National

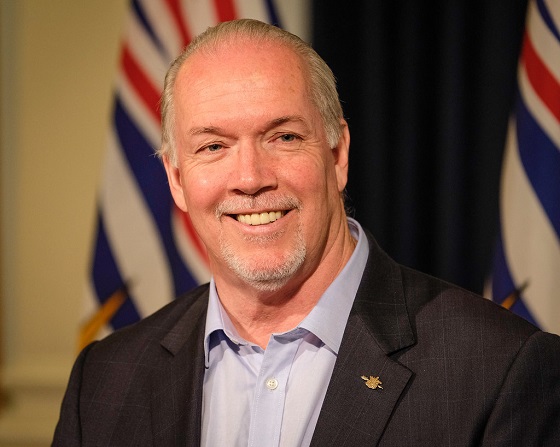

Former BC Premier John Horgan passes away at 65

From Resource Works

He will be remembered as a principled, pragmatic, and honest man, and a popular premier during uncertain times.

John Horgan has passed away at 65 after a courageous third battle with cancer.

A born-and-raised Vancouver Islander, Horgan was a tough and resilient man who will be remembered as a popular, pragmatic premier who brought principles and honesty with him while navigating a changing economic and political landscape.

Regardless of partisan affiliation or belief, there is no question that Horgan truly loved his home province of BC and cared deeply for its people and their future.

Horgan’s path to the premier’s office took him across Canada and beyond, first from Victoria to Ontario, then on to Australia, before returning home to Vancouver Island. Between attending university as a young man, Horgan worked in a pulp mill in Ocean Falls, a small community on the Central Coast of BC. This experience provided him with real insight into the province’s resource sector and the communities that depended on it then—and still do today.

From the 1990s, Horgan worked for the BC New Democratic Party in various staff roles before starting his own business after 2001. In 2005, he returned to politics by being elected as the MLA for Malahat-Juan de Fuca (now Langford-Juan de Fuca). Horgan was re-elected five times by the riding’s voters.

In 2014, Horgan became the leader of the BC NDP, and in 2017, he became Premier of BC, the first NDP premier in 16 years. Once in the premier’s office, Horgan championed pragmatic, progressive policies that strove to balance economic growth with sustainability. His work in developing the province’s liquefied natural gas (LNG) sector was invaluable.

From the outset, Horgan recognized LNG’s potential to modernize the BC economy and make it a key player in global energy markets, and he worked hard to attract investment to the sector. In 2018, he unveiled a new LNG framework that paved the way for LNG Canada’s $40 billion investment in a project that would bring thousands of jobs to northern BC.

Horgan was confident that the LNG sector could coexist with his government’s climate goals and that BC would play a role in reducing global carbon emissions. His pragmatic, forward-thinking vision centered on the ambitious goal of exporting LNG to Asian markets to help them reduce their reliance on higher-emitting energy sources.

Forestry was another sector where Horgan made his mark. Having once worked in a pulp mill, Horgan recognized the importance of forestry to both the province’s history and economy. His approach emphasized sustainability and partnerships with First Nations, while increasing domestic production and reducing log exports. His attempts to modernize forestry had mixed results, but there was no questioning the honesty and good faith he brought to the table.

Another notable aspect of Horgan’s leadership was his commitment to the rule of law, even when it aroused frustration from fellow progressives. In 2020, during the Coastal GasLink protests, Horgan made it clear that the court rulings in favor of the project meant it would proceed regardless. That same year, Horgan acknowledged that the Trans Mountain pipeline project, which his government opposed, would move forward after another court ruling mandated its completion.

It should also be noted that court rulings were some of the only defeats he ever faced as premier, as he led the NDP to a historic victory in the 2020 election. Horgan was also unafraid to take responsibility for policies that went awry, such as stepping back from an unpopular $789-million proposal to rebuild the Royal BC Museum and accepting the blame for it.

Horgan’s leadership of BC during the COVID-19 oubtreak is another part of his legacy that will not be forgotten, especially his trust in British Columbians to be responsible, leading to some of Canada’s most relaxed restrictions during the pandemic.

In 2022, Horgan stepped down after beating cancer for the second time in his life, saying, “While I have a lot of energy, I must acknowledge this may not be the case two years from now.”

Perhaps one of the most important aspects of Horgan’s legacy was that he was a well-liked politician across the political spectrum. While many disagreed with him over policies, few could question that he was an honest and principled leader when it came to steering economic change, respecting the rule of law, and taking responsibility for his actions as premier.

Horgan was a fair, honest, and open-minded man—qualities shared by the best people we meet in life and ones we can only hope all politicians will emulate. We will miss John Joseph Horgan and send our heartfelt condolences to his family, especially his wife and two children.

Business

Most Canadians say retaliatory tariffs on American goods contribute to raising the price of essential goods at home

- 77 per cent say Canada’s tariffs on U.S. products increase the price of consumer goods

- 72 per cent say that their current tax bill hurts their standard of living

A new MEI-Ipsos poll published this morning reveals a clear disconnect between Ottawa’s high-tax, high-spending approach and Canadians’ level of satisfaction.

“Canadians are not on board with Ottawa’s fiscal path,” says Samantha Dagres, communications manager at the MEI. “From housing to trade policy, Canadians feel they’re being squeezed by a government that is increasingly an impediment to their standard of living.”

More than half of Canadians (54 per cent) say Ottawa is spending too much, while only six per cent think it is spending too little.

A majority (54 per cent) also do not believe federal dollars are being effectively allocated to address Canada’s most important issues, and a similar proportion (55 per cent) are dissatisfied with the transparency and accountability in the government’s spending practices.

As for their own tax bills, Canadians are equally skeptical. Two-thirds (67 per cent) say they pay too much income tax, and about half say they do not receive good value in return.

Provincial governments fared even worse. A majority of Canadians say they receive poor value for the taxes they pay provincially. In Quebec, nearly two-thirds (64 per cent) of respondents say they are not getting their money’s worth from the provincial government.

Not coincidentally, Quebecers face the highest marginal tax rates in North America.

On the question of Canada’s response to the U.S. trade dispute, nearly eight in 10 Canadians (77 per cent) agree that Ottawa’s retaliatory tariffs on American products are driving up the cost of everyday goods.

“Canadians understand that tariffs are just another form of taxation, and that they are the ones footing the bill for any political posturing,” adds Ms. Dagres. “Ottawa should favour unilateral tariff reduction and increased trade with other nations, as opposed to retaliatory tariffs that heap more costs onto Canadian consumers and businesses.”

On the issue of housing, 74 per cent of respondents believe that taxes on new construction contribute directly to unaffordability.

All of this dissatisfaction culminates in 72 per cent of Canadians saying their overall tax burden is reducing their standard of living.

“Taxpayers are not just ATMs for government – and if they are going to pay such exorbitant taxes, you’d think the least they could expect is good service in return,” says Ms. Dagres. “Canadians are increasingly distrustful of a government that believes every problem can be solved with higher taxes.”

A sample of 1,020 Canadians 18 years of age and older was polled between June 17 and 23, 2025. The results are accurate to within ± 3.8 percentage points, 19 times out of 20.

The results of the MEI-Ipsos poll are available here.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

Business

B.C. premier wants a private pipeline—here’s how you make that happen

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

At the federal level, the Carney government should scrap several Trudeau-era policies including Bill C-69 (which introduced vague criteria into energy project assessments including the effects on the “intersection of sex and gender with other identity factors”)

The Eby government has left the door (slightly) open to Alberta’s proposed pipeline to the British Columbia’s northern coast. Premier David Eby said he isn’t opposed to a new pipeline that would expand access to Asian markets—but he does not want government to pay for it. That’s a fair condition. But to attract private investment for pipelines and other projects, both the Eby government and the Carney government must reform the regulatory environment.

First, some background.

Trump’s tariffs against Canadian products underscore the risks of heavily relying on the United States as the primary destination for our oil and gas—Canada’s main exports. In 2024, nearly 96 per cent of oil exports and virtually all natural gas exports went to our southern neighbour. Clearly, Canada must diversify our energy export markets. Expanded pipelines to transport oil and gas, mostly produced in the Prairies, to coastal terminals would allow Canada’s energy sector to find new customers in Asia and Europe and become less reliant on the U.S. In fact, following the completion of the Trans Mountain Pipeline expansion between Alberta and B.C. in May 2024, exports to non-U.S. destinations increased by almost 60 per cent.

However, Canada’s uncompetitive regulatory environment continues to create uncertainty and deter investment in the energy sector. According to a 2023 survey of oil and gas investors, 68 per cent of respondents said uncertainty over environmental regulations deters investment in Canada compared to only 41 per cent of respondents for the U.S. And 59 per cent said the cost of regulatory compliance deters investment compared to 42 per cent in the U.S.

When looking at B.C. specifically, investor perceptions are even worse. Nearly 93 per cent of respondents for the province said uncertainty over environmental regulations deters investment while 92 per cent of respondents said uncertainty over protected lands deters investment. Among all Canadian jurisdictions included in the survey, investors said B.C. has the greatest barriers to investment.

How can policymakers help make B.C. more attractive to investment?

At the federal level, the Carney government should scrap several Trudeau-era policies including Bill C-69 (which introduced vague criteria into energy project assessments including the effects on the “intersection of sex and gender with other identity factors”), Bill C-48 (which effectively banned large oil tankers off B.C.’s northern coast, limiting access to Asian markets), and the proposed cap on greenhouse gas (GHG) emissions in the oil and gas sector (which will likely lead to a reduction in oil and gas production, decreasing the need for new infrastructure and, in turn, deterring investment in the energy sector).

At the provincial level, the Eby government should abandon its latest GHG reduction targets, which discourage investment in the energy sector. Indeed, in 2023 provincial regulators rejected a proposal from FortisBC, the province’s main natural gas provider, because it did not align with the Eby government’s emission-reduction targets.

Premier Eby is right—private investment should develop energy infrastructure. But to attract that investment, the province must have clear, predictable and competitive regulations, which balance environmental protection with the need for investment, jobs and widespread prosperity. To make B.C. and Canada a more appealing destination for investment, both federal and provincial governments must remove the regulatory barriers that keep capital away.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoThe Covid 19 Disaster: When Do We Get The Apologies?

-

Crime1 day ago

Crime1 day agoSweeping Boston Indictment Points to Vast Chinese Narco-Smuggling and Illegal Alien Labor Plot via Mexican Border

-

Alberta2 days ago

Alberta2 days agoAlberta school boards required to meet new standards for school library materials with regard to sexual content

-

International24 hours ago

International24 hours agoSupport for the Ukraine war continues because no one elected is actually in charge.

-

Business23 hours ago

Business23 hours agoTrump slaps Brazil with tariffs over social media censorship

-

Business1 day ago

Business1 day agoCBC six-figure salaries soar

-

Environment1 day ago

Environment1 day agoEPA releases report on chemtrails, climate manipulation

-

Addictions1 day ago

Addictions1 day agoCan addiction be predicted—and prevented?