Alberta

International Energy Agency boss prefers oil and gas from Canada

This article is submitted by Canadian Energy Centre Ltd.

Producers building a competitive advantage with ESG performance

The head of the International Energy Agency says Canada is a preferred global oil and gas supplier and should take steps to ensure it remains so in the decades to come.

IEA executive director Fatih Birol is a big advocate for net zero targets, but he knows that even as the world transforms its energy systems, oil and gas will be around for a long time.

He’d prefer the supply comes from “good partners” like Canada, Birol said on Jan. 13 during the virtual launch of the IEA’s Canada 2022 report.

The Paris-based IEA is a world-recognized authority on energy supply, demand and policy.

“Canada has been a cornerstone of global energy markets, a reliable partner, for years,” Birol said.

“We will still need oil and gas for years to come… I prefer that oil is produced by countries… like Canada who want to reduce the emissions of oil and gas.”

World oil consumption has returned near pre-pandemic levels, and natural gas demand surpassed levels pre-COVID last year, according to IEA data. Consumption of both is expected to continue rising even as more renewable energy sources come online.

In Europe, energy customers are feeling the pain of dealing with an unreliable supplier.

Birol said Europe’s natural gas crisis is in part because it depends on Russia for nearly half its natural gas imports. As a result, Russia’s policies “have a huge impact on the European energy mix.”

Right now, Russia has unused capacity to send the equivalent of a full LNG vessel every day to help reduce natural gas prices in Europe, amid a standoff between Moscow and the West over Ukraine, Birol told reporters last week.

“[The] world needs reliable partners,” he said. Canada’s first LNG exports are expected in 2025 and forecast to rise steadily thereafter, the IEA noted in its report.

Canada is the world’s fourth-largest producer of oil and natural gas and home to the third-largest oil reserves, which “creates employment for Canadians and secure and reliable oil and gas for both domestic and global markets,” the IEA said.

Remaining competitive in global oil and gas markets – and ensuring the sector remains a major driver of the Canadian economy beyond 2050 – requires emissions reductions, the IEA said, praising work that has been done already.

Canada is not only stable and reliable, but its LNG supply will also be cleaner than competitors, the IEA said.

The LNG Canada project that is under construction in B.C. is expected to have the lowest carbon emissions intensity of any large LNG facility currently operating in the world, at 60 per cent lower than the global average.

Other proposed LNG projects in Canada plan to use clean, renewable hydroelectricity to power operations, resulting in emissions profiles up to 90 per cent lower than global competitors, the IEA said.

Analysts praised the oil and gas industry’s “strong track record” of reducing emissions intensity, in the oil sands by 32 per cent since 1990 and by 13 per cent for natural gas production since 2010. A further reduction of up to 27 per cent is expected in the oil sands by 2030.

The success is in part because of large investments in clean technology and environmental protection, the IEA said.

Oil and gas companies in Canada together spend an average of $1 billion per year on energy cleantech, in addition to billions in environmental protection.

In 2018, oil and gas companies also invested $3.6 billion in environmental protection initiatives – by far the largest environmental protection spend of any industry in the country, the IEA said.

“Canadian oil and natural gas producers are leveraging their improving environmental, social and governance performance and Canada’s stringent environmental regulations to build a global competitive advantage” as interest in cleaner fuels and environmental sustainability grows.

Alberta

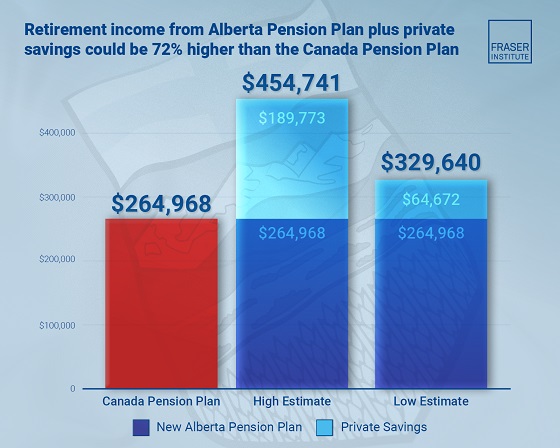

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Alberta1 day ago

Alberta1 day agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Daily Caller20 hours ago

Daily Caller20 hours ago‘Strange Confluence Of Variables’: Mike Benz Wants Transparency Task Force To Investigate What Happened in Butler, PA

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports