Automotive

Forget Tariffs: Biden Should Look to Domestic Mining to Thwart Chinese EVs

Fr0m Heartland Daily News

By Rick Whitbeck

The Biden administration’s decision to raise tariffs on Chinese-manufactured electric vehicles, steel, computer chips, and other technological products is the epitome of a penny wise and a pound foolish.

To much of the nation, the news was a reelection flip-flop, or an attempt to prop up the electric vehicle industry Biden has prioritized since he took office, as part of his green agenda. The international supply chain for electric vehicles isn’t going to magically stop running through the Chinese Communist Party anytime soon.

If Biden really wanted to curb Chinese geopolitical power, he would make fundamental changes to his administration’s history of attacking domestic mining opportunities. Allowing development of copper, graphite, nickel, cobalt, and other critical and strategic minerals right here at home would go much further than imposing tariffs.

Biden has demonstrated affinity for promoting “net zero” policies and forcing transitions away from traditional energy supplies of oil, gas, and coal. In a nutshell, the attacks on domestic mining projects seem completely counterproductive.

According to the International Energy Agency, staggering quantities of subsurface elements will need to be mined by at least five times their current worldwide production by 2040 to meet the Biden administration’s green energy goals. Graphite, cobalt, and lithium all will be needed in quantities exceeding 25 times (or more) their current supplies. In the next quarter century, we will need twice as much copper than has been produced in the last 3,000 years. All of which is impossible when Biden won’t let us dig.

The U.S. has tremendous opportunities to have our own mineral resources. Yet, the Biden administration has thwarted their development at nearly every turn. For example, massive copper and nickel deposits could be developed in Minnesota at the Twin Metals and Duluth Complex projects, but Biden has ordered each of them off-limits for development. The Resolution Copper prospect in Arizona met a similar fate, with the Department of Interior placing on “indefinite hold” its approval.

The Western Hemisphere’s largest copper prospect is Alaska’s Pebble Mine. Kowtowing to environmental extremists—and ignoring a clean U.S. Army Corps of Engineers’ Final Environmental Impact Statement—the Environmental Protection Agency continues to stymie progress on a deposit worth more than $500 billion. All the while shutting down the possibility of 700 full-time jobs in an area of rural Alaska that has seasonal unemployment exceeding 20%.

Alaska has been the target of more than 60 administrative and executive orders targeting its resource-based economy since Biden assumed office. One of the most recent took place on Earth Day, when a congressionally-authorized road to the Ambler Mining District—an area rich in copper, zinc, and other strategic and critical minerals—was stopped by the Department of Interior.

Just like with the Resolution mine in Arizona, the Interior Department used “Indigenous opposition” as its deciding factor, even though many villages and tribes closest to the mining district publicly support the project and its future employment opportunities. In Alaska, the Biden administration literally blocks the road to the minerals Biden’s tariffs claim to protect.

Alaska’s governor, Michael Dunleavy, along with its entire congressional delegation, has been openly critical of the continued hypocrisy of the Biden administration when it comes to talking “net zero” and acting with vigor to oppose domestic mining projects. The same response has come from many within the Minnesota and Arizona congressional community. They’ve been unable to break through to the administration, as Team Biden chooses to listen to eco-activists and career bureaucrats with an anti-development agenda.

What would hurt China, empower America, and begin to chip away at the global imbalance would be mining and processing our crucial minerals and elements domestically. Let’s see if the Biden administration wises up to that fact, or if America tires of being subservient to the CCP and makes fundamental changes to federal leadership in November.

Rick Whitbeck is the Alaska State Director for Power The Future, a national nonprofit organization that advocates for American energy jobs and fights back against economy-killing and family-destroying environmental extremism. Contact him at [email protected] and follow him on X (formerly Twitter) @PTFAlaska

This article was originally published by RealClearEnergy and made available via RealClearWire.

To read more about domestic mining to escape reliance on China, click here.

To read more about clean energy and mining, click here.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

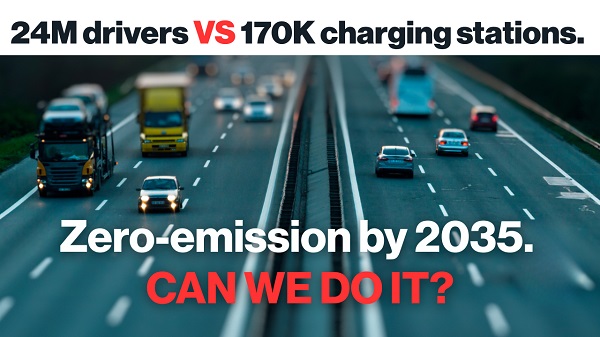

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Automotive

Power Struggle: Electric vehicles and reality

From Resource Works

Tension grows between ambition and market truths

Host Stewart Muir talks on Power Struggle with Brian Maas, president of the California New Car Dealers Association, and Maas introduces us to a U.S. problem that Canada and B.C. also face right now. “The problem is there are mandates that apply in California and 11 other states that require, for the 2026 model year, 35% of all vehicles manufactured for sale in our state must be zero-emission, even though the market share right now is 20%. “So we’ve got a mandate that virtually none of the manufacturers our dealers represent are going to be able to meet.”

Maas adds: “We’re trying to communicate with policymakers that nobody’s opposed to the eventual goal of electrification. California’s obviously led that effort, but a mandate that nobody can comply with and one that California voters are opposed to deserves to be recalibrated.” Meanwhile, in Canada, the same objections apply to the federal government’s requirement, set in 2023, that 100% of new light-duty vehicles sold must be zero-emission vehicles, ZEVs (electric or plug-in hybrid) by 2035, with interim targets of 20 per cent by 2026 and 60 per cent by 2030. There are hefty penalties for dealers missing the targets.

Market researchers note that it now takes 55 days to sell an electric vehicle in Canada, up from 22 days in the first quarter of 2023. The researchers cite a lack of desirable models and high consumer prices despite government subsidies to buyers in six provinces that run as high as $7,000 in Quebec.

In the U.S. The Wall Street Journal reports that, on average, electric vehicles and plug-in hybrids sit in dealer lots longer than gasoline-powered cars and hybrids, despite government pressure to switch to electric. (The Biden administration ruled that two-thirds of new vehicles sold must be electric by 2032.) For Canada, the small-c conservative Fraser Institute reports: “The targets were wild to begin with. As Manhattan Institute senior fellow Mark P. Mills observed, bans on conventional vehicles and mandated switches to electric means, consumers will need to adopt EVs at a scale and velocity 10 times greater and faster than the introduction of any new model of car in history.”

When Ottawa scrapped federal consumer subsidies earlier this year, EV manufacturers and dealers in Canada called on the feds to scrap the sales mandates. “The federal government’s mandated ZEV sales targets are increasingly unrealistic and must end,” said Brian Kingston, CEO of the Canadian Vehicle Manufacturers’ Association. “Mandating Canadians to buy ZEVs without providing them the supports needed to switch to electric is a made-in-Canada policy failure.” And Tim Reuss, CEO of the Canadian Automobile Dealers Association, said: “The Liberal federal government has backed away from supporting the transition to electric vehicles and now we are left with a completely unrealistic plan at the federal level. “There is hypocrisy in imposing ambitious ZEV mandates and penalties on consumers when the government is showing a clear lack of motivation and support for their own policy goals.”

In B.C., sales growth of ZEVs has recently slowed, and the provincial government is considering easing its ZEV targets. “The Energy Ministry acknowledged that it will be ‘challenging’ to reach the target that 90 per cent of new vehicles be zero emission by 2030.” Nat Gosman, an assistant deputy minister in the B.C. energy ministry, cited reasons for the slowdown that include affordability concerns due to a pause in government rebates, supply chain disruptions caused by U.S. tariffs, and concerns about reliability of public charging sites.

Barry Penner, chair of the Energy Futures Institute and a former B.C. Liberal environment minister, said the problem is that the government has “put the cart before the horse” when it comes to incentivizing people to buy electric vehicles. “The government imposed these electric vehicle mandates before the public charging infrastructure is in place and before we’ve figured out how we’re going to make it easy for people to charge their vehicles in multi-family dwellings like apartment buildings.”

Penner went on to write an article for Resource Works that said: “Instead of accelerating into economically harmful mandates, both provincial and federal governments should recalibrate. We need to slow down, invest in required charging infrastructure, and support market-based innovation, not forced adoption through penalties. “A sustainable energy future for BC and Canada requires smart, pragmatic policy, not economic coercion. Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

Back to Power Struggle, and Brian Maas tells Stewart: “I think everybody understands that it’s great technology and I think a lot of Californians would like to have one. . . . The number one reason consumers cited for not making the transition to a zero-emission vehicle is the lack of public charging infrastructure. We’re woefully behind what would be required to move to 100% environment. “And if you live in a multifamily dwelling, an apartment building or something like that, you can’t charge at home, so you would have to rely on a public charger. Where do you go to get that charged?

“The state’s Energy Commission has said we need a million public chargers by 2030 and two million public chargers by 2035. We only have 178,000 now and we’re adding less than 50,000 public chargers a year. We’re just not going to get there fast enough to meet the mandate that’s on the books now.”

In Canada, Resource Works finds there now are more than 33,700 public charging ports, at 12,955 locations. But Ottawa says that to support its EV mandate, Canada will need about 679,000 public ports. “This will require the installation of, on average, 40,000 public ports each year between 2025 and 2040.”

And we remind readers of Penner’s serious call on governments to lighten the push on the accelerator when it comes to ZEV mandates: “Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

- Power Struggle YouTube video: https://ow.ly/8J4T50WhK5i

- Audio and full transcript: https://ow.ly/Np8550WhK5j

- Stewart Muir on LinkedIn: https://ow.ly/Smiq50UWpSB

- Brian Maas on LinkedIn: https://ow.ly/GuTh50WhK8h

- Power Struggle on LinkedIn: https://ow.ly/KX4r50UWpUa

- Power Struggle on Instagram: https://ow.ly/3VIM50UWpUg

- Power Struggle on Facebook: https://ow.ly/4znx50UWpUs

- Power Struggle on X: https://ow.ly/tU3R50UWpVu

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Fraser Institute24 hours ago

Fraser Institute24 hours agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

Censorship Industrial Complex13 hours ago

Censorship Industrial Complex13 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV