Economy

High taxes hurt Canada’s ability to attract talent

From the Fraser Institute

By Alex Whalen and Jake Fuss

With Major League Baseball’s regular season winding down and NHL training camps starting up, some big-name athletes including Maple Leafs captain John Tavares and former Toronto Blue Jays Josh Donaldson and Jose Bautista are involved in lawsuits with the Canada Revenue Agency. While the specifics of each case differ, the overall theme is the same—when signing their contracts in Toronto, these athletes adopted tax planning strategies to manage Canada’s burdensome tax structure.

One might ask: who cares about the tax plight of multi-millionaire pro athletes? But these high-profile cases underscore Canada’s comparative disadvantage in attracting top performers in all fields.

Similar to professional athletes, other high-skilled individuals including doctors, engineers, scientists and entrepreneurs are more likely than other workers to consider tax rates when choosing where to live and work. By maintaining high tax rates relative to similar jurisdictions, Canada has a harder time attracting and retaining these talented individuals.

And you’re almost guaranteed to face higher tax rates in Canada than in the United States. When it comes to top personal income tax rates, 10 of the top 15 highest-taxed jurisdictions in North America (among 61 provinces and U.S. states) are Canadian including the entire top eight.

In fact, a top performer in Ontario, British Columbia or Quebec faces a marginal tax rate at least 11 percentage points higher than the median U.S. state, and 16 percentage points higher than nine U.S. states (which have no state income tax). For a doctor, entrepreneur, professional athlete or other high-skilled worker, the tax differences between these jurisdictions can be substantial. Not surprisingly, the nine U.S. states with no state tax such as Texas, Florida and Tennessee have become favoured destinations for pro athletes and other top talent.

In addition to hurting Canada’s ability to attract high-skilled individuals, high personal income taxes reduce incentives for Canadians to work, save and invest. For example, higher taxes reduce the income workers take home from each hour worked, so many will choose to work fewer hours, resulting in reduced economic growth and prosperity. And higher taxes reduce savings and investment by consuming larger portions of a worker’s earnings.

High tax rates can also lead to less innovation and entrepreneurship, which limits economic growth and thereby affects all Canadians, not merely the wealthy. These innovators and job creators operate in a global marketplace for talent. Once achieving free agency, the typical hockey or baseball star generally will only have 30 to 32 destinations to choose from, all within North America. In contrast, Canada competes for other types of talent with countries from around the globe, making competitiveness even more important.

Professional athletes have a few things in common with other top performers. They are highly mobile, and all else equal, will move to jurisdictions that allow them to take home the highest possible after-tax earnings. While no Canadians are likely losing any sleep over John Tavares’ tax lawsuit, the broader concern over Canada’s competitiveness should be a top priority for policymakers.

Authors:

Daily Caller

UN Chief Rages Against Dying Of Climate Alarm Light

From the Daily Caller News Foundation

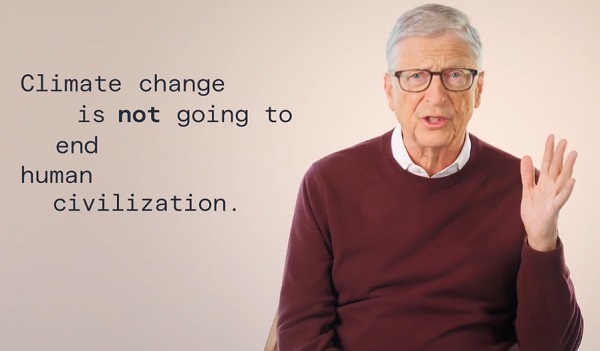

The light of the global climate alarm movement has faded throughout 2025, as even narrative-pushing luminaries like Bill Gates have begun admitting. But that doesn’t mean the bitter clingers to the net-zero by 2050 dogma will go away quietly. No one serves more ably as the poster child of this resistance to reality than U.N. chief Antonio Guterres, who is preparing to host the UN’s annual climate conference, COP30, in Brazil on Nov. 10.

In a speech on Monday, Guterres echoed poet Dylan Thomas’s advice to aging men and women in his famed poem, “Do not go gentle into that good night:”

Do not go gentle into that good night,

Old age should burn and rave at close of day;

Rage, rage against the dying of the light.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Though wise men at their end know dark is right,

Because their words had forked no lightning they

Do not go gentle into that good night.

Seeing that his own words have “forked no lightning,” Guterres raged, raged against the dying of the climate alarm light.

“Governments must arrive at the upcoming COP30 meeting in Brazil with concrete plans to slash their own emissions over the next decade while also delivering climate justice to those on the front lines of a crisis they did little to cause,” Guterres demanded, adding, “Just look at Jamaica.”

Yes, because, as everyone must assuredly know, the Earth has never produced major hurricanes in the past, so it must be the all-powerful climate change bogeyman that produced this major storm at the end of an unusually slow Atlantic hurricane season.

Actually, Guterres’ order to all national governments to arrive in Belem, Brazil outfitted with aspirational plans to meet the net-zero illusion, which everyone knows can and will never be met, helps explain why President Donald Trump will not be sending an official U.S. delegation. Trump has repeatedly made clear – most recently during his September speech before the U.N. General Assembly – that he views the entire climate change agenda as a huge scam. Why waste taxpayer money in pursuit of a fantasy when he’s had so much success pursuing a more productive agenda via direct negotiations with national leaders around the world?

“The Green New Scam would have killed America if President Trump had not been elected to implement his commonsense energy agenda…focused on utilizing the liquid gold under our feet to strengthen our grid stability and drive down costs for American families and businesses,” Taylor Rogers, a White House spokeswoman, said in a statement to the Guardian. “President Trump will not jeopardize our country’s economic and national security to pursue vague climate goals that are killing other countries,” she added.

The Guardian claims that Rogers’s use of the word “scam” refers to the Green New Deal policies pursued by Joe Biden. But that’s only part of it: The President views the entire net-zero project as a global scam designed to support a variety of wealth redistribution schemes and give momentum to the increasingly authoritarian forms of government we currently see cracking down in formerly free democracies like the U.K., Canada, Germany, France, Australia and other western developed nations.

Trump’s focused efforts on reversing vast swaths of Biden’s destructive agenda is undoing 16 years of command-and-control regulatory schemes implemented by the federal government. The resulting elimination of Inflation Reduction Act subsidies is already slowing the growth of the electric vehicles industry and impacting the rise of wind and solar generation as well.

But the impacts are international, too, as developing nations across the world shift direction to be able to do business with the world’s most powerful economy and developed nations in Europe and elsewhere grudgingly strive to remain competitive. Gates provided a clear wake-up call highlighting this global trend with his sudden departure from climate alarmist orthodoxy and its dogmatic narratives with his shift in rhetoric and planned investments laid out in last week’s long blog post.

Guterres, as the titular leader of the climate movement’s center of globalist messaging, sees his perch under assault and responded with a rhetorical effort to reassert his authority. We can expect the secretary general to keep raging as his influence wanes and he is replaced by someone whose own words might fork some lightning.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

The Liberal budget is a massive FAILURE: Former Liberal Cabinet Member Dan McTeague

Prime Minister Mark Carney tabled his government’s long-overdue budget yesterday and took the same approach as his predecessor – spend, spend, spend.

Canada’s deficit is now a staggering $78 BILLION. To make matters worse, Carney doubled down on the industrial carbon tax.

Dan McTeague explains in his latest video.

-

Daily Caller1 day ago

Daily Caller1 day agoUS Eating Canada’s Lunch While Liberals Stall – Trump Admin Announces Record-Shattering Energy Report

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow the UK and Canada Are Leading the West’s Descent into Digital Authoritarianism

-

Energy1 day ago

Energy1 day agoEby should put up, shut up, or pay up

-

Business13 hours ago

Business13 hours agoU.S. Supreme Court frosty on Trump’s tariff power as world watches

-

Business2 days ago

Business2 days agoCapital Flight Signals No Confidence In Carney’s Agenda

-

International2 days ago

International2 days agoThe capital of capitalism elects a socialist mayor

-

Business2 days ago

Business2 days agoFederal budget: Carney government posts largest deficit in Canadian history outside pandemic

-

espionage6 hours ago

espionage6 hours agoU.S. Charges Three More Chinese Scholars in Wuhan Bio-Smuggling Case, Citing Pattern of Foreign Exploitation in American Research Labs