Energy

Flat copper, EV glut, imploding wind power equal green crash

From the Frontier Centre for Public Policy

By Ian Madsen

Large fissures are appearing in the ‘Green Transition’ story climate crusaders tell themselves. They are trying to foist it on a reluctant public and skeptical business world. One recent such crack is the carve-out on carbon taxes for heating oil in the politically-fickle Atlantic provinces. Provincial premiers are trying to get the same treatment for other fossil fuel heating fuels.

Yet, politicians who still hew to the Climate Crisis orthodoxy remain unrepentant. Montreal’s city council has announced that all new buildings of three stories or less will not be permitted to use natural gas heating. Taller buildings would face the ban later. Several cities and states in the United States are also trying to restrict natural gas use. Their efforts seem desperate.

A recent U.K. study concluded that heat pumps are much more expensive than employing natural gas (also true in Canada), and resistance heating is even worse. Due to the study and public pushback, the planned U.K. heat pump mandate was cancelled – and ‘Net Zero’ postponed beyond 2035.

Extreme policy adopted by voting-block-pandering politicos notwithstanding, other constituents of the artificially-sustained Green Transition show signs of weakness. For some, notably wind power, outright impending collapse looms.

Wind turbine companies’ share prices have slumped. The main reason is that wind power contracts are being cancelled in many places. A large project off the New Jersey coast is the latest example. Component and material costs are the main culprits. They caused wind developers to raise requested electricity prices to unaffordable levels, and higher interest rates made capital costs rocket skyward. Recent revelations about the high costs of recycling wind turbine blades have soured governments and the public on this dubious ‘alternative energy’.

Electric vehicles, ‘EV’s’, are another darling of the climate lobby. There is now a large accumulation of unsold EV’s on dealer lots, not just in North America but in China. It takes a very large ‘rebate’ to get anyone to consider buying one – an indication of fundamental unpopularity.

It takes many minutes to recharge the battery pack at a ‘supercharge’ station; or, sometimes, hours at a regular charging station. The former is expensive, the latter is an unacceptable time and opportunity cost for owners. The bigger issue is a woeful lack of chargers for highway driving yet over reaching politicians are pushing a fantasy ban on gasoline vehicles by 2035. Forget that, it won’t be happening.

However, the best indication that the Green fever dreams of excitable politicians and disingenuous so-called Climate activists are becoming a nightmare is the price of copper. Slow expansion of copper production and the increasing demand for it in Green Transition technologies such as EV’s, wind turbines, and solar panels and for all the grid connections and upgrades that they entail should force the copper price to soar. Yet, it is just about where it was three years ago.

Mining companies are reluctant to buy or develop new copper deposits, or expand existing operations, with no visibility for a substantially higher copper price. Costs have risen, too, and particularly for fuel and financing, making future positive returns look implausible.

Energy consumers, households and businesses, are rejecting the hysterical climate extremism that attempts to compel the use of uneconomic and unreliable energy forms and technologies, and the rejection of proven, affordable ones. Politicians should listen, and change.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy

Energy

B.C. premier’s pipeline protestations based in fallacy not fact

From the Fraser Institute

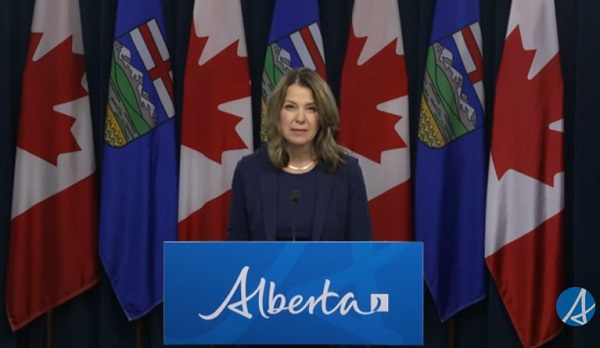

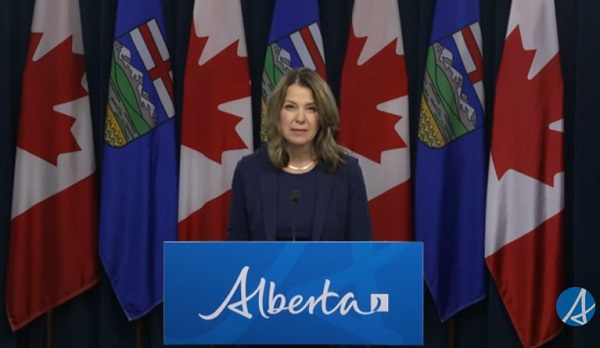

The latest war of words over a pipeline in Canada is between Alberta Premier Danielle Smith, who seeks the construction of a pipeline from Alberta’s oilsands to export facilities on the Pacific coast, and British Columbia Premier David Eby who is foursquare against it.

Smith argues the pipeline is needed to break the U.S. market-lock on Alberta oil, which the United States buys at a discount compared to world prices. Smith argues that increased trade in oil and gas—at higher prices—would be good for Alberta’s economy and Canada’s national economy, and can be done while protecting the environment in both provinces. Eby denies virtually all these claims.

More specifically, Premier Eby makes four arguments against a new pipeline, and all are incorrect.

First, he argues, any pipeline would pose unmitigated risks to B.C.’s coastal environment. But in reality, the data are clear—oil transport off Canada’s coasts is very safe (since the mid-1990s there has not been a single major spill from oil tankers or other vessels in Canadian waters). He also simultaneously argues that it’s pointless to build a new pipeline from Alberta because B.C.’s waters are protected by Bill C-48, the “tanker ban” bill enacted by the Trudeau government in 2017. But in fact, because Bill C-48 only applies to Canadian tankers, a regular stream of oil tankers and large fuel-capacity ships cruise up and down the B.C. coast (between Alaska and other U.S. ports) with stupendous safety records.

Second, Eby argues that B.C.’s First Nations oppose any such pipeline. But in reality, such opposition is quite contingent. The Trans Mountain pipeline expansion project (TMX), which has increased shipping capacity from Alberta to the west coast, has signed agreements with 81 Indigenous community groups (in both provinces) worth $657 million and produced more than $4.8 billion in contracts with Indigenous businesses.

Third, Eby claims that Smith’s proposal is not “real” because no private-sector companies have proposed to build the pipeline. And he’s partly right—no rational investor would look at the regulatory barricade facing pipeline construction and spend the time and money to propose a project. Those applications cost money and lots of it. In 2017, according to TC Energy,before it retracted its Energy East/Eastern proposals due largely to regulatory barriers, the company had spent more than C$1 billion trying to get permits. In a 2016 report, Enbridge listed pre-construction expenditures (which include crafting proposals) of up to US$1.5 billion to build its three proposed pipeline projects. These costs will not have gotten cheaper since then. But even so, the Alberta government’s pipeline proposal has the backing of an advisory group, which includes energy companies Enbridge, Trans Mountain and South Bow—likely because they want to invest in the project after there’s some assurance it will survive the regulatory blockade.

Finally, Eby’s claim that there’s no market demand for new pipelines (which implies there will be no investors) is unsubstantiated. According to S&P Global, Canadian oilsands production will reach a record annual average of 3.5 million barrels of oil per day (b/d) in 2025, five per cent higher than 2024. By 2030, production could top 3.9 million b/d, 500,000 b/d higher than 2024 (although this assumes the federal cap on emissions, imposed by the Trudeau government, does not curtail production as predicted). This profit potential will almost certainly attract investors, if they can overcome the regulatory blockade.

It’s fine, of course, for Premier Eby to look out for the people of B.C. as best he sees fit—that’s his job, after all. But it’s also his job to recognize the limits of his authority. When looking at the TMX project, the Supreme Court of Canada has already ruled that B.C. does not have the authority to block infrastructure of national importance, including pipelines.

But as the saying goes, you’re entitled to your own opinion but not entitled to your own facts. Premier Eby’s objections to another Alberta pipeline are rooted in fallacy, not fact. The Carney government should recognize this fact and decide whether or not another pipeline to B.C. waters is in the “national interest,” which is apparently how you get a permit to build major projects in Canada these days.

Carbon Tax

Back Door Carbon Tax: Goal Of Climate Lawfare Movement To Drive Up Price Of Energy

From the Daily Caller News Foundation

The energy sector has long been a lightning rod for policy battles, but few moments crystallize the tension between environmental activism and economic reality quite like David Bookbinder’s recent admission. A veteran litigator who’s spent years spearheading lawsuits against major oil companies on behalf of Colorado municipalities — including Boulder — Bookbinder let the cat out of the bag during a recent Federalist Society panel.

