Alberta

Mask expert warns Dr. Deena Hinshaw mask use will not protect against COVID-19

Chris Schaefer is the Director of SafeCom Training Services Inc. in Edmonton. He has sent this letter to Dr. Deana Hinshaw. As an open letter it is also being circulated on social medias.

Open Letter to Physicians and the Public of Alberta

Dear Dr. Hinshaw,

Re: Alberta Health recommendation that Albertans wear N95, surgical or non-medical masks in public to reduce the likelihood of transmitting or developing a condition from the coronavirus known as COVID-19

I have been teaching and conducting respirator fit testing for over 20 years and now currently for my company SafeCom Training Services Inc. My clients include many government departments, our military, healthcare providers with Alberta Health Services, educational institutions and private industry. I am a published author and a recognized authority on this subject.

Filter respirator masks, especially N95, surgical and non-medical masks, provide negligible COVID-19 protection for the following reasons:

- Viruses in the fluid envelopes that surround them can be very small, so small in fact that you would need an electron microscope to see them. N95 masks filter 95% of particles with a diameter of 0.3 microns or larger. COVID-19 particles are .08 – .12 microns.

- Viruses don’t just enter us through our mouth and nose, but can also enter through our eyes and even the pores of our skin. The only effective barrier one can wear to protect against virus exposure would be a fully encapsulated hazmat suit with cuffs by ankles taped to boots and cuffs by wrists taped to gloves, while receiving breathing air from a self-contained breathing apparatus (SCBA) This barrier is standard gear to protect against a biohazard (viruses) and would have to be worn in a possible virus hazard environment 24/7 and you wouldn’t be able to remove any part of it even to have a sip of water, eat or use the washroom while in the virus environment. If you did, you would become exposed and would negate all the prior precautions you had taken.

3. Not only are N95, surgical and non-medical masks useless as protection from COVID-19, but in addition, they also create very real risks and possible serious threats to a wearer’s health for the following reasons

A. Wearing these masks increases breathing resistance, making it more difficult to both inhale and exhale. According to our Alberta government regulations on respirator (mask) use, anyone that is required to wear a respirator mask should be screened to determine their ability to safely wear one.

Any covering of the mouth and nose increases breathing resistance, whether the mask is certified or not. Those individuals with pre-existing medical conditions of shortness of breath, lung disease, panic attacks, breathing difficulties, chest pain in exertion, cardiovascular disease, fainting spells, claustrophobia, chronic bronchitis, heart problems, asthma, allergies, diabetes, seizures, high blood pressure and pacemakers need to be pre-screened by a medical professional to be approved to be able to safely wear one. Wearing these masks could cause a medical emergency for anyone with any of these conditions.

Pregnancy-related high blood pressure is possible. More research is necessary to determine the impact of wearing a mask for extended periods of time on pregnancy.

It is dangerous to recommend, much less mandate anyone with medical conditions to wear a mask without educating them about the risks involved in wearing them without having been pre-screened and approved by a medical professional first.

B. In order for any respirator mask to offer protection to a specific user, that user must be individually fitted with the right type, right size, if male – face must be clean shaven (only short moustache allowed). Next, the user must be fit tested with that respirator by a trained professional to determine whether or not the respirator is providing the user with an air- tight seal – a requirement for any respirator mask.

C. N95 masks – N for not resistant to oil particles, 95 for the percentage of protection – the lowest level of all respirator masks.

These masks even when properly sized and fitted will not protect against virus exposure, however they are capable of adequate protection from larger particles such as pet dander, pollen and sawdust.

Surgical masks (the paper ones that loop around the ears) – do not seal to the face and do not filter anything.

Nonmedical and/or homemade masks are dangerous because:

- ● Not engineered for the efficient yet protective requirements of easy inhalation and effective purging of exhaled carbon dioxide

- ● Could cause an oxygen deficiency for the user

- ● Could cause an accumulation of carbon dioxide for the user

- ● Shouldn’t be recommended under any circumstance

D. They increase body temperature and physical stress – could cause a high temperature alert on a thermometer gun

E. They impede verbal communication

F. N95, surgical and nonmedical masks can create infections and possible disease all by themselves by causing exhaled warm, moist air to accumulate on the inside material of the mask, right in front of the user’s mouth and nose, which is the perfect environment for bacteria to form, grow and multiply. That is why N95 and other disposable masks were only designed to be short duration, specific task use and then immediately discarded.

So if masks are not effective in preventing illness, what is? How about the age-old tried, tested and proven method of protecting our health with a healthy diet, clean water, avoidance of processed, junk and fast foods, plenty of fresh air, sunshine, moderate exercise, adequate restful sleep and avoidance of stress?

We all have an immune system that can fight and overcome any COVID-19 threat if it is healthy and we nurture it.

Thank you for reading this open letter and letting me share my expertise. I ask that you share this with the public via media statement as we are all committed to promoting good health for all Albertans. If you or any of the public wish to contact me with a question or comment, I would love to hear from you. I can best be reached [email protected].

Sincerely,

Chris Schaefer

Director

SafeCom Training Services Inc.

Alberta

Calgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

By David Hunt and Jeff Park

Of major cities, none compare to Calgary’s nearly 50 percent property tax burden increase between censuses.

Alberta once again leads the country in taking in more new residents than it loses to other provinces and territories. But if Canadians move to Calgary seeking greater affordability, are they in for a nasty surprise?

In light of declining home values and falling household incomes amidst rising property taxes, Calgary’s overall property tax burden has skyrocketed 47 percent between the last two national censuses, according to a new study by the Aristotle Foundation for Public Policy.

Between 2016 and 2021 (the latest year of available data), Calgary’s property tax burden increased about twice as fast as second-place Saskatoon and three-and-a-half times faster than Vancouver.

The average Calgary homeowner paid $3,496 in property taxes at the last census, compared to $2,736 five years prior (using constant 2020 dollars; i.e., adjusting for inflation). By contrast, the average Edmonton homeowner paid $2,600 in 2021 compared to $2,384 in 2016 (in constant dollars). In other words, Calgary’s annual property tax bill rose three-and-a-half times more than Edmonton’s.

This is because Edmonton’s effective property tax rate remained relatively flat, while Calgary’s rose steeply. The effective rate is property tax as a share of the market value of a home. For Edmontonians, it rose from 0.56 percent to 0.62 percent—after rounding, a steady 0.6 percent across the two most recent censuses. For Calgarians? Falling home prices collided with rising taxes so that property taxes as a share of (market) home value rose from below 0.5 percent to nearly 0.7 percent.

Plug into the equation sliding household incomes, and we see that Calgary’s property tax burden ballooned nearly 50 percent between censuses.

This matters for at least three reasons. First, property tax is an essential source of revenue for municipalities across Canada. City councils set their property tax rate and the payments made by homeowners are the backbone of municipal finances.

Property taxes are also an essential source of revenue for schools. The province has historically required municipalities to directly transfer 33 percent of the total education budget via property taxes, but in the period under consideration that proportion fell (ultimately, to 28 percent).

Second, a home purchase is the largest expense most Canadians will ever make. Local taxes play a major role in how affordable life is from one city to another. When municipalities unexpectedly raise property taxes, it can push homeownership out of reach for many families. Thus, homeoowners (or prospective homeowners) naturally consider property tax rates and other local costs when choosing where to live and what home to buy.

And third, municipalities can fall into a vicious spiral if they’re not careful. When incomes decline and residential property values fall, as Calgary experienced during the period we studied, municipalities must either trim their budgets or increase property taxes. For many governments, it’s easier to raise taxes than cut spending.

But rising property tax burdens could lead to the city becoming a less desirable place to live. This could mean weaker residential property values, weaker population growth, and weaker growth in the number of residential properties. The municipality then again faces the choice of trimming budgets or raising taxes. And on and on it goes.

Cities fall into these downward spirals because they fall victim to a central planner’s bias. While $853 million for a new arena for the Calgary Flames or $11 million for Calgary Economic Development—how City Hall prefers to attract new business to Calgary—invite ribbon-cuttings, it’s the decisions about Calgary’s half a million private dwellings that really drive the city’s finances.

Yet, a virtuous spiral remains in reach. Municipalities tend to see the advantage of “affordable housing” when it’s centrally planned and taxpayer-funded but miss the easiest way to generate more affordable housing: simply charge city residents less—in taxes—for their housing.

When you reduce property taxes, you make housing more affordable to more people and make the city a more desirable place to live. This could mean stronger residential property values, stronger population growth, and stronger growth in the number of residential properties. Then, the municipality again faces a choice of making the city even more attractive by increasing services or further cutting taxes. And on and on it goes.

The economy is not a series of levers in the mayor’s office; it’s all of the million individual decisions that all of us, collectively, make. Calgary city council should reduce property taxes and leave more money for people to make the big decisions in life.

Jeff Park is a visiting fellow with the Aristotle Foundation for Public Policy and father of four who left Calgary for better affordability. David Hunt is the research director at the Calgary-based Aristotle Foundation for Public Policy. They are co-authors of the new study, Taxing our way to unaffordable housing: A brief comparison of municipal property taxes.

Alberta

Petition threatens independent school funding in Alberta

From the Fraser Institute

Recently, amid the backdrop of a teacher strike, an Alberta high school teacher began collecting signatures for a petition to end government funding of independent schools in the province. If she gets enough people to sign—10 per cent of the number of Albertans who voted in the last provincial election—Elections Alberta will consider launching a referendum about the issue.

In other words, the critical funding many Alberta families rely on for their children’s educational needs may be in jeopardy.

In Alberta, the provincial government partially funds independent schools and charter schools. The Alberta Teachers’ Association (ATA), whose members are currently on strike, opposes government funding of independent and charter schools.

But kids are not one-size-fits-all, and schools should reflect that reality, particularly in light of today’s increasing classroom complexity where different kids have different needs. Unlike government-run public schools, independent schools and charter schools have the flexibility to innovate and find creative ways to help students thrive.

And things aren’t going very well for all kids or teachers in government-run pubic school classrooms. According to the ATA, 93 per cent of teachers report encountering some form of aggression or violence at school, most often from students. Additionally, 85 per cent of unionized teachers face an increase in cognitive, social/emotional and behavioural issues in their classrooms. In 2020, one-quarter of students in Edmonton’s government-run public schools were just learning English, and immigration to Canada—and Alberta especially—has exploded since then. It’s not easy to teach a classroom of kids where a significant proportion do not speak English, many have learning disabilities or exceptional needs, and a few have severe behavioural problems.

Not surprisingly, demand for independent schools in Alberta is growing because many of these schools are designed for students with special needs, Autism, severe learning disabilities and ADHD. Some independent schools cater to students just learning English while others offer cultural focuses, expanded outdoor time, gifted learning and much more.

Which takes us back to the new petition—yet the latest attempt to defund independent schools in Alberta.

Wealthy families will always have school choice. But if the Alberta government wants low-income and middle-class kids to have the ability to access schools that fit them, too, it’s crucial to maintain—or better yet, increase—its support for independent and charter schools.

Consider a fictional Alberta family: the Millers. Their daughter, Lucy, is struggling at her local government-run public school. Her reading is below grade level and she’s being bullied. It’s affecting her self-esteem, her sleep and her overall wellbeing. The Millers pay their taxes. They don’t take vacations, they rent, and they haven’t upgraded their cars in many years. They can’t afford to pay full tuition for Lucy to attend an independent school that offers the approach to education she needs to succeed. However, because the Alberta government partially funds independent schools—which essentially means a portion of the Miller family’s tax dollars follow Lucy to the school of their choice—they’re able to afford the tuition.

The familiar refrain from opponents is that taxpayers shouldn’t pay for independent school tuition. But in fact, if you’re concerned about taxpayers, you should encourage school choice. If Lucy attends a government-run public school, taxpayers pay 100 per cent of her education costs. But if she attends an independent or charter school, taxpayers only pay a portion of the costs while her parents pay the rest. That’s why research shows that school choice saves tax dollars.

If you’re a parent with a child in a government-run public school in Alberta, you now must deal with another teacher strike. If you have a child in an independent or charter school, however, it’s business as usual. If Albertans are ever asked to vote on whether or not to end government funding for independent schools, they should remember that students are the most important stakeholder in education. And providing parents more choices in education is the solution, not the problem.

