Alberta

Low emissions, Indigenous-owned Cascade Power Project to boost Alberta electrical grid reliability

The Cascade Power Project. Photo courtesy Kinetcor

From the Canadian Energy Centre

By Will Gibson

New 900-megawatt natural gas-fired facility to supply more than eight per cent of Alberta’s power needs

Alberta’s electrical grid is about to get a boost in reliability from a major new natural gas-fired power plant owned in part by Indigenous communities.

Next month operations are scheduled to start at the Cascade Power Project, which will have enough capacity to supply more than eight per cent of Alberta’s energy needs.

It’s good news in a province where just over one month ago an emergency alert suddenly blared on cell phones and other electronic devices warning residents to immediately reduce electricity use to avoid outages.

“Living in an energy-rich province, we sometimes take electricity for granted,” says Chana Martineau, CEO of the Alberta Indigenous Opportunities Corporation (AIOC) and member of the Frog Lake First Nation.

“Given much of the province was dealing with -40C weather at the time, that alert was a vivid reminder of the importance of having a reliable electrical grid.”

Cascade Power was the first project to receive funding through the AIOC, the provincial corporation established in 2020 to provide loan guarantees for Indigenous groups seeking partnerships in major development projects.

So far, the AIOC has underwritten more than $500 million in support. This year it has $3 billion available, up from $2 billion in 2023.

In August 2020 it provided a $93 million loan guarantee to the Indigenous Communities Consortium — comprised of the Alexis Nakota Sioux Nation, Enoch Cree Nation, Kehewin Cree Nation, O’Chiese First Nation, Paul First Nation, and Whitefish (Goodfish) Lake First Nation — to become equity owners.

The 900-megawatt, $1.5-billion facility is scheduled to come online in March.

“It’s personally gratifying for me to see how we moved from having Indigenous communities being seen as obstacles to partners in a generation,” says Martineau.

The added capacity brought by Cascade is welcomed by the Alberta Electrical System Operator (AESO), which is responsible for the province’s electrical grid. =

“The AESO welcomes all new forms of generation into the Alberta marketplace, including renewables, thermal, storage, and others,” said Diane Kossman, a spokeswoman for the agency.

“It is imperative that Alberta continue to have sufficient dispatchable generation to serve load during peak demand periods when other forms of generation are not able to contribute in a meaningful way.”

The Cascade project also provides environmental benefits. It is a so-called “combined cycle” power facility, meaning it uses both a gas turbine and a steam turbine simultaneously to produce up to 50 per cent more electricity from the same amount of fuel than a traditional facility.

Once complete, Cascade is expected to be the largest and most efficient combined cycle power plant in Alberta, producing 62 per cent less CO2 than a coal-fired power plant and 30 per cent less CO2 than a typical coal-to-gas conversion.

“This project really is aligned with the goals of Indigenous communities on environmental performance,” says Martineau.

The partnership behind the power plant includes Axium Infrastructure, DIF Capital Partners and Kineticor Resource Corp. along with the Indigenous Communities Consortium.

The nations invested through a partnership with OPTrust, one of Canada’s largest pension funds.

“Innovation is not just what we invest in, but it is also how we invest,” said James Davis, OPTrust’s chief investment officer.

“The participation of six First Nations in the Cascade Power Project is a prime example of what is possible when investors, the government and local communities work together.”

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

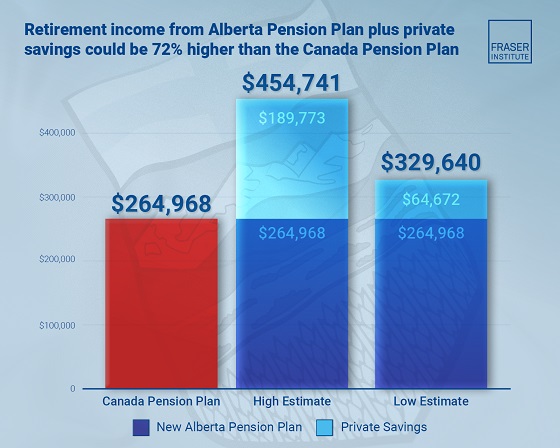

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Business24 hours ago

Business24 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Business2 days ago

Business2 days agoCarney government should apply lessons from 1990s in spending review

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal

-

Alberta23 hours ago

Alberta23 hours agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Daily Caller19 hours ago

Daily Caller19 hours ago‘Strange Confluence Of Variables’: Mike Benz Wants Transparency Task Force To Investigate What Happened in Butler, PA

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda