinkering has triggered a cascade of interventions now devastating Canada’s canola industry.

Rather than letting the market determine Canada’s strengths, federal and provincial politicians decided they knew better, wagering $52.5 billion to lure EV and battery manufacturers to Canada. Massive public subsidies were placed on a handful of firms and technologies.

The Parliamentary Budget Officer delivered a sobering assessment of this boondoggle: it could take decades for taxpayers to break even on these subsidies—and only if nothing goes sideways.

Well, you know what they say about best-laid plans.

After committing billions, Ottawa faced an awkward truth: Chinese manufacturers were eating our lunch, offering EVs at lower prices, thanks in part to their own subsidies. Instead of reversing course, Ottawa hit the panic button and slapped a 100 per cent tariff on Chinese EVs.

Let’s be clear: this wasn’t about national security or consumer protection. It was about salvaging one of the largest industrial bets in Canadian history.

Yes, some sectors require targeted oversight to protect privacy and safety. EVs aren’t one of them. Their risks can be managed with targeted regulations and technical safeguards. But the tariffs do real damage by blocking affordable EVs and denying Canadians the right to judge for themselves.

Predictably, China didn’t take the tariffs lying down. In March, Beijing slapped 100 per cent duties on Canadian canola oil. In August, it hit canola seed with 75.8 per cent tariffs, effectively shutting out Canadian farmers from a $4.9-billion market.

Ninety-nine per cent of canola fields are in Western Canada. Canola is Canada’s top crop export, supporting tens of thousands of Prairie jobs and generating over $43 billion annually.

Another trade war, another lose-lose. Canadians pay more for EVs. Chinese consumers pay more for food.

And now, predictably, agricultural lobbyists are seeking Ottawa’s help. The government—having started the fire—has responded with $370 million in biofuel incentives and expanded financial support for canola producers. More subsidies. More distortion. Another Band-Aid for another self-inflicted wound.

Ironically, Canada’s farm sector already receives substantial government support. Now it’s receiving even more just to survive Ottawa’s protection of a separate subsidized industry. That’s the trouble with industrial policy: helping one sector often means hurting another. And taxpayers get the privilege of funding both.

There’s a better way forward: it doesn’t involve doubling down on mistakes. The solution is to stop the engineering and let the economy breathe. Lower taxes. Fewer regulations. Neutral infrastructure investment. These create the conditions for businesses to rise or fall on merit. That’s how innovation flourishes: through competition, not cabinet-level favouritism.

It’s not hard to follow the dominoes. EV subsidies triggered Chinese tariffs. Tariffs triggered canola retaliation. Canola retaliation now triggers demands for bailouts.

One attempt to pick winners has manufactured a long list of losers.

Had Ottawa stuck with free-trade principles, Canadians could’ve had more affordable EVs, taxpayers would’ve saved billions, and canola farmers would still have access to a vital export market.

Instead, we get a chain reaction of policy “fixes,” each one compensating for the damage done by the last—each one digging the hole deeper.

When governments try to engineer economic outcomes, citizens foot the bill. The real lesson? Governments are great at creating problems. Markets are better at solving them.

If Canada wants a prosperous economic future, it must stop betting the farm on political hunches and let competitive markets do the cultivating.

Conrad Eder is a policy analyst at the Frontier Centre for Public Policy.

Business

Energy leaders send this letter urging Prime Minister Mark Carney to unlock Canada’s resources

An Open Letter to the Prime Minister of Canada

The CEOs of Canada’s largest energy companies, including Canadian Natural Resources, Cenovus, Suncor, Imperial Oil and many more, have issued a new “Build Canada Now” letter to Prime Minister Carney. They are calling for Ottawa to repeal the production cap, scrap the tanker ban, simplify regulations and shorten project approvals so Alberta’s energy sector can create jobs, attract investment and help Canada become a true global energy superpower.

September 15, 2025

The Rt. Hon. Mark Carney, PC, MP

Prime Minister of Canada

Dear Prime Minister Carney,

Six months have passed since the first “Build Canada Now” letter was sent to you and the leaders of Canada’s other political parties outlining an action plan to unlock Canada’s world class oil and natural gas resources to strengthen Canada’s economic sovereignty, resilience and prosperity. After the election, we followed up with a second letter expressing our support for our shared vision of Canada becoming an energy superpower, one that harnesses both conventional and clean energy resources. Since then, we have seen progress but it is insufficient to stimulate the investment and growth required to make this vision a reality.

Thank you for leading the positive change in tone from the Federal Government in terms of the importance of economic development, including expanded investments in conventional energy. The launch of the new Major Projects Office, Indigenous Advisory Council, the initial list of projects of national significance, and the announcement that it will begin work in support of Pathways Plus are critical steps in the right direction. We appreciate the progress the Federal Government has made in these areas.

However, Canada still lacks the clear, competitive and durable fiscal and regulatory policies required to achieve the so-called “Grand Bargain”. That bargain being significant emissions reductions, expanded market access and material upstream production growth. Achieving these three inter-related outcomes goes beyond progressing select major projects but rather includes a multitude of other projects and related investments. Consequently, we reiterate our call to work together to make the policy changes required for this to happen.

Our call to action is urgent, with persistent indicators that the Canadian economy is moving in the wrong direction. The need to improve productivity and create jobs requires swift and decisive action. Canada is blessed with an enviable abundance of oil and natural gas resources and has the expertise to develop them in a manner consistent with environmental responsibility, social values, and working with Indigenous groups for the benefit of Canada and Canadians. As leaders of this sector, we have consistently advocated for the changes required to unwind the past decade of increasing policy complexity and uncertainty that led to delayed investments, lost opportunities and a competitive disadvantage on the global energy stage.

Given your background, you understand that the private sector and public markets require clarity and certainty to make the long-term investments necessary to realizing this sector’s potential, in turn creating thousands of high-paying jobs and significantly strengthening Canada’s economy.

Making the changes expressed in the earlier Build Canada Now letters are necessary to send clear signals that Canada is open for business. To reiterate, we believe that your government must focus on the following:

- Significantly simplify regulations. The Federal Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and repealed, respectively. Existing processes are complex, unpredictable, subjective, and excessively long. Processes need to be clarified and simplified, and decisions must withstand judicial review.

- Shorten timelines for project approvals. The Federal Government needs to dramatically reduce regulatory timelines to approve all projects within months, not years, of application. This is required to restore investor confidence and once again attract capital to Canada. Clarity on provincial versus federal jurisdiction related to project approvals is also required and needs to be respected.

- Commit to grow production, not limit it. The Federal Government’s unlegislated cap on emissions must be eliminated to allow the sector to grow and achieve its potential for the benefit of Canada and Canadians. The “production cap” creates uncertainty, is redundant, will result in production cuts, and stifles investment.

- Fiscal framework that attracts investment. The Federal carbon levy on large emitters is not globally cost competitive and should be repealed allowing provinces to set regulations. The Federal Government can lead cooperation across jurisdictions, protecting domestic and international competitiveness. Industry needs clear, competitive, and durable fiscal frameworks, including associated with carbon and overall taxation, to secure capital and incentivize investment.

- Incent Indigenous investment opportunities. The Federal Government needs to provide Indigenous loan guarantees at scale so industry can create ownership opportunities to increase prosperity and ensure Indigenous communities benefit from resource development.

As you have clearly stated, our country needs to move from “uncertainty to prosperity”. There needs to be tangible change to make this happen, and without clear and urgent action we risk missing a generational opportunity to capture the potential before Canada now.

As Parliament resumes for the Fall sitting, the energy industry remains committed to working with you, your cabinet, and the provinces on an urgent basis to achieve the energy sector’s potential for the good of Canada. Together, Canada can become the global energy superpower we all envision. We look forward to your response.

Sincerely,

Original signatories

Brandon Anderson

President & CEO

NorthRiver Midstream Inc

Doug Bartole

President & CEO

InPlay Oil Corp.

Robert Broen

President & CEO

Athabasca Oil Corporation

Scott Burrows

President and Chief Executive Officer

Pembina Pipeline Corp.

Chris Carlsen

President & COO

Birchcliff Energy Ltd.

Brad W. Corson

Chairman, President and Chief Executive Officer

Imperial Oil Ltd.

N. Murray Edwards

Executive Chairman

Canadian Natural Resources Limited

Darlene Gates

President and Chief Executive Officer

MEG Energy Corp.

Paul Hawksworth

President and Chief Executive Officer

Inter Pipeline Ltd.

Tyson Huska

President & CEO

Longshore Resources Ltd.

Mike Lawford

President & CEO

NuVista Energy Ltd.

Chris Mazerolle

President

Chevron Canada Resources

Nicholas McKenna

President

ConocoPhillips Canada

Paul Myers

President

Pacific Canbriam Energy Limited

François Poirier

President and Chief Executive Officer

TC Energy Corp.

Susan Riddell Rose

President & CEO

Rubellite Energy Corp.

Don Simmons

President & CEO

Hemisphere Energy Corporation

Adam Waterous

Executive Chairman, Board of Directors

Strathcona Resources Ltd.

Richard Wyman

President

Chance Oil and Gas Limited

Terry Anderson

President and Chief Executive Officer

ARC Resources Ltd.

Michael Binnion

President & CEO

Questerre Energy Corporation

Craig Bryksa

President and Chief Executive Officer

Veren Inc.

David J. Burton

President & CEO

Lycos Energy Inc.

Paul Colborne

President & CEO

Surge Energy Inc.

Greg Ebel

President and Chief Executive Officer

Enbridge Inc.

Grant Fagerheim

President and Chief Executive Officer

Whitecap Resources Inc.

Bryan Gould

Founder & CEO

Aspenleaf Energy Limited

Philip B. Hodge

President & CEO

Pine Cliff Energy Ltd.

Rich Kruger

President and Chief Executive Officer

Suncor Energy Inc.

Byron Lutes

President

Mancal Energy Inc.

Brendan McCracken

President & CEO

Ovintiv Canada ULC

Jon McKenzie

President and Chief Executive Officer

Cenovus Energy Inc.

Curtis Philippon

President & CEO

Gibson Energy

Mike Rose

President and Chief Executive Officer

Tourmaline Oil Corp.

Brian Schmidt

President & CEO

Tamarack Valley Energy Ltd.

David Spyker

President & CEO

Freehold Royalties Ltd.

Bevin Wirzba

President and Chief Executive Officer

South Bow Corp.

Vern Yu

President & Chief Executive Officer

AltaGas

Additional signatories

-

International2 days ago

International2 days agoTrump sues New York Times for $15 billion over ‘malicious, defamatory’ election coverage

-

Crime1 day ago

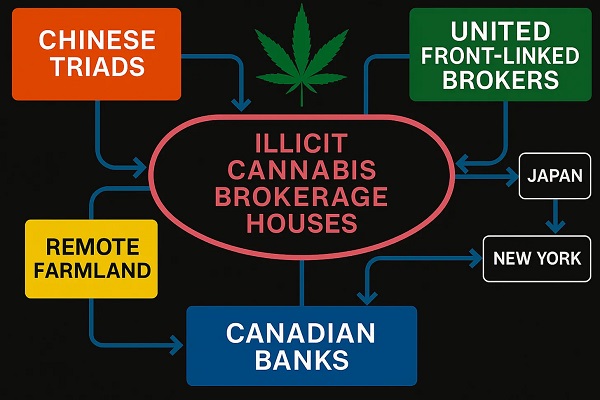

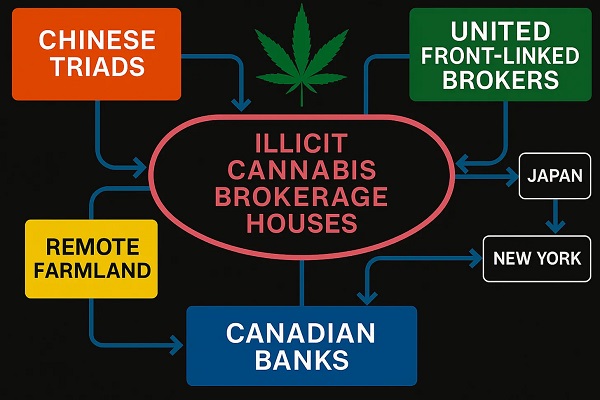

Crime1 day agoFrom Vancouver to Oklahoma: Canadian Murder Case and CCP ‘Police Station’ Links Align U.S. Testimony and The Bureau’s PRC Pot Investigations

-

Alberta2 days ago

Alberta2 days agoEducation negotiations update: Minister Horner

-

Addictions2 days ago

Addictions2 days agoNo, Addicts Shouldn’t Make Drug Policy

-

Christopher Rufo2 days ago

Christopher Rufo2 days agoCharlie Kirk Did It All the Right Way

-

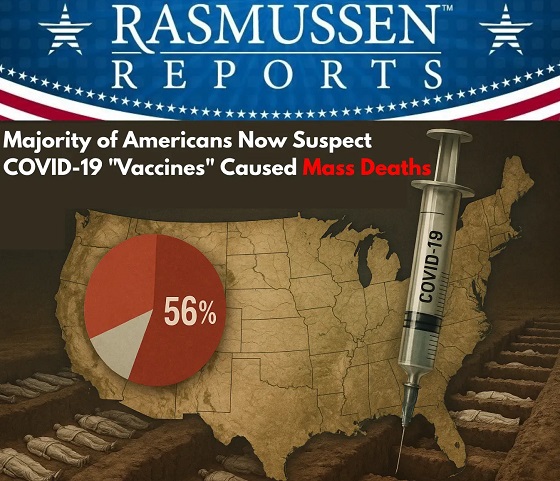

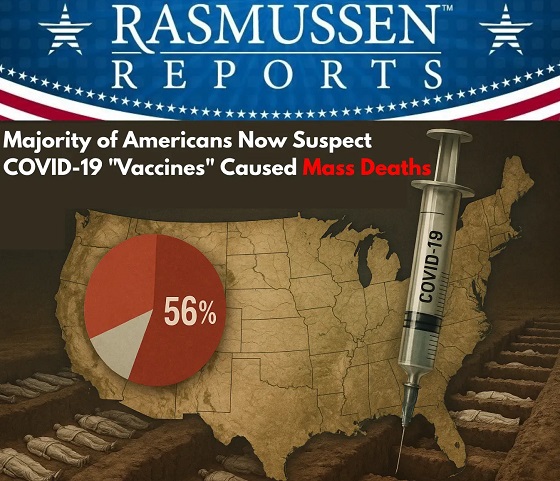

COVID-192 days ago

COVID-192 days agoNew Study Obliterates the “Millions Saved” COVID Shot Myth

-

Internet2 days ago

Internet2 days agoHow Google Quietly Shapes Human Behaviour and Thought

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCarney’s Housing Meltdown: Building A Mystery