-

Automotive23 hours ago

Automotive23 hours agoParliament Forces Liberals to Release Stellantis Contracts After $15-Billion Gamble Blows Up In Taxpayer Faces

-

National1 day ago

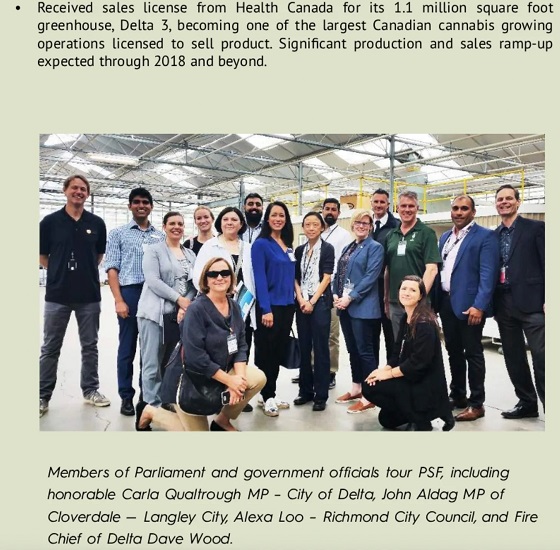

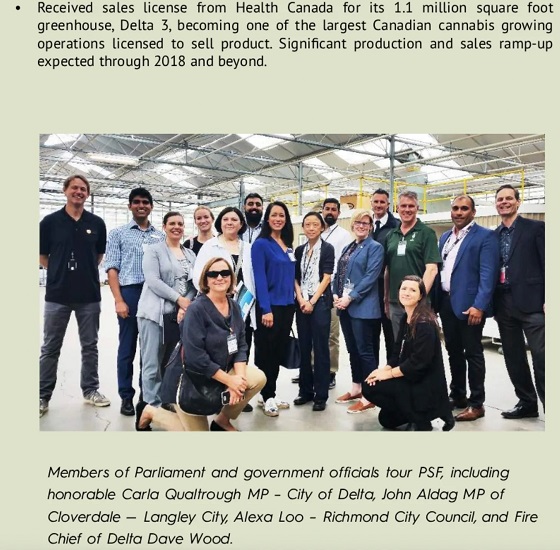

National1 day agoPolitically Connected Canadian Weed Sellers Push Back in B.C. Court, Seek Distance from Convicted Heroin Trafficker

-

Crime2 days ago

Crime2 days agoFrance stunned after thieves loot Louvre of Napoleon’s crown jewels

-

Uncategorized2 days ago

Uncategorized2 days agoNew report warns WHO health rules erode Canada’s democracy and Charter rights

-

Business1 day ago

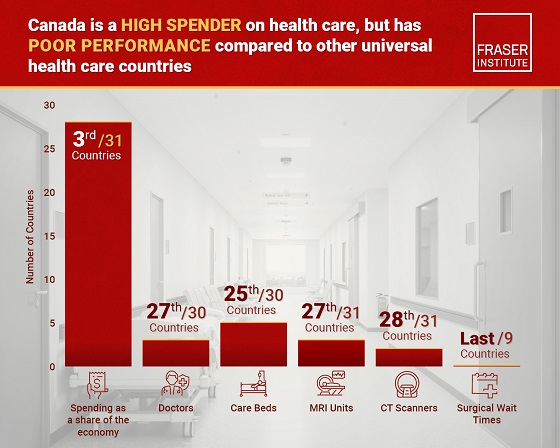

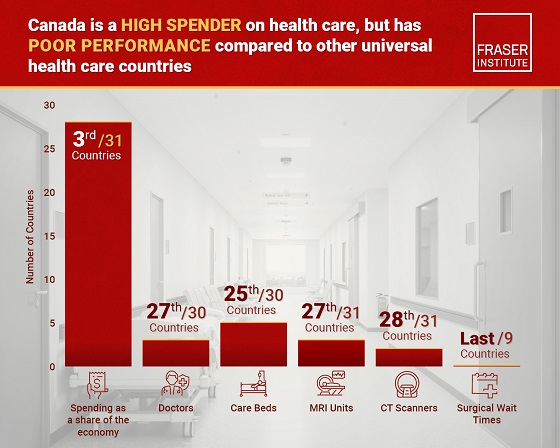

Business1 day agoCanada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care

-

Alberta1 day ago

Alberta1 day agoPetition threatens independent school funding in Alberta

-

MAiD13 hours ago

MAiD13 hours agoDisabled Canadians increasingly under pressure to opt for euthanasia during routine doctor visits

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears