Business

Government laws designed to rescue Canadian media have done the opposite

From the MacDonald-Laurier Institute

This article first appeared as the cover story to our September 2023 issue of Inside Policy. You can download the full issue here.

By Peter Menzies, October 4, 2023

The federal government has made a regulatory mess with wrongheaded legislation targeting digital media content.

Few things are more fundamental to a nation’s economic prosperity and social cohesion than a robust communications framework.

Canada has its challenges in terms of rural and northern internet and mobile connectivity, but the nation’s overall communications mainframe is, by most international measures, in good shape. The rest of the story involving what gets carried on the mainframe (i.e., the actual content) isn’t as pretty. In fact, two recent communications policy initiatives proposed by the federal government have put tens of thousands of jobs at risk in the creative and news industries.

Money goes where it is likely to generate profit, and if some key arteries aren’t unclogged quickly, the flow of communications investment dollars in Canada could seize up. Worse, the future of what has been a thriving creative economy, driven by independent content creators, is now uncertain.

Meanwhile, the news industry is on the cusp of becoming permanently reliant on government subsidies – a dependency that’s certain to undermine the public’s already wavering trust in its independence.

But first, the good news. While measures vary by source and date, Canada consistently ranks among the world’s top 20 nations when it comes to fixed broadband connectivity, and as high as No. 1 in the world when it comes to mobile internet capacity. Given that most of nations in the top ten for broadband connectivity are smaller in landmass than Prince Edward Island, this is a considerable achievement for a country the size of Canada. This connectivity, however, has come at a premium – consumer in this country are historically among those paying the highest rates anywhere in the world, particularly when it comes to mobile plans. Costs to consumers remain high but have been trending downward in recent years as carriers shift strategic priorities from acquiring new consumers to retaining existing ones.

Far more challenging is a regulatory environment that is less than friendly when it comes to attracting private investment. The Canadian Radio-television and Telecommunications Commission (CRTC) has been risk-averse in its dealings with Mobile Virtual Network Operators (MVNOs) and smaller Internet Service Providers (ISPs) looking for competitive access rates to incumbent networks. Still, competition is one area that appears to be a priority for the CRTC. The regulator’s new chair, Vicky Eatrides, has a background in competition policy; a new vice chair, Adam Scott, is thoroughly familiar with the Telecom industrial framework; and the new Ontario Regional Commissioner, Bram Abramson, has experience as a regulatory officer for a smaller telco. (Abramson’s former employer, TekSavvy Solutions, recently waved the white flag in its efforts to compete in the Canadian market and put itself up for sale.)

Now the bad news – and, fair warning, there’s a lot of it.

Canada is aggressively regulating the internet – not in priority areas such as privacy, algorithms and data collection, but in terms of its content and its users’ freedom of navigation. The Online Streaming Act (Bill C-11) came into force in the spring, amending the Broadcasting Act to define the internet’s audio and video content as “broadcasting” and, as such, placing all this content under the authority of the CRTC. The goals remain the same as they did during the broadcast radio and cable television world of the early 1990s: the funding of certified TV and film properties, ensuring Canadian content (CanCon) gets priority over foreign programming and ensuring designated groups – BIPOC and LGBTQ2S, among other acronyms – and official language minorities are represented. How exactly the CRTC intends to achieve this without disrupting what has been a booming decade for film and television production in a freewheeling global market remains to be seen. As does how it will give its supply-managed content priority without imposing economic harm on the 100,000 Canadians who earn a living in the unlicensed, uncertified world of YouTube and other major streaming platforms.

While the CRTC has promised to provide at least preliminary answers to these questions by the end of next year, years of regulatory haggling and court challenges await and the regulator’s reputation for the timely resolution of matters is spotty at best. As of September 22, for instance, it still hadn’t dealt with a cabinet order to review its CBC licensing decision; a decision which, itself, which took 18 months for the regulator to reach (following a January 2021 hearing that was held three years after the term of the CBC’s previous license had expired). Regulatory sloth of this nature on a routine matter does not inspire much optimism for the expedient handling of the far more complex issue of online streaming.

Indeed, the burden of the Online Streaming Act has already overwhelmed the CRTC’s administrative capacities. In August, it autorenewed the licenses of 343 television channels, discretionary services, and cable and satellite services for two to three years each. It subsequently announced it wouldn’t be dealing with any radio matters at all for “at least” two years. It even nervously punted a demand for the cancellation of Fox News’ Canadian carriage into the future by declaring it necessary to re-do the entire framework involving cable carriage of foreign television channels. It has clearly signaled that it plans to manage nothing other than telecom and Online Streaming Act issues for years to come. Everything else is on hold until such time comes to initiate a catch-up process that, in turn, will itself take years to clear the logjam. All this at a time of significant disruption that demands corporate and regulatory nimbleness.

But even what appears to be catastrophic regulatory arrest pales in comparison to the impact of the federal government’s second significant piece of new internet legislation: the Online News Act. Rarely has legislation designed to assist a sector – news production – been so poorly constructed that it has managed to make everything worse for everyone involved.

Based on the unproven premise that Big Tech companies were profiting from “stealing” content from news organizations, the Act was designed to force Meta (Facebook’s parent company) and Google to redistribute their considerable advertising revenue to those who used to receive the lion’s share of this revenue – newspapers and broadcasters. From the beginning, Meta indicated that the premise and the cost of the legislation, unless amended, would force it to cease the carriage of links to news stories and suspend its existing support programs for Canadian journalism.

The government and the news industry lobbyists who backed the bill grossly overestimated their economic value to Meta and insisted the tech giant was bluffing. Last week, however, Brian Myles, Director of Le Devoir, told an online panel hosted by the Canadian Journalism Foundation that it was clear Meta wasn’t bluffing and, going forward, news organizations would have to adapt to its exit from the market and the considerable financial impact it will have on their industry. He nevertheless held out hope that a rapprochement of some kind might still be possible with Google.

Like Meta, Google has indicated that it, too, will suspend both news linkage and its current partnerships with Canadian news organizations, unless the federal government can provide more economically acceptable options than what it has heretofore offered. As much financial harm as Meta’s departure will cause, there is consensus that Google’s departure – if it occurs – would be a disaster on a nuclear scale.

Even if a deal is reached, the best the news industry can hope for is that Google’s financial concessions will offset a portion of the losses suffered from losing access to Facebook, Instagram and Threads (among other Meta properties). Any money that can be squeezed out of an agreement with Google would be meaningful but a far cry from the hundreds of millions the industry was dreaming of a year ago. The largest recipients of any such windfall, of course, will be those who least need it – namely CBC and Bellmedia.

The bottom line is that, following passage the Online News Act, there will be less revenue for Canadian news organizations than there was just a few months ago. As a result, publishers are pleading for “temporary” measures such as the Journalism Labour Tax Credit and Local Journalism Initiative to be not just extended but enhanced. Up to 35 percent of legacy newsrooms costs would be covered by the federal government while, without Facebook, it will be near impossible for local news innovators outside of the legacy bubble to build audiences.

Next up is an anticipated Online Harms Act, designed to control “lawful but awful” speech through a government-appointed Digital Safety Commissioner. Expect more policy mayhem in the months to come.

Peter Menzies is a senior fellow at MLI and a former vice-chair of the CRTC.

Business

Some Of The Wackiest Things Featured In Rand Paul’s New Report Alleging $1,639,135,969,608 In Gov’t Waste

From the Daily Caller News Foundation

Republican Kentucky Sen. Rand Paul released the latest edition of his annual “Festivus” report Tuesday detailing over $1 trillion in alleged wasteful spending in the U.S. government throughout 2025.

The newly released report found an estimated $1,639,135,969,608 total in government waste over the past year. Paul, a prominent fiscal hawk who serves as the chairman of the Senate Homeland Security and Governmental Affairs Committee, said in a statement that “no matter how much taxpayer money Washington burns through, politicians can’t help but demand more.”

