Business

Growth in value of Alberta energy has benefits nationwide

From the Canadian Energy Centre

The recent expansion of the Trans Mountain pipeline helped drive a surge in the value of Alberta’s energy production, which rose to $139 billion in 2024, according to the latest Alberta Energy Outlook.

The Alberta Energy Regulator (AER) reported that last year was the second-highest value of the province’s energy production on record, after 2022’s banner year of $167 billion.

For comparison, the annual average between 2015 and 2019 was just $74 billion.

Industry experts say the strong numbers highlight the continued importance of oil and gas to Canada’s economic prosperity.

“Every Albertan will benefit from this windfall, but it trickles through the Canadian economy as well, notably in higher GDP, productivity, exports and trade diversification: all things we badly need,” said Heather Exner-Pirot, director of energy, natural resources and environment at the Ottawa-based Macdonald-Laurier Institute.

“If the case for another bitumen pipeline wasn’t already clear, this seals the deal.”

The additional export capacity provided by the Trans Mountain expansion has enabled producers to move more oil to international markets at stronger prices — fueling both production growth and higher revenues for companies and governments.

An economic powerhouse

Bitumen from the oil sands remains the largest contributor to Alberta’s energy economy, according to the AER’s analysis, and improved market access has narrowed the discount faced by Western Canadian Select crude.

“Alberta continues to lead Canada’s energy story — not only through robust oil and gas production but also by accelerating momentum in emerging resources like hydrogen, lithium, and geothermal,” said AER principal economist Afshin Honarvar.

The regulator’s annual outlook found that the value of bitumen production in 2024 totaled $95.8 billion.

Natural gas liquids including propane, butane and ethane generated $19.7 billion, followed by conventional crude oil at $18.2 billion and natural gas at $5 billion.

Western Canada also stands to benefit from continued growth in natural gas production to meet global demand, particularly with the LNG Canada export terminal now operating.

The AER undertook a reassessment of natural gas reserves, which saw Alberta’s volume increase by 440 per cent, taking Canada from 15th place to ninth place globally.

Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

“This is telling us that Alberta is a crucial part of the energy supply in North America,” Honavar said.

“We are a reliable source and an affordable source, without any worries that we will run out of reserves or resources.”

LNG Canada announced its first official cargo of liquefied natural gas destined for global markets on July 1, 2025. Photo courtesy LNG Canada

Benefits across the country

According to Canada Energy Regulator data, Alberta is responsible for about 84 per cent of Canada’s total oil and equivalent production and about 60 per cent of the country’s natural gas output.

Across the country, Natural Resources Canada estimates the sector employs about 450,000 people directly or indirectly.

Energy products were by far Canada’s top export in 2024, valued at $196 billion — more than double the next largest category, metal and mineral products, at $94.8 billion, according to Statistics Canada.

In 2023, the most recent year of data available, oil and gas contributed 7.7 per cent of Canada’s GDP, or $209 billion, the federal department says.

“It’s a huge industry, dominated by the oil sands, that Canada really benefits from and will continue to benefit from for decades,” said Richard Masson, executive fellow with the School of Public Policy at the University of Calgary.

He said the rise in Alberta’s production value translates directly into fiscal gains for the provincial and federal governments.

Well pad at Cenovus Energy’s Christina Lake oil sands facility southeast of Fort McMurray, Alta. CP Images photo

Alberta collected $19.2 billion in resource royalties during the 2023–24 fiscal year, with corporate taxes and income tax revenues also boosted by high industry activity.

The province also reported an unexpected $8 billion budget surplus for 2024-25 due to higher energy revenues.

“Energy royalties provide almost as much as personal income tax does for Alberta. If we didn’t have it, we would have to have a sales tax and other government revenues,” Masson said.

Rising production

According to the AER, bitumen production climbed by 4.3 per cent last year to an average of 3.56 million barrels per day. Driven by continued investment, the regulator forecasts output will rise to about four million barrels per day by 2034.

The key to realizing this potential is further expansion of export pipeline capacity to ensure additional oil production can reach international markets.

Investment in emerging energy technology

Wells at the Clive carbon capture, utilization and storage (CCUS) project near Red Deer, Alta. Photo courtesy Enhance Energy

The AER report says capital investment in Alberta’s energy sector hit $30.9 billion in 2024, the highest level in nearly a decade.

That spending included not just oil and gas, but growing investments in hydrogen, helium, lithium, and carbon capture and storage (CCS) projects.

The regulator forecasts continued momentum in both traditional and emerging sectors.

Hydrogen production in Alberta is expected to grow from 2.6 million tonnes per year to 4.4 million tonnes by 2034.

Since 2015, CCS projects have captured and stored 16 million tonnes of CO₂ deep underground — equivalent to taking over 3.7 million cars off the road for a year.

Business

Energy leaders send this letter urging Prime Minister Mark Carney to unlock Canada’s resources

An Open Letter to the Prime Minister of Canada

The CEOs of Canada’s largest energy companies, including Canadian Natural Resources, Cenovus, Suncor, Imperial Oil and many more, have issued a new “Build Canada Now” letter to Prime Minister Carney. They are calling for Ottawa to repeal the production cap, scrap the tanker ban, simplify regulations and shorten project approvals so Alberta’s energy sector can create jobs, attract investment and help Canada become a true global energy superpower.

September 15, 2025

The Rt. Hon. Mark Carney, PC, MP

Prime Minister of Canada

Dear Prime Minister Carney,

Six months have passed since the first “Build Canada Now” letter was sent to you and the leaders of Canada’s other political parties outlining an action plan to unlock Canada’s world class oil and natural gas resources to strengthen Canada’s economic sovereignty, resilience and prosperity. After the election, we followed up with a second letter expressing our support for our shared vision of Canada becoming an energy superpower, one that harnesses both conventional and clean energy resources. Since then, we have seen progress but it is insufficient to stimulate the investment and growth required to make this vision a reality.

Thank you for leading the positive change in tone from the Federal Government in terms of the importance of economic development, including expanded investments in conventional energy. The launch of the new Major Projects Office, Indigenous Advisory Council, the initial list of projects of national significance, and the announcement that it will begin work in support of Pathways Plus are critical steps in the right direction. We appreciate the progress the Federal Government has made in these areas.

However, Canada still lacks the clear, competitive and durable fiscal and regulatory policies required to achieve the so-called “Grand Bargain”. That bargain being significant emissions reductions, expanded market access and material upstream production growth. Achieving these three inter-related outcomes goes beyond progressing select major projects but rather includes a multitude of other projects and related investments. Consequently, we reiterate our call to work together to make the policy changes required for this to happen.

Our call to action is urgent, with persistent indicators that the Canadian economy is moving in the wrong direction. The need to improve productivity and create jobs requires swift and decisive action. Canada is blessed with an enviable abundance of oil and natural gas resources and has the expertise to develop them in a manner consistent with environmental responsibility, social values, and working with Indigenous groups for the benefit of Canada and Canadians. As leaders of this sector, we have consistently advocated for the changes required to unwind the past decade of increasing policy complexity and uncertainty that led to delayed investments, lost opportunities and a competitive disadvantage on the global energy stage.

Given your background, you understand that the private sector and public markets require clarity and certainty to make the long-term investments necessary to realizing this sector’s potential, in turn creating thousands of high-paying jobs and significantly strengthening Canada’s economy.

Making the changes expressed in the earlier Build Canada Now letters are necessary to send clear signals that Canada is open for business. To reiterate, we believe that your government must focus on the following:

- Significantly simplify regulations. The Federal Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and repealed, respectively. Existing processes are complex, unpredictable, subjective, and excessively long. Processes need to be clarified and simplified, and decisions must withstand judicial review.

- Shorten timelines for project approvals. The Federal Government needs to dramatically reduce regulatory timelines to approve all projects within months, not years, of application. This is required to restore investor confidence and once again attract capital to Canada. Clarity on provincial versus federal jurisdiction related to project approvals is also required and needs to be respected.

- Commit to grow production, not limit it. The Federal Government’s unlegislated cap on emissions must be eliminated to allow the sector to grow and achieve its potential for the benefit of Canada and Canadians. The “production cap” creates uncertainty, is redundant, will result in production cuts, and stifles investment.

- Fiscal framework that attracts investment. The Federal carbon levy on large emitters is not globally cost competitive and should be repealed allowing provinces to set regulations. The Federal Government can lead cooperation across jurisdictions, protecting domestic and international competitiveness. Industry needs clear, competitive, and durable fiscal frameworks, including associated with carbon and overall taxation, to secure capital and incentivize investment.

- Incent Indigenous investment opportunities. The Federal Government needs to provide Indigenous loan guarantees at scale so industry can create ownership opportunities to increase prosperity and ensure Indigenous communities benefit from resource development.

As you have clearly stated, our country needs to move from “uncertainty to prosperity”. There needs to be tangible change to make this happen, and without clear and urgent action we risk missing a generational opportunity to capture the potential before Canada now.

As Parliament resumes for the Fall sitting, the energy industry remains committed to working with you, your cabinet, and the provinces on an urgent basis to achieve the energy sector’s potential for the good of Canada. Together, Canada can become the global energy superpower we all envision. We look forward to your response.

Sincerely,

Original signatories

Brandon Anderson

President & CEO

NorthRiver Midstream Inc

Doug Bartole

President & CEO

InPlay Oil Corp.

Robert Broen

President & CEO

Athabasca Oil Corporation

Scott Burrows

President and Chief Executive Officer

Pembina Pipeline Corp.

Chris Carlsen

President & COO

Birchcliff Energy Ltd.

Brad W. Corson

Chairman, President and Chief Executive Officer

Imperial Oil Ltd.

N. Murray Edwards

Executive Chairman

Canadian Natural Resources Limited

Darlene Gates

President and Chief Executive Officer

MEG Energy Corp.

Paul Hawksworth

President and Chief Executive Officer

Inter Pipeline Ltd.

Tyson Huska

President & CEO

Longshore Resources Ltd.

Mike Lawford

President & CEO

NuVista Energy Ltd.

Chris Mazerolle

President

Chevron Canada Resources

Nicholas McKenna

President

ConocoPhillips Canada

Paul Myers

President

Pacific Canbriam Energy Limited

François Poirier

President and Chief Executive Officer

TC Energy Corp.

Susan Riddell Rose

President & CEO

Rubellite Energy Corp.

Don Simmons

President & CEO

Hemisphere Energy Corporation

Adam Waterous

Executive Chairman, Board of Directors

Strathcona Resources Ltd.

Richard Wyman

President

Chance Oil and Gas Limited

Terry Anderson

President and Chief Executive Officer

ARC Resources Ltd.

Michael Binnion

President & CEO

Questerre Energy Corporation

Craig Bryksa

President and Chief Executive Officer

Veren Inc.

David J. Burton

President & CEO

Lycos Energy Inc.

Paul Colborne

President & CEO

Surge Energy Inc.

Greg Ebel

President and Chief Executive Officer

Enbridge Inc.

Grant Fagerheim

President and Chief Executive Officer

Whitecap Resources Inc.

Bryan Gould

Founder & CEO

Aspenleaf Energy Limited

Philip B. Hodge

President & CEO

Pine Cliff Energy Ltd.

Rich Kruger

President and Chief Executive Officer

Suncor Energy Inc.

Byron Lutes

President

Mancal Energy Inc.

Brendan McCracken

President & CEO

Ovintiv Canada ULC

Jon McKenzie

President and Chief Executive Officer

Cenovus Energy Inc.

Curtis Philippon

President & CEO

Gibson Energy

Mike Rose

President and Chief Executive Officer

Tourmaline Oil Corp.

Brian Schmidt

President & CEO

Tamarack Valley Energy Ltd.

David Spyker

President & CEO

Freehold Royalties Ltd.

Bevin Wirzba

President and Chief Executive Officer

South Bow Corp.

Vern Yu

President & Chief Executive Officer

AltaGas

Additional signatories

Business

Canada’s ‘supply management’ system makes milk twice as expensive and favours affluent dairy farms

From the Fraser Institute

By Fred McMahon

While the Canada-U.S. trade negotiations continue, with much speculation about potential deals, one thing is certain: Canada’s agricultural marketing boards remain a barrier to success.

A White House official said as much: “[Canada] has repeatedly demonstrated a lack of seriousness in trade discussions as it relates to removing trade barriers.” That’s a clear reference to agricultural marketing boards, our Iron Curtain trade barrier. International trade lawyer Lawrence L. Herman aptly described boards as “Canada’s Soviet-style supply management system.”

Agricultural marketing boards are as Canadian as maple syrup, but more so. Maple syrup is international. Supply management is uniquely Canadian. No other country has such a system. And for good reason. It’s odious policy, favouring an affluent few, burdening the poorest, and creating needless friction with allies and trading partners.

President Trump’s distaste for the boards is well known. But, it’s not just Donald. The European Union, the United Kingdom, the World Trade Organization (effectively all of Canada’s trading partners)—and, wait for it, the majority Canadian farmers—all oppose the boards.

Canada claims to support free trade, except when we don’t. Canada seals off a large portion of its agricultural market with the system, but gets irritable when another country closes part of its market—say for autos, aluminum or steel.

Marketing boards employ a variety of tools, including quotas and tariffs, and a large bureaucracy to block international and interprovincial trade and deprive Canadians of choice in dairy, eggs and poultry. Without competition, productivity stagnates and prices soar.

The cost of living in the United States is 8.4 per cent higher than in the Canada, rent 14.9 per cent higher. But, thanks to our marketing boards, milk is twice as expensive—C$3.07 a litre on average in Canada versus C$1.47 in the United States. The most recent estimate of the cost of the system revealed, using 2015 data, that the average Canadian household pays an extra $300 to $433 annually because of marketing boards, hitting hard poorer Canadians, who spend a higher portion of their income on food than affluent Canadians.

Martha Hall Findlay, former Liberal MP and leadership contender, now director of the University of Calgary’s School of Public Policy, wrote with outrage, “The average Canadian dairy farm’s net worth is almost $4 million…. This archaic [supply-management] system forces a single mother on welfare to pay hundreds of dollars more per year than she needs to, just so we can continue to enrich a small number of cartel millionaires… members of the oft-vilified ‘one-percent’.”

Don’t expect meaningful negotiations. Canada’s Parliament, endorsed by the Senate, recently unanimously passed Bill C-202, which prohibits the foreign affairs minister from negotiating increased quotas or reduced tariffs for imports of supply-managed products.

The dairy industry, particularly in Quebec, is the big player. To protect this mighty lobby, Bloc Québécois Leader Yves-François Blanchet proposed C-202, backed by all parties, fearing a Quebec backlash if they stood up for Canadians, including for Quebecers who lack the privilege of owning one of province’s 4,200 multi-million-dollar dairy farms of Canada’s 9,400.

The Canadian Agri-Food Trade Alliance (CAFTA), Grain Growers of Canada (GGC), and other farm groups oppose C-202. Scott Hepworth, acting chair of GGC, said, “Parliament chose to prioritize one group of farmers over another. As a grain producer, I know firsthand how important international trade is to my family’s livelihood. Without reliable access to global markets, farmers like me are left behind.”

Canada has 65,000 grain farms and 53,000 pig and beef farms, compared to 14,700 supply-managed farms, less than one per cent of the total of 190,000 farms in Canada.

Marketing boards benefit a tiny minority of Canadian farmers while damaging the majority and increasing prices for all Canadians. One benefit of Donald Trump’s trade war against Canada has been the resolve on all levels of government to reduce home-grown obstacles to growth, including iron trade curtains between provinces.

The spineless response to C-202 reveals the weakness of that resolve and politician’s willingness to bend the knee to rich lobbies, toss other farmers under the bus, and carelessly pile on costs for Canadians, particularly low-income ones.

