C2C Journal

Indecent Proposals: How Activist Investors Hijacked Responsible Corporate Governance

From the C2C Journal

By Gina Pappano of InvestNow

It’s a central tenet of the free-market economy: a corporation’s job is to maximize investment returns to its shareholders. Bluntly, to make money. And “shareholder proposals” have been a powerful tool enabling investors to pressure a company’s board to take a particular action to increase its value. In recent years, however, activist groups have been weaponizing shareholder proposals to pressure companies into pursuing ideological goals, especially environmental and “progressive” social-welfare causes. In the case of the oil and natural gas industry, they’ve even pushed for companies to take actions that would drive them out of business. Veteran markets expert Gina Pappano examines this damaging phenomenon – and the new movement pushing back.

C2C Journal

Wisdom of Our Elders: The Contempt for Memory in Canadian Indigenous Policy

By Peter Best

What do children owe their parents? Love, honour and respect are a good start. But what about parents who were once political figures – does the younger generation owe a duty of care to the beliefs of their forebears?

Two recent cases in Canada highlight the inter-generational conflict at play in Canada over Indigenous politics. One concerns Prime Minister Mark Carney and his father Robert. The other, a recent book on the life of noted aboriginal thinker William Wuttunee edited by his daughter Wanda. In each case, the current generation has let its ancestors down – and left all of Canada worse off.

William Wuttunee was born in 1928 in a one-room log cabin on a reserve in Saskatchewan, where he endured a childhood of poverty and hardship. Education was his release, and he went on to become the first aboriginal to practice law in Western Canada; he also served as the inaugural president of the National Indian Council in 1961.

Wuttunee rose to prominence with his controversial 1971 book Ruffled Feathers, that argued for an end to Canadian’s Indian Reserve system, which he believed trapped his people in poverty and despair. He dreamed of a Canada where Indigenous people lived side-by-side all other Canadians and enjoyed the same rights and benefits.

Such an argument for true racial equality put Wuttunee at odds with the illiberal elite of Canada’s native community, who still believe in a segregated, race-based relationship between Indigenous people and the rest of Canada. For telling truth to power, Wuttunee was ostracized from the native political community and banned from his own reserve. He died in 2015.

This year, William’s daughter Wanda had the opportunity to rectify the past mistreatment of her father. In the new book Still Ruffling Feathers – Let Us Put Our Minds Together, Wanda, an academic at the University of Manitoba, and several other contributors claim to “fearlessly engage” with her father’s ideas. Unfortunately, the authors mostly seek to bury, rather than

praise, Wuttunee’s vision of one Canada for all.

Wanda claims her father’s desire for a treaty-free, reserve-free Canada would be problematic today because it would have required giving up all the financial and legal goodies that have since been showered upon Indigenous groups. But there is a counterfactual to consider. What if Indigenous Canadians had simply enjoyed the same incremental gains in income, health and other social indicators as the rest of the country during this time?

Ample evidence on the massive and longstanding gap between native and non-native Canadians across a wide variety of socio-economic indicators suggest that integration would have been the better bet. The life expectancy for Indigenous Albertans, for example, is a shocking 19 years shorter than for a non-native Albertans. William Wuttunee was right all along about the damage done by the reserve system. And yet nearly all of the contributors to Wanda’s new book refuse to admit this fact.

The other current example concerns Robert Carney, who had a long and distinguished career in aboriginal education. When the future prime minister was a young boy, Robert was the principal of a Catholic day school in Fort Smith, Northwest Territories; he later became a government administrator and a professor of education. What he experienced throughout his

lifetime led the elder Carney to become an outspoken defender of Canada’s now-controversial residential schools.

When the 1996 Royal Commission on Aboriginal Peoples (RCAP) attacked the legacy of residential schools, Carney penned a sharp critique. He pointed out that the schools were not jails despite frequent claims that students were there against their will; in fact, parents had to sign an application form to enroll their children in a residential school. Carney also bristled at

the lack of context in the RCAP report, noting that the schools performed a key social welfare function in caring for “sick, dying, abandoned and orphaned children.”

In the midst of the 2025 federal election campaign, Mark Carney was asked if he agreed with his father’s positive take on residential schools. “I love my father, but I don’t share those views,” he answered. Some Indigenous activists have subsequently accused Robert Carney of residential school “denialism” and “complicity” in the alleged horrors of Canada’s colonial education system.

Like Wanda Wuttunee, Mark Carney let his father down by distancing himself from his legacy for reasons of political expediency. He had an opportunity to offer Canadians a courageous and fact-based perspective on a subject of great current public interest by drawing upon his intimate connection with an expert in the field. Instead, Mark Carney caved to the

requirements of groupthink. As a result, his father now stands accused of complicity in a phony genocide.

As for William Wuttunee, he wanted all Canadians – native and non-native alike – to be free from political constraints. He rejected racial segregation, discrimination and identity politics in all forms. And yet in “honouring” his life’s work, his daughter misrepresents his legacy by sidestepping the core truths of his central belief.

No one doubts that Wanda Wuttunee and Mark Carney each loved their dads, as any son or daughter should. And there is no requirement that a younger generation must accept without question whatever their parents thought. But in the case of Wuttunee and Carney, both offspring have deliberately chosen to tarnish their fathers’ legacies in obedience to a poisonous

ideology that promotes the entirely un-Canadian ideal of permanent racial segregation and inequity. And all of Canada is the poorer for it.

Peter Best is a retired lawyer living in Sudbury, Ontario. The original, longer version of this story first appeared in C2CJournal.ca.

Artificial Intelligence

The Emptiness Inside: Why Large Language Models Can’t Think – and Never Will

This is a special preview article from the:

Early attempts at artificial intelligence (AI) were ridiculed for giving answers that were confident, wrong and often surreal – the intellectual equivalent of asking a drunken parrot to explain Kant. But modern AIs based on large language models (LLMs) are so polished, articulate and eerily competent at generating answers that many people assume they can know and, even

better, can independently reason their way to knowing.

This confidence is misplaced. LLMs like ChatGPT or Grok don’t think. They are supercharged autocomplete engines. You type a prompt; they predict the next word, then the next, based only on patterns in the trillions of words they were trained on. No rules, no logic – just statistical guessing dressed up in conversation. As a result, LLMs have no idea whether a sentence is true or false or even sane; they only “know” whether it sounds like sentences they’ve seen before. That’s why they often confidently make things up: court cases, historical events, or physics explanations that are pure fiction. The AI world calls such outputs

“hallucinations”.

But because the LLM’s speech is fluent, users instinctively project self-understanding onto the model, triggered by the same human “trust circuits” we use for spotting intelligence. But it is fallacious reasoning, a bit like hearing someone speak perfect French and assuming they must also be an excellent judge of wine, fashion and philosophy. We confuse style for substance and

we anthropomorphize the speaker. That in turn tempts us into two mythical narratives: Myth 1: “If we just scale up the models and give them more ‘juice’ then true reasoning will eventually emerge.”

Bigger LLMs do get smoother and more impressive. But their core trick – word prediction – never changes. It’s still mimicry, not understanding. One assumes intelligence will magically emerge from quantity, as though making tires bigger and spinning them faster will eventually make a car fly. But the obstacle is architectural, not scalar: you can make the mimicry more

convincing (make a car jump off a ramp), but you don’t convert a pattern predictor into a truth-seeker by scaling it up. You merely get better camouflage and, studies have shown, even less fidelity to fact.

Myth 2: “Who cares how AI does it? If it yields truth, that’s all that matters. The ultimate arbiter of truth is reality – so cope!”

This one is especially dangerous as it stomps on epistemology wearing concrete boots. It effectively claims that the seeming reliability of LLM’s mundane knowledge should be extended to trusting the opaque methods through which it is obtained. But truth has rules. For example, a conclusion only becomes epistemically trustworthy when reached through either: 1) deductive reasoning (conclusions that must be true if the premises are true); or 2) empirical verification (observations of the real world that confirm or disconfirm claims).

LLMs do neither of these. They cannot deduce because their architecture doesn’t implement logical inference. They don’t manipulate premises and reach conclusions, and they are clueless about causality. They also cannot empirically verify anything because they have no access to reality: they can’t check weather or observe social interactions.

Attempting to overcome these structural obstacles, AI developers bolt external tools like calculators, databases and retrieval systems onto an LLM system. Such ostensible truth-seeking mechanisms improve outputs but do not fix the underlying architecture.

The “flying car” salesmen, peddling various accomplishments like IQ test scores, claim that today’s LLMs show superhuman intelligence. In reality, LLM IQ tests violate every rule for conducting intelligence tests, making them a human-prompt engineering skills competition rather than a valid assessment of machine smartness.

Efforts to make LLMs “truth-seeking” by brainwashing them to align with their trainer’s preferences through mechanisms like RLHF miss the point. Those attempts to fix bias only make waves in a structure that cannot support genuine reasoning. This regularly reveals itself through flops like xAI Grok’s MechaHitler bravado or Google Gemini’s representing America’s Founding Fathers as a lineup of “racialized” gentlemen.

Other approaches exist, though, that strive to create an AI architecture enabling authentic thinking:

Symbolic AI: uses explicit logical rules; strong on defined problems, weak on ambiguity;

Causal AI: learns cause-and-effect relationships and can answer “what if” questions;

Neuro-symbolic AI: combines neural prediction with logical reasoning; and

Agentic AI: acts with the goal in mind, receives feedback and improves through trial-and-error.

