CBDC Central Bank Digital Currency

Lawmakers, conservatives blast WHO plan for ‘global governance’ on future pandemics

From LifeSiteNews

“The treaty would put us under the thumb of the U.N. and communist China and the WHO for whatever they wanted to declare a crisis, whether it’s poverty crisis, or a gun violence crisis or a climate crisis, or a health crisis, and make us listen to the WHO. That is not constitutional.”

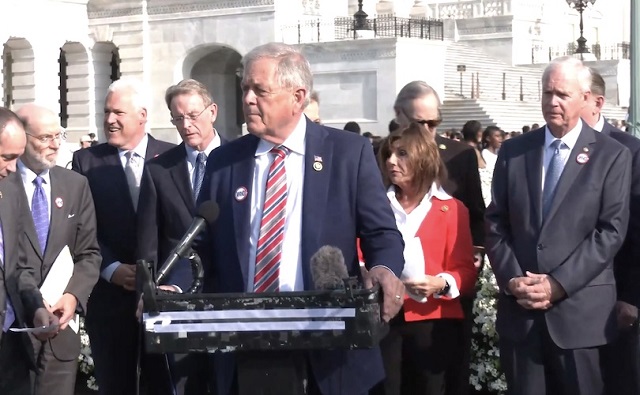

Republican lawmakers and conservative activists rallied outside the U.S. Capitol Thursday morning to raise awareness of and opposition to a global pandemic agreement that they say poses a grave threat to national sovereignty and basic freedoms.

On May 27, the World Health Assembly (the governing forum of the World Health Organization’s 194 member nations) is slated to meet and finalize the details of the WHO Pandemic Agreement, on the surface a plan to better handle global health crises like COVID-19 in the future. However, critics have found a number of alarming details in the drafts that have been released.

The Washington Stand’s Ben Johnson explains that the plan’s February 8-15 draft “redistribute 20% of all U.S. ‘pandemic-related products’’ to other nations,” empower censorship for the sake of preventing an “infodemic” of “too much information” and “false or misleading information” from creating “mistrust in health authorities and undermin[ing] public health and social measures,” and institute a “Conference of the Parties” to alter the deal further via a two-thirds vote.

An updated draft released April 16 drops the “infodemic” language in favor of a shorter and more vague statement about “[r]ecognizing the importance of building trust and ensuring timely sharing of information to prevent misinformation, disinformation and stigmatization”; but retains the redistribution language as well as the Conference of the Parties’ amendment power–meaning that the most objectionable aspects of earlier drafts could be restored once the agreement is adopted.

On Thursday, the Sovereignty Coalition organized a press conference to make their opposition to “global governance” known. Participants included U.S. Sen. Ron Johnson (R-WI), U.S. Reps. Bob Good (VA-5), Chris Smith (NJ-4), Chip Roy (TX-21), and other members of Congress; Family Research Council president Tony Perkins, Tea Party Patriots Action president Jenny Beth Martin, Center for Security Policy executive chairman Frank Gaffney, and Women’s Rights without Frontiers and Anti-Globalist International president Reggie Littlejohn, among other heads of conservative groups.

‘Not Now’ Campaign to Defend America’s Sovereignty Against WHO https://t.co/ThSRYgGHtP

— Sovereignty Coalition (@sovcoalition) April 18, 2024

“This is the most important issue that is getting the least amount of attention relative to its importance,” declared Good. “The treaty would put us under the thumb of the U.N. and communist China and the WHO for whatever they wanted to declare a crisis, whether it’s poverty crisis, or a gun violence crisis or a climate crisis, or a health crisis, and make us listen to the WHO. That is not constitutional.”

“Are we for standing up for Americans, or are we for ceding authority to international bodies to govern us and to shove their progressive, radical, Marxist ideas on the American people?” asked Roy.

Should the agreement be ratified, Littlejohn warned, the Conference of the Parties would have the power to “mandate vaccines, mandate masks, mandate lockdowns, and mandate quarantines,” as well as “mandate that the governments of the world surveil and censor their citizens, no doubt through digital IDs, which can be used as the basis of a Chinese-style, social credit.”

The Sovereignty Coalition also released a poll of 1,000 likely voters by McLaughlin & Associates finding that only 29% thought it was a “good idea” to delegate America’s pandemic decision making to the WHO, that nearly 75% thought health decisions should remain with their elected representatives, that nearly 64% believe any such agreement must be ratified by the Senate, and that 68% want approval delayed until the public has had the opportunity to see and debate the final text.

Long known for a similar left-wing bias to that of the United Nations, the WHO has faced additional criticism since COVID’s outbreak in 2020 for, among other offenses, opposing bans on travel from China that could have limited the reach of COVID, for legitimizing the false claims coming out of the Chinese government that initially downplayed the gravity of the situation and covered up the Communist regime’s mishandling of it, and for favoring the lockdown and mandate policies that exacerbated harm while curtailing basic freedoms and failing to improve health outcomes.

“In December [2019], the WHO refused to act on or publicize Taiwan’s warning that the new respiratory infection emerging in China could pass from human to human,” U.S. Sen. Marco Rubio (R-FL) wrote in April 2020. “In mid January [2020], despite accumulating evidence of patients contracting what we now know as COVID-19 from other people, the organization repeated the [Chinese Communist Party’s] lie that there was no evidence of human-to-human transmission. In January, the WHO, at Beijing’s behest, also blocked Taiwan from participating in critical meetings to coordinate responses to the coronavirus and even reportedly provided wrong information about the virus’s spread in Taiwan.”

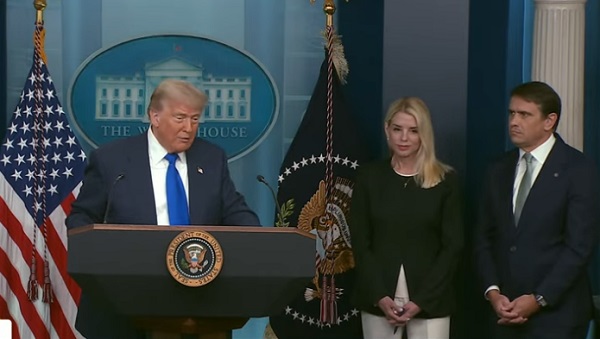

Near the end of its tenure, the Trump administration began the process of formally withdrawing the United States from the WHO. But upon taking office, President Joe Biden notified the body that it would contribute $200 million by the end of February 2021, restoring the aid Trump had canceled and asserting a “renewed commitment” to the WHO.

Banks

Top Canadian bank studies possible use of digital dollar for ‘basic’ online payments

From LifeSiteNews

A new report released by the Bank of Canada proposed a ‘promising architecture well-suited for basic payments’ through the use of a digital dollar, though most Canadians are wary of such an idea.

Canada’s central bank has been studying ways to introduce a central bank digital currency (CBDC) for use for online retailers, according to a new report, despite the fact that recent research suggests Canadians are wary of any type of digital dollar.

In a new 47-page report titled, “A Retail CBDC Design For Basic Payments Feasibility Study,” which was released on June 13, 2025, the Bank of Canada (BOC) identified a “promising architecture well-suited for basic payments” through the use of a digital dollar.

The report reads that CBDCs “can be fast and cheap for basic payments, with high privacy, although some areas such as integration with retail payments systems, performance of auditing and resilience of the core system state require further investigation.”

While the report authors stopped short of fully recommending a CBDC, they noted it is a decision that could happen “outside the scope of this analysis.”

“Our framing highlights other promising architectures for an online retail CBDC, whose analysis we leave as an area for further exploration,” reads the report.

When it comes to a digital Canadian dollar, the Bank of Canada last year found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Indeed, a 2023 study found that most Canadians, about 85 percent, do not want a digital dollar, as previously reported by LifeSiteNews.

The study found that a “significant number” of Canadians are suspicious of government overreach and would resist any measures by the government or central bank to create digital forms of official money.

The BOC has said that it would continue to look at other countries’ use and development of CBDCs and will work with other “central banks” to improve so-called cross border payments.

Last year, as reported by LifeSiteNews, the BOC has already said that plans to create a digital “dollar,” also known as a central bank digital currency (CBDC), have been shelved.

Digital currencies have been touted as the future by some government officials, but, as LifeSiteNews has reported before, many experts warn that such technology would restrict freedom and could be used as a “control tool” against citizens, similar to China’s pervasive social credit system.

The BOC last August admitted that the creation of a CBDC is not even necessary, as many people rely on cash to pay for things. The bank concluded that the introduction of a digital currency would only be feasible if consumers demanded its release.

Conservative Party leader Pierre Poilievre has promised, should he ever form the government, he would oppose the creation of a digital dollar.

Contrast this to Canada’s current Liberal Prime Minister Mark Carney. He has a history of supporting central bank digital currencies and in 2022 supported “choking off the money” donated to the Freedom Convoy protests against COVID mandates.

Banks

Legal group releases report warning Canadians about central bank digital currencies

From LifeSiteNews

By

“central bank digital currency could hand incredible power to the Government and Bank of Canada to monitor financial transactions, punish whatever behaviours the government deems undesirable, and penalize those on the wrong side of government ambitions”

The Justice Centre for Constitutional Freedoms released a new report examining how the adoption of a central bank digital currency in Canada could undermine the rights and freedoms of Canadians, including their privacy, autonomy, security, equality, and access to economic participation.

Financial transactions are increasingly conducted digitally. In 2023, a mere 11 percent of transactions were conducted with cash, according to Payments Canada.

This trend is not limited to individual consumers. Government entities, including government departments, agencies, and Crown Corporations, have rapidly digitized access to, and delivery of, their goods and services over the past decade.

READ: Mark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

Against this backdrop, in 2017, the Bank of Canada (a Crown Corporation) began exploring the possibility of implementing its own government-issued and government-controlled cashless currency – a central bank digital currency (CBDC).

In a 2023 Bank of Canada survey on CBDCs, however, 82 percent of 89,423 respondents strongly disagreed that the Bank of Canada should be researching or building the capability to issue a CBDC. Despite these results, the Bank of Canada continues to research a CBDC for Canada.

The Justice Centre’s report critically evaluates the impact a CBDC could have on Canadians’ fundamental rights and freedoms. Absent robust legislative protections and oversight, a CBDC could allow the Government and Bank of Canada to monitor Canadians’ purchases, donations, investments and other financial transactions.

A CBDC has the potential to empower government to reward and punish the behaviours and lifestyle choices of individual Canadians, as Communist China does with its “social credit” system. Allowing the government to peer into and influence Canadians’ purchasing behaviours could have a profoundly damaging impact on their privacy and autonomy, cautions the report.

READ: Financial expert warns all-digital monetary system would enable ‘complete control’ of citizens

Canada is not the first jurisdiction to explore a CBDC. This report evaluates the Bank of Canada’s exploration within a global context, applying lessons learned from jurisdictions like Nigeria, the Caribbean, and others.

After analyzing negative outcomes of “going cashless” in jurisdictions such as Australia, Sweden, Finland, and Norway, this report advocates for the value of cash and the need for robust institutional and legislative protections for the use of cash.

Ben Klassen, Education Programs Coordinator at the Justice Centre and lead author of the report, stated, “Many Canadian politicians and policy designers would have us participate in a frantic (and global) race to digitize goods and services, including our dollar. The finish line, we are told, promises heightened profitability, convenience, and security. While the pursuit of innovation and efficiency can deliver worthwhile rewards, we must always remember the values of privacy, autonomy, security, equality, and access to economic participation. Adopting a central bank digital currency risks excluding the homeless, the elderly, the ‘internetless,’ the technologically illiterate, and the conscientious objector.”

“Most seriously, a central bank digital currency could hand incredible power to the Government and Bank of Canada to monitor financial transactions, punish whatever behaviours the government deems undesirable, and penalize those on the wrong side of government ambitions,” continued Mr. Klassen. “This issue should be framed as a contrast between a ‘digital dollar’ and a ‘human dollar’ – our currency cannot be designed without regard for the humans and human values that will be profoundly impacted by its design.”

READ: RFK Jr. warns Americans ‘will be slaves’ if central bank digital currency is established

This report was produced in collaboration with Sharon Polsky – President of AMINAcorp.ca, President of the Privacy & Access Council of Canada, and a Privacy by Design Ambassador with more than 30 years’ experience in advising governments and policy designers on privacy and access matters.

Reprinted with permission from the Justice Centre for Constitutional Freedoms.

-

Alberta9 hours ago

Alberta9 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Automotive1 day ago

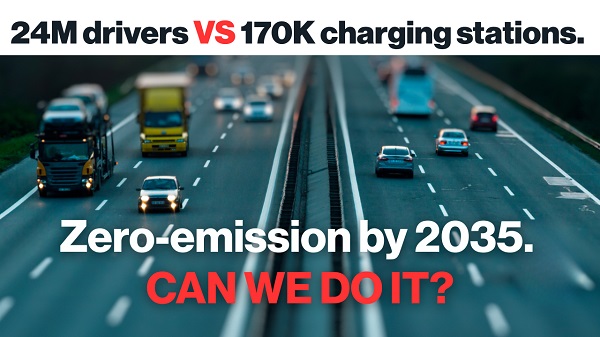

Automotive1 day agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Business11 hours ago

Business11 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Crime11 hours ago

Crime11 hours agoSuspected ambush leaves two firefighters dead in Idaho

-

Business1 day ago

Business1 day agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Alberta8 hours ago

Alberta8 hours agoWhy the West’s separatists could be just as big a threat as Quebec’s

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoFDA Exposed: Hundreds of Drugs Approved without Proof They Work