Economy

If Canadian families spent and borrowed like the federal government, they would be $427,759 in debt

From the Fraser Institute

By Grady Munro and Jake Fuss

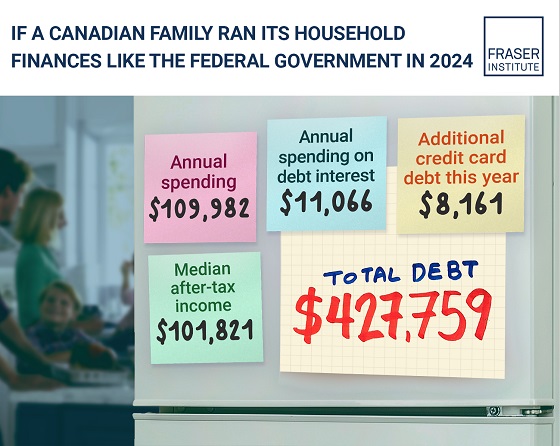

If the median Canadian family spent and borrowed like the federal government, they would already be $427,759 in debt and continuing to borrow, finds a new study published today by the Fraser Institute.

“If the median family in Canada spent and borrowed like the federal government, they would be in serious financial trouble,” said Grady Munro, a Fraser Institute policy analyst and co-author of Understanding the Scale of Canada’s Federal Deficit.

The $39.8 billion deficit expected by Ottawa in 2024/25 represents the 17th consecutive annual federal deficit, with continued deficits expected into the foreseeable future, eventually resulting in higher taxes for Canadians.

Continuous annual borrowing by Ottawa to finance increased spending has driven federal total debt from 53.0 per cent of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8 per cent ($2.1 trillion) in 2024/25.

To put this into perspective, the study’s analysis offers an example of what a median family’s household finances would look like if they were to spend and borrow like the federal government in 2024.

The study found that the median Canadian family in 2024 would spend $109,982 while only earning $101,821, meaning that it would borrow $8,161 just to pay for its normal spending. This $8,000-plus in additional debt is on top of the $427,759 in existing debt the family would already hold based on previous borrowing.

Illustrative of the burden of debt, $11,066 of the family’s income, representing almost 11 per cent, would be spent on just the interest costs of existing debt.

“Unlike most households, where debt is often offset by assets such as a home or investments, the federal government has little in the way of assets to offset its enormous debt,” said Jake Fuss, director of fiscal policy at the Fraser Institute and coauthor. “And it’s important to note that this government debt burden on Canadian families does not include the burden of provincial and municipal government debt, which depending on one’s location, can be significant.”

- For many years the federal government’s approach to government finances has relied on spending-driven deficits and a growing debt burden, causing a deterioration in the state of federal finances.

- While deficits can sometimes be justified in certain circumstances, perpetual spending-driven deficits have become the norm rather than a temporary exception for the federal government. The $39.8 billion deficit expected in 2024/25 is the 17th consecutive annual deficit, and deficits are expected to continue into the foreseeable future.

- Deficits have helped drive federal gross debt from 53.0% of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8% ($2.1 trillion) in 2024/25.

- This increase in the level of federal debt comes with costs and will result in higher taxes on Canadians.

- It may be hard to comprehend the scale of the deficits and debt, so to contextualize the current state of federal finances this bulletin provides an example of what a median family’s household budget would look like in 2024 if it managed its finances the way the federal government does.

- The median family earning $101,821 in 2024 would be spending $109,982 if it spent the way the federal government does. To cover the difference, it would put $8,161 on a credit card, despite already being $427,759 in debt.

- Of the total amount spent, $11,066 would go towards interest on the debt his year. Simply put, a Canadian family that chose to spend like the federal government would be in financial trouble.

Authors:

Business

Most Canadians say retaliatory tariffs on American goods contribute to raising the price of essential goods at home

- 77 per cent say Canada’s tariffs on U.S. products increase the price of consumer goods

- 72 per cent say that their current tax bill hurts their standard of living

A new MEI-Ipsos poll published this morning reveals a clear disconnect between Ottawa’s high-tax, high-spending approach and Canadians’ level of satisfaction.

“Canadians are not on board with Ottawa’s fiscal path,” says Samantha Dagres, communications manager at the MEI. “From housing to trade policy, Canadians feel they’re being squeezed by a government that is increasingly an impediment to their standard of living.”

More than half of Canadians (54 per cent) say Ottawa is spending too much, while only six per cent think it is spending too little.

A majority (54 per cent) also do not believe federal dollars are being effectively allocated to address Canada’s most important issues, and a similar proportion (55 per cent) are dissatisfied with the transparency and accountability in the government’s spending practices.

As for their own tax bills, Canadians are equally skeptical. Two-thirds (67 per cent) say they pay too much income tax, and about half say they do not receive good value in return.

Provincial governments fared even worse. A majority of Canadians say they receive poor value for the taxes they pay provincially. In Quebec, nearly two-thirds (64 per cent) of respondents say they are not getting their money’s worth from the provincial government.