-

International2 days ago

International2 days agoTrump sues New York Times for $15 billion over ‘malicious, defamatory’ election coverage

-

Crime1 day ago

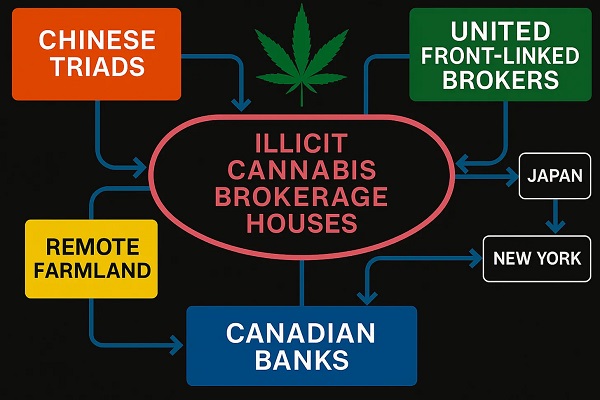

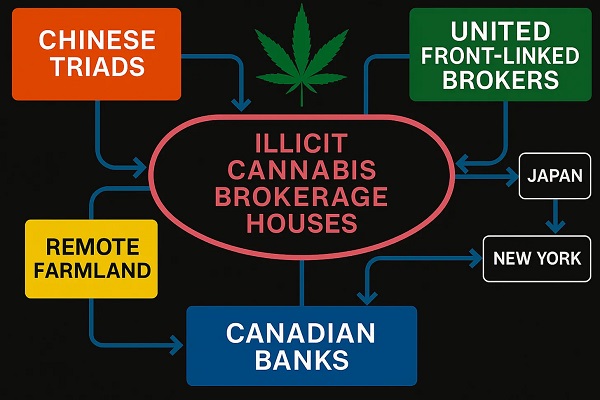

Crime1 day agoFrom Vancouver to Oklahoma: Canadian Murder Case and CCP ‘Police Station’ Links Align U.S. Testimony and The Bureau’s PRC Pot Investigations

-

Alberta2 days ago

Alberta2 days agoEducation negotiations update: Minister Horner

-

Addictions2 days ago

Addictions2 days agoNo, Addicts Shouldn’t Make Drug Policy

-

Christopher Rufo2 days ago

Christopher Rufo2 days agoCharlie Kirk Did It All the Right Way

-

Internet2 days ago

Internet2 days agoHow Google Quietly Shapes Human Behaviour and Thought

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCarney’s Housing Meltdown: Building A Mystery

-

COVID-192 days ago

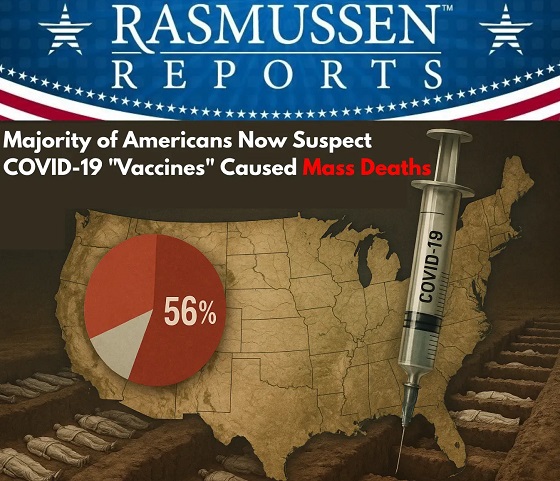

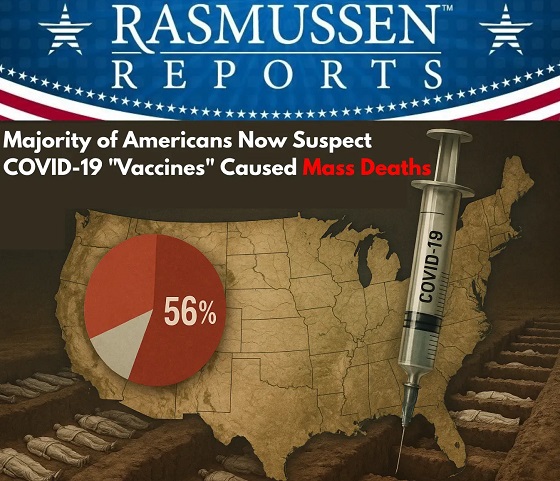

COVID-192 days agoNew Study Obliterates the “Millions Saved” COVID Shot Myth