In an all-too-rare acknowledgement of the lawfare campaign’s real goal, Bookbinder admitted that he views the lawsuits mainly as a proxy for a carbon tax. In other words, the winning or losing of any of the cases is irrelevant; in Bookbinder’s view, the process becomes the punishment as companies and ultimately consumers pay the price for using oil and gas and the industry’s refined products.

“Tort liability is an indirect carbon tax,” Bookbinder stated plainly. “You sue an oil company, an oil company is liable. The oil company then passes that liability on to the people who are buying its products … The people who buy those products are now going to be paying for the cost imposed by those products. … [This is] somewhat of a convoluted way to achieve the goals of a carbon tax.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The cynicism is so thick you could cut it with a knife.

On one hand, the fact that winning is irrelevant to the plaintiff firms who bring the cases has become obvious over the last two years as case after case has been dismissed by judges in at least ten separate jurisdictions. The fact that almost every case has been dismissed on the same legal grounds only serves to illustrate that reality.

Bookbinder’s frank admission lands with particular force at a pivotal juncture. In late September, the Department of Justice, along with 26 state attorneys general and more than 100 members of Congress, urged the Supreme Court to grant certiorari in one of the few remaining active cases in this lawfare effort, in Boulder, Colorado.

Their briefs contend that allowing these suits to proceed unchecked would “upend the constitutional balance” between federal and state authority, potentially “bankrupt[ing] the U.S. energy sector” by empowering local courts to override national energy policy.

For the companies named in the suits, these cases represent not just a tiresome form of legal Kabuki Theater, but a financial and time sink that cuts profits and inhibits capital investments in more productive enterprises. You know, like producing oil and gas to meet America’s ravenous energy needs in an age of explosive artificial intelligence growth.

“I’d prefer an actual carbon tax, but if we can’t get one of those, and I don’t think anyone on this panel would [dis]agree Congress is likely to take on climate change anytime soon—so this is a rather convoluted way to achieve the goals of a carbon tax,” Bookbinder elaborated in his panel discussion.

John Yoo, the eminent UC Berkeley law professor and former Bush-era official, didn’t hold back in his analysis for National Review. He described the lawfare campaign as a “backdoor” assault on the energy industry, circumventing the federal government’s established role in environmental regulation.

“There are a variety of cities and states that don’t agree with the federal government, and they would like to see the energy companies taxed,” Yoo explained. “Some of them probably like to see them go out of business. Since they can’t persuade through the normal political process of elections and legislation like the rest of the country, they’re using this back door,” he added.

What we see in action here is the fact that, although the climate alarm industry that is largely funded by an array of dark money NGOs and billionaire foundations finds itself on the defensive amid the aggressive policy actions of the Trump 47 administration, it is far from dead. Like the Democrat party in which they play an integral role, the alarmists are fighting the battle in their last bastion of power: The courts.

As long as there are city and county officials willing to play the role of plaintiffs in this long running Kabuki dance, and a Supreme Court unwilling to intercede, no one should doubt that this stealth carbon tax lawfare effort will keep marching right along.

-

Business1 day ago

Business1 day ago$15B and No Guarantees? Stellantis Deal explained by former Conservative Shadow Minister of Innovation, Science and Technology

-

Agriculture1 day ago

Agriculture1 day agoFrom Underdog to Top Broodmare

-

Business14 hours ago

Business14 hours agoLiberals backtrack on bill banning large cash gifts, allowing police to search Canadians’ mail

-

Alberta2 days ago

Alberta2 days agoAlberta’s licence plate vote is down to four

-

Health14 hours ago

Health14 hours agoFor Anyone Planning on Getting or Mandating Others to Get an Influenza Vaccine (Flu Shot)

-

Alberta19 hours ago

Alberta19 hours agoPremier Smith moves to protect Alberta in International Agreements

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs The Latest Tiger Woods’ Injury Also A Death Knell For PGA Champions Golf?

-

Sports13 hours ago

Sports13 hours ago‘We Follow The Money’: Kash Patel Says Alleged NBA Ties To Mafia Just ‘The Start’ Of FBI Investigation