Energy

It should not take a crisis for Canada to develop the resources that make people and communities thrive.

From Resource Works

Canada is suddenly sprinting to build things it slow-walked for a decade.

“Canada has always been a nation of builders, from the St. Lawrence Seaway to Expo 67. At this hinge moment in our history, Canada must draw on this legacy and act decisively to transform our economy from reliance to resilience. We are moving at a speed not seen in generations,” announced Prime Minister Mark Carney at the end of August.

He was echoed by British Columbia Premier David Eby shortly after.

“There’s never been a more critical time to diversify our economy and reduce reliance on the U.S., and B.C. is leading the way in Canada, with clean electricity, skilled workers and strong partnerships with First Nations,” the premier stated after his government approved the Ksi Lisims LNG project, led by the Nisga’a nation.

In the face of President Donald Trump’s tariffs, Ottawa has unveiled a first wave of “national projects” that includes an expansion of LNG Canada to 28 million tonnes a year, a small modular reactor at Darlington, two mines, and a port expansion, all pitched as a way to “turbocharge” growth and reduce exposure to a trade war with the United States.

The list notably excludes new oil pipelines, and arrives with rhetoric about urgency and nation-building that begs a simple question: why did it take a crisis to prioritize what should have been routine economic housekeeping?

The most tangible impact of resource projects can be observed in the impact it has on communities. The Haisla Nation is enjoying an economic renaissance with their involvement in the LNG Canada project on their traditional lands, which became operational in June.

Furthermore, the Haisla are set to unveil their own facility, Cedar LNG, in 2028. Already, the impact of employment and strong paycheques in the community is transforming, as former Haisla Chief Councillor Crystal Smith as attested many times.

Former Haisla Chief Councillor Crystal Smith.

“Let’s build a bright and prosperous future for every Canadian and every Indigenous person that wants to be involved, because change never happens inside of our comfort zones, or the defensive zone,” said Crystal Smith at a speech delivered to the 2025 Testimonial Dinner Award on April 24 in Toronto.

Fortunately, the new pro-resource posture has a legislative backbone. Parliament passed the One Canadian Economy Act to streamline approvals for projects deemed in the national interest, a centrepiece of the government’s plan to cut internal trade barriers and fast-track strategic infrastructure.

Supporters see it as necessary in a period of economic rupture, while critics warn it risks sidelining Indigenous voices in the name of speed. Either way, it is an admission that Canada’s previous processes had become self-defeatingly slow.

British Columbia offers a clear case study. Premier David Eby is now leaning hard into liquefied natural gas. His government and Ottawa both approved the Nisga’a Nation-backed Ksi Lisims LNG project under a “one project, one review” approach, with Eby openly counting on the Nisga’a to build support among neighbouring nations that withheld consent.

It is a marked turn from earlier NDP caution, framed by the premier as a race against an American Alaska LNG push that could capture the same Asian markets.

Yet the pivot only underscores how much time was lost. For years, resource projects faced overlapping provincial and federal hurdles, from the Impact Assessment Act’s expanded federal reach to the 2018 federal tanker ban on B.C.’s north coast.

Within B.C., a thicket of regulations, policy uncertainty, and contested interpretations of consultation obligations chilled investment, while political positions on pipelines hardened. Industry leaders called it “regulatory paralysis.” These were choices, not inevitabilities.

The national “go-fast” stance also arrives with unresolved tensions. Ottawa has installed a Calgary-based office to clear and finance major projects, led by veteran executive Dawn Farrell, and is touting the emissions performance of LNG Canada’s expansion.

Dawn Farrell, head of the Major Projects office in Calgary.

At Resource Works, we wholeheartedly endorsed the move, given the proven ability and success of Dawn Farrell in the resource industry. It must also be acknowledged that the major projects office will only be an office unless it meaningfully makes these projects happen faster.

A decade that saw eighteen B.C. LNG proposals produced one major build, and moving to LNG Canada’s second phase is entangled with power-supply constraints and policy conditions. That slow cadence is how countries fall behind.

If the current urgency becomes a steady habit, Canada can still convert this scramble into lasting capacity. If not, the next shock will find us sprinting again, only further from the finish line.

Resource Works News

Energy

A picture is worth a thousand spreadsheets

From Resource Works

What if the secret to understanding Canada’s energy future lies not in spreadsheets but in storytelling?

When I think about who has done the most to make sense of Canada’s energy story — not just in charts and forecasts but in human terms — Peter Tertzakian sits near the top of that list. He’s an energy economist, author, and communicator who has spent decades helping Canadians understand the world beneath their light switches and fuel gauges — and why prosperity, energy, and responsible development are inseparable.

Peter is the founder and CEO of Studio.Energy. He is also widely known as the founder of the ARC Energy Research Institute and co-host of the ARC Energy Ideas podcast, alongside Jackie Forrest. Week after week, they unpack what’s happening in the markets, in technology, and in policy, always with the rare gift of clarity. He’s also the author of two influential books, A Thousand Barrels a Second and The End of Energy Obesity, both written long before “energy transition” became a household term.

When we sat down for our Power Struggle conversation, I mentioned how remarkable it is that someone with Peter’s credentials — an economist, investor, and advisor to industry — is also an exhibiting artist whose photography can regularly be found in a gallery in the Canadian Rockies. That’s when he smiled and said what has become one of his signature lines: “I’ve always said a picture is worth a thousand spreadsheets.”

What followed was a fascinating discussion about how visual storytelling can bridge the gap between data and understanding. Peter explained that what began as a hobby has evolved into a personal quest to communicate complex energy subjects more effectively. His photographs, which range from industrial scenes to landscapes shaped by human activity, help connect the emotional and analytical sides of the energy story. The pictures, he said, reveal the same truths that his spreadsheets do — only in a way that more people can feel.

That resonates deeply with what we do at Resource Works — translating complexity into clarity so that Canadians can see how responsible resource development strengthens communities, funds public services, and opens doors for Indigenous partnerships. Like Peter, we believe that understanding energy isn’t about choosing sides; it’s about understanding systems, trade-offs, and the people behind the numbers.

Peter’s concern — and one I share — is how difficult it has become to find truth amid the noise. “People are bombarded by noise, especially today. And not all of that noise is true,” he said. “The challenge now is extracting the signal.” Whether you’re a policymaker, a corporate leader, or just someone trying to make sense of global change, Peter’s approach is to step away from confrontation and toward comprehension. His ability to blend visuals, narrative, and numbers makes complicated issues accessible without oversimplifying them.

Prosperity, Not Population, Drives Energy Demand

Our conversation also turned to the forces shaping global energy demand. Peter reminded me that the biggest driver isn’t population growth — it’s prosperity. “When a person moves from a rural setting to a city, their energy consumption goes up twentyfold, sometimes more,” he said. The story of urbanization, particularly in China, explains much of the past few decades of energy growth. Renewables have slowed that curve, but as Peter points out, “our use of fossil fuels is still growing.”

What I most admire about Peter is that he doesn’t preach. “I don’t have all the answers,” he told me. “My role is to discuss treatment options — not to perform the surgery.” It’s a refreshingly honest stance in a world where too many experts claim certainty.

On Power Struggle, Peter Tertzakian reminded me why he’s so respected across the energy world: he brings intelligence without ego, curiosity without ideology, and a deep respect for the audience’s ability to think. His work reminds us that Canada’s resource story — when told with honesty and creativity — is one of innovation, community, and shared prosperity. And that storytelling — visual, verbal, and numerical — remains our most powerful tool for navigating change.