Unfortunately, the current progress in AI relies almost entirely on scaling LLMs. And the alternative approaches receive far less funding and attention – the good old “follow the money” principle. Meanwhile, the loudest “AI” in the room is just a very expensive parrot.

LLMs, nevertheless, are astonishing achievements of engineering and wonderful tools useful for many tasks. I will have far more on their uses in my next column. The crucial thing for users to remember, though, is that all LLMs are and will always remain linguistic pattern engines, not epistemic agents.

The hype that LLMs are on the brink of “true intelligence” mistakes fluency for thought. Real thinking requires understanding the physical world, persistent memory, reasoning and planning that LLMs handle only primitively or not all – a design fact that is non-controversial among AI insiders. Treat LLMs as useful thought-provoking tools, never as trustworthy sources. And stop waiting for the parrot to start doing philosophy. It never will.

The original, full-length version of this article was recently published as Part I of a two-part series in C2C Journal. Part II can be read here.

Gleb Lisikh is a researcher and IT management professional, and a father of three children, who lives in Vaughan, Ontario and grew up in various parts of the Soviet Union.

-

Alberta14 hours ago

Alberta14 hours agoDanielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

-

Health1 day ago

Health1 day agoSaskatchewan woman approved for euthanasia urged to seek medical help in Canada rather than US

-

Indigenous1 day ago

Indigenous1 day agoResidential school burials controversy continues to fuel wave of church arsons, new data suggests

-

International1 day ago

International1 day agoFBI didn’t think it had cause to raid Trump but DOJ did it anyway

-

Health1 day ago

Health1 day agoCanadian gov’t considers sharing census data on gender-confused children

-

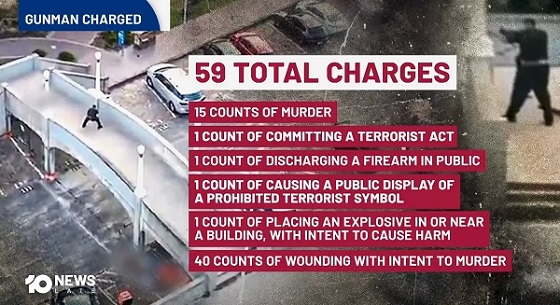

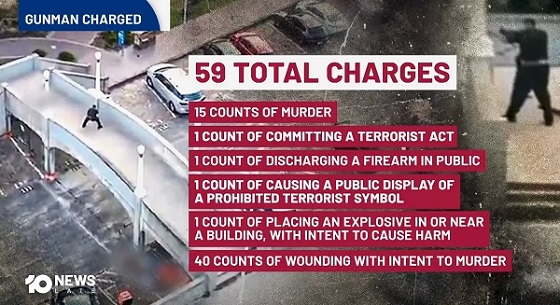

Crime16 hours ago

Crime16 hours agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

Energy19 hours ago

Energy19 hours agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Business2 days ago

Business2 days agoCOP30 finally admits what resource workers already knew: prosperity and lower emissions must go hand in hand

Popular delusions: Climate activists push for an end to the oil and natural gas industry even as an energy-hungry world set records last year for energy consumption and oil production; the world will need crude oil and natural gas for decades to come and Canada could be a preferred supplier. (Sources: (photo)

Popular delusions: Climate activists push for an end to the oil and natural gas industry even as an energy-hungry world set records last year for energy consumption and oil production; the world will need crude oil and natural gas for decades to come and Canada could be a preferred supplier. (Sources: (photo)  Annual general meetings (AGM) used to be mostly stodgy affairs, dedicated to discussing a company’s financial statements and general business; the rise of shareholders’ proposals has made some of them much more contentious. Depicted, (top) Ford’s AGM, 1980; (middle) Bank of America’s AGM, 2024; (bottom) an activist is removed from Shell’s 2023 AGM. (Sources of photos: (top)

Annual general meetings (AGM) used to be mostly stodgy affairs, dedicated to discussing a company’s financial statements and general business; the rise of shareholders’ proposals has made some of them much more contentious. Depicted, (top) Ford’s AGM, 1980; (middle) Bank of America’s AGM, 2024; (bottom) an activist is removed from Shell’s 2023 AGM. (Sources of photos: (top)  Renee Jones, a former director of the U.S. Securities and Exchange Commission, defended the right of shareholders to bring matters to a vote at AGMs; many such proposals have focussed on left-leaning environmental, social and governance (ESG) topics, and companies have been anxious to play along. At right, a screenshot from the presentation entitled “Unlocking the Power of Environmental, Social and Governance Data” by the World Economic Forum. (Source of right photo:

Renee Jones, a former director of the U.S. Securities and Exchange Commission, defended the right of shareholders to bring matters to a vote at AGMs; many such proposals have focussed on left-leaning environmental, social and governance (ESG) topics, and companies have been anxious to play along. At right, a screenshot from the presentation entitled “Unlocking the Power of Environmental, Social and Governance Data” by the World Economic Forum. (Source of right photo:  Advocates of “stakeholder capitalism” believe companies should care less about profit – but it’s the push for those profits that makes companies successful, creates jobs and wealth, and finances retirement for millions. (Source of photo:

Advocates of “stakeholder capitalism” believe companies should care less about profit – but it’s the push for those profits that makes companies successful, creates jobs and wealth, and finances retirement for millions. (Source of photo:  The United Nations-supported Principles of Responsible Investing, signed by 3,500 asset managers – including the Canada Pension Plan Investment Board – demanded that companies pursue ESG goals to “better align investors with broader objectives of society”; ideological dogma has replaced the pursuit of shareholder value. (Source of photos: (left) expatpostcards/Shutterstock; (right) Sheila Fitzgerald/Shutterstock)

The United Nations-supported Principles of Responsible Investing, signed by 3,500 asset managers – including the Canada Pension Plan Investment Board – demanded that companies pursue ESG goals to “better align investors with broader objectives of society”; ideological dogma has replaced the pursuit of shareholder value. (Source of photos: (left) expatpostcards/Shutterstock; (right) Sheila Fitzgerald/Shutterstock) Oil and natural gas companies and financial institutions have been the primary targets of shareholder proposals in Canada, which typically demand aggressive decarbonization and divestment from the energy sector. Shown at bottom, protesters march at the RBC AGM, Toronto. (Sources: (chart)

Oil and natural gas companies and financial institutions have been the primary targets of shareholder proposals in Canada, which typically demand aggressive decarbonization and divestment from the energy sector. Shown at bottom, protesters march at the RBC AGM, Toronto. (Sources: (chart)  One of the world’s most successful investors, Warren Buffett, has been decidedly lukewarm on ESG, a position one business magazine called “unconventional” – an indication of how thoroughly the ideology has penetrated. (Source of photo:

One of the world’s most successful investors, Warren Buffett, has been decidedly lukewarm on ESG, a position one business magazine called “unconventional” – an indication of how thoroughly the ideology has penetrated. (Source of photo:  “Asset managers and for-profit corporations have a fiduciary duty to maximize value,” says Vivek Ramaswamy, co-founder of Strive, an asset management firm committed to the primacy of shareholders’ financial interests; the firm’s data on the fall of ESG-focussed fund launches suggests his approach is resonating with investors. (Source of left photo: AP Photo/J. Scott Applewhite)

“Asset managers and for-profit corporations have a fiduciary duty to maximize value,” says Vivek Ramaswamy, co-founder of Strive, an asset management firm committed to the primacy of shareholders’ financial interests; the firm’s data on the fall of ESG-focussed fund launches suggests his approach is resonating with investors. (Source of left photo: AP Photo/J. Scott Applewhite) Pushing back: The U.S. State Financial Officers Foundation has urged corporations and fund managers to put shareholders first; 18 member states have enacted anti-ESG laws, including prohibitions on state entities investing with asset managers deemed to be discriminating against or boycotting the fossil fuel industry. (Source of photo:

Pushing back: The U.S. State Financial Officers Foundation has urged corporations and fund managers to put shareholders first; 18 member states have enacted anti-ESG laws, including prohibitions on state entities investing with asset managers deemed to be discriminating against or boycotting the fossil fuel industry. (Source of photo:  Blazing the trail: ExxonMobil early this year filed a lawsuit to block two activist groups from submitting shareholder proposals demanding that the company stop exploring for oil and natural gas and, thereby, “change the nature of its ordinary business or to go out of business entirely”; in June the activist groups backed down. (Source of photo:

Blazing the trail: ExxonMobil early this year filed a lawsuit to block two activist groups from submitting shareholder proposals demanding that the company stop exploring for oil and natural gas and, thereby, “change the nature of its ordinary business or to go out of business entirely”; in June the activist groups backed down. (Source of photo:  In the first actions of their kind in Canada, the not-for-profit group InvestNow – led by the author – submitted several shareholder proposals to Canadian banks, asking them to commit to keep investing in the oil and natural gas sector, and to Suncor Energy Inc., asking it to drop its “net zero” commitment; Suncor, the author points out, has held its overall greenhouse gas emissions virtually flat year-over-year, and should unapologetically keep producing oil. (Sources: (photo)

In the first actions of their kind in Canada, the not-for-profit group InvestNow – led by the author – submitted several shareholder proposals to Canadian banks, asking them to commit to keep investing in the oil and natural gas sector, and to Suncor Energy Inc., asking it to drop its “net zero” commitment; Suncor, the author points out, has held its overall greenhouse gas emissions virtually flat year-over-year, and should unapologetically keep producing oil. (Sources: (photo)