Economy

Five Canadian premiers demand Trudeau scrap carbon tax for all provinces and not just a few

From LifeSiteNews

By ‘singling out Atlantic Canadians with this relief, it has caused divisions across the country. All Canadians are equally valued and should be equally respected,’ the premiers wrote

Five Canadian premiers from coast to coast banded together to demand Prime Minister Justin Trudeau drop the carbon tax on home heating bills for all provinces, saying his policy of giving one region a tax break over another has caused “divisions.”

“It is of vital importance that federal policies and programs are made available to all Canadians in a fair and equitable way,” reads a letter dated November 10 and signed by Premiers Tim Houston of Nova Scotia, Blaine Higgs of New Brunswick, Doug Ford of Ontario, Danielle Smith of Alberta, and Scott Moe of Saskatchewan.

The premiers wrote that by “singling out Atlantic Canadians with this relief, it has caused divisions across the country. All Canadians are equally valued and should be equally respected.”

In the letter, the premiers demanded a meeting with Trudeau to discuss the matter and “urge the federal government to remove the carbon tax on all forms of home heating across Canada immediately.”

“We are calling on the federal government to do the right thing and treat all Canadians fairly by removing the federal carbon tax from all forms of home heating. This would help address the significant affordability concerns faced by families from coast to coast to coast,” the premiers wrote.

“Given the vast impacts of carbon pricing, we are asking for a meeting to discuss this issue.”

Trudeau recently announced he was pausing the collection of the carbon tax on home heating oil for three years, but only for Atlantic Canadian provinces. The current cost of the carbon tax on home heating fuel is 17 cents per litre. Most Canadians, however, heat their homes with clean-burning natural gas, a fuel that will not be exempted from the carbon tax.

Trudeau’s announcement came amid dismal polling numbers showing his government will be defeated in a landslide by the Conservative Party come the next election.

Indeed, a recent poll even shows the Green Party outperforming the Liberals in Atlantic Canada.

The premiers’ letter was signed by two Atlantic provinces that benefit from the carbon tax pause but whose leaders do not think it is fair they get special treatment over the others.

The premiers warned Trudeau that with winter coming most Canadians will be hit with high heating bills thanks to the carbon tax.

“Many Canadian households do not use home heating oil and instead use all forms of heating to heat their homes. Winter is coming and these people also deserve a break. It is of vital importance that federal policies and programs are made available to all Canadians in a fair and equitable way,” the letter reads.

“The federal government was elected by voters across this country. This is an opportunity to show them that they won’t be penalized for their choice of home heating source.”

The Conservative Party of Canada (CPC) under leader Pierre Poilievre firmly opposes the carbon tax. Poilievre recently dared Trudeau to call a “carbon tax” election so Canadians can decide for themselves if they want a government for or against a tax that has caused home heating bills to double in some provinces.

A recent CPC motion calling for the carbon tax to be paused for all Canadians failed to pass after the Liberal and Bloc Quebecois MPs voted against it. This motion interestingly had support from the New Democratic Party (NDP), which means its passage is likely.

85 percent of small businesses now opposed to Trudeau’s carbon tax

Opposition to Trudeau’s carbon tax is strong and growing, notably among small business owners. Indeed, a recent poll shows that 85% of small businesses reject the federal carbon tax.

The poll, conducted by the Canadian Federation of Independent Business (CFIB), shows that opposition to the carbon tax has nearly doubled in only a year. Last year, about 52% of businesses opposed a carbon tax.

CFIB president Dan Kelly noted that “the entire federal carbon tax structure is beginning to look like a shell game.”

When it comes to small businesses, Kelly said that they pay “about 40% of the costs of the carbon tax, but the federal government has promised to return only 10% to small businesses.”

LifeSiteNews reported last month how Trudeau’s carbon tax is costing Canadians hundreds of dollars annually, as the rebates given out by the federal government are not enough to compensate for the increased fuel costs.

The Trudeau government’s current environmental goals – in lockstep with the United Nations’ “2030 Agenda for Sustainable Development” – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization in which Trudeau and some of his cabinet are involved.

conflict

Middle East clash sends oil prices soaring

This article supplied by Troy Media.

By Rashid Husain Syed

By Rashid Husain Syed

The Israel-Iran conflict just flipped the script on falling oil prices, pushing them up fast, and that spike could hit your wallet at the pump

Oil prices are no longer being driven by supply and demand. The sudden escalation of military conflict between Israel and Iran has shattered market stability, reversing earlier forecasts and injecting dangerous uncertainty into the global energy system.

What just days ago looked like a steady decline in oil prices has turned into a volatile race upward, with threats of extreme price spikes looming.

For Canadians, these shifts are more than numbers on a commodities chart. Oil is a major Canadian export, and price swings affect everything from

provincial revenues, especially in Alberta and Saskatchewan, to what you pay at the pump. A sustained spike in global oil prices could also feed inflation, driving up the cost of living across the country.

Until recently, optimism over easing trade tensions between the U.S. and China had analysts projecting oil could fall below US$50 a barrel this year. Brent crude traded at US$66.82, and West Texas Intermediate (WTI) hovered near US$65, with demand growth sluggish, the slowest since the pandemic.

That outlook changed dramatically when Israeli airstrikes on Iranian targets and Tehran’s counterattack, including hits on Israel’s Haifa refinery, sent shockwaves through global markets. Within hours, Brent crude surged to US$74.23, and WTI climbed to US$72.98, despite later paring back overnight gains of over 13 per cent. The conflict abruptly reversed the market outlook and reintroduced a risk premium amid fears of disruption in the world’s critical oil-producing region.

Amid mounting tensions, attention has turned to the Strait of Hormuz—the narrow waterway between Iran and Oman through which nearly 20 per cent of the world’s oil ows, including supplies that inuence global and

Canadian fuel prices. While Iran has not yet signalled a closure, the possibility

remains, with catastrophic implications for supply and prices if it occurs.

Analysts have adjusted forecasts accordingly. JPMorgan warns oil could hit US$120 to US$130 per barrel in a worst-case scenario involving military conflict and a disruption of shipments through the strait. Goldman Sachs estimates Brent could temporarily spike above US$90 due to a potential loss of 1.75 million barrels per day of Iranian supply over six months, partially offset by increased OPEC+ output. In a note published Friday morning, Goldman Sachs analysts Daan Struyven and his team wrote: “We estimate that Brent jumps to a peak just over US$90 a barrel but declines back to the US$60s in 2026 as Iran supply recovers. Based on our prior analysis, we estimate that oil prices may exceed US$100 a barrel in an extreme tail scenario of an extended disruption.”

Iraq’s foreign minister, Fuad Hussein, has issued a more dire warning: “The Strait of Hormuz might be closed due to the Israel-Iran confrontation, and the world markets could lose millions of barrels of oil per day in supplies. This could result in a price increase of between US$200 and US$300 per barrel.”

During a call with German Foreign Minister Johann Wadephul, Hussein added: “If military operations between Iran and Israel continue, the global market will lose approximately five million barrels per day produced by Iraq and the Gulf states.”

Such a supply shock would worsen inflation, strain economies, and hurt both exporters and importers, including vulnerable countries like Iraq.

Despite some analysts holding to base-case forecasts in the low to mid-US$60s for 2025, that optimism now looks fragile. The oil market is being held hostage by geopolitics, sidelining fundamentals.

What happens next depends on whether the region plunges deeper into conflict or pulls back. But for now, one thing is clear: the calm is over, and oil is once again at the mercy of war.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

Alberta’s grand bargain with Canada includes a new pipeline to Prince Rupert

From Resource Now

Alberta renews call for West Coast oil pipeline amid shifting federal, geopolitical dynamics.

Just six months ago, talk of resurrecting some version of the Northern Gateway pipeline would have been unthinkable. But with the election of Donald Trump in the U.S. and Mark Carney in Canada, it’s now thinkable.

In fact, Alberta Premier Danielle Smith seems to be making Northern Gateway 2.0 a top priority and a condition for Alberta staying within the Canadian confederation and supporting Mark Carney’s vision of making Canada an Energy superpower. Thanks to Donald Trump threatening Canadian sovereignty and its economy, there has been a noticeable zeitgeist shift in Canada. There is growing support for the idea of leveraging Canada’s natural resources and diversifying export markets to make it less vulnerable to an unpredictable southern neighbour.

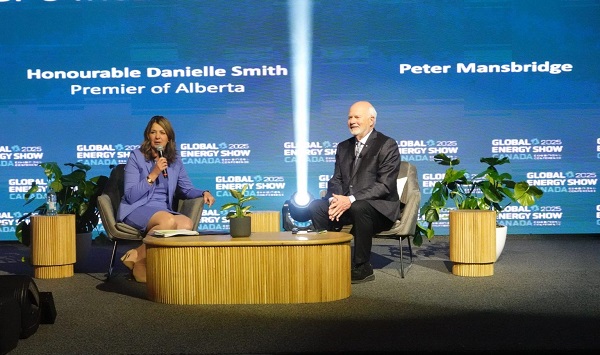

“I think the world has changed dramatically since Donald Trump got elected in November,” Smith said at a keynote address Wednesday at the Global Energy Show Canada in Calgary. “I think that’s changed the national conversation.” Smith said she has been encouraged by the tack Carney has taken since being elected Prime Minister, and hopes to see real action from Ottawa in the coming months to address what Smith said is serious encumbrances to Alberta’s oil sector, including Bill C-69, an oil and gas emissions cap and a West Coast tanker oil ban. “I’m going to give him some time to work with us and I’m going to be optimistic,” Smith said. Removing the West Coast moratorium on oil tankers would be the first step needed to building a new oil pipeline line from Alberta to Prince Rupert. “We cannot build a pipeline to the west coast if there is a tanker ban,” Smith said. The next step would be getting First Nations on board. “Indigenous peoples have been shut out of the energy economy for generations, and we are now putting them at the heart of it,” Smith said.

Alberta currently produces about 4.3 million barrels of oil per day. Had the Northern Gateway, Keystone XL and Energy East pipelines been built, Alberta could now be producing and exporting an additional 2.5 million barrels of oil per day. The original Northern Gateway Pipeline — killed outright by the Justin Trudeau government — would have terminated in Kitimat. Smith is now talking about a pipeline that would terminate in Prince Rupert. This may obviate some of the concerns that Kitimat posed with oil tankers negotiating Douglas Channel, and their potential impacts on the marine environment.

One of the biggest hurdles to a pipeline to Prince Rupert may be B.C. Premier David Eby. The B.C. NDP government has a history of opposing oil pipelines with tooth and nail. Asked in a fireside chat by Peter Mansbridge how she would get around the B.C. problem, Smith confidently said: “I’ll convince David Eby.”

“I’m sensitive to the issues that were raised before,” she added. One of those concerns was emissions. But the Alberta government and oil industry has struck a grand bargain with Ottawa: pipelines for emissions abatement through carbon capture and storage.

The industry and government propose multi-billion investments in CCUS. The Pathways Alliance project alone represents an investment of $10 to $20 billion. Smith noted that there is no economic value in pumping CO2 underground. It only becomes economically viable if the tradeoff is greater production and export capacity for Alberta oil. “If you couple it with a million-barrel-per-day pipeline, well that allows you $20 billion worth of revenue year after year,” she said. “All of a sudden a $20 billion cost to have to decarbonize, it looks a lot more attractive when you have a new source of revenue.” When asked about the Prince Rupert pipeline proposal, Eby has responded that there is currently no proponent, and that it is therefore a bridge to cross when there is actually a proposal. “I think what I’ve heard Premier Eby say is that there is no project and no proponent,” Smith said. “Well, that’s my job. There will be soon. “We’re working very hard on being able to get industry players to realize this time may be different.” “We’re working on getting a proponent and route.”

At a number of sessions during the conference, Mansbridge has repeatedly asked speakers about the Alberta secession movement, and whether it might scare off investment capital. Alberta has been using the threat of secession as a threat if Ottawa does not address some of the province’s long-standing grievances. Smith said she hopes Carney takes it seriously. “I hope the prime minister doesn’t want to test it,” Smith said during a scrum with reporters. “I take it seriously. I have never seen separatist sentiment be as high as it is now. “I’ve also seen it dissipate when Ottawa addresses the concerns Alberta has.” She added that, if Carney wants a true nation-building project to fast-track, she can’t think of a better one than a new West Coast pipeline. “I can’t imagine that there will be another project on the national list that will generate as much revenue, as much GDP, as many high paying jobs as a bitumen pipeline to the coast.”

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWOKE NBA Stars Seems Natural For CDN Advertisers. Why Won’t They Bite?

-

Crime1 day ago

Crime1 day agoUK finally admits clear evidence linking Pakistanis and child grooming gangs

-

Health2 days ago

Health2 days agoLast day and last chance to win this dream home! Support the 2025 Red Deer Hospital Lottery before midnight!

-

conflict17 hours ago

conflict17 hours agoTrump: ‘We’ have control over Iranian airspace; know where Khomeini is hiding

-

Alberta14 hours ago

Alberta14 hours agoAlberta health care blockbuster: Province eliminating AHS Health Zones in favour of local decision-making!

-

Business1 day ago

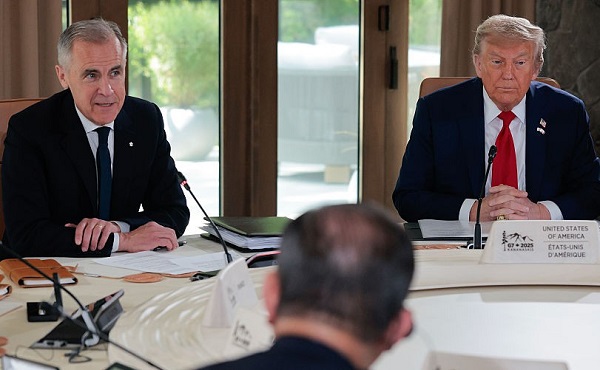

Business1 day agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Energy2 days ago

Energy2 days agoCould the G7 Summit in Alberta be a historic moment for Canadian energy?

-

conflict2 days ago

conflict2 days agoIsrael bombs Iranian state TV while live on air