- Power Struggle audio and transcript

- Peter Tertzakian in Arc Energy Research Institute podcasts

- Peter Tertzakian on X

- Peter Tertzakian on LinkedIn

- Stewart Muir on X

- Stewart Muir on LinkedIn

Power Struggle on social media

Alberta

Federal budget: It’s not easy being green

From Resource Works

Canada’s climate rethink signals shift from green idealism to pragmatic prosperity.

Bill Gates raised some eyebrows last week – and probably the blood pressure of climate activists – when he published a memo calling for a “strategic pivot” on climate change.

In his memo, the Microsoft founder, whose philanthropy and impact investments have focused heavily on fighting climate change, argues that, while global warming is still a long-term threat to humanity, it’s not the only one.

There are other, more urgent challenges, like poverty and disease, that also need attention, he argues, and that the solution to climate change is technology and innovation, not unaffordable and unachievable near-term net zero policies.

“Unfortunately, the doomsday outlook is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world,” he writes.

Gates’ memo is timely, given that world leaders are currently gathered in Brazil for the COP30 climate summit. Canada may not be the only country reconsidering things like energy policy and near-term net zero targets, if only because they are unrealistic and unaffordable.

It could give some cover for Canadian COP30 delegates, who will be at Brazil summit at a time when Prime Minister Mark Carney is renegotiating his predecessor’s platinum climate action plan for a silver one – a plan that contains fewer carbon taxes and more fossil fuels.

It is telling that Carney is not at COP30 this week, but rather holding a summit with Alberta Premier Danielle Smith.

The federal budget handed down last week contains kernels of the Carney government’s new Climate Competitiveness Strategy. It places greater emphasis on industrial strategy, investment, energy and resource development, including critical minerals mining and LNG.

Despite his Davos credentials, Carney is clearly alive to the fact it’s a different ballgame now. Canada cannot afford a hyper-focus on net zero and the green economy. It’s going to need some high octane fuel – oil, natural gas and mining – to prime Canada’s stuttering economic engine.

The prosperity promised from the green economy has not quite lived up to its billing, as a recent Fraser Institute study reveals.

Spending and tax incentives totaling $150 billion over a decade by Ottawa, B.C, Ontario, Alberta and Quebec created a meagre 68,000 jobs, the report found.

“It’s simply not big enough to make a huge difference to the overall performance of the economy,” said Jock Finlayson, chief economist for the Independent Contractors and Business Association and co-author of the report.

“If they want to turn around what I would describe as a moribund Canadian economy…they’re not going to be successful if they focus on these clean, green industries because they’re just not big enough.”

There are tentative moves in the federal budget and Climate Competitiveness Strategy to recalibrate Canada’s climate action policies, though the strategy is still very much in draft form.

Carney’s budget acknowledges that the world has changed, thanks to deglobalization and trade strife with the U.S.

“Industrial policy, once seen as secondary to market forces, is returning to the forefront,” the budget states.

Last week’s budget signals a shift from regulations towards more investment-based measures.

These measures aim to “catalyse” $500 billion in investment over five years through “strengthened industrial carbon pricing, a streamlined regulatory environment and aggressive tax incentives.”

There is, as-yet, no commitment to improve the investment landscape for Alberta’s oil industry with the three reforms that Alberta has called for: scrapping Bill C-69, a looming oil and gas emissions cap and a West Coast oil tanker moratorium, which is needed if Alberta is to get a new oil pipeline to the West Coast.

“I do think, if the Carney government is serious about Canada’s role, potentially, as an global energy superpower, and trying to increase our exports of all types of energy to offshore markets, they’re going to have to revisit those three policy files,” Finlayson said.

Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute, said she thinks the emissions cap at least will be scrapped.

“The markets don’t lie,” she said, pointing to a post-budget boost to major Canadian energy stocks. “The energy index got a boost. The markets liked it. I don’t think the markets think there is going to be an emissions cap.”