Not coincidentally, Quebecers face the highest marginal tax rates in North America.

On the question of Canada’s response to the U.S. trade dispute, nearly eight in 10 Canadians (77 per cent) agree that Ottawa’s retaliatory tariffs on American products are driving up the cost of everyday goods.

“Canadians understand that tariffs are just another form of taxation, and that they are the ones footing the bill for any political posturing,” adds Ms. Dagres. “Ottawa should favour unilateral tariff reduction and increased trade with other nations, as opposed to retaliatory tariffs that heap more costs onto Canadian consumers and businesses.”

On the issue of housing, 74 per cent of respondents believe that taxes on new construction contribute directly to unaffordability.

All of this dissatisfaction culminates in 72 per cent of Canadians saying their overall tax burden is reducing their standard of living.

“Taxpayers are not just ATMs for government – and if they are going to pay such exorbitant taxes, you’d think the least they could expect is good service in return,” says Ms. Dagres. “Canadians are increasingly distrustful of a government that believes every problem can be solved with higher taxes.”

A sample of 1,020 Canadians 18 years of age and older was polled between June 17 and 23, 2025. The results are accurate to within ± 3.8 percentage points, 19 times out of 20.

The results of the MEI-Ipsos poll are available here.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

Business

Trump confirms 35% tariff on Canada, warns more could come

Quick Hit:

President Trump on Thursday confirmed a sweeping new 35% tariff on Canadian imports starting August 1, citing Canada’s failure to curb fentanyl trafficking and retaliatory trade actions.

Key Details:

- In a letter to Canadian Prime Minister Mark Carney, Trump said the new 35% levy is in response to Canada’s “financial retaliation” and its inability to stop fentanyl from reaching the U.S.

- Trump emphasized that Canadian businesses that relocate manufacturing to the U.S. will be exempt and promised expedited approvals for such moves.

- The administration has already notified 23 countries of impending tariffs following the expiration of a 90-day negotiation window under Trump’s “Liberation Day” trade policy.

Diving Deeper:

President Trump escalated his tariff strategy on Thursday, formally announcing a 35% duty on all Canadian imports effective August 1. The move follows what Trump described as a breakdown in trade cooperation and a failure by Canada to address its role in the U.S. fentanyl crisis.

“It is a Great Honor for me to send you this letter in that it demonstrates the strength and commitment of our Trading Relationship,” Trump wrote to Prime Minister Mark Carney. He added that the tariff response comes after Canada “financially retaliated” against the U.S. rather than working to resolve the flow of fentanyl across the northern border.

Trump’s letter made clear the tariff will apply broadly, separate from any existing sector-specific levies, and included a warning that “goods transshipped to evade this higher Tariff will be subject to that higher Tariff.” The president also hinted that further retaliation from Canada could push rates even higher.

However, Trump left the door open for possible revisions. “If Canada works with me to stop the flow of Fentanyl, we will, perhaps, consider an adjustment to this letter,” he said, adding that tariffs “may be modified, upward or downward, depending on our relationship.”

Canadian companies that move operations to the U.S. would be exempt, Trump said, noting his administration “will do everything possible to get approvals quickly, professionally, and routinely — In other words, in a matter of weeks.”

The U.S. traded over $762 billion in goods with Canada in 2024, with a trade deficit of $63.3 billion, a figure Trump called a “major threat” to both the economy and national security.

Speaking with NBC News on Thursday, Trump suggested even broader tariff hikes are coming, floating the idea of a 15% or 20% blanket rate on all imports. “We’re just going to say all of the remaining countries are going to pay,” he told Meet the Press moderator Kristen Welker, adding that “the tariffs have been very well-received” and noting that the stock market had hit new highs that day.

The Canadian announcement is part of a broader global tariff rollout. In recent days, Trump has notified at least 23 countries of new levies and revealed a separate 50% tariff on copper imports.

“Not everybody has to get a letter,” Trump said when asked if other leaders would be formally notified. “You know that. We’re just setting our tariffs.”

-

Business18 hours ago

Business18 hours agoMost Canadians say retaliatory tariffs on American goods contribute to raising the price of essential goods at home

-

National1 day ago

National1 day agoWomen and girls beauty pageant urges dismissal of transgender human rights complaint

-

Alberta18 hours ago

Alberta18 hours agoCross-Canada NGL corridor will stretch from B.C. to Ontario

-

International2 days ago

International2 days agoSupport for the Ukraine war continues because no one elected is actually in charge.

-

Business2 days ago

Business2 days agoTrump slaps Brazil with tariffs over social media censorship

-

Business2 days ago

Business2 days agoCBC six-figure salaries soar

-

Business19 hours ago

Business19 hours agoB.C. premier wants a private pipeline—here’s how you make that happen

-

Addictions2 days ago

Addictions2 days agoCan addiction be predicted—and prevented?