Fraser Institute

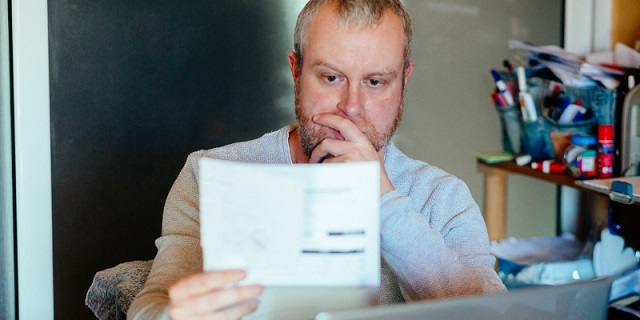

Here’s your annual bill for public health care

From the Fraser Institute

Notably, the amount paid by the average family has increased by 239.7 per cent since 1997 (the first year of available data).

According to a recent survey by Statistics Canada, almost half of Canadians said that rising prices are affecting their ability to meet day-to-day expenses. At the same time, Canadians are increasingly aware of their significant tax burden, with 74 per cent feeling the average family is overtaxed. This is not surprising given the average Canadian family spends more on taxes than food, clothing and shelter combined.

However, one contributor to this growing tax burden remains hidden—the price we pay public health care. You read that right. Public health care is not free—but it’s very difficult to figure out exactly how much we pay for it on an individual or family basis.

This is primarily because our public health-care system is funded through general government revenues. In other words, there’s no dedicated tax that fully funds the system. Our income taxes, sales taxes, business taxes and other taxes get poured into a fiscal vat, from which governments take a generous portion for health care.

While it’s easy enough to gauge total health-care spending by governments ($225.1 billion) or how much was spent per Canadian ($5,614), it remains nearly impossible for Canadian families of different sizes and incomes to calculate how much they contribute towards that vast amount.

But a recent study helps us get a general idea. According to the study, an average family of four (two parents and two children) with an average income of $176,266 will pay an estimated $17,713 (in taxes) for public health care this year. Single Canadians, with an average income of $55,925, will pay $5,629. Of course, these amounts vary by income with the poorest 10 per cent of income earners paying $639 while the top 10 per cent pay $47,071.

Notably, the amount paid by the average family has increased by 239.7 per cent since 1997 (the first year of available data). This increase is 3.1 times greater than the rate of inflation, 2.2 times greater than food cost increases, and 1.6 times greater than housing costs increases. And crucially, the cost of public health care for the average family has increased 1.7 times faster than their average incomes grew during the same period.

These figures are not only important for families who are interested in how their tax dollars are spent, they are one very important side of the equation when trying to understand whether we receive good value for our health-care dollars. Moreover, as politicians continue to promise ever increasing health-care spending to fix our crumbling system, it’s crucial for Canadians to understand exactly how that spending impacts their wallets.

One thing is clear. With nearly an $18,000 price tag for the average family of four, Canada’s public health-care system is anything but free.

Author:

Business

Carney government should apply lessons from 1990s in spending review

From the Fraser Institute

By Jake Fuss and Grady Munro

For the summer leading up to the 2025 fall budget, the Carney government has launched a federal spending review aimed at finding savings that will help pay for recent major policy announcements. While this appears to be a step in the right direction, lessons from the past suggest the government must be more ambitious in its review to overcome the fiscal challenges facing Canada.

In two letters sent to federal cabinet ministers, Finance Minister François-Philippe Champagne outlined plans for a “Comprehensive Expenditure Review” that will see ministers evaluate spending programs in each of their portfolios based on the following: whether they are “meeting their objectives” are “core to the federal mandate” and “complement vs. duplicate what is offered elsewhere by the federal government or by other levels of government.” Ultimately, as a result of this review, ministers are expected to find savings of 7.5 per cent in 2026/27, rising to 10 per cent the following year, and reaching 15 per cent by 2028/29.

This news comes after the federal government has recently made several major policy announcements that will significantly impact the bottom line. Most notably, the government added an additional $9.3 billion to the defence budget for this fiscal year, and committed to more than double the annual defence budget by 2035. Without any policies to offset the fiscal impact of this higher defence spending (along with other recent changes), this year’s budget deficit (which the Liberal’s election platform initially pegged at $62.3 billion) will likely surpass $70.0 billion, and potentially may reach as high as $92.2 billion.

A spending review is long overdue. Recent research suggests that each year the federal government spends billions towards programs that are inefficient and/or ineffective, and which should be eliminated to find savings. Moreover, past governments (both federal and provincial) have proven that fiscal adjustments based on spending reviews can be very successful—just look at the Chrétien government’s 1995 Program Review.

In its 1995 budget, the federal Chrétien government launched a comprehensive review of all federal spending that—along with several minor tax increases—ultimately balanced the federal budget in two years and helped Canada avert a fiscal crisis. Two aspects of this review were critical to its success: it reviewed all federal spending initiatives with no exceptions, and it was based on clear criteria that not only tested whether spending was efficient, but which also reassessed the federal government’s role in delivering programs and services to Canadians. Unfortunately, the Carney government’s review is missing these two critical aspects.

The Carney government already plans to exclude large swathes of the budget from its spending review. While it might be reasonable for the government to exclude defence spending given our recent commitments (though that doesn’t appear to be the plan), the Carney government has instead chosen to exclude all transfers to individuals (such as seniors’ benefits) and provinces (such as health-care spending) from any spending cuts. Based on the last official spending estimates for this year, these two areas alone represent a combined $254.6 billion—or more than half of total spending after excluding debt charges—that won’t be reviewed.

This is a major weakness in the government’s plan. Not only does this limit the dollar value of savings available, it also means a significant portion of the government’s budget is missing out on a reassessment that could lead to more effective delivery of services for Canadians.

For example, as part of the 1995 program review, the Chrétien government overhauled how it delivered welfare transfers to provincial governments. Specifically, the federal government replaced two previous programs with a new Canada Health and Social Transfer (CHST) that addressed some major flaws with how the government delivered welfare assistance. While the transition to the CHST did include a $4.6 billion reduction in spending on government transfers, the new structure gave the federal government better control over spending growth in the future and allowed provincial governments more flexibility to tailor social assistance programs to local needs and preferences.

In addition to considering all areas of spending, the Carney government’s spending review also needs to be more ambitious in its criteria. While the current criteria are an important start—for example, it’s critical the government identifies and eliminates spending programs that aren’t achieving their stated objectives or which are simply duplicating another program—the Carney government should take it one step further and explicitly reflect on the role of the federal government itself.

Among other criteria that focused on efficiency and affordability of programs, the 1995 program review also evaluated every spending program based on whether government intervention was even necessary, and whether or not the federal government specifically should be involved. As such, not only did the program review eliminate costly inefficiencies, it also included the privatization of government-owned entities such as Petro-Canada and Canadian National Railway—which generated considerable economic benefits for Canadians.

Today, the federal government devotes considerable amounts of spending each year towards areas that are outside of its jurisdiction and/or which government shouldn’t be involved in the first place—national pharmacare, national dental care, and national daycare all being prime examples. Ignoring the fact that many of these areas (including the three examples) are already excluded from the Carney government’s spending review, the government’s criteria makes no explicit effort to test whether a program is targeting an area that’s outside of the federal purview.

For instance, while the government will test whether or not a spending program fits within the federal mandate, that mandate will not actually ensure the government stays within its own jurisdictional lane. Instead, the mandate simply lays out the key priorities the Carney government intends to focus on—including vague goals including, “Bringing down costs for Canadians and helping them to get ahead” which could be used to justify considerable federal overreach. Similarly, the government’s other criterion to not duplicate programs offered by other levels of government provides little meaningful restriction on government spending that is outside of its jurisdiction so long as that spending can be viewed as “complementing” provincial efforts. In other words, this spending review is unlikely to meaningfully check the costly growth in the size of government that Canada has experienced over the last decade.

Simply put, the Carney government’s spending review, while a step in the right direction, is missing key elements that will limit its effectiveness. Applying key lessons from the Chrétien government’s spending review is crucial for success today.

Grady Munro

Policy Analyst, Fraser Institute

Business

B.C. premier wants a private pipeline—here’s how you make that happen

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

At the federal level, the Carney government should scrap several Trudeau-era policies including Bill C-69 (which introduced vague criteria into energy project assessments including the effects on the “intersection of sex and gender with other identity factors”)

The Eby government has left the door (slightly) open to Alberta’s proposed pipeline to the British Columbia’s northern coast. Premier David Eby said he isn’t opposed to a new pipeline that would expand access to Asian markets—but he does not want government to pay for it. That’s a fair condition. But to attract private investment for pipelines and other projects, both the Eby government and the Carney government must reform the regulatory environment.

First, some background.

Trump’s tariffs against Canadian products underscore the risks of heavily relying on the United States as the primary destination for our oil and gas—Canada’s main exports. In 2024, nearly 96 per cent of oil exports and virtually all natural gas exports went to our southern neighbour. Clearly, Canada must diversify our energy export markets. Expanded pipelines to transport oil and gas, mostly produced in the Prairies, to coastal terminals would allow Canada’s energy sector to find new customers in Asia and Europe and become less reliant on the U.S. In fact, following the completion of the Trans Mountain Pipeline expansion between Alberta and B.C. in May 2024, exports to non-U.S. destinations increased by almost 60 per cent.

However, Canada’s uncompetitive regulatory environment continues to create uncertainty and deter investment in the energy sector. According to a 2023 survey of oil and gas investors, 68 per cent of respondents said uncertainty over environmental regulations deters investment in Canada compared to only 41 per cent of respondents for the U.S. And 59 per cent said the cost of regulatory compliance deters investment compared to 42 per cent in the U.S.

When looking at B.C. specifically, investor perceptions are even worse. Nearly 93 per cent of respondents for the province said uncertainty over environmental regulations deters investment while 92 per cent of respondents said uncertainty over protected lands deters investment. Among all Canadian jurisdictions included in the survey, investors said B.C. has the greatest barriers to investment.

How can policymakers help make B.C. more attractive to investment?

At the federal level, the Carney government should scrap several Trudeau-era policies including Bill C-69 (which introduced vague criteria into energy project assessments including the effects on the “intersection of sex and gender with other identity factors”), Bill C-48 (which effectively banned large oil tankers off B.C.’s northern coast, limiting access to Asian markets), and the proposed cap on greenhouse gas (GHG) emissions in the oil and gas sector (which will likely lead to a reduction in oil and gas production, decreasing the need for new infrastructure and, in turn, deterring investment in the energy sector).

At the provincial level, the Eby government should abandon its latest GHG reduction targets, which discourage investment in the energy sector. Indeed, in 2023 provincial regulators rejected a proposal from FortisBC, the province’s main natural gas provider, because it did not align with the Eby government’s emission-reduction targets.

Premier Eby is right—private investment should develop energy infrastructure. But to attract that investment, the province must have clear, predictable and competitive regulations, which balance environmental protection with the need for investment, jobs and widespread prosperity. To make B.C. and Canada a more appealing destination for investment, both federal and provincial governments must remove the regulatory barriers that keep capital away.

-

Business1 day ago

Business1 day agoCarney government should apply lessons from 1990s in spending review

-

Business1 day ago

Business1 day agoTrump to impose 30% tariff on EU, Mexico

-

illegal immigration2 days ago

illegal immigration2 days agoICE raids California pot farm, uncovers illegal aliens and child labor

-

Entertainment1 day ago

Entertainment1 day agoStudy finds 99% of late-night TV guests in 2025 have been liberal

-

Energy1 day ago

Energy1 day agoLNG Export Marks Beginning Of Canadian Energy Independence

-

Frontier Centre for Public Policy14 hours ago

Frontier Centre for Public Policy14 hours agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Uncategorized14 hours ago

Uncategorized14 hours agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion6 hours ago

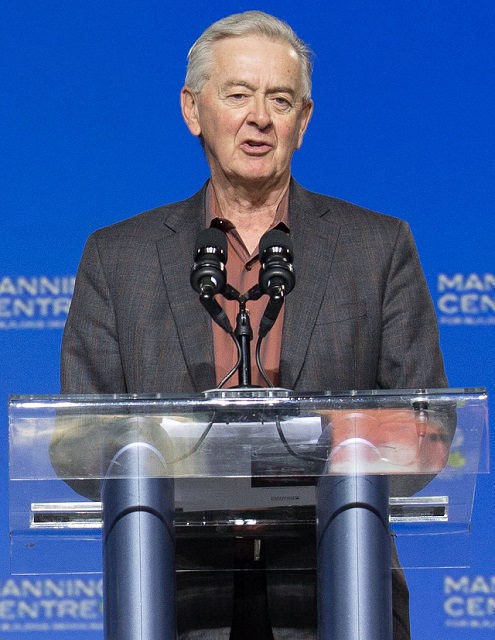

Opinion6 hours agoPreston Manning: Three Wise Men from the East, Again