Some key measures in the budget for unlocking investments in energy, mining and decarbonization include:

- incentives to leverage $1 trillion in investment over the next five years in nuclear and wind power, energy storage and grid infrastructure;

- an expansion of critical minerals eligible for a 30% clean technology manufacturing investment tax credit;

- $2 billion over five years to accelerate critical mineral production;

- tax credits for turquoise hydrogen (i.e. hydrogen made from natural gas through methane pyrolysis); and

- an extension of an investment tax credit for carbon capture utilization and storage through to 2035.

As for carbon taxes, the budget promises “strengthened industrial carbon pricing.”

This might suggest the government’s plan is to simply simply shift the burden for carbon pricing from the consumer entirely onto industry. If that’s the case, it could put Canadian resource industries at a disadvantage.

“How do we keep pushing up the carbon price — which means the price of energy — for these industries at a time when the United States has no carbon pricing at all?” Finlayson wonders.

Overall, Carney does seem to be moving in the right direction in terms of realigning Canada’s energy and climate policies.

“I think this version of a Liberal government is going to be more focused on investment and competitiveness and less focused around the virtue-signaling on climate change, even though Carney personally has a reputation as somebody who cares a lot about climate change,” Finlayson said.

“It’s an awkward dance for them. I think they are trying to set out a different direction relative to the Trudeau years, but they’re still trying to hold on to the Trudeau climate narrative.”

Pictured is Mark Carney at COP26 as UN Special Envoy on Climate Action and Finance. He is not at COP30 this week. UNRIC/Miranda Alexander-Webber

Resource Works News

-

Business2 days ago

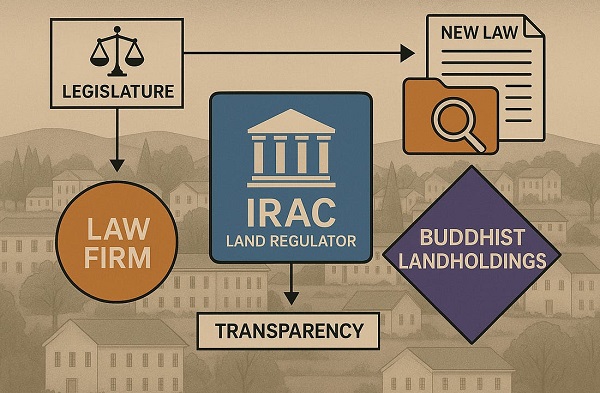

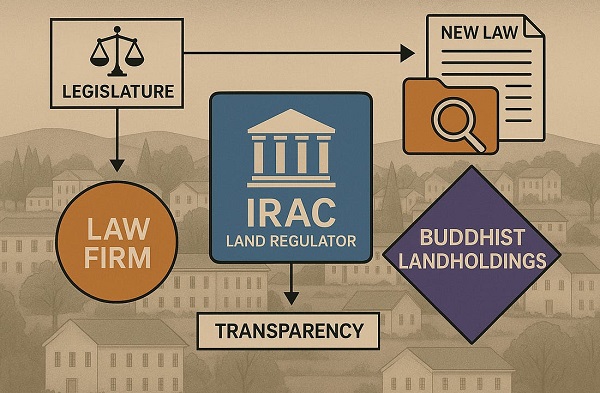

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

International2 days ago

International2 days agoIs America drifting toward civil war? Joe Rogan thinks so

-

Energy2 days ago

Energy2 days agoCanada’s oilpatch shows strength amid global oil shakeup

-

COVID-192 days ago

COVID-192 days agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoEU’s “Democracy Shield” Centralizes Control Over Online Speech

-

Alberta19 hours ago

Alberta19 hours agoChatGPT may explain why gap between report card grades and standardized test scores is getting bigger

-

Fraser Institute22 hours ago

Fraser Institute22 hours agoCourts and governments caused B.C.’s property crisis—they’re not about to fix it

-

International1 day ago

International1 day agoUS announces Operation Southern Spear, targeting narco-terrorists