“Fiscal responsibility may not be the most crowded road, but it’s one I’ve walked year after year — and this holiday season will be no different,” Paul continued. “So, before we get to the Feats of Strength, it’s time for my Airing of (Spending) Grievances.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The 2025 “Festivus” report highlighted a spate of instances of wasteful spending from the federal government, including the Department of Health and Human Services (HHS) spent $1.5 million on an “innovative multilevel strategy” to reduce drug use in “Latinx” communities through celebrity influencer campaigns, and also dished out $1.9 million on a “hybrid mobile phone family intervention” aiming to reduce childhood obesity among Latino families living in Los Angeles County.

The report also mentions that HHS spent more than $40 million on influencers to promote getting vaccinated against COVID-19 for racial and ethnic minority groups.

The State Department doled out $244,252 to Stand for Peace in Islamabad to produce a television cartoon series that teaches children in Pakistan how to combat climate change and also spent $1.5 million to promote American films, television shows and video games abroad, according to the report.

The Department of Veterans Affairs (VA) spent more than $1,079,360 teaching teenage ferrets to binge drink alcohol this year, according to Paul’s report.

The report found that the National Science Foundation (NSF) shelled out $497,200 on a “Video Game Challenge” for kids. The NSF and other federal agencies also paid $14,643,280 to make monkeys play a video game in the style of the “Price Is Right,” the report states.

Paul’s 2024 “Festivus” report similarly featured several instances of wasteful federal government spending, such as a Las Vegas pickleball complex and a cabaret show on ice.

The Trump administration has been attempting to uproot wasteful government spending and reduce the federal workforce this year. The administration’s cuts have shrunk the federal workforce to the smallest level in more than a decade, according to recent economic data.

Festivus is a humorous holiday observed annually on Dec. 23, dating back to a popular 1997 episode of the sitcom “Seinfeld.” Observance of the holiday notably includes an “airing of grievances,” per the “Seinfeld” episode of its origin.

Alberta

A Christmas wish list for health-care reform

From the Fraser Institute

By Nadeem Esmail and Mackenzie Moir

It’s an exciting time in Canadian health-care policy. But even the slew of new reforms in Alberta only go part of the way to using all the policy tools employed by high performing universal health-care systems.

For 2026, for the sake of Canadian patients, let’s hope Alberta stays the path on changes to how hospitals are paid and allowing some private purchases of health care, and that other provinces start to catch up.

While Alberta’s new reforms were welcome news this year, it’s clear Canada’s health-care system continued to struggle. Canadians were reminded by our annual comparison of health care systems that they pay for one of the developed world’s most expensive universal health-care systems, yet have some of the fewest physicians and hospital beds, while waiting in some of the longest queues.

And speaking of queues, wait times across Canada for non-emergency care reached the second-highest level ever measured at 28.6 weeks from general practitioner referral to actual treatment. That’s more than triple the wait of the early 1990s despite decades of government promises and spending commitments. Other work found that at least 23,746 patients died while waiting for care, and nearly 1.3 million Canadians left our overcrowded emergency rooms without being treated.

At least one province has shown a genuine willingness to do something about these problems.

The Smith government in Alberta announced early in the year that it would move towards paying hospitals per-patient treated as opposed to a fixed annual budget, a policy approach that Quebec has been working on for years. Albertans will also soon be able purchase, at least in a limited way, some diagnostic and surgical services for themselves, which is again already possible in Quebec. Alberta has also gone a step further by allowing physicians to work in both public and private settings.

While controversial in Canada, these approaches simply mirror what is being done in all of the developed world’s top-performing universal health-care systems. Australia, the Netherlands, Germany and Switzerland all pay their hospitals per patient treated, and allow patients the opportunity to purchase care privately if they wish. They all also have better and faster universally accessible health care than Canada’s provinces provide, while spending a little more (Switzerland) or less (Australia, Germany, the Netherlands) than we do.

While these reforms are clearly a step in the right direction, there’s more to be done.

Even if we include Alberta’s reforms, these countries still do some very important things differently.

Critically, all of these countries expect patients to pay a small amount for their universally accessible services. The reasoning is straightforward: we all spend our own money more carefully than we spend someone else’s, and patients will make more informed decisions about when and where it’s best to access the health-care system when they have to pay a little out of pocket.

The evidence around this policy is clear—with appropriate safeguards to protect the very ill and exemptions for lower-income and other vulnerable populations, the demand for outpatient healthcare services falls, reducing delays and freeing up resources for others.

Charging patients even small amounts for care would of course violate the Canada Health Act, but it would also emulate the approach of 100 per cent of the developed world’s top-performing health-care systems. In this case, violating outdated federal policy means better universal health care for Canadians.

These top-performing countries also see the private sector and innovative entrepreneurs as partners in delivering universal health care. A relationship that is far different from the limited individual contracts some provinces have with private clinics and surgical centres to provide care in Canada. In these other countries, even full-service hospitals are operated by private providers. Importantly, partnering with innovative private providers, even hospitals, to deliver universal health care does not violate the Canada Health Act.

So, while Alberta has made strides this past year moving towards the well-established higher performance policy approach followed elsewhere, the Smith government remains at least a couple steps short of truly adopting a more Australian or European approach for health care. And other provinces have yet to even get to where Alberta will soon be.

Let’s hope in 2026 that Alberta keeps moving towards a truly world class universal health-care experience for patients, and that the other provinces catch up.

-

International2 days ago

International2 days agoGeorgia county admits illegally certifying 315k ballots in 2020 presidential election

-

International2 days ago

International2 days agoCommunist China arrests hundreds of Christians just days before Christmas

-

Energy23 hours ago

Energy23 hours agoThe Top News Stories That Shaped Canadian Energy in 2025 and Will Continue to Shape Canadian Energy in 2026

-

Business1 day ago

Business1 day agoSome Of The Wackiest Things Featured In Rand Paul’s New Report Alleging $1,639,135,969,608 In Gov’t Waste

-

Alberta2 days ago

Alberta2 days agoCalgary’s new city council votes to ban foreign flags at government buildings

-

Business2 days ago

Business2 days agoWarning Canada: China’s Economic Miracle Was Built on Mass Displacement

-

International23 hours ago

International23 hours ago$2.6 million raised for man who wrestled shotgun from Bondi Beach terrorist

-

Alberta2 days ago

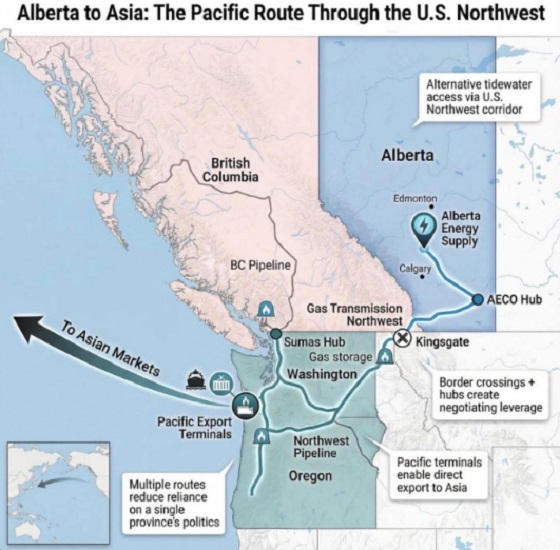

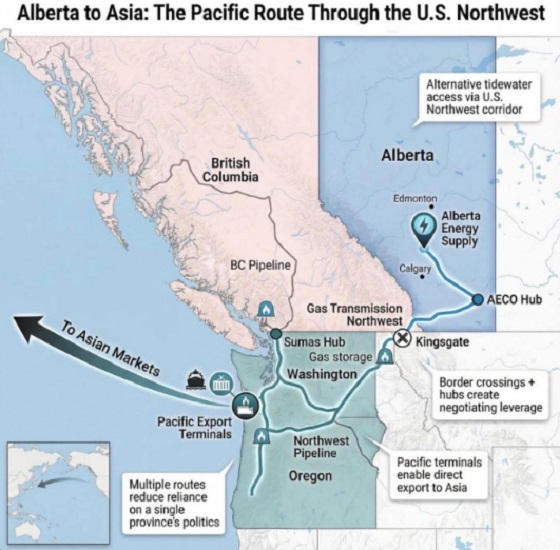

Alberta2 days agoWhat are the odds of a pipeline through the American Pacific Northwest